Gold Survival Gold Article Updates:

06 March 2013

This Week:

- What is Causing the Falling NZ Dollar Gold Price?

- RBNZ: Making the NZ Banking Less “Systemically Risky”

- Jim Sinclair: The Big Falls in Gold are in the Future

- Warning: Do You Have An Aussie Bank Account?

Gold and Silver Price Action

Given the big bounce that occurred last Tuesday/Wednesday, it’s no surprise we are down on prices of a week ago. Gold in NZ Dollars currently sits at NZ$1900.86 versus NZ$1957 last week.

Silver is today priced at NZ$34.61 per ounce down from NZ$35.62 last Wednesday.

NZD Gold having dropped below the support of $1950 tested this last week but hasn’t managed to hold above that level. So you can see in the short term chart below, we remain in this downward channel.

Meanwhile NZD silver remains above the support levels that have held over the past 2 years of consolidation.

Given the kiwi dollar is remaining pretty strong, the local prices are taking their lead mainly from the US dollar gold and silver price currently.

What is Causing the Falling NZ Dollar Gold Price?

This morning we read an article by Adrian Ash of Bullionvault discussing real interest rates and gold. But more importantly it is the direction of real interest rates that counts.

Ash shows the below chart and points out “in the mid-1970s, saw gold prices halve in just 18 months, even though the real rate of interest stayed below zero for much of that time.

And once the direction of travel in real interest rates turned round, gold began the second leg of its 1970s’ bull market, rising 8-fold between the end of 1976 and the start of 1980.”

So even though rates remained negative for much of this move, it was enough to send gold falling simply because of the change of direction (of course the massive central bank selling in the mid 70’s didn’t help either).

We have seen a similar occurrence from September 2011 where real rates have bounced higher also and even though barely positive now, it has coincided with a fall in gold (gold hit its high in US dollars in September 2011).

How do NZ real interest rates compare?

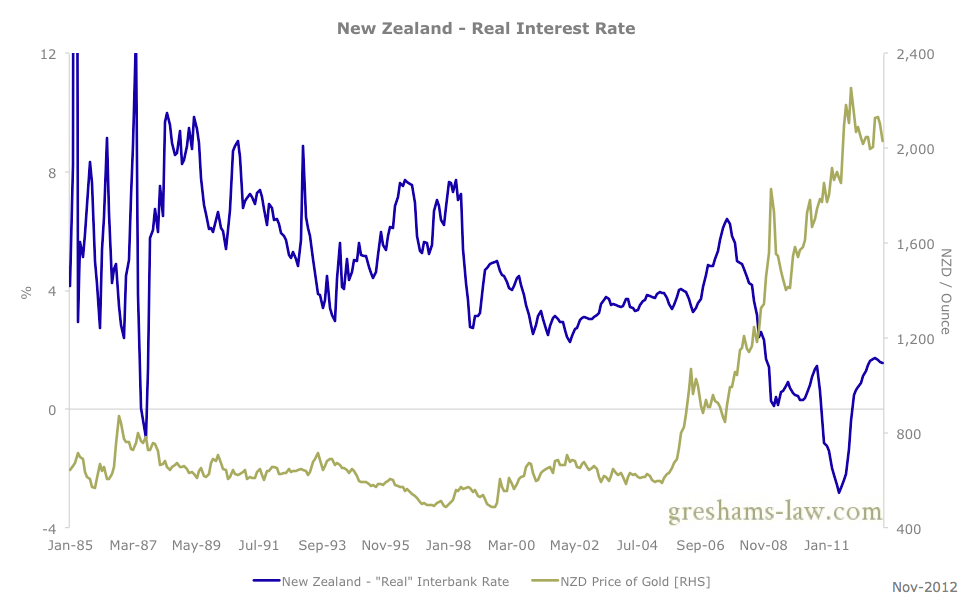

We defer to the great charts on greshams-law.com to look at real rates in New Zealand.

