|

Prices and Charts

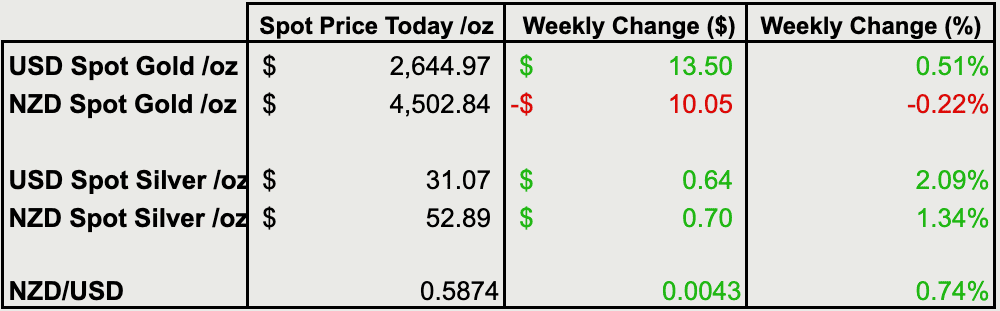

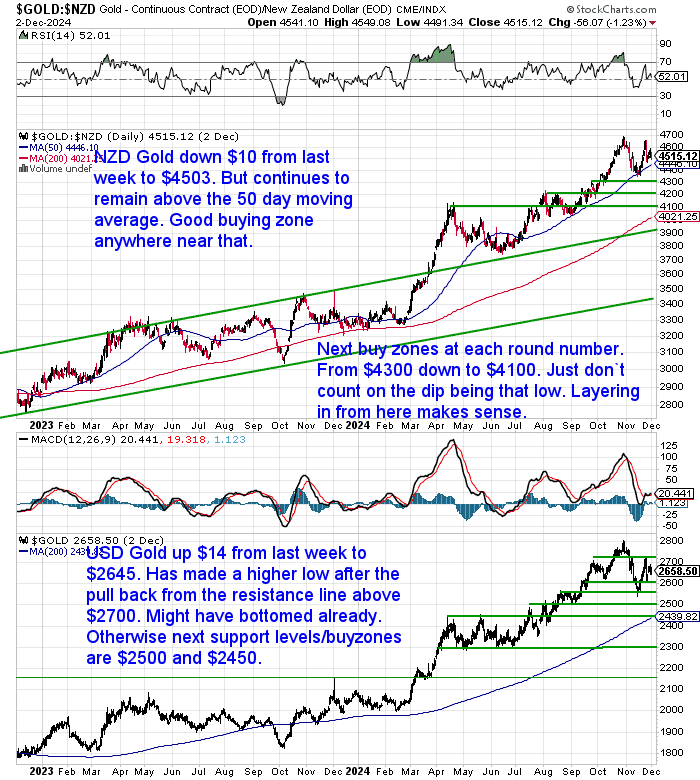

NZD Gold Hovering Around $4500

Gold in New Zealand dollars was down $10 from a week ago to $4503. It continues to hold above the key 50 day moving average (MA) line. It is likely to be good buying anywhere near that line (currently at $4446). There are other buy zones to watch below there, but we might not see gold return to those. So consider an initial position here.

USD gold is up $14 to $2645. It looks to have made a higher low after the pullback from the resistance line above $2700. So it may well have bottomed already around $2550. Otherwise the next support levels are at $2500 and $2450.

