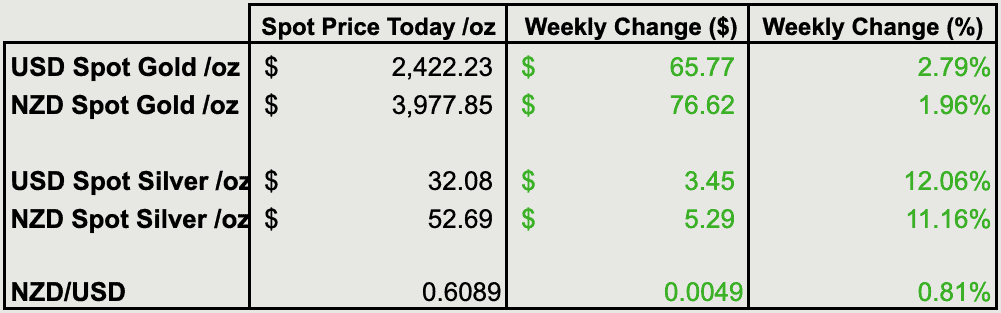

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3804 |

| Buying Back 1kg NZ Silver 999 Purity | $1568 |

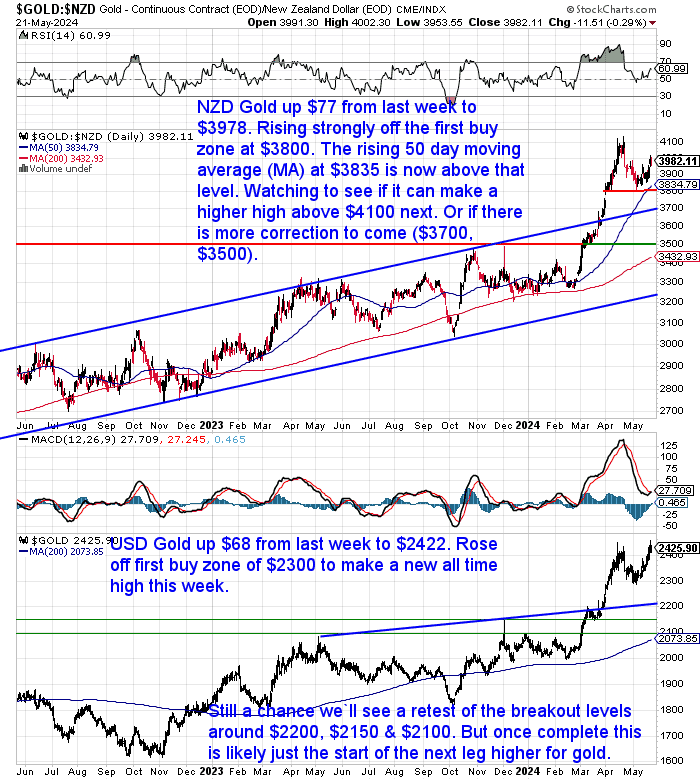

USD Gold Hits Another All-Time High

Gold had a strong week, up $77 in NZD terms (2%). Continuing its rise off our first buy zone at $3800. The rising 50-day MA has now moved up above this level. So we are watching to see if NZD gold can now make a higher high above $4100.

The rise was even stronger in USD terms, up 2.8% and hitting another new all-time high price above $2400. So that was a pretty shallow correction for gold. Of course, it can always head lower still. But to us it is looking pretty solid, so we wouldn’t bet on it.

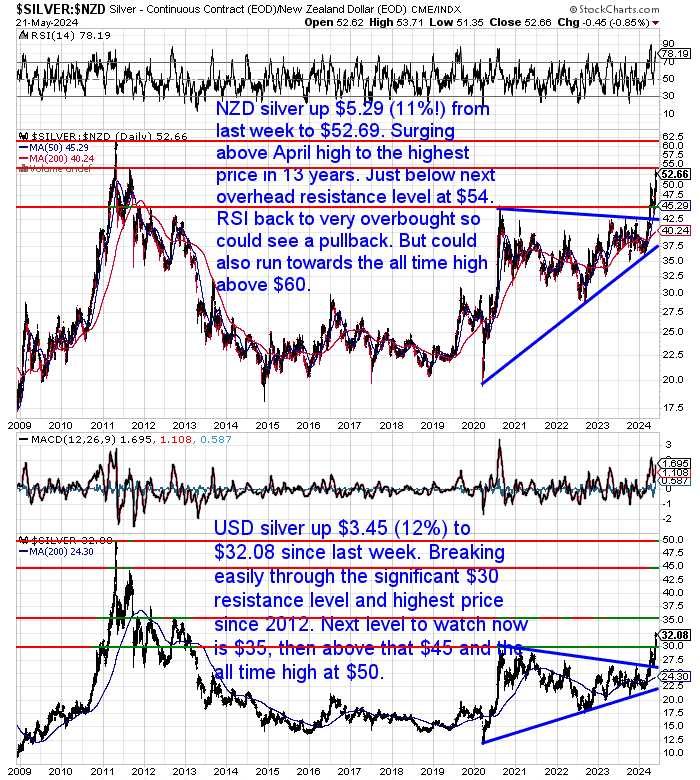

USD Silver Breaks Above Key $30 Mark – 12-Year High

But silver was the star this week. In NZ Dollars it bolted up $5.29 or a massive 11% to $52.69. Now the highest price in 13 years. It’s not far below the next overhead resistance level at $54. RSI is back to very overbought (well above 70) so a dip lower from there normally would be expected. However, this doesn’t look like a normal run-up. So it wouldn’t surprise us to see NZD silver mount a challenge for the all-time high above $60.

