Prices and Charts

NZD Gold Bouncing – on the Back Way to Recent High?

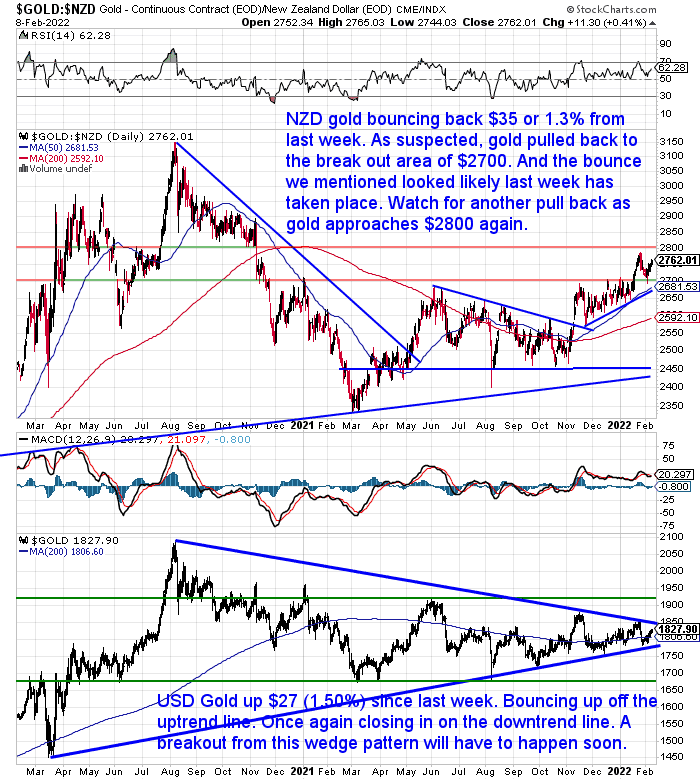

Gold in NZ Dollars has bounced back over the past 7 days. Up $35 or 1.3% from then. As we suspected it might, NZD gold pulled back to the breakout area of $2700. Then the bounce we mentioned looked likely last week took place. Now we are watching for another pullback once gold approaches the recent high of $2800 again. Gold may need to consolidate above $2700 before it can push too much higher. But once $2800 is broken, there is not much resistance until $2950.

Looking at the gold in US dollars, we can see the price continues to bounce back and forth in the wedge formation that dates back to the high of August 2020. This is getting more and more compressed so will have to break out of this pattern before very long. We’re thinking that the break out will be up.

