China and Russia continue buying near record levels even as the gold price rises

Recent data shows that gold demand has remained strong in the likes of China, Russia, India and Turkey, even while the price has been rising. Eastern cultures are more inclined to “buy the dips” than those of us in the west who seem more likely to chase the price higher. How strong has eastern demand been and why are they buying?

China’s 2017 Gold Demand back over 2,000 tonnes

We’ve been reporting on China and gold since their government began actively encouraging its citizens to buy gold in 2009.

In 2017 China’s gold demand was back over 2,000 tonnes. Still not up to the 2015 record of 2596 tonnes, but rising from 2016 and the 4th highest year of gold purchases on record.

Via Ed Steer’s Gold and Silver Daily

Via Ed Steer’s Gold and Silver Daily

India and Turkey Gold Demand

The numbers for India for the end of 2017 are not out yet but…

“India likely imported and smuggled into the country close to or more than 1,000 tonnes.”

While ”Turkey imported 370 tonnes of gold in 2017. This exceeded the previous record in 2013 by over 22%. I would note that the size of Turkey’s demand was not expected.”

Source.

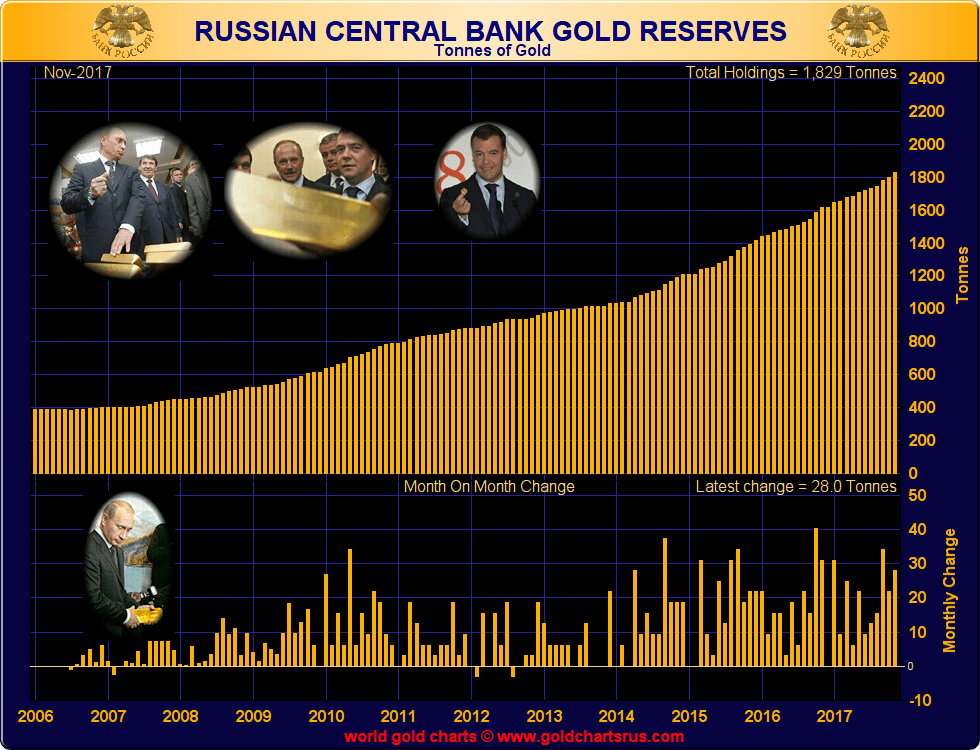

Russian gold reserves hit historic high, stockpiling record 223 tons last year

Meanwhile the “Central Bank of Russia (CBR) added 300,000 ounces (9.3 tons) of gold to its reserves in December, bringing the total yearly holdings to a record 1,838.211 tons, worth over $76 billion in monetary terms.”

This chart is only up to end of November. But you can clearly see the trend for the Russian Central Bank over the past decade. Buy gold every month.

Bank of Russia Gold Reserves, to November 2017. Source: www.GoldChartsRUs.com

China Slowing or Halting Purchases of US Treasuries

A report was recently released “that Chinese officials have encouraged slowing or halting purchases of US Treasuries.

The dollar fell against all major currencies, and especially gold, after the report.

