Here’s a few reasons from our favourite newsletter writer Chris Weber as to why silver is lagging gold:

“First is that gold has a strong monetary reserve place in the vaults of the central banks the way silver does not have.

Further, wealthy people, whose distance from normal people is far larger today than it was in the 1970s, have gold rather than silver.

Also, global mining production for silver has been far larger than for gold. Unlike gold, new mining production for silver over the past generation has caused the total silver supply to increase far more than gold.

On the other hand, silver is demanded by many more diverse industries than gold is. But where you can list the reasons why silver ‘should’ be higher, the fact is that 2017 saw silver lag gold. It always used to be certain that silver would outperform gold in both directions. But last year saw gold up 13% and silver up about half that. I’m not sure I’ve ever seen that type of action before, on an annual basis.

…[Silver] it can lag for years, and do nothing for years as well. And then, all of a sudden, in the seeming blink of an eye, it transforms into a high-flying asset.

At some point, it will again.”

Clive Maud also has another theory as to why silver is lagging gold currently. Check that out below…

Silver Market Update – Clive Maund – Why Silver is Lagging Gold

First published at clivemaund.com

Since gold and silver are “joined at the hip” much of what is written about gold and the dollar in the parallel Gold Market update applies equally to silver, so here we will look mainly at the points that need to be made separately for silver.

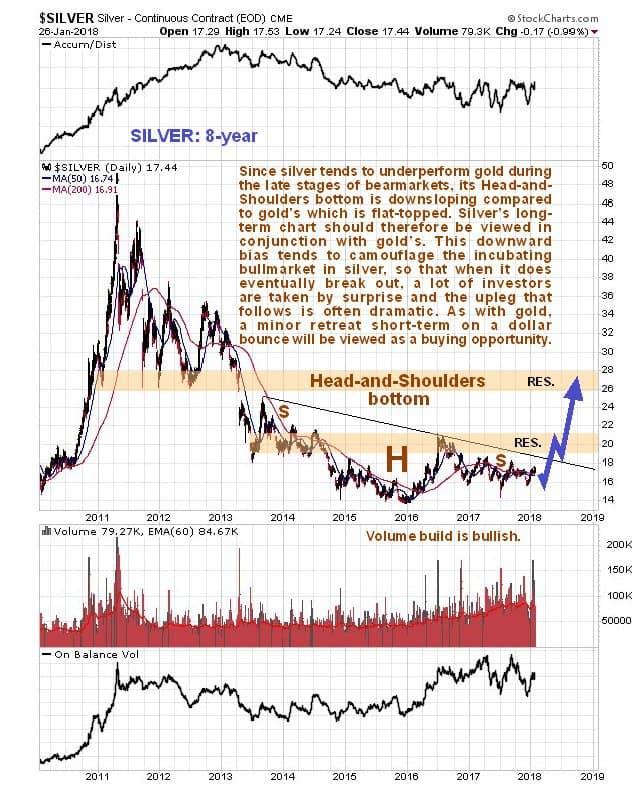

The first point that we will look at is that silver’s giant Head-and-Shoulders bottom pattern is downsloping compared to the flat-topped one forming in gold, as we can see on its latest 8-year chart shown below. This is because silver tends to underperform gold in the late stages of bearmarkets. One important effect of this is to camouflage the incubating bullmarket in silver, as investors tend to take one look at its long-term chart and say “Well, that’s not much good is it? – it’s still going down.” This gives silver – and silver stocks – considerable “snapback” potential once both it and gold break out of their respective base patterns, meaning a sizable rally that for many investors “comes out of the blue”. Silver at this point is still spluttering along sideways at a low level marking out the Right Shoulder of its H&S bottom pattern, but as the “neckline” of the base pattern is downsloping, it won’t take all that much for it to break out of it. Once it does it will encounter a zone of quite strong resistance in the $26 – $28 zone at the underside of the earlier top pattern. Note the big volume buildup as the Right Shoulder has formed, which is bullish, as it is with gold, although in the case of silver, there has not been so much upside volume, which is why its volume indicators have not advanced much – yet.

