Gold Kiwi 1oz Coin Special30 x 1oz NZ Mint 99.99% Gold Kiwi Coins.

Good condition (no scratches) and various years but not in individual plastic wrapping or casings. Normally priced at Spot + 5.7% at NZ Mint. Selling 1-9 coins at Spot plus 5% (Approx $1827) Selling 10-28 coins at Spot + 4% (Approx $1810) Selling 29+ coins at Spot plus 3% (Approx $1792) Get in fast as there’s only 30 of the 80 left now. Ph 0800 888 465 and speak to David or reply to this email. |

This Week:

- Silver Plunging – but not so much in NZ dollars

- NZ Dollar – Going Lower or Ready for a Big Bounce?

- Silver Supply Shortages?

- Weird Goings on in the Silver Market

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1741.67 | + $9.20 | + 0.53% |

| USD Gold | $1155.60 | – $17.80 | – 1.51% |

| NZD Silver | $22.80 | – $0.42 | – 1.80% |

| USD Silver | $15.13 | – $0.60 | – 3.81% |

| NZD/USD | 0.6635 | – 0.0138 | – 2.03% |

We’re a day early with our weekly email today. We’re travelling tomorrow towards Taupo for a few days so getting it out today to be sure it gets to you.

Big moves in gold and particularly silver overnight as you can see from the percentage changes from last week in the table above.

Yet again though these have been dampened here in NZ by an even weaker NZ dollar.

Will the Kiwi dollar ever stop falling?

More on that soon…

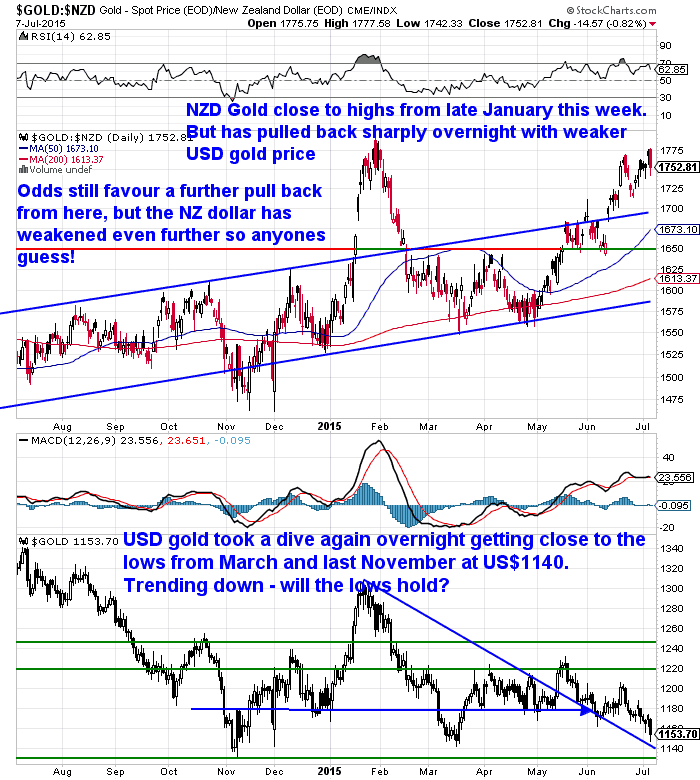

While the USD gold price is very close to its lows (bottom of chart below), the NZD gold price is actually not far off its high for 2015. Care of the weakening Kiwi dollar.

