Gold Survival Guide Updates

Dec 18, 2013

This Week:

- The (Mini) Taper finally occurs

- A Fed Policy Change That Will Increase the Gold Price

- A great interview with G. Edward Griffin

- RBNZ says it will be raising rates next year – we’ll see

Well, the Taper finally arrived overnight, or at least it was the mini-taper as only a $10 billion reduction in the Feds money printing programme from $85 billion down to $75 billion per month beginning in January.

Perhaps somewhat surprisingly the Bernank cut back before the end of his term – although it does let him go out on a high of course. Interestingly stocks have bounced higher suggesting perhaps the expectation that it could have been more than $10 billion? Who knows but for now stocks are the favoured place to park money in the west. Well in the US at least, here in NZ it of course remains property.

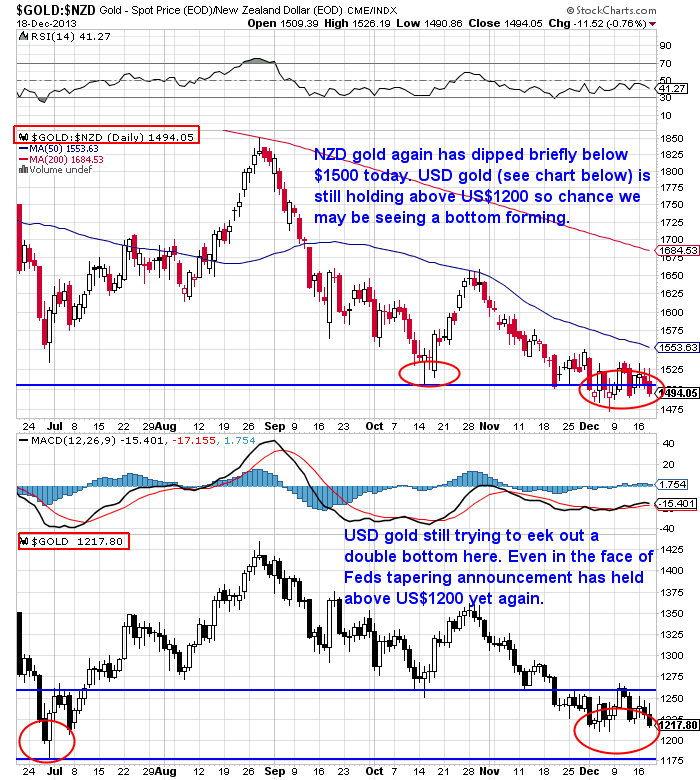

Gold and silver both dropped fairly sharply after the announcement but both closed US trading above recent lows – so that may be encouraging. Gold managed to hold above the US$1200 level yet again. Gold really does seem to be trying to eek out a bottom here.

With the kiwi dollar dropping back a bit to 0.8199, gold in NZ dollars was still down 2.03% on a week ago to $1485.85. As you can see in the chart below it has spent most of December bouncing around the NZ$1500 level.

If the USD gold price can hold on around here (see bottom half of chart below) we may be see a bottom forming in the local price of gold as well.

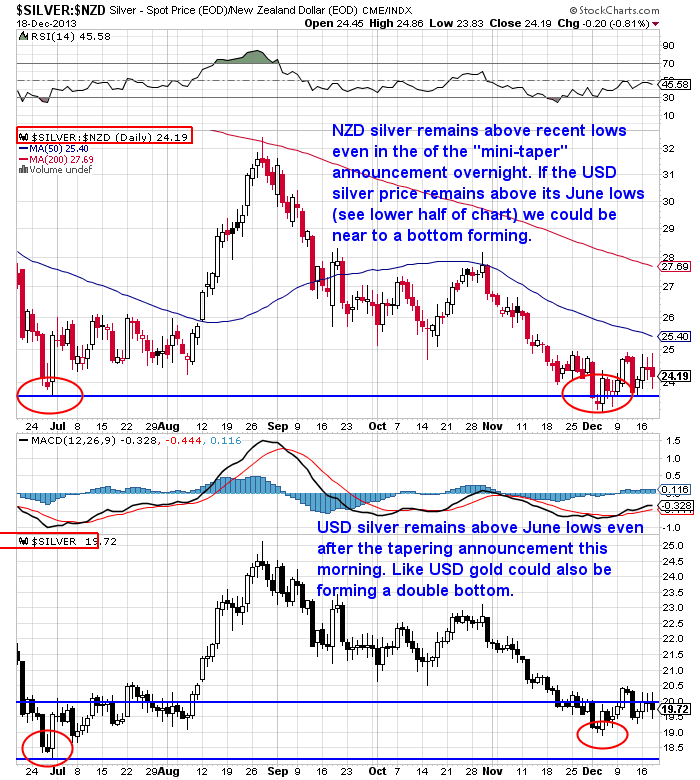

Meanwhile NZ dollar silver is down 1.83% from last week to $24.14 per ounce. Holding nicely above the lows from earlier in the month.

