This Week:

- What Will Happen With Brexit?

- Gold – A Bob Each Way?

- Does a Gold Revaluation to US$10,000 Make Sense? Will it be Good or Bad?

- Gold Ratios Update: Dow/Gold, NZ Housing to Gold, & Gold/Silver Ratio – Jan 2019

Prices and Charts

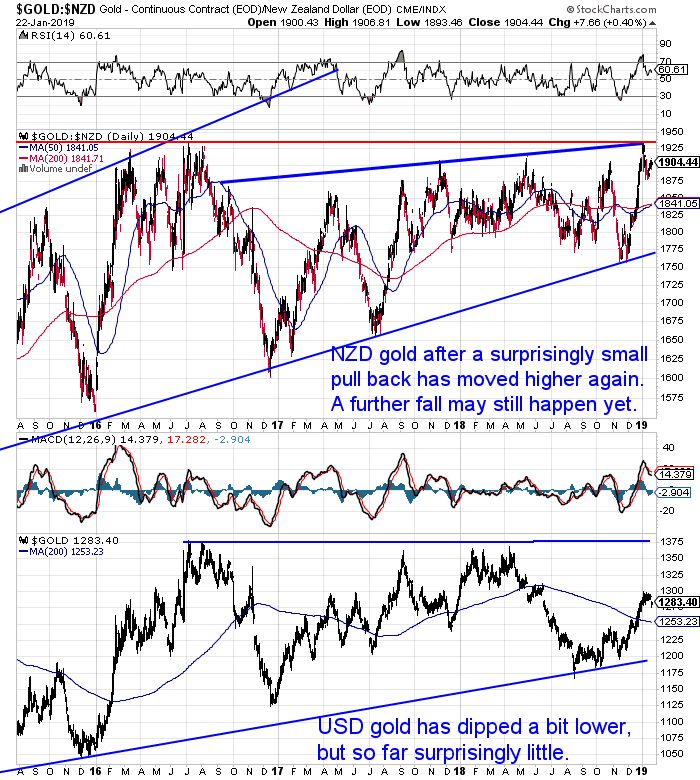

Gold Bouncing Back Already?

Gold in NZ dollars has bounced back about 1% this week. This was after a surprisingly small $50 per ounce fall. The price remains well above the moving averages.

The RSI overbought/oversold indicator has pulled back to about 60 now. So getting close to neutral. However we may still see a further fall to make a lower low maybe around the $1850 mark?

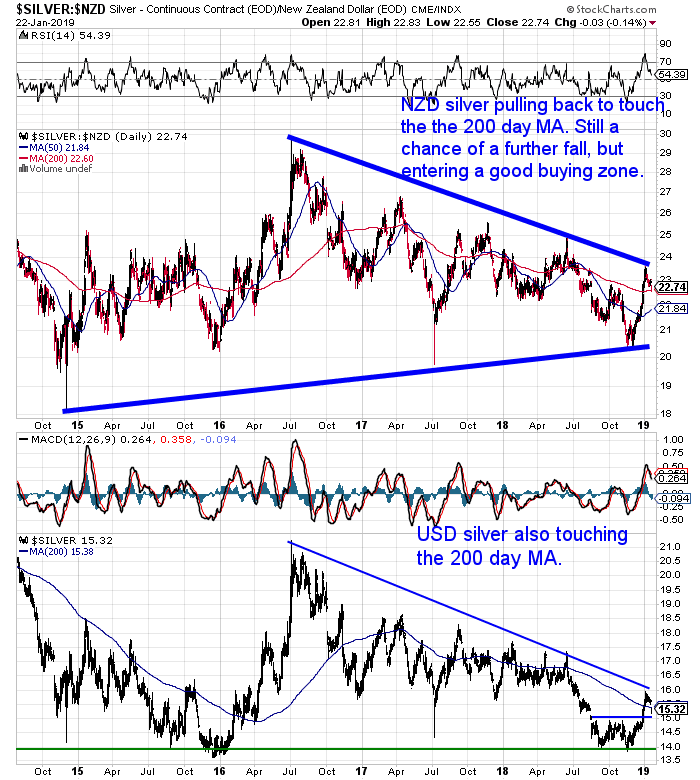

NZD silver has fallen further than gold. It has now touched the 200 day moving average. The RSI is also very close to neutral now. But there is still a chance of a further retracement back to around $22 perhaps.

If you’ve been looking to buy silver we are getting close to a good buy zone now.

The brief fall in both metals has been largely due to a weaker Kiwi dollar – dipping sharply this week.

The NZ Dollar now sits just above 0.6700. It’s once again below both the 50 and 200 day moving averages. With the RSI neutral it’s a tough call as to whether it makes a lower low now or turns higher. We’re leaning towards a lower low.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

Will a Gold Revaluation to US$10,000 Be Good or Bad?

This may not be our preferred outcome but a gold revaluation has happened in the past. So it’s worth considering what the implications of this would be.

