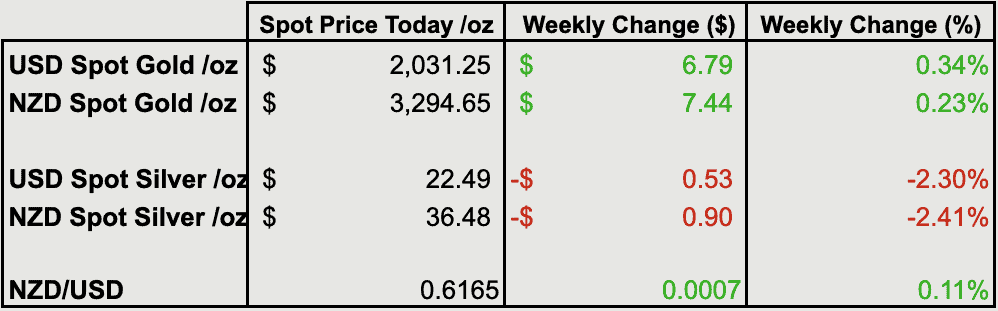

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3149 |

| Buying Back 1kg NZ Silver 999 Purity | $1118 |

Late Update

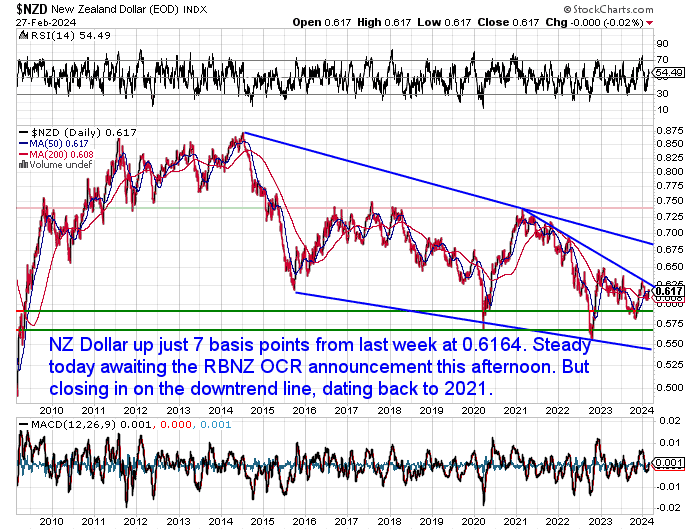

Just as we’re about to hit send, prices have jumped higher after the RBNZ announcement sounded “less hawkish” (i.e. less likely to raise rates). The Kiwi dollar fell to 0.6113. NZD gold jumped to $3,326.26 and NZD silver is up to $36.86.

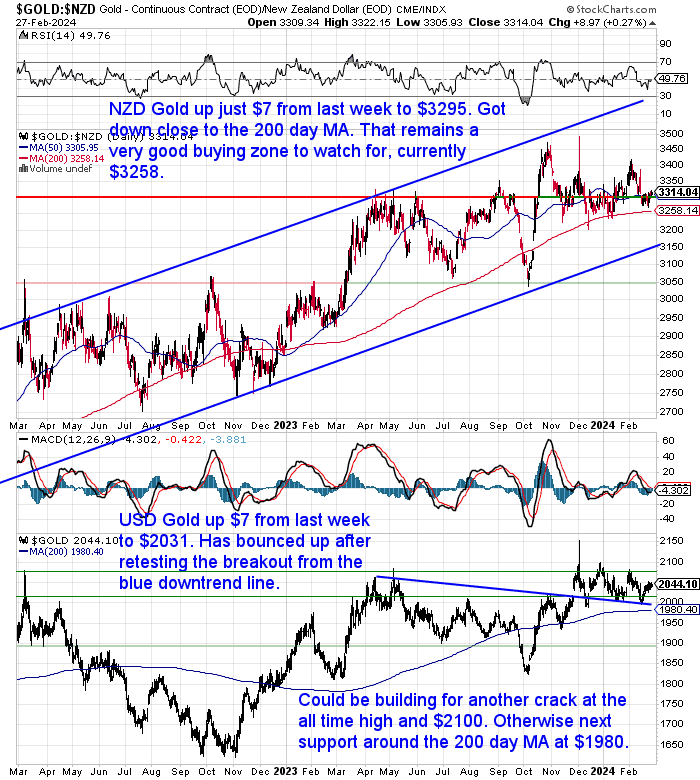

Gold Barely Changed From Last week

Gold in New Zealand dollars was up just $7 from a week ago. Sitting just below the 50-day moving average today at $3295. It got down close to the 200-day MA line during the week. That remains a very good buying zone if we see any further dips down.

