This Week:

- SILVER INVESTMENT: The Lowest Risk, Highest Return Potential vs. Stocks & Real Estate

- Bullish Indicator: Large Silver Speculators First Net Short Position in Memory

- What is COTs?

Prices and Charts

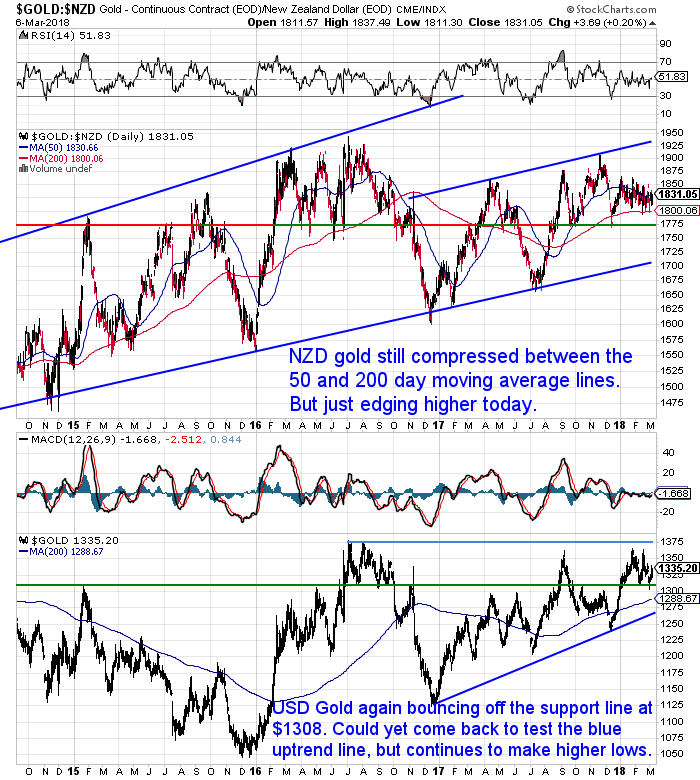

NZ Dollar Gold Range-Bound

Gold and silver rose sharply overnight pushing them into the green for the week even with a rising NZ dollar.

Gold in NZ Dollars continues to be compressed between the 50 and 200 day moving averages.

Stuck between $1800 and $1850 since the start of 2018. The stronger Kiwi dollar so far in 2018, keeping gold in NZ Dollars in check.

But USD gold (bottom part of the below chart) is making a bullish ascending triangle (see the blue lines). This is a bullish pattern where a series of higher lows are made while at the same time bumping up against the same overhead resistance line. More often than not this type of pattern breaks out to the upside.

A significant break out like that would most likely also push the NZD gold price higher too. Gold could first pull back towards the rising blue trend line first though. But things are building nicely.

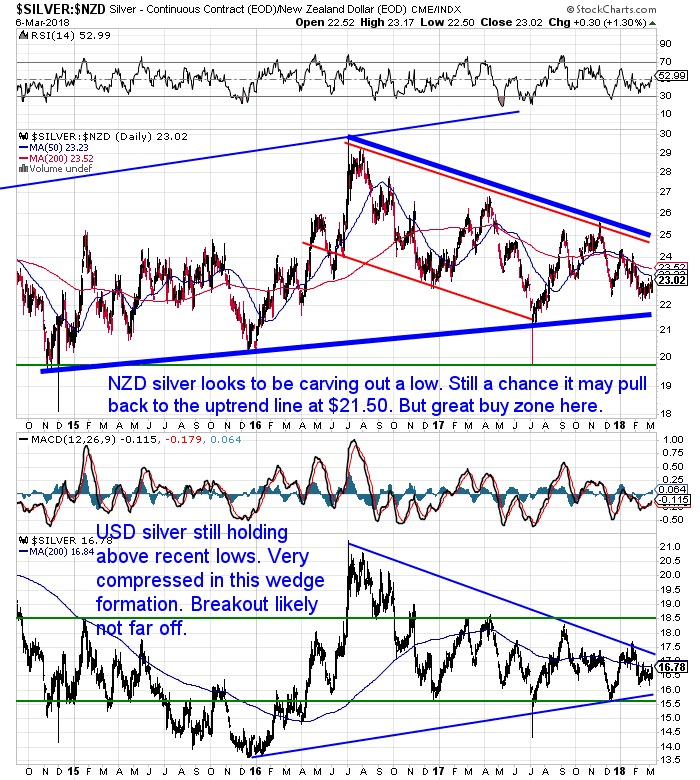

Meanwhile NZD silver may just be edging higher. Perhaps having carved out a low just above $22. There is still a chance it may head down to the blue uptrend line at about $21.50.

But as you’ll read in this weeks two articles, the positioning of key traders in the silver futures market points to a bottom being in for silver or very close to one if not.

The Kiwi dollar dipped to the 200 day MA this past week, but has risen again today. We may see the NZ Dollar trade in the 0.72 to 0.74 range for a bit yet.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

What is COT’s?

We had a question yesterday from Paul reading something discussed in one of this week’s posts: “What is COT’s?”

COTs = Commitment of Traders Report

It tracks the positions of gold and silver futures traders. And whether they are long or short – i.e. betting that prices will rise or fall.

In the report these futures traders get grouped according to who they are. For example, Large Speculators (hedge funds and the like), or Commercials (meaning bullion banks and commercial hedgers like miners etc -usually the “smart moneY’)

So their positions can be useful particularly at extremes as indicators of where prices may soon be about to head.

Currently in silver the Large Speculators are short (very unusual – in fact may not have ever happened before). They are usually wrong at the extremes. That is their overall long position is usually high at tops in silver or gold (they’re all betting the price will rise). And usually low at bottoms. But in this case they have actually gone short overall with the silver price pretty low.

While the Commercials net short position in silver is currently very low historically. So they think prices are likely to rise from here. They are usually right at the extremes. They usually have a higher net short position when prices are peaking as they are hedging themselves against the price falling.

Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

With that explanation out of the way, check out this weeks posts below for a more in depth look at this positioning of the futures traders.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

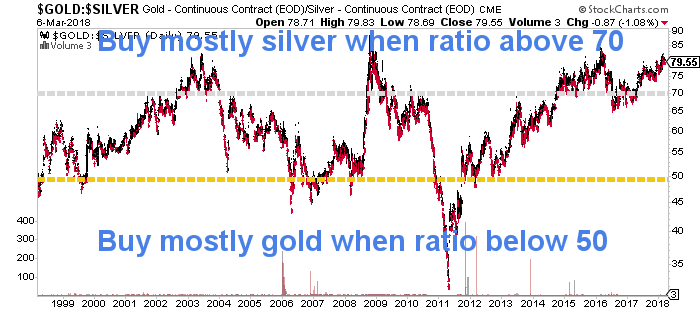

Silver Remains the Best Buy

Silver remains on our “best buy” list.

The gold to silver ratio has edged down slightly from recent highs above 80, but still remains heavily in favour of buying silver over gold at these levels. History says a hefty move in silver is likely not that far away.

If you don’t have any silver in your possession yet, get in touch to discuss your options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|

Pingback: Latest on the COMEX Silver CoT Report - Gold Survival Guide

Pingback: New Silver Bull Coming - Gold Survival Guide