So perhaps almost all the weak hands have been flushed out of the gold and silver markets? Not too long ago most would have bet that a taper announcement would have sent them to new lows. Lawrie Williams at mineweb noted during the week in a piece titled “Taper talk boosts gold. Is this a fundamental change in direction?” that:

—–

“One does not exactly need a long memory to recall that every indication that the U.S. Fed may actually implement any kind of taper since the proposal was first put forward by Ben Bernanke has been met with a sharp downturn in the gold price – until perhaps a couple of weeks ago when the opposite seems to have happened.”

—–

Of course gold did go lower while stocks rose this morning so it might take a few more days to see if gold holds up above the June lows or not.

However in the long run we have to agree with what Chris Hunter, Editor-in-Chief, of Bonner & Partners, Bill Bonners Family Office noted before the Fed announcement this morning…

—–

“Whether or not the Fed tapers now, or next quarter, will have little real impact on the market – other than the possible psychological damage of investors believing the Fed is taking away the proverbial “punchbowl.”

But here’s the thing: Even if the Fed tapers, it’s still keeping its foot firmly on the monetary stimulus pedal.

That’s because the federal budget deficit is shrinking… and Treasury issuance is shrinking with it. That means all a taper will achieve is to stop the Fed buying an even greater share of government debt…

With the government issuing less Treasuries to balance its books, a modest tapering by the Fed will merely keep its monetary stimulus about level.

Don’t forget that the Bank of Japan is easing, too. The Fed is buying $45 billion of Treasuries every month (and another $40 billion of government-backed mortgage bonds). But since July, the BoJ has started buying an additional $25 billion of Treasuries a month.

As former Merrill Lynch economist David Rosenberg put it yesterday, the Fed “taking the Maserati from 160 mph to 140 mph is hardly a game changer.”

The bottom line: Global QE is here to stay – no matter what the Fed announces today.”

—–

We too remain to be convinced that an ongoing significant reduction in money printing will be possible without causing a loss of confidence. And of course confidence is what the name of the game remains.

Our favourite financial newsletter writer Chris Weber was right on the money as he so often is in his latest report where he stated:

—–

“I think they have to show that they are doing something, probably cosmetic, to justify all their talk of tapering.

It would not surprise me to see the announcement of their next meeting say that they’ll cut the $85 billion in new money back by a small percent, perhaps five or ten. But remember that there are all sorts of “back door” ways that they can buy assets and create new money.”

—–

A great point that he makes – so it may be a public taper and yet the Fed may still manage to create a similar amount of new money behind the scenes. Crooks and thieves are what the central planners are so don’t discount the possibility.

A Fed Policy Change That Will Increase the Gold Price

Another consideration is the $2.5 Trillion that banks continue to park at the Federal Reserve as “excess reserves”. So even if no more digital money was created by the fed there are still ways and means of getting more of this vast sum actually into circulation and cranking up the “velocity of money”.

As we’ve discussed in recent weeks it is these “excess reserves” that remain parked at the Fed which are not being lent out by banks. But in recent weeks there have been a number of stories concerning the reduction of the interest rate that the fed pays to banks to park excess reserves. Also senior members of the ECB have commented on the possibility of negative interest rates. In our newsletter on November 29th we stated:

“Negative Interest rates on Bank deposits coming?

We’ve noticed negative interest rates have been mentioned this past week more than once. Firstly a representative from the European Central Bank (ECB) inferred that one of the tools still in their kit could be to make the deposit rate it charges banks negative. Supposedly this would be to force banks to loan money instead of just depositing it with the ECB. Source.

Next we noticed a report on US banks warning they may have to charge depositors if the Fed lowers the interest rate it pays banks for holding excess reserves with them. Source.

Even though the talk of “tapering” continues, our guess is we will see more QE yet and these reports show the possibility of banks actually charging people to hold their money is not out of the question, although may be a way off yet.”

And on December 5th we discussed comments that insider, and until recently Fed Chairman candidate, Larry Summers put forward at a recent IMF conference:

“At the IMF Research Conference on November 8, 2013, former Treasury Secretary Larry Summers presented a plan to expand the con game.

Summers says that it is not enough merely to give the banks interest free money. More should be done for the banks. Instead of being paid interest on their bank deposits, people should be penalized for keeping their money in banks instead of spending it.”

So perhaps this change in policy is closer to hand than it might seem? This is often how these changes are handled, initially just with a few sound bites here and there to gauge reaction.