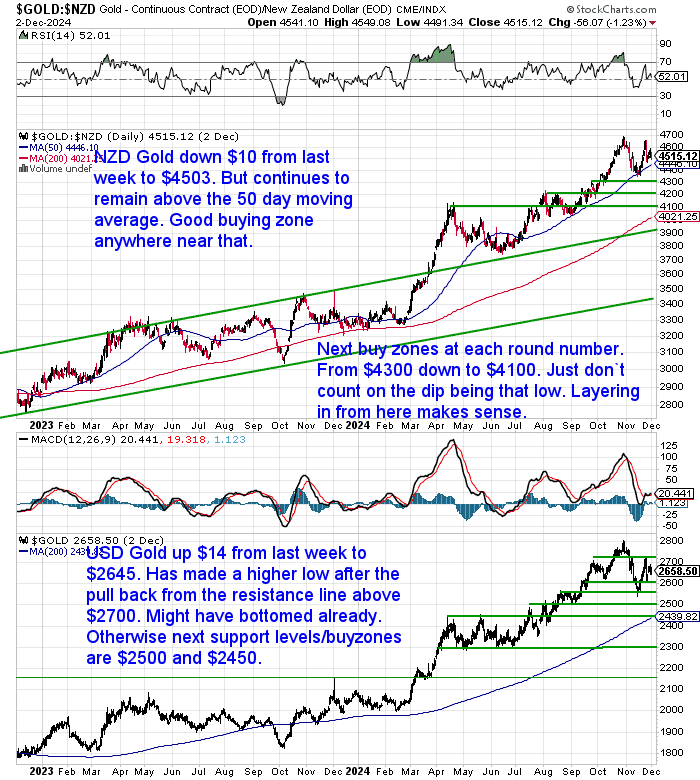

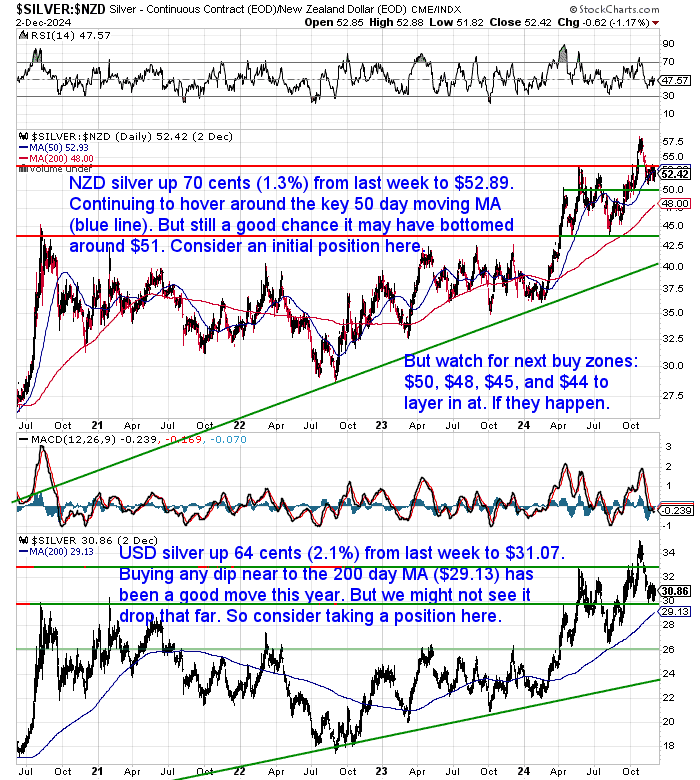

NZD Silver Up 1.3%

NZD silver is up 70 cents or 1.3% from 7 days ago to $52.89. It continues to hover on either side of the 50-day MA. But there is a good chance it may already have bottomed around the $51 mark. So right here is likely a good place to take an initial position in silver. If there were any further drops the buy zones would be at $50, then the 200-day MA at $48.

While in USD terms silver was up 64 cents or over 2% to $31.07. Buying any dip down close to the 200-day MA has been a good move all this year. It’s not too far above that right now, so consider layering in from here.