NZD Silver Bounce Outperforms Gold

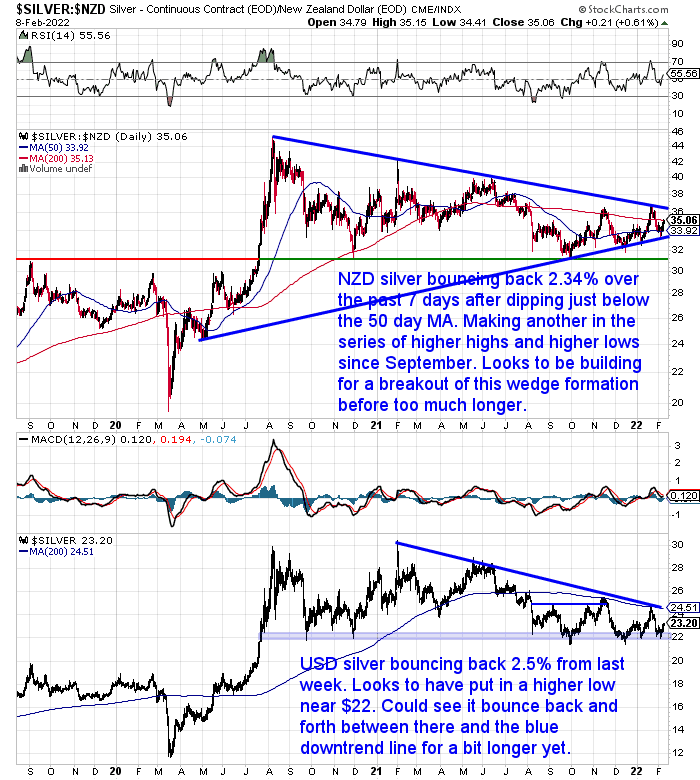

Silver in New Zealand dollars also bounced back over the past 7 days. Even more than gold, rising 2.34% after dipping just below the 50 day moving average (MA) the previous week. NZD silver made another higher low in the series of higher lows and higher highs we have seen since September. NZD silver looks to be building for a break out of this wedge formation before too much longer. As it is getting more and more compressed. But could be another month or 2 of sideways action before this.

Kiwi Dollar Slightly Stronger

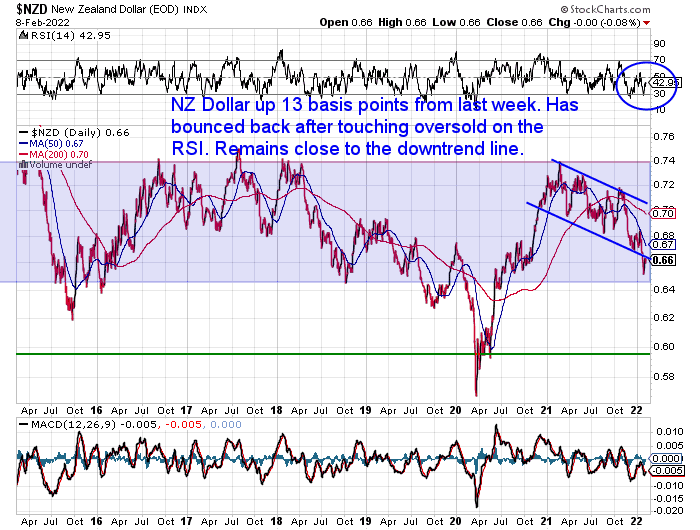

The New Zealand Dollar was up just 13 basis points from 7 days ago. It has now bounced back a bit after touching oversold on the RSI indicator. But so far has not gotten back above the downtrend line that was recently pierced. The Kiwi remains clearly in a downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The Safest Way to Invest in Gold

This week’s feature article looks at what is the safest way to invest in gold?

It covers:

- Why Invest in Physical Gold?

- Disadvantages of Investing in Physical Gold

- Physical Gold Versus Other Investment Options

- Jewellery

- ETFs

- Gold Futures & Contracts

- Gold Mining Stocks

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

US S&P To Meltup 40%, Then Crash By 80%?