Silver Plunging – but not so much in NZ dollars

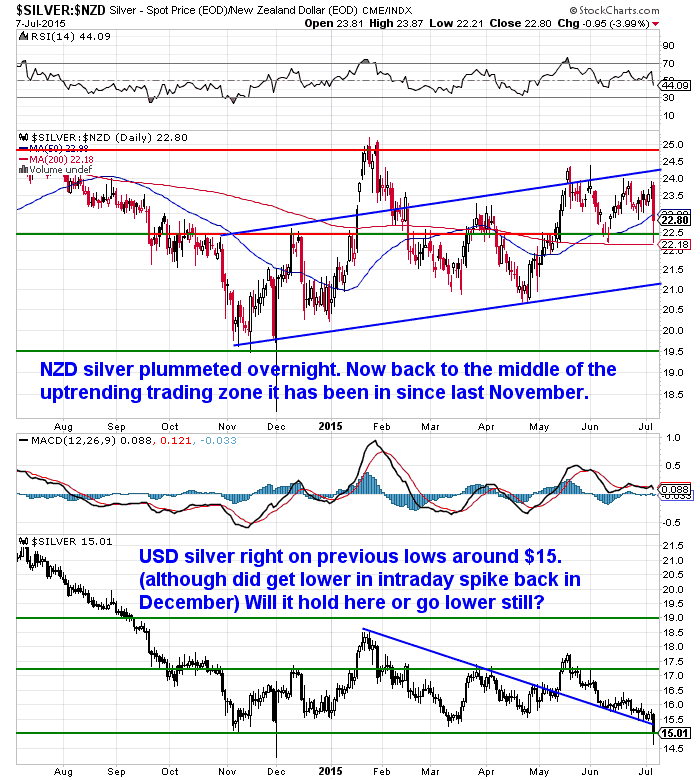

Silver is actually right on it’s lows in US dollar terms today.

While it has pulled back sharply in NZ Dollars but is only sitting around the middle of the uptrending range it has been in since November.

NZ Dollar – Going Lower or Ready for a Big Bounce?

Seems just about all the bank economists now expect four OCR interest rate cuts this year. Westpac included:

While the country’s balance sheet has improved over recent years, the RBNZ’s latest credit figures show that New Zealand’s economic resilience is starting to erode.Stephens said debt is now growing at a faster rate than nominal GDP – for both sensible reasons (dairy farmers accessing credit lines to get through bad times) and for more worrying ones (mortgage debt rising on the back of Auckland’s property market).“It’s worth noting that much of the deleveraging of recent years has been on the corporate side – the ratio of household debt to household income is already back where it was in 2008.

“It is likely to rise further if house prices continue their upward trajectory.”

Source.

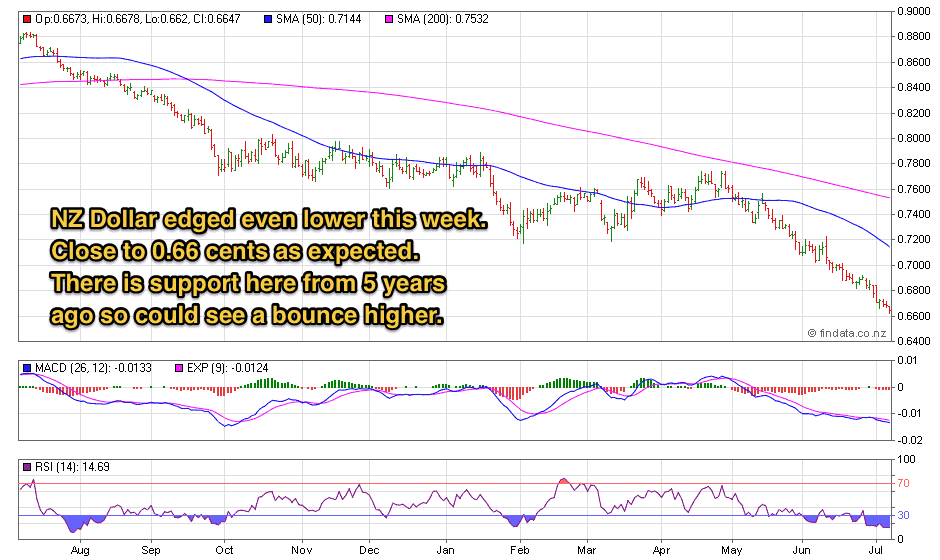

So all this would seem to lend weight to the notion that the NZ dollar will fall even further.

HiFX’s Dan Bell thinks so. Saying it may continue falling, potentially to around US60c, given global, and domestic issues driving it:

Source.

But it could be that most of this is getting priced into the NZ dollar already.