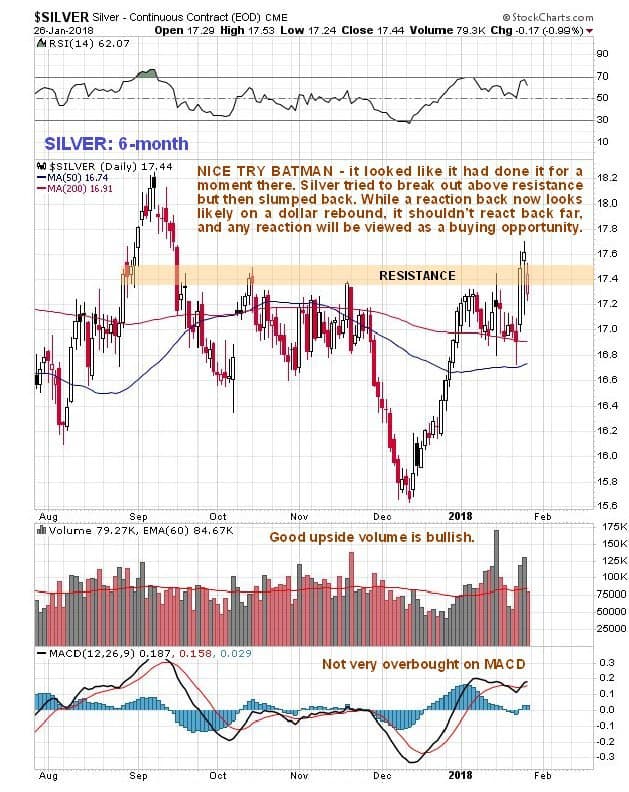

On silver’s latest 6-month chart we can see that it made a plucky but short-lived attempt to break above a line of resistance in the $17.30 – $17.50 zone last week. It failed and is now vulnerable to reacting back on a short-lived dollar relief rally, although it shouldn’t drop far, probably no lower than $16.80, and any such drop will be viewed as presenting a buying opportunity, especially in the better silver stocks.

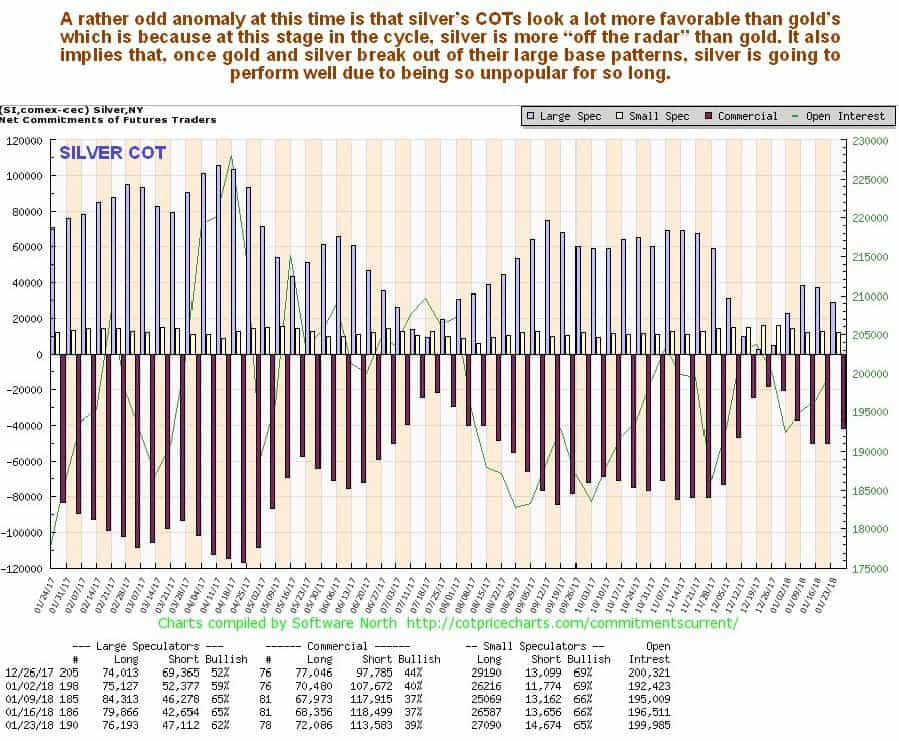

The latest COT for silver is considerably better looking than the latest COT for gold, which is rather surprising, and is viewed as an indication that any reaction will be minor, and also supports our contention that when silver does break out of its base pattern, the resulting rally could be sharp.

GSG Editor: Silver has dropped since this was written. Thus far not much below the $16.80 level Clive Maund mentioned. So silver continues in the basing pattern and we await the “sharp” breakout.

In the meantime see Could Silver Be Worth More Than Gold? for more help on deciding between gold and silver.

Or see When to buy gold or silver: The ultimate guide for all you need to know about when to buy either metal.