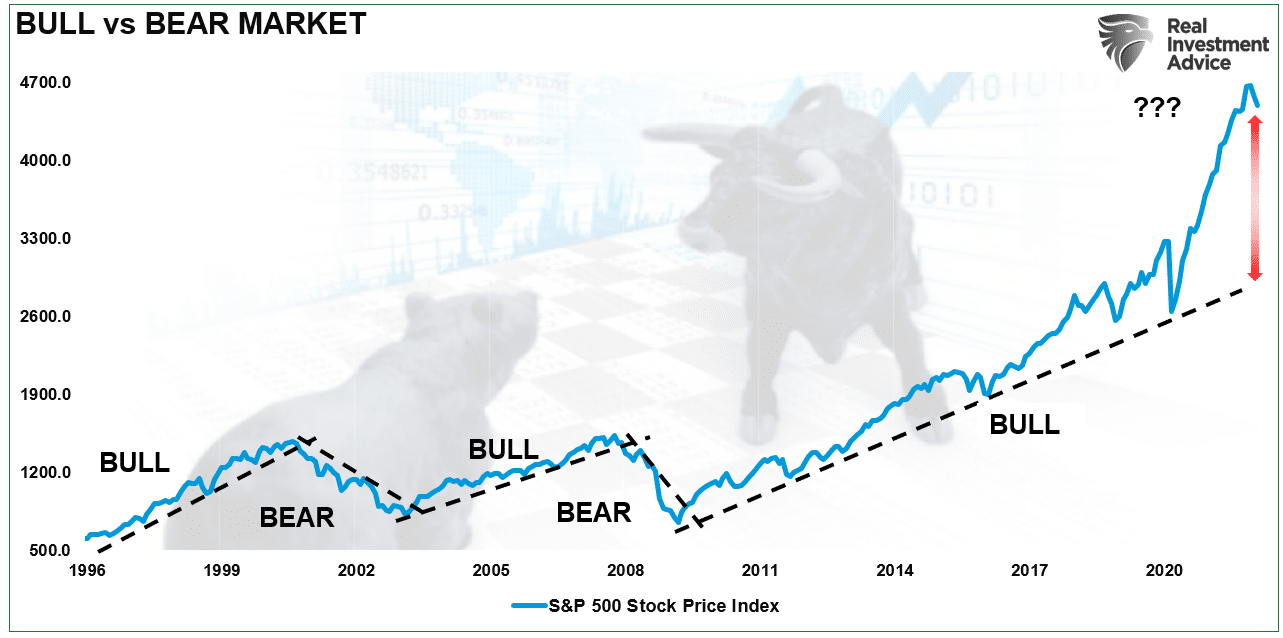

Lately we’ve been discussing the potential for a bear market in the stock market. Meaning a greater than 20% correction.

An interesting article points out that the US stock market could actually fall 50% and this would still “only” be a correction not a bear market.

See: A 50-Percent Decline Will Only Be A Correction

As the writer argues a bear market is when we see a long term change in trend from up to down.

But he also points out that:

“When you realize that a 50-percent decline in prices would still maintain the “bullish trend” of the market, it just shows how exacerbated markets are due to a decade of monetary interventions.”

However in many ways this is just semantics, as a 50% fall would still wipe out a lot of wealth. It would also lead people to feel “less rich” and likely cut back on spending too.

We still think the US and other central banks are likely to step in and once again open up the currency spigots to try and juice things higher.

But here’s a slightly different perspective…

Recently we saw this interview with David Hunter on Adam Taggart’s Wealthion Youtube channel.

The title pretty much explains it all: “David Hunter: S&P To Meltup 40%, Then Crash By 80% – All This Year!”

Hunter makes the good point that despite how crazy overvalued the stock market is, we still haven’t seen the blow-off top where everyone piles is in and we get a huge surge higher.

So perhaps there could be more to come yet, before an even bigger fall? It seems a bold call to say we could see a surge and then a 80% fall, all before the end of this year!

But there is historical precedent for such falls. Back during the great depression the stock market under went similar sized falls although this was over a longer timeframe than just one year.

“The early 1930 rally came after the market had fallen nearly 50% in the fall of 1929. The spring 1930 rally took the market up nearly 50% again, to a level that was only about 20% below the previous peak.

That rally, of course, was also the biggest sucker’s rally in history. After the market peaked in April 1930, it crashed again, eventually ending up down 89% from the 1929 high and more than 80% from the 1930 high. The market did not reach the 1930 high again for another quarter of a century.”

Source.

Personally we think it is a bit a fools errand to try and predict price levels and timeframes. That is near on impossible to do.

But both these articles show how overvalued the stock market has become. The David Hunter interview also shows it could get even more overvalued yet. But the trouble is how do you know when to get out?

So if you are investing in managed funds, KiwiSaver, shares etc, just be sure you have chosen a portion of your wealth not to invest. As we don’t see gold and silver as investments, but rather as insurance for your wealth.

Make sure you have enough insurance in place to balance out the rest of your investments.

So get in touch if you’d like a quote…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|