Table of contents

- Introduction: Why This Matters in 2025

- NZD Strength: What It Means and Why It Matters

- Gold vs Silver: Do They React Differently to a Strong NZ Dollar?

- What the Data Shows: Gold and Silver Prices vs NZD

- Should I Wait for the NZ Dollar to Weaken?

- Final Thoughts: Strong NZD, Strong Time to Buy?

- FAQs on Strong NZD relationship to Gold and Silver Prices

Estimated reading time: 6 minutes

Introduction: Why This Matters in 2025

This year, the New Zealand dollar has surged by over 8.5% against the US dollar — one of the strongest annual performances in recent memory. While a stronger Kiwi might be good news for overseas travel or importing goods, it also raises an important question for bullion buyers:

What happens to the NZ gold and silver price when the NZ dollar strengthens? Should I still buy precious metals now — or wait for the NZD to fall again?

Let’s consider how currency strength affects local bullion prices and whether 2025 is still a smart time to buy gold and silver in NZD.

NZD Strength: What It Means and Why It Matters

When we talk about the New Zealand dollar being “strong,” we’re usually comparing it to the US dollar — the world’s reserve currency and the unit gold is priced in globally.

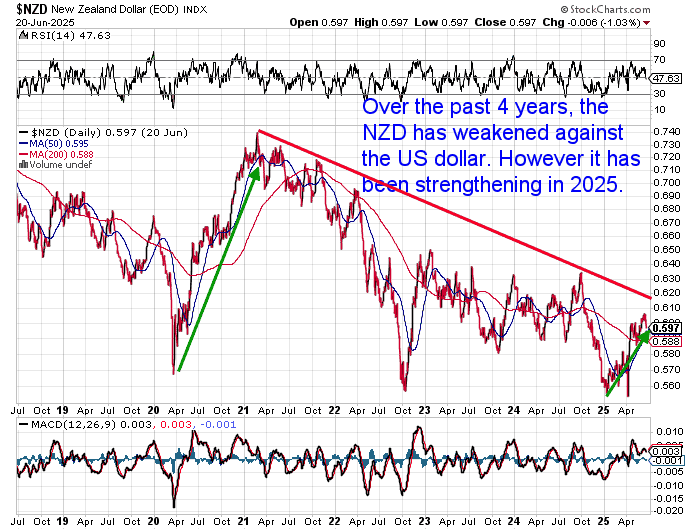

In 2025, the NZD/USD rate has moved from 0.55 to nearly 0.60. Meaning every NZ dollar now buys more US dollars — and, by extension, more gold and silver in USD terms. [See official NZD/USD exchange rates from the Reserve Bank].

So, as the NZD strengthens:

- Gold in USD might rise, but

- NZD-denominated gold can underperform USD gold, stay flat, or even fall

This gives local buyers a rare window of opportunity to acquire gold and silver at relatively lower NZ prices. Even while global prices might be climbing.

Gold vs Silver: Do They React Differently to a Strong NZ Dollar?

While gold tends to get all the attention, silver prices in NZD can behave differently — often with more volatility — during shifts in the NZD/USD exchange rate.

Here’s why:

- Gold is primarily a monetary metal, valued for its role as a long-term store of wealth.

- Silver plays a dual role: it’s both a monetary metal and an industrial one. This means it responds not only to inflation and currency changes but also to global demand from sectors like electronics and solar energy.

Silver tends to show greater price swings than gold, both up and down. When the NZD is strong, it can dampen local silver prices, just like with gold. But silver’s reaction also depends on the health of global industry.

- If industrial demand is cooling, silver may lag behind gold.

- If inflation expectations or stimulus-driven growth return, silver often rebounds more sharply — giving investors more upside potential (and more risk).

Tip: If you already hold gold, adding silver when the NZD is strong can offer diversification and potential for higher gains — especially when global demand is expected to recover.

Let’s take a closer look at the price data — and how both metals have performed in NZD terms during recent shifts in the exchange rate.

