This Week:

- Using the Gold Silver Ratio to Time Buying Silver

- RBNZ Cryptocurrency to Replace NZ Physical Currency with a Digital Alternative?

- What’s “Changing”: Interbank Lending, Interest Rates and Inflation?

- The Ultimate Iron Lady

Prices and Charts

Silver in Serious Buy Zone

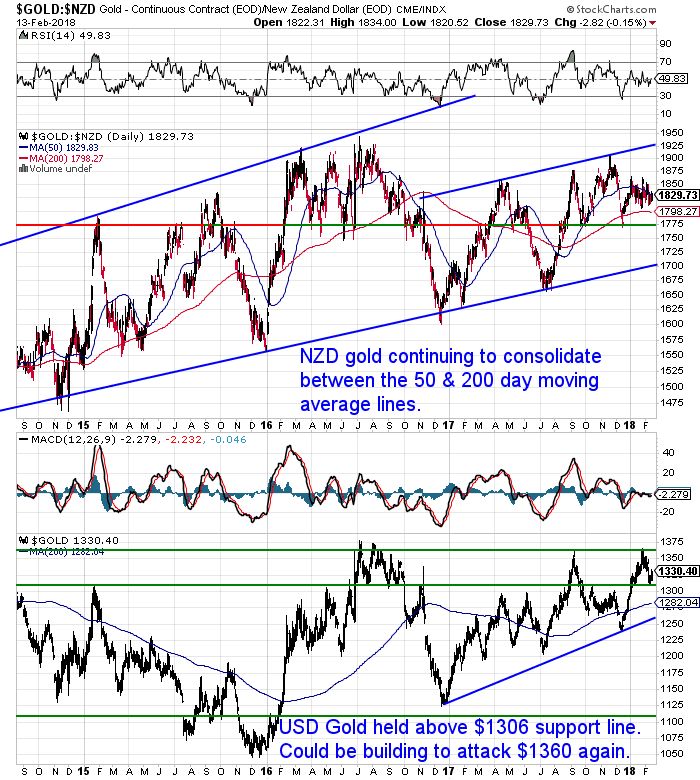

With the Kiwi dollar weakening slightly, gold in NZ Dollars was up by 0.75% this week. NZD Gold continues to consolidate between the 50 and 200 day moving average lines.

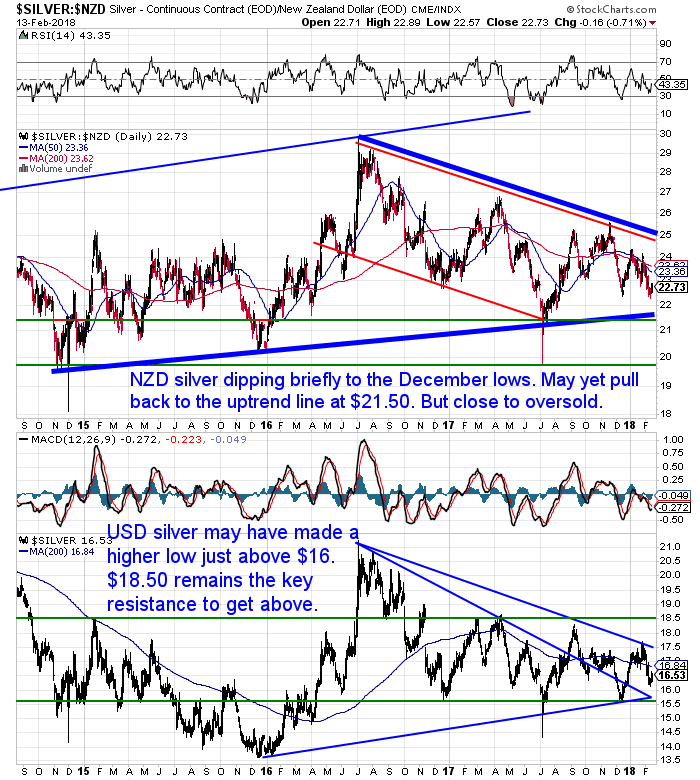

NZD silver is unchanged from a week ago. However during the week silver did dip briefly down to the December lows. It could yet head down to test the uptrend line around $21.50. But we are entering a serious buy zone for silver now. As that uptrend line has been strong support over the past 3 years.

The wedge formation that silver has been in since 2016 is getting steadily more compressed. NZD silver will have to break out of this before too long. Odds are it being in favour of the longer term trend of the last 3 years – which is up.

More soon on another reason why silver is looking a great buy currently.