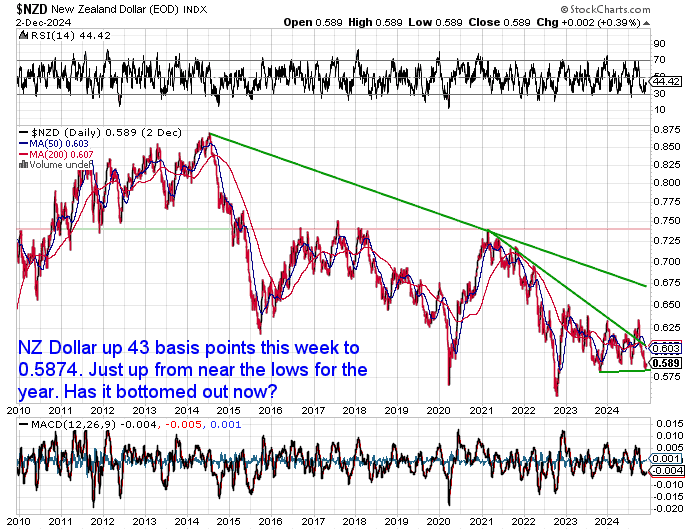

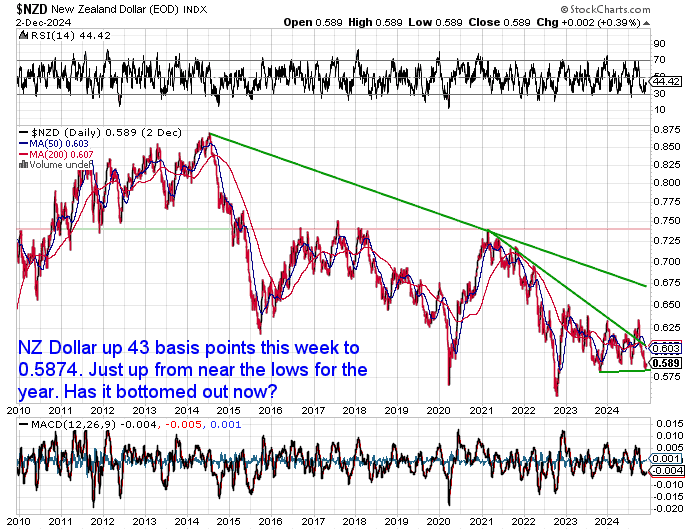

Has the NZ Dollar Bottomed?

The Kiwi dollar is up 43 basis points from last week to 0.5874. It is up from near to the lows for the year. There is a good chance that the post-election strength of the US dollar is over with people realizing that the US dollar will have to weaken during Trump’s next term. So the NZ dollar might have bottomed out already.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

From Ancient Greece to NZ Homes: Is Silver Undervalued by 20x?

In our latest article, we explore how historical wages and modern housing prices indicate that silver may be significantly undervalued today. By examining the daily earnings of ancient Greek laborers, paid in silver, and comparing them to current New Zealand house prices measured in silver ounces, we uncover a striking disparity. This analysis suggests that silver’s value could be much higher than its current market price.

Discover how these historical and contemporary comparisons reveal silver’s potential for substantial appreciation. Whether you’re interested in precious metals, real estate, or economic history, this article offers valuable insights into silver’s undervaluation.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