Our feature article this week looks at this possible change in Fed policy in more detail. Paying particular attention to comments by ex Fed vice chairman Alan Blinder in his recent Op-Ed in the Wall Street Journal on the possibility of a reduction in the interest rate the fed pays. We think this is something to keep a close eye out for in the future and as the article outlines is likely to have an impact on the gold price.

Our feature article this week looks at this possible change in Fed policy in more detail. Paying particular attention to comments by ex Fed vice chairman Alan Blinder in his recent Op-Ed in the Wall Street Journal on the possibility of a reduction in the interest rate the fed pays. We think this is something to keep a close eye out for in the future and as the article outlines is likely to have an impact on the gold price.

A Fed Policy Change That Will Increase the Gold Price

G Edward Griffin – a great interview at the Daily Bell

If you haven’t come across him before, Edward G Griffin is the author of perhaps our favourite book The Creature from Jekyll Island: A Second Look at the Federal Reserve

This week we stumbled across a great interview with him at the Daily Bell which is definitely worth a read.

G. Edward Griffin on Globalism, Collectivism and ‘Right Principles’

It also reminded us of a number of other short videos and interviews we’ve posted from him in the past.

G. Edward Griffin: Legalized Plunder

“The Fed’s sole purpose: keeping the banks afloat” – G. Edward Griffin

G. Edward Griffin: How You can END THE FED

If you have yet to read “The Creature” with the 100 year anniversary of the Fed coming up on 23rd December, now would be a good time to familiarise yourself with its history and to help spread the word as to why we’d be better off without it. At the very least check out a few of the pieces we mentioned above.

RBNZ says it will be raising rates next year – We’ll see

Quite a bit of press this week on how the RBNZ says it will be raising rates next year – we continue to say “wait and see”. This looks to us much like the US Fed talking the talk with some doubt as to the walking of the walk. Of course we could see some rate rises but we are yet to be convinced that it is a one way bet. Perhaps instead it will be a mini-rise before further cuts come into play much like has occurred in Australia in the past few years.

“Forward Guidance” (which we discussed last week here) is simply another word for jawboning. It aims to have people react to it and therefore delay the central bank having to actually take any concrete action. If they talk of raising rates perhaps people will exercise some caution and they can avoid raising rates.

Much like the US “recovery” is built upon the illusion of rising stock market prices, our recovery here is built upon rising house prices since almost no one invests in the stock market. The NZ current account deficit remains very high at $4.8 billion or 4.1% of GDP. So we continue to buy much more than we sell like most of the western world.

And if you are still tempted to believe the hype that all is cured Satyajit Das gives a great summary of where the world is at and what might lie ahead on marketwatch this week entitled:

“Global economy’s recovery is a sheep in wolf’s clothing

Commentary: Officials promote government of the debt, by the debt, and for the debt”

We’ve featured a few things in the past from Das too. In fact he was interviewed and commented specifically on New Zealands prospects last year which we commented on here

Writer Satyajit Das on How New Zealand Will Fare in the Crisis

Holiday Hours

The last few years when there has been low volume in the gold and silver markets around New Year, there have been significant price declines. So we may well see a chance to buy when the price is low again before the end of the month.

Our local New Zealand suppliers are closing at the end of the day on Monday December 23rd and reopening Monday 6th January. So we won’t have access to locally refined gold and silver products during this time.

However we will still be able to offer some imported products such as PAMP gold and silver and Canadian gold and silver Maple coins during the holidays.

So get in touch if you see a price dip as you will be able to buy on most days apart from Christmas Day, Boxing Day and New Years Day holiday.

As always we are not strictly Monday to Friday 9am to 5pm so if in doubt just phone or email.

This will most likely be our last weekly update until Thursday 9th January, so we wish you a happy, safe and relaxing Christmas and a prosperous New Year!

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| RBNZ Forward Guidance and Other Bunkum |

2013-12-11 21:10:29-05 2013-12-11 21:10:29-05 |

Gold Survival Gold Article Updates: Dec. 12, 2013 This Week: Gold Manipulated Upwards? Record shorts fail to push gold to new lows The Correction Isn’t Over, But Gold’s Headed to $20,000 RBNZ Forward Guidance and Other Bunkum Gold Manipulated Upwards? A bit of a turnaround from last week with […]

read more…

| A Fed Policy Change That Will Increase the Gold Price |

2013-12-18 17:19:29-05 2013-12-18 17:19:29-05 |

With the gold price falling this morning upon the news of the Federal Reserve announcing a slight reduction in its money printing programme this is a timely piece. It looks ahead to a little discussed possibility of the next course of action that the Fed may take in the not too distant future. That of […]

read more…

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1485.85/ oz |

US $1218.25/ oz |

Spot Silver |

|

| NZ $24.14/ oz NZ $776.01/ kg |

US $19.79/ oz US $636.25/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuideToday’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$844.13

(price is per kilo only for orders of 5 kgs or more)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.