|

Gold Survival Gold Article Updates

Oct. 17, 2014

This Week:

- Why the RBNZ is Wrong About Money

- Dubai – City of Gold: A Visit to Dubai “Gold Souk”

- Bonds Flash Crash

- Where to for gold now?

- Silver to Oil and Silver to S&P ratios

First up we’ve written a couple of articles this week so we’ll keep the newsletter short so you have time to check them out. Also apologies for being a day late. Our email sending service has had “issues’ so we weren’t able to send this yesterday.

We have a report from our visit to Dubai Gold Markets last week.

And we have our comments on the Reserve Bank of New Zealand’s “What is Money?” video that they have released as part of “Money Week”. Some important thoughts in there, especially for anyone with kids.

Plus we have a couple others. Scroll down to the end of the email to check them all out.

Charts and Prices

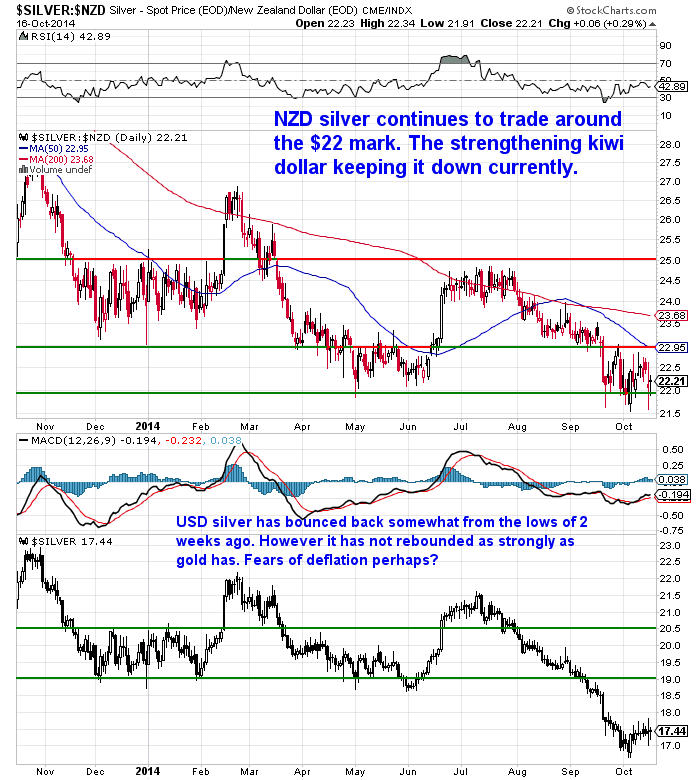

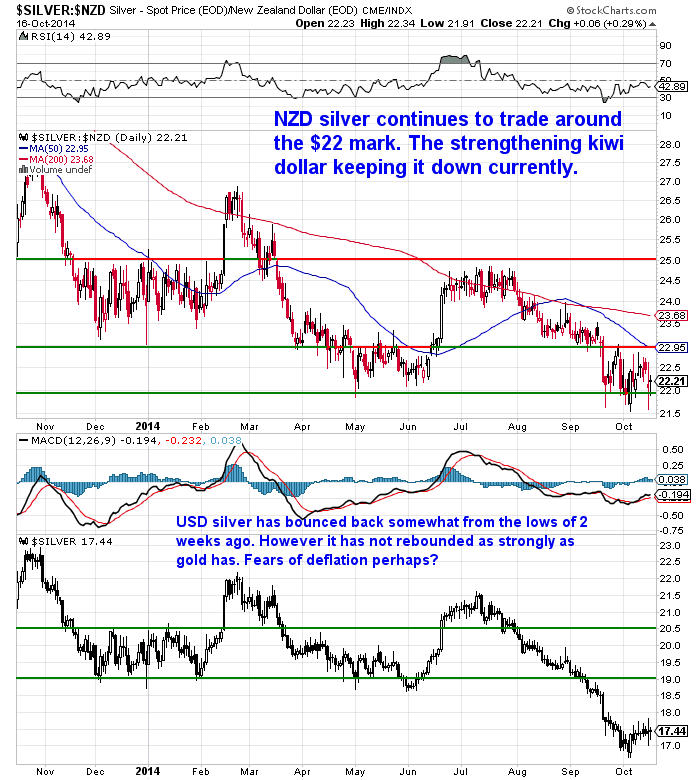

Gold has continued to bounce back after the lows set 2 weeks ago, while silver has been more muted. Fears of deflation seem to be the predominant factor also affecting share-markets this past week with the dow plunging.