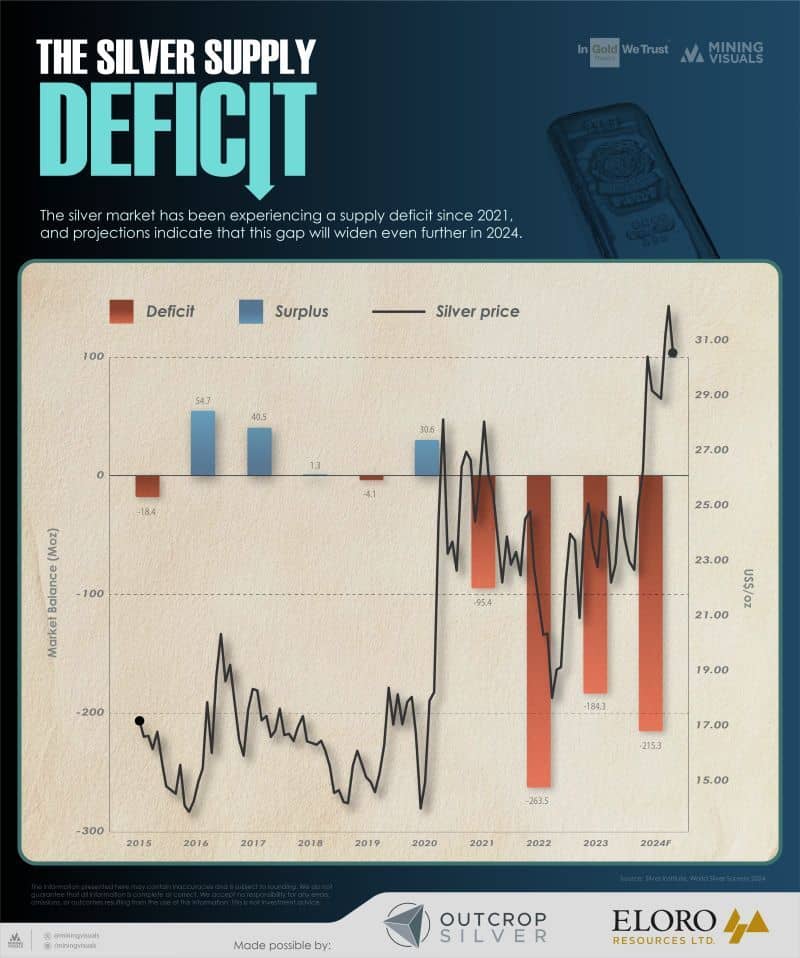

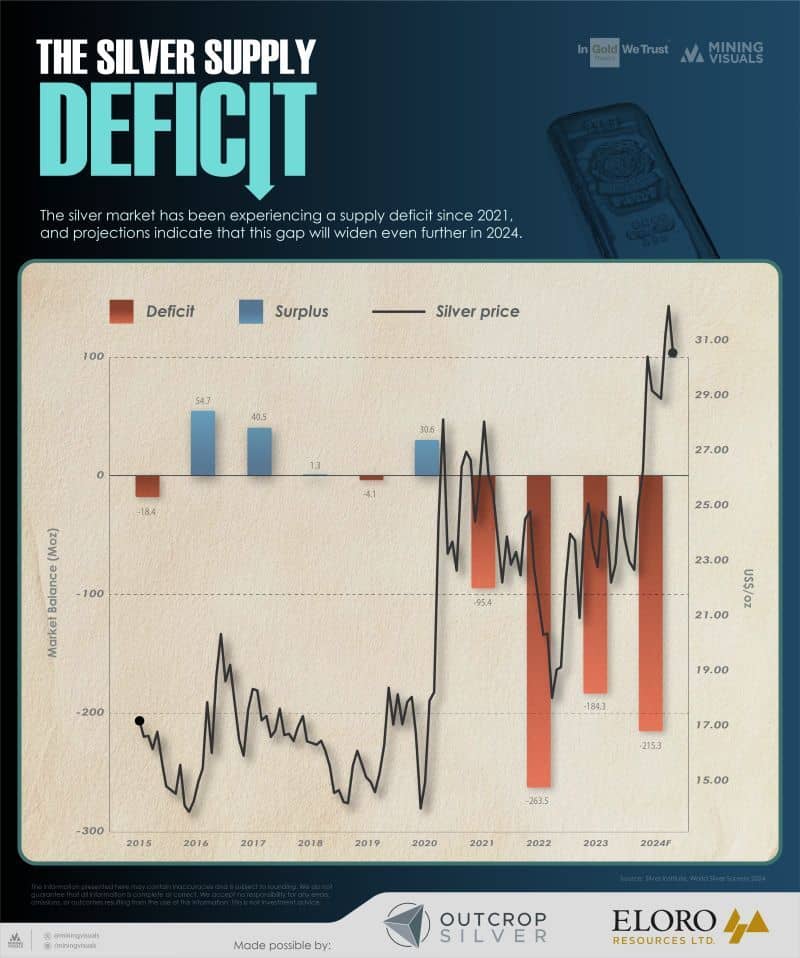

Silver Supply Deficit Since 2021 Continues

While silver is clearly undervalued on a historical basis, whether from 40 or 2500 years ago, it is also being consumed at an ever faster rate. Care of increased use in electronics and solar panels silver supply remains in a deficit.

