A Review of Relationship Between Silver and the US Dollar

What can we learn from the last time silver went sideways for a number of months while the US dollar rose strongly?

This is just one of the many points covered in this excellent video from Chris Duane.

Here’s just some of what is covered:

- What has changed in the world since 2005 (when he first started buying silver)

- What this might mean for the valuation of silver in the future

- Why you should only own physical silver

- The pattern currently playing out in the relationship between the US Dollar and Silver. And how the previous 2 times this has occurred led to large rises in the valuation of silver.

- How he’s not selling any silver until the dollar is again defined by silver rather than the other way around that it is currently.

- The only way to grow your wealth in a rigged economy with low interest rates and rising debt.

- How to transfer your wealth to the next financial reality.

Don’t want to watch the full video? We’ve taken a couple of screen shots of the key Silver/US Dollar chart he discusses and summarise it for you below…

As Chris Duane points out the markets are all very manipulated so charting has limited use, but it does let us look at the relationship between the US Dollar and the price of silver.

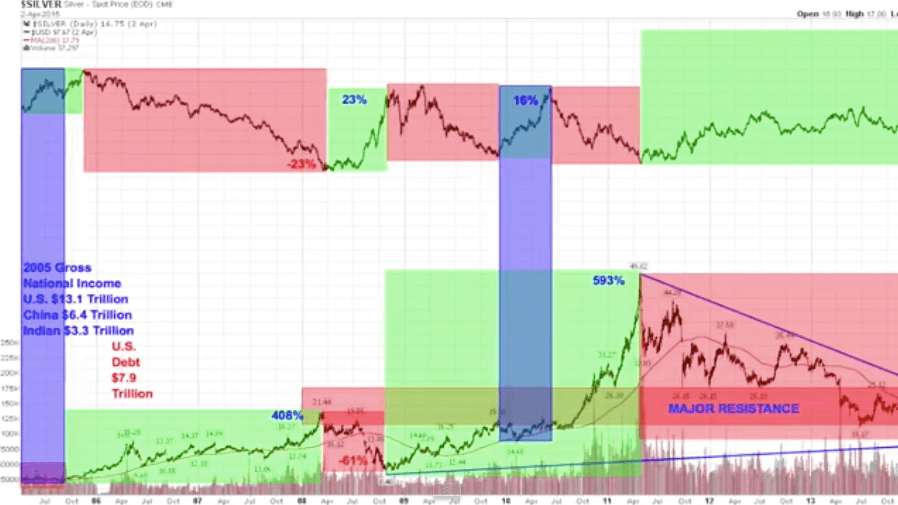

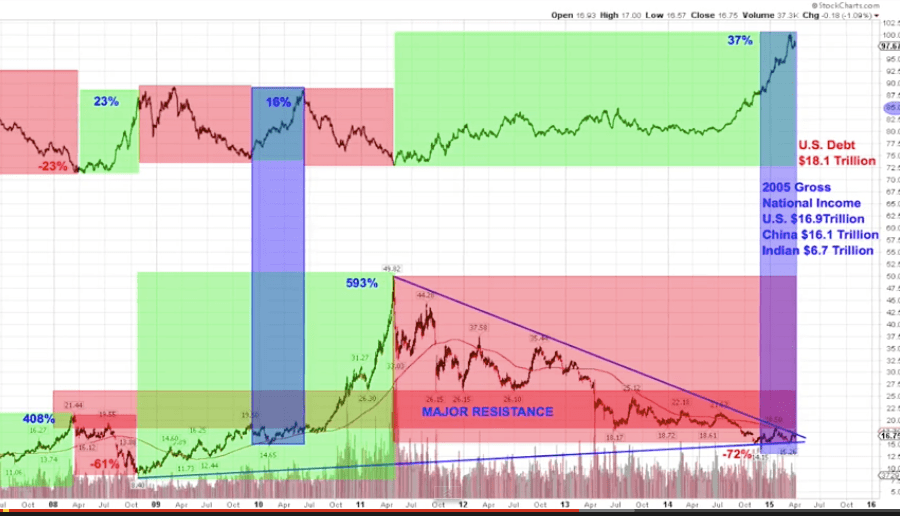

The line at the top of the chart below is the US Dollar while silver is the lower line.