It was a similar situation for gold priced in USD. Also up just $7 to $2031. It has bounced up after retesting the breakout from the downtrend line. Our guess remains that USD gold is building for an eventual crack at the all time high. Otherwise the next support remains at $1980 at the 200-day MA.

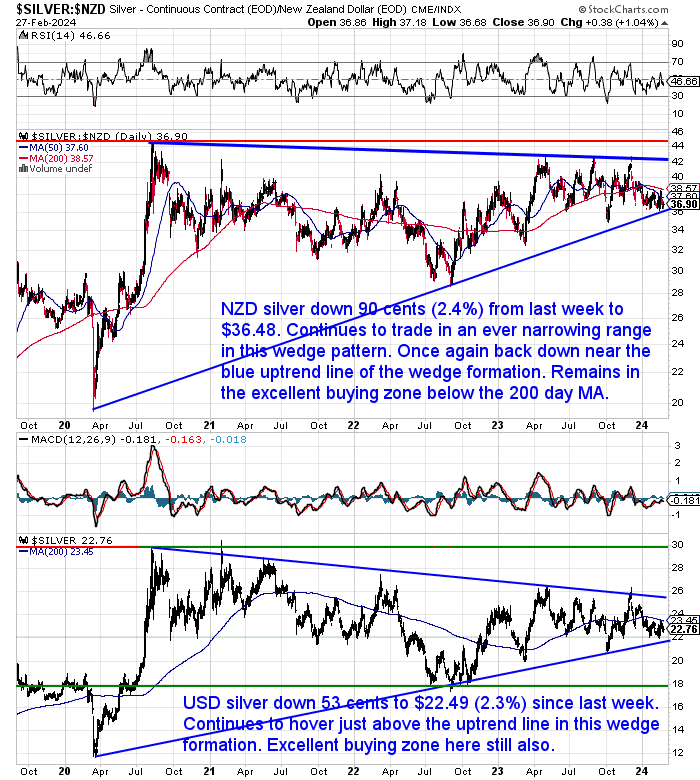

NZD Silver Again Dips to Uptrend Line Buying Zone

NZD silver fell 90 cents or 2.4% for the week. Once again dipping back down to the blue uptrend line, which continues to be very strong support. The current region remains an excellent place to buy a position in the white metal. As NZD silver continues to bounce between the 200-day MA and the uptrend line.

It’s a similar-looking chart for USD silver. It was down 53 cents over the past 7 days. Dropping 2.3% but remains just up from the downtrend line. Great buying anywhere under the 200-day MA.

NZ Dollar Flat Ahead of RBNZ Monetary Policy Announcement

The Kiwi dollar is up just 7 basis points from last week. Overnight it has hardly moved as currency traders appear to be waiting on the news on the Official Cash Rate from the RBNZ monetary policy announcement later today (more on that below). But the Kiwi looks to be closing in downtrend line at the moment.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Stacking Smart: Choosing the Right Silver Bar for You

Investing in silver bars can be a smart way to diversify your portfolio and hedge against inflation. But with a variety of sizes and factors to consider, choosing the right silver bar can seem daunting. This week, we’ll break down everything you need to know about buying silver bars, including:

- The key advantages of silver bars over silver coins

- How to find the perfect size for your investment goals

- Essential factors to consider when selecting a silver bar

So, whether you’re a seasoned stacker or just starting out, this article is packed with valuable insights to help you make informed decisions about your silver bar purchases.

P.S. Unsure which silver bar is right for you? This week’s feature article has all the answers…

What Type of Silver Bar Should I Buy in 2024? – The Ultimate Guide to Silver Bars

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

RBNZ Monetary Policy Statement Today – Hold or Hike?

By the time you read this the New Zealand central bank will have announced what it is doing with the official cash rate in the first of 4 monetary policy statements for 2024.