Well, NZ real rates were falling from 2006 to 2011 also, which coincided with a rising NZ dollar gold price. We also had a change in direction in 2011 with real rates rising due to falling reported government CPI and since then gold has been falling too. We currently (as of Dec 2012) sit at 1.6% and may be starting to flatline here.

But look for a possible change of direction in real interest rates to signal a rise in the NZ dollar price of gold. This could come about through the Reserve Bank cutting interest rates further if the economy deteriorates. Or from inflation rising. Or even a bit of both! We reckon one or the other will occur before too long.

If the above is a bit hard to follow then see this old article on real interest rates for more detail:

Real interest rates in New Zealand: What can they tell us about when to buy gold

RBNZ: Making the NZ Banking Less “Systemically Risky”?

On Monday we received a press release from the Reserve Bank outlining a consultation document just released on macro-prudential tools. As part of trying to strengthen the NZ banking system post financial crisis, they are looking at options other than the current monetary policy.

The 4 tools outlined in the consultation paper include:

1. the countercyclical capital buffer;

2. the core funding ratio;

3. sectoral capital requirements; and

4. restrictions on high loan-to-value residential mortgage lending.

You may have heard a bit about the 4th one in the media of late given rising nominal house prices in NZ: Loan to Value Ratios.

This is where the reserve bank might place limits on how much a bank can lend to home buyers as a percentage of the purchase price. The idea being that not letting people borrow 95% or 100% of the value of the house would lower the systemic risk of the banking system. Sounds sensible perhaps?

What do we reckon?

Crazy! They cause prices to rise by having cheap money i.e. historically low interest rates, and then try to “solve” the problem they cause by creating new rules and regulations!

Plus of course people would still find ways of borrowing if they really wanted to, outside the banking system. So we’d have our doubts as to the impact.

Never fear though. We will continue to bore ourselves to tears reading each of the RBNZ press releases so you don’t have to dear reader! And we’ll report back anything of interest. But in this case not too much of interest we reckon.

Jim Sinclair: The Big Falls in Gold are in the Future

We have a couple of great posts on the website this week.

First up is one from Darryl Schoon:

First up is one from Darryl Schoon:

He discusses “Mr Gold” Jim Sinclairs past few months commentary and how he foretold the current fall in prices. Darryl explains the reason for the latest fall:

“Exiting their short positions removed the possibility the bullion banks would suffer catastrophic losses if gold prices exploded upwards. Now, the banks will instead be able to profit by being on the long side of the trade leaving the managed funds and speculators to bear the losses.”

This article is definitely a must read whether you’re an old hand in the gold game or someone new.

Speaking of Jim Sinclair, he has been a busy man of late. This week he also did an interview with Eric King on King World News (KWN). Which if you haven’t listened to it yet you should. If you don’t have the time you can read the 2 blog posts on KWN instead.

Bulls and Bears to Be Wiped Out 3 Times in Gold and

We Are Witnessing a Historic Low in Gold

Jim actually elaborates on much of what was written in the Darryl Schoon article in this interview.

Perhaps one of Sinclairs most interesting quotes was that this current down-move is quite small in percentage terms – around 10% he mentioned. It’s more than that in kiwi dollar terms but as we’ve pointed out recently, still small compared to the 30% 2009 decline.

Sinclair (who can be a bit cryptic) seems to indicate that he thinks the biggest move down will come in the $4000-$5000 range:

“When gold goes into the $4,000 to $5,000 range, which I’m absolutely sure it will, be prepared for something very, very few people will be able to stand.

You will be wiping out the bulls and the bears, I’m going to guess, three times. If this has been hard for a gold person to withstand, then they don’t have a chance when gold is trading between $4,000 and $5,000. And that will happen.”

So perhaps it’ll be from much higher levels that we’ll then see something like the 50% down move that occurred in the mid 70’s. Sinclair seems confident we are close to the lows in gold now. But as Darryl Schoon states in the above article “Perhaps a squeeze on gold shorts will soon take gold to $3,500 to $12,400 as predicted by Jim Sinclair or, it may come later. Have faith, it will come.”

