This Week:

- Currency, doing business, & tax rates on the rich: How does New Zealand compare?

- Silver futures commitment of traders data looks bullish

- Another gold veteran thinks gold will reach full valuation in the next few years

- The one personality trait that all gold and silver investors need to be profitable

This week gold in USD seems to have just edged out of the wedge it has been trading in for much of the year (see chart below). We’ve read a lot about this pattern in the past week, so it will be interesting to see if USD gold does indeed head higher from here as many commentators now think it will.

This bounce was no doubt helped by the comments from ECB head “Super Mario” (wish we’d thought of that name!) that “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be big enough!”

We will have to wait and see if his bite is as good as his bark or if Germany will “put the muzzle on” to continue the same metaphor. The Fed is also meeting this week amid much speculation. We still wonder if they will make any moves yet but there is plenty of talk they will.

Of course for us here in NZ we do have the USD/NZD exchange rate to factor in as always. Lately it seems that the exchange rate has been the dominant factor in the local gold price. Our guess is that if USD gold does strengthen from here, the local gold price will be dragged up by this too, even if it is a case of not so much as the USD gold price with the kiwi dollar staying stronger.

As you can see in the chart below the kiwi gold price did head higher this past week although today it is again just down below the $2000 NZ per ounce mark once again. We NZers certainly are getting plenty of bites of the cherry at these lower levels.

NZD Silver is just inching higher but in USD terms it has been quite strong of late.

Silver futures commitment of traders data looks bullish

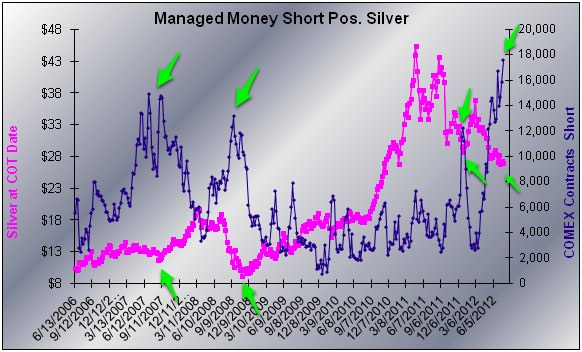

Speaking of silver, we read this interesting article from theGotGoldReport.com yesterday looking at the futures market Committment of Traders (COT) data for silver. We’ve included one of the charts from this below.

It can take a bit of getting your head around this futures stuff, but it can be worth the effort.

The chart is of the short positions held by the “Managed Money,” (Blue line) which includes “hedge funds, Commodity Trading Advisors (CTAs) and other funds that trade futures for clients. They are normally on the long side for silver futures, but over the past couple months they have been adding more and more short positions up to a new record high for the entire disaggregated COT report data going back to 2006.”

In short, these extremes in the past have been contrarian indicators of bottoms in the silver price (Pink line) – which you can see by the greens arrows we’ve added. Go and read the full article onGotGoldReport.com anyway as it’s not very long.

Another gold veteran thinks gold will reach full valuation in the next few years

A couple weeks ago we mentioned how a number of the big guns in the precious metals world were calling for records in gold over the next 12 months.

This week we read on KingWorldNews an opinion from John Hathaway – another gold veteran we think highly of, who effectively also commented that gold will reach full valuation in the next few years. He stated “We are at the end game for all of that, and over the next three or four years I think we will see gold reintroduced in an official monetary role.” But he cautioned, “That can only be done at substantially higher valuations in terms of paper currency.”

This weeks articles:

This week we stumbled across a few articles that ranked New Zealand in terms of our currency, the ease of doing business here, and Tax rates on the rich, compared to elsewhere in the world. So we thought it might be interesting to share our thoughts on these with you in this weeks main article:

Currency, Doing Business, & Tax Rates on the Rich: How Does New Zealand Compare?

Another must read article we have for you this week is “The One Personality Trait that All Gold and Silver Investors Need to be Profitable”. This article is highly relevant in times like these where precious metals are seemingly going nowhere, so be sure to check that out too.

Finally we have a video which is not exactly full of joy but offers some useful insights from a former US government insider as to what he sees progressing from here on in. The New Economic Collapse Video – It makes uncomfortable but urgent viewing

Well that’s it for this week. The metals seem poised for something big at the moment. With all the negativity towards them of late it’s surprising they haven’t dipped lower during this long consolidation phase over the past year. As always get in touch if you have any questions or want some help with a first purchase of bullion.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David) goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles

2012-07-24 22:01:58-04

This week: Precious metals hold up well in the face of everything else falling More on China and Gold Common Questions from First Time Buyers Sorry but this week’s musing will be a bit light, care of a sick child and a mess to clean up! That’s too much information already on that topic so […] read more…

The One Personality Trait that All Gold & Silver Investors Need to be Profitable

2012-07-25 19:08:55-04

Before one ever buys a single troy ounce of gold and silver, one should ensure first and foremost that one understands that gold and silver are volatile in price every single year. Many people commit the same mistake in buying gold and silver that they commit when buying into the stock market – they don’t [… read more…

The New Economic Collapse Video: It makes uncomfortable but urgent viewing

2012-07-29 18:31:55-04

Some sobering thoughts follow from a former US federal government insider in this very interesting interview… When Casey Research Chief Technology Investment Analyst Alex Daley met former Reagan Budget Director David Stockman to talk about the economy and where he sees it leading taxpayers investors and savers in the near future, he got some very […] read more…

Currency, Doing Business, & Tax Rates on the Rich: How Does New Zealand Compare?

2012-07-31 08:59:21-04

Today we have a bit of a comparison of little old New Zealand in a number of measures, from various odds and ends we’ve come across in the past week. So we’ll get to have a look at where we rank globally on a range of topics such as: Our currency Ease of doing business […] read more…

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Writer Satyajit Das on How New Zealand will Fare in the Crisis | Gold Prices | Gold Investing Guide

Pingback: Double Whammy for Buyers of Gold and Silver in NZ | Gold Prices | Gold Investing Guide