Silver in USD made an even more significant move this week. It flew up $3.45 or 12% from last week. Now sitting above $32. It easily busted through what had been the very significant resistance line at $30.

We have read a few analysts who think Silver might turn down from around here and have a sharper correction. Could do. They believe because gold hasn’t been rising very strongly this is a warning. However, to us this looks like a really strong silver market which is finally playing catch up to gold. The breakout has not really been noticed yet. So now we watch to see if it can break US$35 and then maybe even US$45.

More on silver price targets in this week’s feature article below.

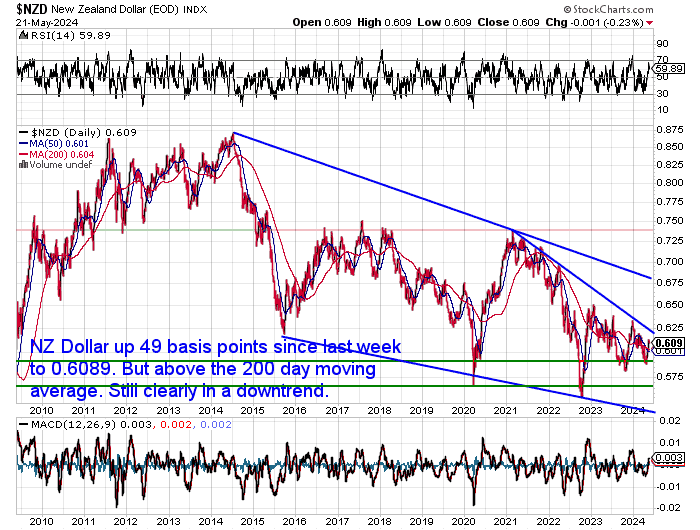

NZ Dollar up 0.8%

The Kiwi dollar was up 49 basis points (0.8%) from last week. At 0.6089 it is back above the 200-day moving average. But as it has been for years, still clearly in the downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

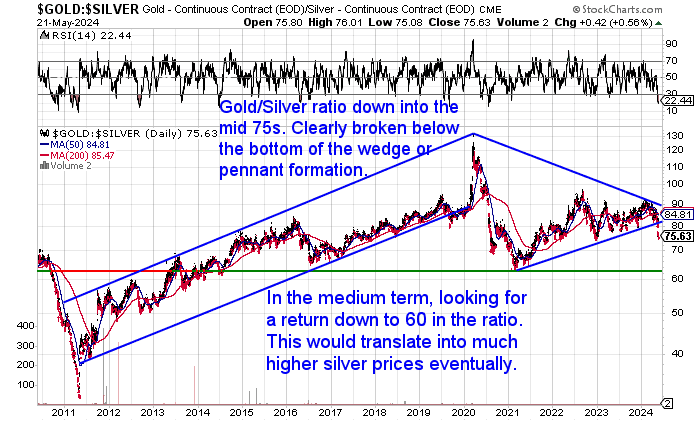

Gold Silver Ratio Breaks Lower

With silver breaking above the key $30 level we have also seen the gold-silver ratio (which we publish each day in our daily price alert) also break noticeably lower. Clearly now out of the flag or pennant formation. In the coming months, we can now expect a move down towards 60, which will mean much higher silver prices.

Silver Sentiment: Set to Surge, or Still Stuck in the Slump?

Silver’s recent performance might leave you scratching your head. This week’s feature article explores the psychology behind investor sentiment in the silver market.

You’ll discover:

- How investor sentiment can significantly impact the price of silver

- The different phases of investor psychology in a typical market cycle

- Where silver might be positioned in this cycle, based on recent market behavior

Curious if the silver market is on the precipice of a significant change? This article delves into the fascinating world of investor psychology and its potential impact on silver’s price trajectory.

Where Are We in the Psychology of the Silver Market Cycle in 2024?

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

NZ Bank Depositor Compensation Scheme Fund to be Built Up Over 20 Years – Will It Be Enough?

“Finance Minister Nicola Willis has decided New Zealand’s incoming Depositor Compensation Scheme (DCS) will build up a fund size over 20 years equivalent to 0.8% of protected deposits, or about $1 billion, Treasury says. This key detail is included in a consultation paper issued by Treasury this week.