In a note this morning ASB economists said:

“Most analysts expect the RBNZ will leave the OCR unchanged at 5.5%. However, markets are pricing a roughly 20% chance of a 25bp rate hike and we acknowledge that it’s a closer call than it has been for a while. While we don’t expect any change to the OCR, we do expect a hawkish tone and for the RBNZ’s statement to give a clear indication of its ongoing level of disquiet around inflation pressures. Nevertheless, we still expect the RBNZ will forecast headline inflation to fall below 3% by the second half of this year and reach 2% by the second half of 2025.”

This holding pattern looks likely in the USA and UK too:

“Federal Reserve Governor, Michelle Bowman, said that she expects inflation will continue to ease if the Fed Funds rate stays at its current restrictive level. But she maintains that it’s too soon to be cutting at this point. She noted that if “incoming data continue to indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive.” However, she stressed that they weren’t there yet.

Meanwhile Bank of England deputy Governor, Dave Ramsen, said that he was unwilling to change monetary policy while lingering concerns about the inflation outlook remain. The BoE bank rate is currently 5.25%, but key indicators of inflation persistence remain according to Ramsen. Like the Fed’s Bowman, Ramsen noted it would be about how long rates stay at the current level.”

“Sticky Inflation” + Low Retail Sales = Stagflation?

So the RBNZ still looks likely to say that inflation will fall to 2% by the second half of 2025. However, while we think inflation could dip in the short term, longer term things seem to be looking more like stagflation to us. That is higher inflation in a sluggish economy. Take these news items as early evidence:

“Most retail sales took a tumble in December quarter, sticky NZ inflation a worry for economist

…Westpac said the retail stats made glum reading and it expected GDP only rose 0.1 per cent in the quarter, probably well below inflation and population growth.“I’m not sure if the economy is in a technical recession,” Westpac senior economist Satish Ranchhod said today.

But the R-word aside, the New Zealand economy was undoubtedly stalling, he said, and persistently high inflation was the biggest bogeyman.”

“Westpac says its customers are spending just 3.4% more than they were a year ago, while the population’s increased 2.8% and retail prices are up around 4%. Westpac senior economist Satish Ranchhod said that combination means that “even though we’re splashing out more cash, many New Zealand households are actually getting less in their trolleys”.

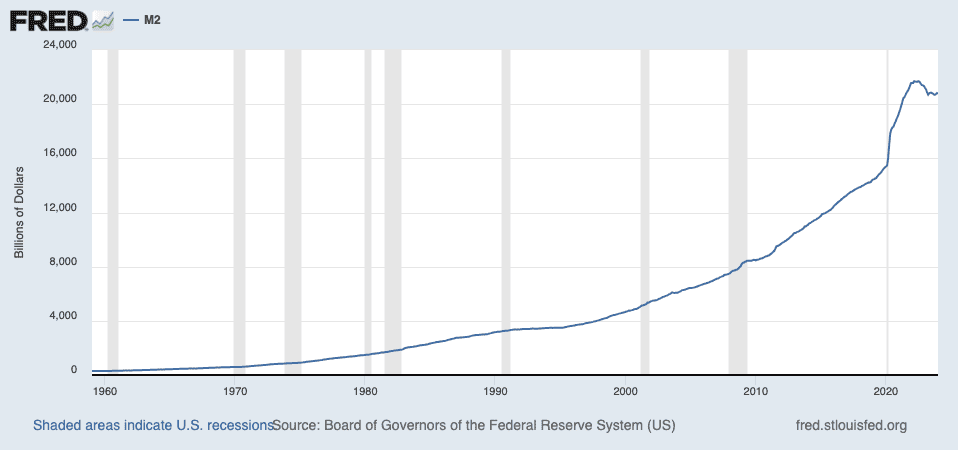

Stock Market Rally vs. Shrinking Money Supply: A Cause for Concern?

Our favourite newsletter writer Chris Weber this week highlighted the seemingly contradictory situation in the stock market. While stock prices are reaching new highs, the money supply, which has fueled past market rallies, is actually shrinking at an alarming rate. This has not happened since the Great Depression of the 1930s.

Key points to that Chris made are that stock prices are at record highs, despite:

- High price-to-earnings ratios

- Low dividend yields

- Shrinking money supply (fastest rate since the 1930s)

- Falling credit from the Federal Reserve

Of course the stock market could well keep going up from here. But these factors should give some cause for concern:

- This situation is unprecedented and potentially dangerous.