So the counter to this is how oversold the NZ dollar has now become and it could be due a pretty serious bounce higher…

This Currency Could Rally Double Digits in the Coming Months

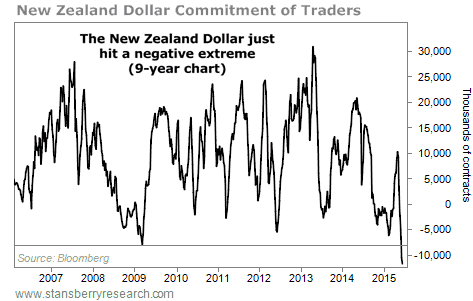

The fall in the New Zealand dollar has been spectacular. And investors have fled… which gives us an opportunity. History says this currency could soon bounce by double digits…Negativity in the New Zealand dollar hit its most extreme reading ever in June.

You can see this in the chart below. It shows the Commitment of Traders (COT) for the New Zealand dollar. The COT is a weekly report that shows the real money bets of futures trades.

It shows if traders love or hate an asset. And it’s a useful contrarian indicator when it hits an extreme.

Today, the COT shows the most extreme negativity we’ve ever seen. Traders are betting the New Zealand dollar will continue its decline. But they’re all making the same bet…

History shows that when futures traders all agree, the opposite tends to happen. And that means the New Zealand dollar could jump higher soon…

…but the New Zealand dollar isn’t a “buy” yet.

You see, the COT just hit a negative extreme. We need to see the COT rise above zero before we consider buying. That will likely occur as the currency begins rising, which further lowers our risk.”

Source.

If the Kiwi dollar has a chunky bounce higher we could see lower gold and silver prices here in NZ as a result. After moving steadily higher all year that wouldn’t be a complete surprise.

Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $285 you can have 1 months long life emergency food supply.

Learn More.

—–

Silver Supply Shortages?

We had a question from a reader today asking if we had noticed any tightness in the silver market.

This was after he’d read a couple of articles…

Has The Global Run On Silver Begun? Shortages On The Horizon?

US Mint Runs Out Of Silver On Same Day Price Of Silver Plunges To 2015 Lows

The first one discusses the possibility that we will see shortages in the not too distant future.

But the second covers how the US Mint has run out of Silver Eagle coins. It also makes the point that it is very strange to see the price of silver falling today, when the US Mint issues a statement that they have no Silver Eagle coins due to increased demand.

So what are we seeing in terms of supply and demand?

We’ve seen a bit of an uptick in purchases, but a definite sharp increase in subscribers to our newsletter. So probably care of Greece there is more interest in gold and silver in NZ too.

[Sidenote: Actually if you’ve joined us recently – welcome aboard!We cover a lot of ground in these weekly emails. If you’re somewhat new to the world of precious metals you might find the odd bit of info goes over your head. If so, just hit reply and we’ll do our best to answer any questions.]

Reports from various Mints and suppliers throughout the US and Europe show they have had a more noticeable increase in buyers.

Perhaps not surprising as we are much further removed from the Greek troubles down here.

Just in is an email from an offshore supplier of ours:

So they are also expecting delays from the Royal Canadian Mint too.

However the thing to consider here is that these delays are likely to be due to fabrication issues not an actual shortage of physical silver itself.

That is in order to “mint” a coin, the Mints require “blanks” first. This is usually where the bottlenecks appear, in that the producers of the blanks can’t keep up with demand.

Evidence of this is that locally refined silver here in NZ is not under any significant delays currently.

But as the first article notes there are some strange goings on in the silver market at the moment. So this could well change in the future. But we don’t like to be all hypey and say “silver is running out!” Because at the moment at least – it isn’t.

Weird Goings on the Silver Market

As just mentioned there are some strange goings on in silver of late. Here’s a couple that the likes of Bix Weir and others have made mention of the past couple of weeks:

Weirdness Number 1.

As already noted in the ZeroHedge article mentioned above the silver price is taking a dive today while there is huge demand for Government Mint coins in the US, UK, and Europe. Evidenced by the US mint running out of Silver Eagles.

Perhaps this isn’t a huge surprise as there are really 2 separate markets. A paper futures market in which hedge funds and institutions invest. And a physical market where the “little guys” buy. It is still the futures markets (for now at least) which set the price.

Bix Weir pulls no punches in what he believes though.