China is likely to stop buying US Treasuries, and that will have major repercussions for US monetary policy. It will hamper the Fed in reducing its bloated balance sheet, perhaps forcing another round of QE, which would be positive for gold.”

Dr. Ron Paul on Gold and What Does a China Attack on the Dollar Mean?

This winding back of US Treasury debt is discussed by Ron Paul in the video below.

He explains that China has been accumulating gold for years, and are now taking steps to tie it to yuan. Interest rates in the U.S. are rising, and the Chinese are not so eager to keep piling up on U.S. dollars and U.S. Treasury debt.

Eastern Gold Buying Doesn’t Drive the Gold Price (Yet)

As we’ve reported before, it still seems to be western investment demand that has the biggest impact upon price.

“Big money flows into gold from Western Institutional investors are what continue to be the main drivers of the paper derived gold price. While Chinese and Indian demand is great, it is these western buyers that affect the global pricing due to the current structure of the global gold market.”

That is, currently at least, the east seems to be a price taker rather than a price maker.

But this is likely to slowly and steadily continue to change.

Last year there were reports on the possibility of China launching a Yuan based oil futures contract. A futures contract that might also be allowed to be converted to gold. Thereby allowing China’s oil suppliers to circumvent the use of the US Dollar and instead end up with gold.

This is how that would work:

Nick Giambruno: Under the current petrodollar system, all global oil sales are made in dollars. However, the Chinese government recently announced a new mechanism that will allow oil producers anywhere in the world to trade oil for gold.

China’s new mechanism will totally bypass the U.S. dollar and the U.S. financial system… along with any restrictions, regulations, or sanctions from Washington. So for many oil producers, it will be much more attractive than the petrodollar system.

I call it China’s “golden alternative” to the petrodollar. Whatever you call it, though, it will allow for the large-scale trade of oil for gold, instead of dollars.

Here’s how it will work…

The Shanghai International Energy Exchange is launching a crude-oil futures contract denominated in yuan, China’s currency. This will allow oil producers around the world to sell their oil for yuan.

Of course, the yuan is a fiat currency, just like the dollar. And most oil producers don’t want large stashes of yuan. The Chinese government knows this. That’s why it’s linked the crude-oil futures contract with the option to efficiently convert yuan into physical gold through gold exchanges in Shanghai and Hong Kong.

Chris Lowe: How soon will this new system be up and running?

Nick Giambruno: I spoke with officials at the Shanghai International Energy Exchange. They told me they plan to go live with it before the end of the year, or shortly thereafter.

The oil futures contract looks due to launch in March according to latest reports.

Although there is still yet to be any real news on how or if the gold convertibility would work.

Nonetheless, these recent announcements are all further steps along the path of de-dollarisation.

The Steady March to Dethrone of the Dollar

As the insightful Ronni Stoeferle says:

The issue of when a global reserve currency begins or ends is not an exact science. There are no press releases announcing it, and neither are there big international conferences that end with the signing of treaties and a photo shoot. Nevertheless we can say with confidence that the reign of every world reserve currency has to come to and end at some point in time.

…The process of moving away from the dollar — prepared by Europe and triggered by China and Russia — can no longer be stopped. And as a “supra-national” reserve asset, gold plays an important role in it.

Obviously the likes of China and Russia realise this “important role” gold will play. They are not buying it just because it looks pretty!

We may eventually see the pricing power for gold move, from being mostly driven by the New York and London paper markets, to being significantly impacted by the purchasing of these eastern nations.

Be sure you have your own gold (and silver) reserves in place before this day arrives.

For more on this topic see these articles: Does a Gold Revaluation to US$10,000 With All Major Countries Make Sense?

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

Why New Zealand Won’t Have Any Say in a Global Currency Reset

Pingback: The Russian Central Bank and the New Golden Rule - Gold Survival Guide

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: Why is Russia Selling US Treasuries and Buying Gold? - Gold Survival Guide

Pingback: If the US Dollar or SDR Was Linked to Gold, How Would This Affect New Zealand? - Gold Survival Guide

Pingback: Why You Should Become Your Own Central Bank - Even if Your Nation’s Central Bank Has Gold Reserves - Gold Survival Guide