- The shrinking money supply historically coincides with significant market downturns.

- Ignoring these warning signs could lead to substantial financial stress.

- Be cautious about the stock market and explore alternative investment options.

Stock Market Most Concentrated Since 1930s as Insiders Sell

Interestingly this week we also came across another statistic that compared the US stock market to the 1930s. Showing that the top 10% of stocks size versus the entire US stock market:

Source.

While the insiders seem to be selling. Earlier in February we had the Gates Foundation:

They know what’s coming…Interesting 🧐🔥

In the fourth quarter of 2023, the Bill & Melinda Gates Foundation Trust dumped its stake in several large companies, including Apple, Meta, Google-owner Alphabet,

Amazon and Nvidia.

Source.

Then most recently we have Jamie Dimon:

Jamie Dimon Sells 822,000 Shares Of JPMorgan For The First Time As Stock Hits All-Time HighFirst Zuck and Bezos, now it’s Jamie Dimon’s turn to sell the top

At a time when insiders are dumping stock at a pace not seen in years…

Source.

Meanwhile we have other “smart money” buying commodities at what will likely be near the bottom in the next leg up:

“First Druckenmiller, now Paul Singer’s Elliott – the smart money’s getting in (near the bottom). “The mandate is to buy across all assets, including base metals and precious metals in addition to commodities in demand for electric vehicle production.”

Why the Quiet Could Be the Calm Before the Gold Storm

Then we have Gold volatility at similar lows to last year and those during 2018 and 2019. These were all times when the gold price rose significantly soon after.

“Never SELL a quiet Market” – Sentiment seems to confirm this as well.

Gold Volatility (GVZ) is back down to 11, We are bearing levels that have seen lows in the gold price. The green circles correspond GVZ to GLD price action.

IMO, Silver is “leveraged gold” at this point.

Mike Gleeson elaborates on this current lack of interest in the gold market:

“As speculative fervor fuels price spikes in technology stocks and [digital] currencies, gold continues to quietly hold its major support level.

The monetary metal tested the critical $2,000 level again this week. After dipping early in the week, prices bounced modestly on Thursday.

The metals space remains unloved and under-owned by the investing public. And the mainstream financial media is wholly uninterested in it.

Hardly anyone is paying attention to the sector at all. But some of the few who are paying attention are spotting compelling opportunities.

Even though retail investors are shunning anything related to precious metals, physical demand from industry, central banks, and consumers in the Far East is growing.

…Of course, gold is much closer than silver to making new highs. The yellow metal is in what could be described as a stealth bull market. Prices are holding firm just below all-time highs despite the fact that gold isn’t even on the radar of the investing public.

Disinterest among the public is evidenced by the fact that exchange-traded products linked to gold prices have seen massive outflows. Meanwhile, gold mining companies have been trashed, sending valuations toward historic lows.

Sentiment in the precious metals space is at the polar opposite of the hyped up high-tech sector.”

The lesson here will likely be that boring is good. It’s just that most people don’t realise it until well after the fact. If you’re ready to buy while it’s boring then please get in touch.

Do you have financial insurance in the form of the only no counterparty risk financial asset?

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

New Australian Product: The Superoo 16 Litre Gravity Water Filter by Filteroo. Leak free design with double the capacity of similar filters.

This filter will provide you and your family with safe drinking water for years to come. It’s simple, lightweight, easy to use, and very cost effective. Comes complete with Stainless Steel Tap, Stand and Water Jug.

—–

This Weeks Articles:

What Type of Silver Bar Should I Buy in 2024? – The Ultimate Guide to Silver Bars

Mon, 26 Feb 2024 12:27 PM NZST

This article will help you decide what type of silver bar to buy in 2024. You’ll learn everything you need to know when buying silver bars including: So after looking at all the reasons as to why to buy silver, you’ve come to the conclusion now is the time to buy. You’ve also determined what […]

The post What Type of Silver Bar Should I Buy in 2024? – The Ultimate Guide to Silver Bars appeared first on Gold Survival Guide.

Read More…

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: 1216.04 (pick up price – dispatched in 5 weeks)

Box of 500 coins (dispatched in 4 weeks):

2023 coins: $21,698.69Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.