Gold in US dollars is up $15.34 or 1.25% from last week to US$1240.25.

While Gold in NZ dollars has been kept down by an again strengthening NZ dollar. Up $4 to $1564 or in percentage terms up 0.25% from last week.

Silver in US dollars is virtually unchanged from last week. Up just 2 cents to $17.41 or 0.11%.

While Silver in NZ dollars is down 19 cents or 0.85% to $21.96.

The kiwi dollar has moved up from 0.7852 to 0.7930.

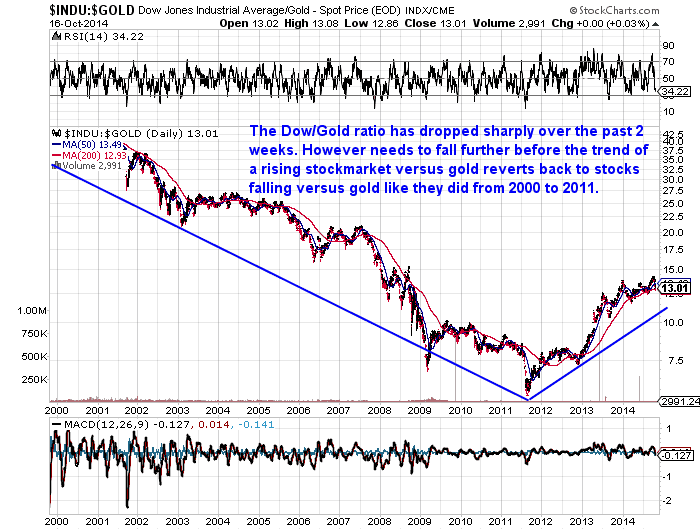

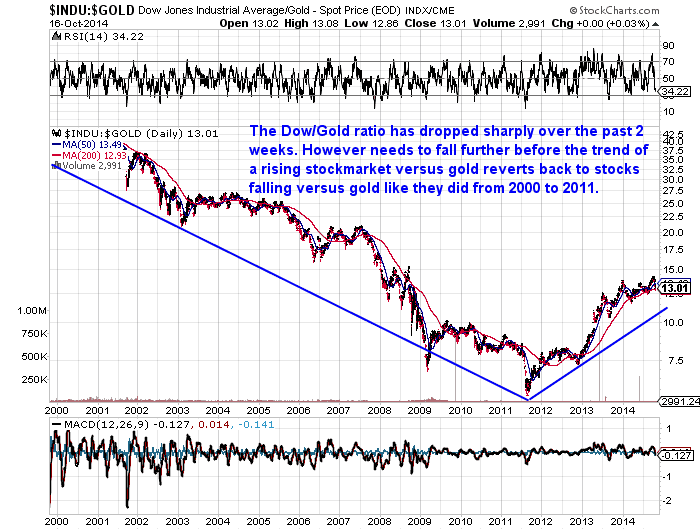

As noted already stock markets globally have fallen this week. The DOW to gold ratio has dropped sharply from 14.25 down to just under 13. (This is simply a measure of how many ounces of gold it takes to buy the US DOW Jones industrial average.)

However the trend of a rising stock market (the DOW) against falling gold hasn’t been broken yet as can be seen in the chart below.

Our best guess is that stocks could continue to run for a bit longer yet. But at some point a really decent crash will again come likely returning the Dow/Gold ratio to 1 or even lower as it did in the 1930s and 1980.

While the US stock markets plunged we saw a rush of money again into US treasuries. taking the yield down briefly below 2.5%. We commented on this possibility back in July which seemed unlikely to most given all the talk of rising interest rates.

We think this is due to deflationary fears which might also be a factor in why silver continues to under-perform gold. Interestingly with this flood of money into US treasuries (i.e. the falling bond yield indicates more people are buying them because as bond prices go up, the yield falls), has not caused the US dollar to rise. Which suggests it may have topped out for now.

So this could support gold and silver prices too. Of course this would likely mean a stronger NZ dollar so it will depend on how that performs as to what it means for NZ gold and silver buyers.

Where to for gold now?

Our guess is that for now it looks promising that the triple bottom in USD gold at $1180 is holding. So the tide may be quietly turning for gold and silver. There was certainly a lot of despair around when the lows arrived 2 weeks ago.

The chart below shows a few things of note:

1. We remain above the important 50 and 200 day moving averages

2. Gold did break out of the 2 year downtrend in late July

3. It remains in a gently rising trend channel

So all positives. we’d still like to see new highs for the year above NZ$1650 before we get too excited though.