In this article we’ll explain:

- Why a gold revaluation could take place

- How this $10,000 revaluation could work

- How it would impact a countries GDP

- Why the figure of $10,000 is used

- How a gold revaluation would affect the average working person

- Whether a gold revaluation would be a good thing or a bad thing

Latest Gold Ratios Update: Dow/Gold, NZ Housing toGold, & Gold/Silver Ratio

There was a lot of volatility towards the end of 2018.

How did this affect various measures we use to value and compare gold to other assets such as:

- Shares versus Gold Ratio

- Gold Silver Ratio

- Housing to Gold Ratio

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold – A Bob Each Way?

Last week we looked at the issues faced by the Federal reserve continuing it’s “quantitative tightening” programme and interest rates rises.

Murray Dawes makes the point that regardless of what the US Fed does here gold stands to benefit over the next year…

“Is it time for gold to shine once more?

I’ve had very little interest in gold for years. After the huge smashing it received between 2012 and 2015, with gold stocks plummeting up to 90% or more, I decided not to play too heavily in the sector. But over the last few years we have seen a slow grinding rally that has built a nice base for a possible launch to higher prices.

When I look at the situation in the world and contemplate what could benefit under most scenarios, gold actually sticks out. If the US Fed completely takes fright at the market’s weakness, and backs off from rate rises or even starts printing money again, the US dollar should weaken substantially and gold should benefit from that and lower rates.

But if the Fed holds its course and continues to raise rates to the point where the equity markets tumble again, gold should benefit from safe haven buying despite the higher rates.

Gold looking good

Source: Tradingview.com

I can make a case that gold should perform fairly well whatever happens from here over the next year or so.

We have seen a monthly buy pivot last month from the buy zone of the previous up-wave so from a technical viewpoint it’s all systems go for gold until we see a monthly sell pivot.”

What Will Happen With Brexit?

Hard to miss the kerfuffle over Brexit during the past week or 2. But just what are the likely impacts going to be?

Simon Angelo at Money Morning NZ provided an excellent summary of the possible outcomes given that Brexit is scheduled to take place on March 29.

“Scenario #1: May pulls a rabbit out of the hat and somehow uses the power of this crushing vote to lean on the EU for a better deal and rush it through in time.

Seems a long shot, given how firm the EU has already been and how any such deal has to be approved by the myriad of member states. However, stranger things have happened. Should you believe this a possibility, I would buy GBP and LSE (London Stock Exchange) picks now and wait for the boost.

And perhaps the UK’s bargaining position has not been fully realised. Just under one-in-five German cars such as BMW are sold to Britain. The biggest EU state does not want them crashing off that road.

Scenario #2: May fails the confidence vote and this leads to a successful call for a new country referendum on whether the UK should leave the EU at all.

…[Obviously this didn’t happen as May survived the no confidence vote]

Scenario #3: More time is sought, Brexit drags on, and a deal with compromises chomping at the edges is slowly pushed through.

The 29 March deadline would have to be extended. It would not surprise me if this is the most likely outcome. My observation of living in an old country in Europe is that things take far longer than they do in the New World. It took three months for us to open a bank account, and a year to start the repairs on my apartment building. This seems perfectly normal. Europeans are used to delay. As a New Zealander, I thought I’d gone back 30 years.

In terms of the markets under this scenario, there would be slower improvement and things may get worse before they get better. But there will be an eventual turn as the UK and EU finally find ground and continue to hobble along together but apart.

Scenario #4: The UK crashes out of the EU with no deal and falls on WTO rules.

This is my personal favourite and a real chance for the UK to find independence and potential success. Let’s face it: the Eurozone has been a dead space of anaemic growth and declining opportunity when compared to advancing regions such as the Asia-Pacific.

Done well, the UK can cut regulation, taxes, become the Singapore of Europe and forge new free-trade relationships with faster-growing nations. Trump has already expressed his concerns that May’s Brexit deal could derail a US-UK free-trade agreement. So, with this out of the way, the UK could well become a favoured trading partner with the world’s largest economy.

This path is the riskiest, and there would be a long period where the UK finds itself cut adrift and in total need of reinvention. It took independent Singapore more than 20 years to rise through such challenges.

In this case, market opportunity in the UK would be a risky and very long-term bet. I’d still be buying, though, if there’s a major sale at the store.

Well, it could even go other ways, but for me to suggest any further would be simply like throwing a dart at the dartboard after one too many pints at the pub.”

On top of the Brexit uncertainty we’ve also got slowing Chinese GDP growth, a US Government shutdown, and trade wars.

So there are a host of geopolitical issues currently in the air.

The global elite aren’t seeing things as too that rosy either. At the yearly gathering at Davos…

“…PWC has released its annual global CEO survey with the results showing an increasingly pessimistic outlook.

Nearly 30 per cent of the 1300 business leaders PWC polled believe global economic growth will decline in the next 12 months.

This time last year just five per cent were feeling gloomy – something PWC describes as a record jump in pessimism.”

Source.

Which could be why Billionaire real estate investor Sam Zell told Bloomberg he’s stocking up on gold for the first time in his life.

Time to follow him perhaps?

Check out the deals available currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Learn More and Pre-order NOW….

—–

|