Now check out the blue vertical “bar” in 2010. At this point the dollar rose 16%, while silver went pretty much sideways for about 6 months or so. This also occurred back in 2005 (the other blue bar), where the dollar rallied while silver stayed the same.

Now the next screenshot brings us up to current times in the same chart. You can see since silver peaked in 2011, the US Dollar is up 37%, while silver has fallen as much as 72%. But the interesting thing to note is that since late last year when the US Dollar really started to steam roll higher (indicated by the 3rd blue vertical bar on the far right of the chart below), silver has again held up really well. Just moving sideways or slightly up, even in the face of the US dollar powering much higher.

So this is potentially a very bullish indicator for silver.

Now we know “history never repeats”, but there is a good case for it rhyming here.

If it does then we should see the US dollar fall again and silver begin another hefty rise. Just as it did the previous two occasions we saw this pattern play out. These previous rallies amounted to 408% and 593% each.

Plus there are also other factors in play right now that also point to an end of the silver bear market in the not too distant future:

- Silver is also about to break through it’s 200 day moving average (MA).

- Silver is also currently above its 50 day MA.

- Silver is building a base just below the major resistance area.

- US debt level has more than doubled since 2006. On this basis $15 silver in 2006 should be twice the price today but instead it’s still around the same price.

- The rest of the world is lining up to get rid of the US Dollar as the reserve currency – with even the USA’s “allies” like UK, Australia, Saudi Arabia and even us here in New Zealand, having joined the Asian Infrastructure Investment Bank (AIIB). The AIIB appears to be an alternative to the current IMF/World Bank/ US centric global monetary system. (See this Zero Hedge article for more on who exactly has joined or applied to the AIIB.)

- Unlike 2008, this isn’t an institutional or corporate problem but rather now a sovereign nation problem. With debts having been transferred to sovereign nation balance sheets instead. So the next financial crisis whatever may set it off, will be bigger than the last. Even Australia is also about to start to tax bank deposits. So why would you leave money in a bank awaiting for it to likely be taxed in the next financial crisis?

Here is the full video:

Our Take on the Chris Duane Silver Seminar Video

There are some very good points made here. We’d also agree that charts aren’t the be all and end all. But they can give us some indicators that may point to lower risk times to purchase gold and silver.

While there are no guarantees, this certainly appears to be a lower risk time to buy silver. There is very little interest in silver currently in the west – including here in New Zealand. We may well be back close to 2005 levels in this regard. So this is another positive factor that Chris didn’t mention.

And if you’re worried that a falling US dollar will mean a rising NZ dollar and nullify any gains in the price of silver in NZ dollars. Then don’t. On the previous two occasions this occurred, the gains in NZ dollar priced silver were still very significant, even with a rising NZ dollar.

We’re not sure whether China is actively working against the US to end its dollar hegemony as Chris outlines. Or rather whether China is merely playing its part in the money masters overall plans to produce a global currency system and solidify their control.

Perhaps it doesn’t really matter exactly who is pulling what strings, but rather we think it pays to consider the impact of the strings being pulled.

While we hope for a future like Chris where people can decide what they use as money. A future different to the current “debt and death” paradigm as he calls it. We’re not certain we’ll get it.

However it would appear to us that at the very least it is highly likely that gold will take some part – perhaps quite significant – in a new global monetary system – maybe as part of an updated IMF Special Drawing Rights (SDR). See this recent newsletter for more on this topic: Announcements Due: China Gold Reserves and SDR Inclusion) Silver will likely be dragged up (perhaps to even higher levels percentage wise) with gold when this happens.

As we outlined in Announcements Due: China Gold Reserves and SDR Inclusion, these changes in the SDR are due within the next year so it would pay to be on board with your physical precious metals as financial insurance before these occur. As there will likely be much volatility in currencies as a result.

Get a quote for Gold or Silver here.

Related: NZ Dollar Falls – Why is the NZ Dollar Weaker and Where to Now?