On top of this we are yet to witness a flood of buying either. We reckon this won’t happen until we see some sustained rises in prices. Unlike the likes of Indians (who saw their gold imports soar 450% in September), westerners prefer to buy when prices are rising from our experience.

Unlike gold itself, gold stocks are still yet to rise much off the lows. But perhaps they have been held back by the general stock market weakness of late?

Jeff Clark reckons they may dip down to test the lows again very soon before rising higher after this. See this short article of his:

Here’s When We Could See Explosive Gains in Gold Stocks

Silver to Oil and Silver to S&P ratios

We also spotted this interesting article on silver to oil and silver to S&P ratios this week. Silver, Warfare and Welfare

The charts in there show silver is ready to rally versus oil and the stock market. The writer comments:

—–

“Do you expect the emphasis upon warfare and welfare to change? Do you expect fewer dollars to be created? Do you expect central banks will self-destruct by allowing interest rates to rise and/or deflationary forces to overwhelm the economy?

An accident where the financial elite are hurt more than the masses could happen but it seems like an unlikely scenario. Hence, as with the past 50 years, expect more currency in circulation, much more debt, higher consumer prices, more warfare, and more welfare.

Further, expect the prices for silver and gold to increase relative to the S&P, and expect silver prices to increase more rapidly than the price of crude oil.

Inevitable? Certainly not, but the best overall predictor of future prices, future policies, and future wars seems to be the long term trends shown by past prices, policies, and wars.”

—–

Hard to argue with much of that in the long run. If you are yet to get some precious metals insurance then get in touch. Or if you want to add to what you have – which we have seen a few of our regular buyers do this past week. Prices remain low especially for silver which today are close to the lows again.

This Weeks Articles:

Gold Survival Gold Article Updates Oct 8, 2014 This week: Gold triple bottom? So is the bottom in for silver finally? France vs Monaco vs UAE There has been action aplenty this week in precious metals markets. As can be seen in our charts below this week. Friday’s – as ever – dodgy US […]

read more…

Why the RBNZ is Wrong About Money |

2014-10-09 02:21:34-04

2014-10-09 02:21:34-04 2014-10-15 19:38:07-04“The Reserve Bank plays an important role in the functioning of money. It provides the country’s notes and coins and works to keep prices stable. It also promotes, through regulation, the soundness of the institutions where people keep their money (like banks and many finance companies) and the soundness of the payments systems sitting behind […]

2014-10-15 19:38:07-04“The Reserve Bank plays an important role in the functioning of money. It provides the country’s notes and coins and works to keep prices stable. It also promotes, through regulation, the soundness of the institutions where people keep their money (like banks and many finance companies) and the soundness of the payments systems sitting behind […]

2014-10-16 01:18:16-04A brief visit to Dubai this week gave us the chance to check out their famous Gold Souk or Gold Market. Like much of the east gold maintains an important role in society here. It is still a common form of saving – particularly in jewellery form much like in India, (who also happens to […]

2014-10-16 01:18:16-04A brief visit to Dubai this week gave us the chance to check out their famous Gold Souk or Gold Market. Like much of the east gold maintains an important role in society here. It is still a common form of saving – particularly in jewellery form much like in India, (who also happens to […]

2014-10-16 04:52:52-04The Casey Research Summit finished recently. Here’s some further opinions from speakers at the summit on Japan and China in particular… The Asian Age of Transformation By Casey Research Financial pundits are divided on Asia. Some believe China and Japan are going to have their day in the sun, while others fear that economic mismanagement will lead to a […]

2014-10-16 04:52:52-04The Casey Research Summit finished recently. Here’s some further opinions from speakers at the summit on Japan and China in particular… The Asian Age of Transformation By Casey Research Financial pundits are divided on Asia. Some believe China and Japan are going to have their day in the sun, while others fear that economic mismanagement will lead to a […]

2014-10-16 05:26:27-04Here’s more from the line up of speakers at the just concluded Casey Research Summit… Gold: Time to Prepare for Big Gains? By Casey Research Years of a severe downturn in the gold market have left very few bulls to speak out in favor of the yellow metal. Here are some positive opinions on the […]

2014-10-16 05:26:27-04Here’s more from the line up of speakers at the just concluded Casey Research Summit… Gold: Time to Prepare for Big Gains? By Casey Research Years of a severe downturn in the gold market have left very few bulls to speak out in favor of the yellow metal. Here are some positive opinions on the […]