The paper covers the funding strategy for the (DCS), known as the Statement of Funding Approach (SoFA). The DCS will be established by the Deposit Takers Act and will compensate up to $100,000 for each depositor per licensed deposit taker in the event of a deposit taker failing. The DCS is currently scheduled to launch in mid-2025.”

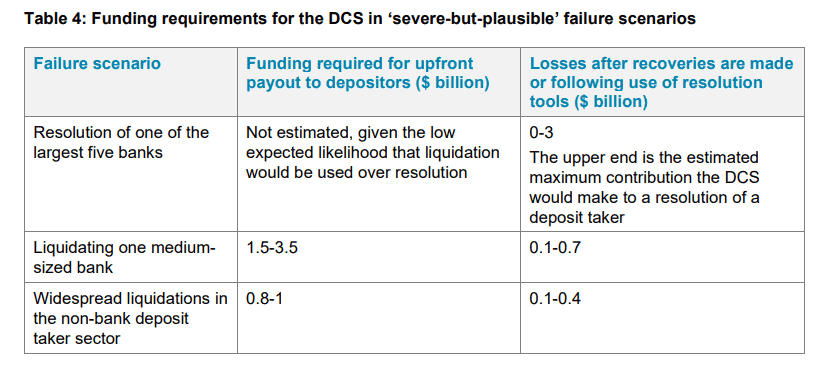

They arrived at this 0.8% of protected deposits based upon it being enough to handle a ‘severe-but-plausible’ bank failure event.

However, a closer look at this ‘severe but plausible’ failure shows that it is based upon only 3 scenarios (see the table below).

What is a resolution?

“Resolution is the restructuring of a deposit taker by a resolution authority using resolution tools to safeguard public interests, including the continuity of the deposit taker’s critical functions, financial stability, and minimal costs to taxpayers. Resolution can involve another deposit taker purchasing the assets and assuming the liabilities of the failing deposit taker or transferring the assets and liabilities to a bridge bank until a buyer is found.”

So basically they believe a large bank will not need to be liquidated but can be sold to another bank. Then there could be anywhere up to $3 billion in losses that the DCS would be required to fund.This ‘severe-but-plausible’ only includes the actual liquidation of one medium sized bank or widespread liquidations in the non-bank deposit taker sector.

Hmmm. We’re not so sure that their definition of ‘severe-but-plausible’ gels with what our definition would be.

As we’ve discussed previously, if one large bank fails we think this is more likely to be due to systemic problems that could be affecting a large number of banks.

The article then goes on to say:

OBR to be ‘modernised’

Meanwhile, the Reserve Bank says it’s looking to “modernise some aspects” of its Open Bank Resolution (OBR) tool for responding to a bank failure, and integrate the DCS with it.

In case you didn’t know, the Open Bank Resolution (OBR) is just a nice way of saying depositor haircut. Where shareholder but also depositors funds are used to re-capitalise a failed bank. A bank is closed, the RBNZ calculates how many dollars are needed to keep it operating, this is taken from shareholders and depositors and the bank is reopened after the haircut.

This is the current system in place in NZ should a bank fail. Currently no deposits are guaranteed in any NZ bank. As stated above the new DCS is not due until mid 2025.

Something interesting we noted was that a Reserve Bank spokesman said:“…we are reviewing the scope of depositor haircuts in light of the upcoming DCS, which will protect depositors up to $100,000 per depositor per institution. We are also considering the implications of industry developments, notably SBI 365 [365 day-a-year payments].”

Reading between the lines, do they perhaps think that 365 day-a-year payments increase the odds of bank runs and failures?

But the RBNZ also just pointed out quite rightly that the deposit guarantee creates moral hazard:

RBNZ says there’s a moral hazard risk with deposit guarantee. There’s a “moral hazard risk” the the deposit guarantee scheme could lead some people to chase the higher interest rates offered by non-banks, Reserve Bank governor Adrian Orr told journalists.

True. There’s also the moral hazard that banks are less careful with their borrowing knowing they can’t actually fail. And that depositors also make no effort to understand how secure their bank is.So while the DCS means we all have $100,000 compensation if a bank fails, it also potentially increases the odds of a failure.

Gold and Gold Miners Still Only 1% of Total Global Assets

In recent months we’ve reported how many central banks and also sovereign wealth funds are increasing their gold reserves. However, the below chart shows just how low a level this is happening from. So therefore there is still an awful lot of room for this to increase significantly in years to come…

An important reminder:

Multiple times in history, the precious metals industry was considered the largest market among global assets.

Today, however, it has shrunk so much that it’s almost a rounding error.

The potential for capital to flow back into this industry is substantial, especially as central banks urgently seek to accumulate metals and traditional 60/40 portfolios face pressure to redefine their capital allocation and incorporate hard assets.

Even a minor increase in investment could significantly impact the entire mining sector.

H/t to my friend

@LawrenceLepard

Source.

What’s your own percentage of gold and silver compared to your total assets? Hopefully more than 1%?

If not, you know where to come to find some more…

|

||||||||||||||||||||

This Week’s Articles: |

||||||||||||||||||||

|