“But let’s call a spade, a spade and go right to the REASON I got into silver in the first place…WE ALL KNEW THE END OF MANIPULATION WOULD COME ONE DAY!Obviously, it isn’t today but it will be recognized very soon that the silver situation is NOT an ordinary run-of-the-mill situation.

All it will take is ONE free market trade to send the price of silver from $15/oz to a value that nobody has seen in modern day markets. Why? Because there has never been a single day in modern day silver trading that the price of silver has not been controlled and suppressed. Not one day!

When it is “freely traded” with all of the the relevant information about silver rigging known to everyone – the market will immediately SHUT DOWN with NOBODY offering physical silver for sale and EVERYBODY wanting to buy some.”

Weirdness Number 2.

There have been some massive changes in the precious metals derivative numbers.

Evidence?

How about a couple of entries in the latest derivatives report from the US Office of Comptroller of Currencies.

Other Precious Metals (ie Silver) 4Q 2014 1Q2015

JP Morgan $10.7B $13.4B

Citibank $3.9B $53.0B

Bix notes:

“Obviously, there is either a GIGANTIC mistake [there wasn’t as the numbers were later confirmed correct] or big change on the latest OCC Derivatives Report or Citbank has just broken every law known to man and added a concentrated silver position larger than THREE YEARS worth of global silver production at 2.7 Billion ounces of paper silver…Here we have a “too big to fail” bank adding an outrageous amount to precious metal derivatives to their overall exposure for no apparent reason.

Why is Citibank, a bank the US taxpayer bailed out, playing in the silver derivative markets anyways?

And then we have the overall commodities changing dramatically for JPM according to Zerohedge we have to wonder….what is going on??”

It certainly it seems Citibank has been engaging in some very unusual activity in silver with a massive increase in their precious metals (excluding gold) derivative book.

Bron Sucheki of the Perth Mint also looked into these reports and confirmed that the numbers were legitimate.

The gold derivatives have now been lumped in with foreign currencies. We don’t know why. Maybe to make the market even more opaque? Or could it be that gold is in the process of being realigned as a currency as per Basel II banking rules?

Anyway Bron goes on to say:

Source.

A commenter in the post, DaveG99 also made a couple of good points:

“Good work Bron. This clarification contains 2 key points – that the Comptroller of the Currency now considers gold derivatives in the same category as currencies, Basel II or no. This, taken at face value appears to be a significant shift away from Bernanke’s public assertion on the issue.Is this a setup for some remonetization plan for gold?

I also noted that ECB consolidated balance sheet lists gold and gold derivatives on the very top line of assets held – at a hefty 380 billion Euros.

The bigger issue is silver, with the distorted OI to COMEX inventory ratio. I can’t see how Citi is legally within position limits unless it is hedging – which seems impossible given the available silver.

All this in a volatile backdrop for PM prices -Any idea on what is going on here?”

No one replied to the comment and we certainly don’t have any idea either! It seems a massive number and hard to imagine how legal a position of that size is in any market.

So definite wierdness there.

Bix also had a few other thoughts on why things are getting interesting right now:

1) “Today is the COMEX reporting cutoff day for the last trades of the 2nd Quarter. The 3rd Quarter 2015 is their planned global market meltdown to hit in the last month of the quarter…September.

2) JPM is now rumored to have CLOSED OUT their huge paper short and dumped it on Citibank.

3) JPM is MASSIVELY long physical silver according to Ted Butler.

4) The European Derivative Complex is breaking down due to Greek derivatives.

5) The September/October collapse is close at hand.”

We shall see I guess. There is a lot of murmuring about September/October on the interwebs.

** Urgent Message for All Car Owners **

A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these. One for each car in your family or give one to someone you care about.

7 Reasons to (Still) Buy Gold

If you’re mulling over a purchase then this weeks feature article on the website might give you a few more reasons to buy.

If you’re mulling over a purchase then this weeks feature article on the website might give you a few more reasons to buy.

One of the 7 reasons includes not being caught up in what the Greek depositors have been.

Check out how our deposits here in NZ could one day be at the same risk:

7 Reasons to (Still!) Buy Gold

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,920 and delivery is now about 7-10 business days.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

Pingback: Silver Shortage - Is it For Real and What About in NZ? - Gold Prices | Gold Investing Guide