Other Articles This Week

This week we have the second part of the Max Keiser interview with Professor Fekete. (Link to Part 1 if you didn’t watch it last week is here). As usual Max manages to butt in a bit. However he still draws some wisdom from the Prof, so it’s worth a watch and only about 13 minutes long.

This week we have the second part of the Max Keiser interview with Professor Fekete. (Link to Part 1 if you didn’t watch it last week is here). As usual Max manages to butt in a bit. However he still draws some wisdom from the Prof, so it’s worth a watch and only about 13 minutes long.

Prof Fekete Interviewed by Max Keiser Part 2: Silver Conspiracy

And lastly is a deconstruction of just what the recently released Fed minutes really meant. As we have pointed out at the time better to watch what they do not what they say. However this article does a great job of delving into what the Fed really means when reading between the lines a bit.

And lastly is a deconstruction of just what the recently released Fed minutes really meant. As we have pointed out at the time better to watch what they do not what they say. However this article does a great job of delving into what the Fed really means when reading between the lines a bit.

The Recent Fed FOMC Minutes Should Anger Every Investor/

Warning: Do You Have An Aussie Bank Account?

If you’ve ever lived in Aussie and still have an old bank account with a few bucks in it, take heed of the latest from the crooks, we mean government, across the ditch. Amendments made at the end of 2012 mean the Aussie Govt can seize (aka steal) money from bank accounts that have been inactive for just 3 years! That’s a cunning way to make up for a budget deficit alright!

As if you needed another reason to not keep too much cash in the bank!

If you’ve got some spare cash sitting around that you’d like to turn into real money then get in touch:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Is it Time to Sell Gold or Silver? |

2013-02-26 22:53:46-05 2013-02-26 22:53:46-05 |

Gold Survival Gold Article Updates: 27 February 2013 This Week: Latest Charts Good News for Gold from Goldman Is it Time to Sell Gold or Silver? As we suspected in last weeks feature article (Pleasure or Pain? Where to Now for Gold and Silver in New Zealand Dollars?), gold and silver have proceeded […]

read more…

| GOLDMAN TARGETS $1200 GOLD |

2013-02-28 22:17:49-05 2013-02-28 22:17:49-05 |

In our latest newsletter we noted that Goldman Sachs has lowered their gold price targets for 2013 and beyond. We headed up the blurb “Good News for Gold from Goldman“, as we reckoned the odds are best not to trust what the banks (especially the bullion banks like Goldman Sachs) have to say about their […]

read more…

| The Recent Fed FOMC Minutes Should Anger Every Investor |

2013-03-01 21:05:25-05 2013-03-01 21:05:25-05 |

The Fed minutes released the week before last seem to have many thinking the US Fed is about to ease up a gear or two on the money printer. However Vedran Vuk digs beneath the surface of the commonly quoted excerpts to see what the pointy heads at the Fed are really indicating in their […]

read more…

| Prof Fekete Interviewed by Max Keiser Part 2: Silver Conspiracy |

2013-03-04 19:17:28-05 2013-03-04 19:17:28-05 |

Last week we posted the first part of this Keiser Report video interview with Professor Antal Fekete. So below is the part 2, which focuses more on silver than gold this time. Max Kesier manages to cover a fair bit of ground with the Professor in this interview also. Including: How it took from 1879 […]

read more…

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1900.86/oz |

US $1576.95 |

Spot Silver |

|

| NZ $34.61/oz NZ $1112.62/kg |

US $28.71/oz US $923.03/kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo)

$1218.32

(price is per kilo for $50,000 plus)

Buy direct from the mint but at cheaper prices using our discount code GSG001.

Click here for more info

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Pingback: What is Causing the Falling NZD Gold Price? | Gold Survival Guide