“Consuming 20% more Silver than we produce, yet supply is unable to respond.”

Source.

Another reason to expect higher silver prices.

Gold Adjusted For Inflation Breakout. Silver Not Far Behind

Gold adjusted for inflation has clearly broken out. Silver is also getting close.

“#Silver might not get its historical breakout confirmation this year, but still has a bullish backdrop.

You see, if #gold vs #inflation closes the year where it is now, that is a historical breakout confirmed!

Silver tracks this.”

Source.

Start of a Second Inflationary Wave?

Speaking of Inflation…

The Fed is about to face a policy quagmire, in my view.

With core PCE inflation now at 2.8%, today’s data reaffirms that consumer prices are likely bottoming.

History suggests we might be witnessing the start of a second inflationary wave.

What makes this situation unique is the Fed’s limited capacity to combat this second wave, as raising rates further could exacerbate the government’s already heavy debt burden.

I can’t stress this enough:

This scenario is profoundly bearish for the US dollar in my view.

Adding to this, Trump has repeatedly advocated for a weaker dollar, further compounding this bearish USD view.

Trump Vows to Defend the Dollar with 100% Tariffs on BRICS Nations

Over the weekend, Trump warned BRICS nations that any attempt to create a rival currency to the US dollar would be met with 100% tariffs.

Bloomberg reports:

Trump Demands ‘Commitment’ From BRICS on Using US Dollar

“US President-elect Donald Trump warned the so-called BRICS nations that he would require commitments that they would not move to create a new currency as an alternative to using the US dollar and repeated threats to levy a 100% tariff.

“The idea that the BRICS Countries are trying to move away from the dollar while we stand by and watch is OVER,” Trump said in a post to his Truth Social network on Saturday.”

Source.

However the likes of Russia are already using gold to bypass US sanctions and the SWIFT wire transfer system. This can be done completely “off grid” by using for example the United Arab Emirates as a conduit for the trade. There is no footprint left behind, unlike even bitcoin which still is traceable to some degree in terms of tracking movements between wallets etc.

This might be merely an empty threat from Trump. Making a bold threat to encourage discussion. But the BRICS likely don’t actually need to create an alternative to the dollar when there is already one that has existed for thousands of years. An alternative that is already being used to some degree now.

Gold as the Answer? Judy Shelton’s Strategy to Fix the Dollar

We’ve recently read about Judy Shelton’s theory on how the US could once again have sound money.

Shelton, a long-time advocate for the gold standard, proposes in her book, Good as Gold: How to Unleash the Power of Sound Money, that the U.S. could restore the dollar’s value by issuing Treasury bonds redeemable in gold. She argues that the Federal Reserve’s discretionary policies lead to economic instability, as unpredictable interest rate changes can cause market disruptions, such as bank failures and commercial real estate downturns. Shelton believes that tying the dollar to gold would limit policymakers’ ability to manipulate the currency, promoting long-term economic stability and growth. Her proposal aims to create a more predictable monetary system by reducing the Federal Reserve’s influence and re-establishing a gold-backed dollar.

The difficulty in achieving this?

“The likely benefits of such bonds are so significant that it may seem surprising that they have not been implemented. The problem, of course, is that this form of bond would reveal the man behind the curtain. It would show that government officials can and do play fast and loose with the dollar and with the US financial system to enable themselves and their friends a free hand to borrow and spend, and to actively “manage” the economy.

Dr. Shelton’s proposed changes will be vigorously resisted by those who benefit from the existing status quo – large commercial banks and financial institutions, Federal Reserve officials and bureaucrats, politicians and regulators – everyone who benefits from the Fed’s tendency to loose monetary policy. Still advocates of freedom and prosperity should continue to make the arguments and offer proposals for moving to a sound monetary regime.”

Source.

Our thoughts?

What the BRICS nations do in terms of a new currency, or what the incoming US administration does to the US dollar is not really such a big deal. Why?

Because today everyone anywhere can create their own gold standard by simply buying and holding gold.

The future is uncertain, but gold maintaining your purchasing power is not.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.

|

|

|