This Week:

- Gold Purity and Silver Purity – A Complete Guide

- Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

- Visa Goes Down in the UK, Chaos Ensues, Cash is Suddenly King

Prices and Charts

Gold Again in the “Buy Zone”

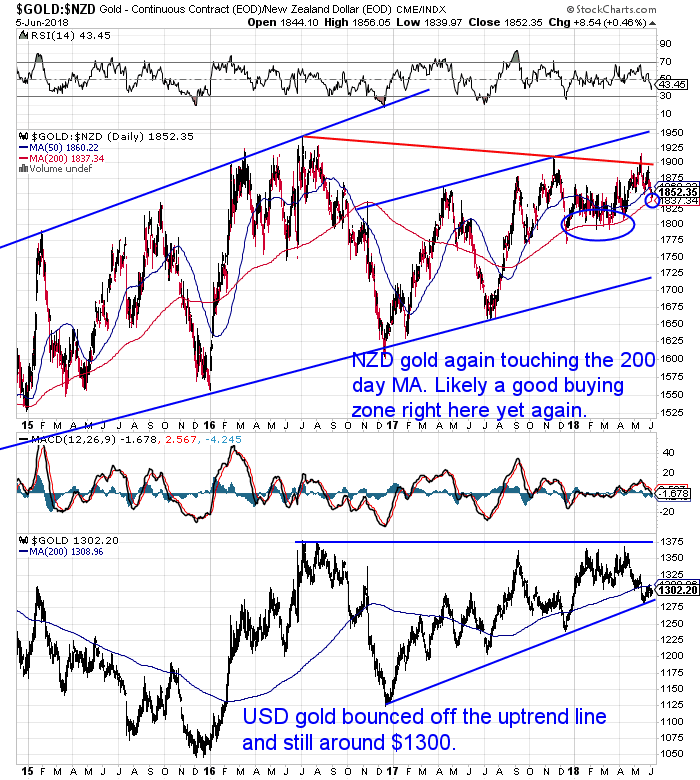

Gold in NZ Dollars is down over 2% this week. Now sitting just above the 200 day moving average.

Looking at the chart below you can see that the red 200 day moving average (MA) line has been strong support so far in 2018. In fact it is almost a year since the price of gold was below this key technical indicator.

So yet again NZD gold is in a very good buying zone.

Silver Still Stuck in the Wedge

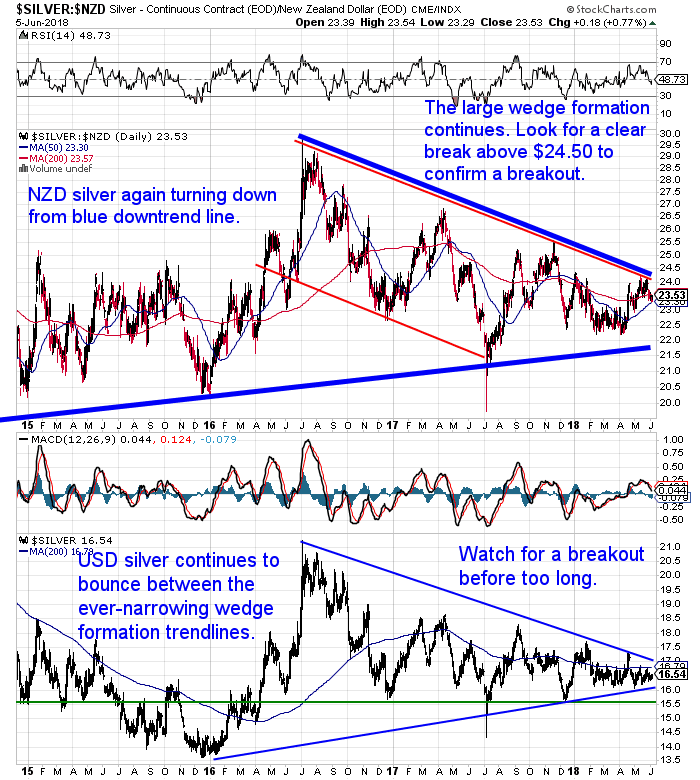

NZD silver held up comparatively better than gold. Down just over 1% for the week after again turning down from the blue downtrend line.

There’s not much more to be said about silver. The giant wedge formation continues. As it does silver is getting more and more compressed. When it finally breaks out – likely in the coming months – there should be a big move coming. Hopefully to the upside.

NZ Dollar Up Sharply

The NZ Dollar has been the main drag on local gold and silver prices. Up 1.81%, but now getting close to overbought. Also edging above the upper Bollinger band, so the Kiwi may struggle to get above the moving average lines.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Visa Goes Down in the UK, Chaos Ensues, Cash is Suddenly King

Last week we reported how a power failure in Melbourne meant that BNZ customers couldn’t use ATMs, Eftpos, internet banking, or physical bank branches for several hours over the weekend.

It highlighted how many people had no backup means to make payment.

The outage was only for a few hours. Imagine the disorder if it lasted days or even a week?

Well Europe got a similar and longer lasting taste over the last weekend, when Visa had a major outage. This resulted in millions of people being unable to use their debit or credit cards for over 12 hours.

As Don Quijones reports this was significant in the U.K. where “the chaos unleashed was particularly acute since it is one of the world’s most cashless economies, pipped to the post only by Canada and Sweden”.

He noted:

“In a beautiful irony, Visa, a company whose stated mission is to “put cash out of business” as quickly as possible, had little choice but to urge its customers to withdraw and use physical bank notes for transactions until the technical issue was resolved. Without access to cash, the chaos caused by yesterday’s outage would have been immeasurably worse.”

For more details on this plan by Visa to get rid of cash see: Visa Ups the War on Cash + How Governments Can Kill Cash

Don Quijones concludes:

“Going completely cashless [comes] with risks, as consumers in Europe were just reminded: system outage. If the payment system goes down and all you have to pay with are cards or your mobile phone, you could suddenly find yourself quite literally cashless, as happened to many Puerto Ricans after the power outages in 2017, caused by Hurricane Maria, knocked out electronic transactions and ATMs for days or weeks on end.

It was a stark reminder of just how fragile and vulnerable a 100% cashless society would be — at least until a cashless system can be created that is 100% safe from the threats posed by natural disasters, accidents, cybercriminals, and basic human incompetence. And it’s why cash retains its crucial role in the payment universe, whatever Visa, driven by its desire for more profits and a larger market share, might want people to believe. Even some of Europe’s senior central bankers are now willing to publicly concede, printed banknotes should retain their place and their role in society as legal tender for a long time to come.”

Source.

Gold Purity and Silver Purity – A Complete Guide

We continue our “back to basics” series in our feature article this week. Have you ever wondered how gold and silver purity was expressed? There is a difference between gold and silver bullion (bars and coins) versus gold and silver jewellery.

Also learnhow to be sure of the purity of the metals you are buying.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Do you know how much gold the RBNZ holds? What about the Reserve Bank of Australia?

Does it matter? Would it help a nations citizens if a central bank has gold reserves? The answer may surprise you.

You’ll also discover 3 specific ways to become your own central bank.

A reminder we have a new updated “Shop” page.

So head over and see all the new products available today.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|