What the Data Shows: Gold and Silver Prices vs NZD

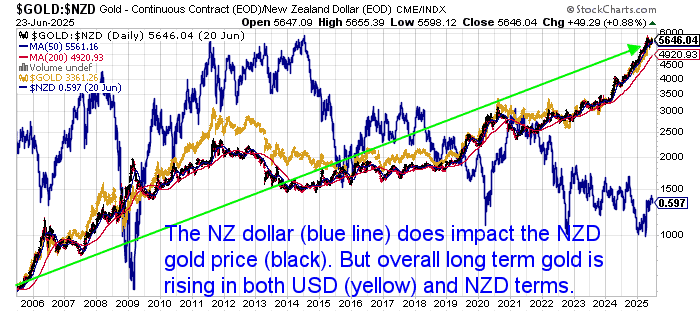

Over the long term, gold and silver tend to rise in all currencies, including the NZD. But the path isn’t always smooth. During periods when the NZ dollar strengthens significantly, local gold and silver prices can:

- Pause or dip

- Deliver “sideways” movements

- Lag behind USD bullion performance

The following charts show how NZD gold and silver prices have behaved relative to their USD counterparts. Note how NZD-based bullion prices can remain flat or even decline during periods of NZD strength — even when global (USD) bullion prices are rising. For example in 2009, the NZ dollar strengthened, USD gold rose, but NZD gold dropped. Although this was after a very strong rise in NZD gold, while the NZ dollar plunged.

Gold often appears steadier — holding value even as the NZD strengthens — while silver can overshoot both on the way down and on the way back up. This can offer opportunities for strategic accumulation.

Check the latest gold and silver prices in NZD here.

Should I Wait for the NZ Dollar to Weaken?

This is a common question. But here’s the catch:

Nobody rings a bell at the top or bottom of the currency market.

Waiting for the NZD to fall can leave you:

- Chasing prices higher as gold rises faster than the currency moves

- Missing your hedge if a global shock hits while the NZD is still “strong”

The second bullet point is very relevant today, as bullets – or at least missiles – fly around the middle east.

Gold isn’t simply about price gains — it’s about protecting purchasing power over time. And today’s strong NZD gives you more leverage to do that efficiently.

Learn more about timing your gold and silver purchases in NZ.

Final Thoughts: Strong NZD, Strong Time to Buy?

Yes, the NZ dollar is up in 2025. But so is the risk in global markets. Including:

- rising debt levels,

- potential war and rising oil prices,

- recession risk and increasing inflation.

And a strong NZD might just be the smartest time to secure gold and silver. As local precious metals prices are somewhat dulled.

However, gold (and silver) remains a timeless way to hold real value outside the financial system. Because as the charts above show, in the long run all currencies are being devalued against gold. They are simply taking it in turns to be the “pretty horse in the glue factory”.

A good motto to follow: Buy when others are relaxed. Hold while others panic.

Shop the range of physical gold and silver available today.

FAQs on Strong NZD relationship to Gold and Silver Prices

Not necessarily. A strong NZD lowers local bullion prices, letting you buy more ounces per dollar — it’s often a hidden opportunity.

Gold and silver are priced in USD. When the NZD strengthens, the same ounce costs fewer NZD.

Not unless you’re prepared to manage FX risk. Holding local gold protects against domestic inflation and keeps things simpler.

It can be — especially for those willing to accept more price swings. Gold is more stable; silver adds leverage and risk.

– Buy more now while pricing is in your favour

– Use dollar-cost averaging to smooth timing

– Consider diversifying with silver

Editor’s Note: This article was originally published on 3 July 2012 and fully rewritten with updated charts on 7 September 2021. It has now been extensively updated again on 24 June 2025 to reflect the latest NZD trends and bullion pricing insights.

Pingback: A longer term view of NZD silver | Gold Prices | Gold Investing Guide

Pingback: Why Has the New Zealand Dollar Been Rising of Late? | Gold Prices | Gold Investing Guide

I can’t remember who said it recently… It’s like a bunch of boats in the harbour, and all of them are sinking. Some boats are sinking faster, and some boats are sinking slower. If you’re on a boat that’s sinking slower, and you’re looking at a boat that’s sinking faster as a point of reference, you’d think that you’re on a boat that’s rising.

All of the fiat currencies are sinking boats, and currency exchange markets create an illusion that some fiat currencies sometimes increase in value.

So long as all fiat currencies are being inflated (and that’s the corner that our world has painted itself into), they’re ALL losing value.

Thanks ASE, Yes that is a very good metaphor to use to demonstrate exactly what is going on.

Pingback: Gold Price Forecast: What Experts Predict - Gold Survival Guide