The NZ Dollar held above 0.72 this week. But down on a week ago. The Kiwi could be building towards a run at the overhead resistance of 0.75. But longer term it remains within the wedge formation between 0.68 and 0.76.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Gold/Silver Ratio: Buy Signal For Silver

We’ve been highlighting the Gold Silver ratio in our daily prices alerts the last couple of weeks. You can gain access to those here. https://goldsurvivalguide.co.nz/dailypricesalert/

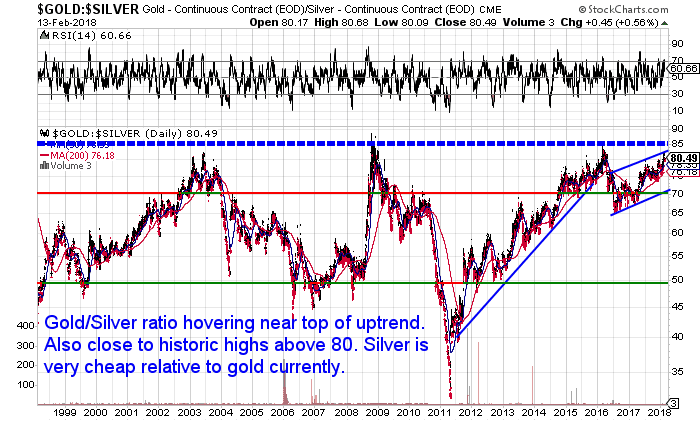

A rising ratio shows that gold is expensive relative to silver, and a falling ratio shows that gold is cheap relative to silver.

Over the long run the gold to silver ratio generally moves between 50 and 70. But right now it’s trading far above that range.

The chart below shows the gold silver ratio went above 80 last week. So it takes 80 ounces of silver to buy one ounce of gold.

Looking back the ratio has only been this high a few other times in history. This extreme indicates that silver is a better value than gold today.

Using the Gold Silver Ratio to Time Buying Silver

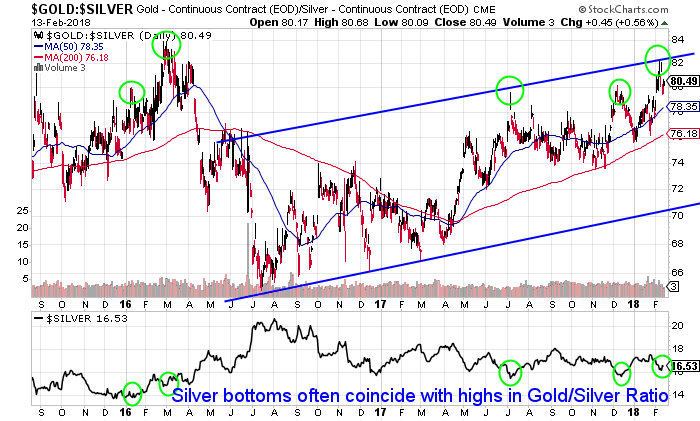

The gold to silver ratio is also at the top of the uptrend it has been in for the past 18 months.

We’ve seen the argument made that the gold to silver ratio is of no use in timing to buy silver. Other than simply showing it is better value than gold.

However at the extremes like we are in now, we beg to differ,

Check out 2.5 year chart below. When the gold silver ratio (main chart) has reached these extreme highs at or above 80 in the past, this has coincided with a bottom in the price of silver also (see lower section of the chart).

Therefore at these extreme, not only is silver great value compared to gold, but in dollar terms silver is often at a low also.

Currently silver seems to have turned up from a low. So there’s a good chance we are seeing this pattern repeat.

Making it a great buy zone for silver.

For more detail on the gold silver ratio check out: What is the Gold Silver Ratio?

You might also be interested in: Could Silver Be Worth More Than Gold?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

RBNZ Cryptocurrency to Replace NZ Physical Currency with a Digital Alternative?

This week we stumbled across a report on the Reserve Bank of New Zealand (RBNZ) website on cryptocurrencies. We missed it back in November. It was titled: Crypto-currencies – An introduction to not-so-funny moneys.

It has a key paragraph in it we though worth writing about.

In this post you’ll see what the RBNZ cryptocurrency plans are and how this compares to other central banks around the world. Plus what the outcome might be of a central bank digital currency to replace physical cash.

We’ve also got 2 other posts on the site this week. They look at current changes in interbank lending, interest rates, inflation and velocity of money and their impacts on gold.

What’s “Changing”: Interbank Lending, Interest Rates and Inflation?

The Ultimate Iron Lady

Scroll down for more on them.

If you’ve been looking to buy silver, then the indicators we discussed earlier point to this being a very good time to buy.

Get in touch to discuss your options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|

Pingback: Gold Ratios Update: Dow/Gold, NZ Housing to Gold, & Gold/Silver Ratio - Gold Survival Guide

Pingback: Buy Silver in New Zealand

Pingback: Why Silver May Not Be “Off the Radar” For Much Longer - Gold Survival Guide