Reader Question:

“You can’t eat gold, and it won’t pay my insurance, rates, or put fuel in my tank. So why does everyone think it’s still valuable when everything’s going to hell? Wouldn’t food, tools, ammo or productive land be more useful?”

It’s a fair question. If you’re staring down empty supermarket shelves, gold can feel like a pretty useless rock. But that view misses what makes gold valuable — not just in a collapse, but in every system that follows one.

Let’s unpack why gold still holds real, lasting value — even when trust in everything else disappears.

Table of contents

- Quick Summary: Why Gold Still Has Value

- You Can’t Eat Gold — But That’s Not the Point

- Gold’s Power: Scarcity + Trust

- Paper Money Is Designed to Lose Value

- What Happens When the System Fails?

- But Isn’t Gold Just… Metal?

- Related Reading

- Bottom Line

- Free Resource: The Gold Survival Starter Guide

- Frequently Asked Questions About Gold’s Value and Fiat Money

Estimated reading time: 5 minutes

Quick Summary: Why Gold Still Has Value

- Gold can’t be printed into oblivion

- It stores value better than any paper currency

- It’s trusted worldwide – even when systems fail

- It outlives empires, regimes, and fiat resets

- Central banks still hoard it for a reason

You Can’t Eat Gold — But That’s Not the Point

Gold is not a survival item like food, water, or fuel. It’s a store of wealth — designed to move value through time, not through a single crisis.

Think of it like this:

- You barter essentials during short-term disruption

- You use gold when the dust settles — to restart, trade up, rebuild

In the 2008 Zimbabwe hyperinflation, people bartered food, but gold dust bought bread when the local currency collapsed.

In Venezuela, people used grams of gold to buy supplies — even while the Bolívar was still technically “legal tender.”

So no you can’t eat gold. But try eating a $20 bank note and you’ll still be hungry too!

Gold’s Power: Scarcity + Trust

Gold has outlasted every fiat currency because:

- It’s scarce (can’t be printed)

- It’s durable (doesn’t corrode)

- It’s divisible (you can trade small amounts)

- It’s trusted across borders and cultures

- It’s not controlled by governments or central banks

Fiat currencies fail because they rely on trust in governments. And when that trust fails, paper money collapses. Gold doesn’t rely on anyone’s promise.

Read: If/When the US Dollar Collapses – What Will Gold Be Priced In?

Paper Money Is Designed to Lose Value

The dollar (and every other fiat currency) loses purchasing power over time because:

- Governments print more to cover spending

- Inflation eats away at savings

- Central banks manipulate interest rates and debt cycles

In contrast, gold has held purchasing power for centuries.

One ounce of gold bought a fine suit in Roman times. It still does today.

| Feature | Gold | Paper Money |

|---|---|---|

| Scarce? | ✅ Limited by nature | ❌ Printed at will |

| Universal trust? | ✅ Globally trusted | ❌ Depends on government |

| Store of value? | ✅ Proven for 5,000 years | ❌ Constantly devaluing |

| Useful in collapse? | ✅ Black markets & barter | ❌ Often worthless |

| Inflation-proof? | ✅ Historically resistant | ❌ Loses purchasing power |

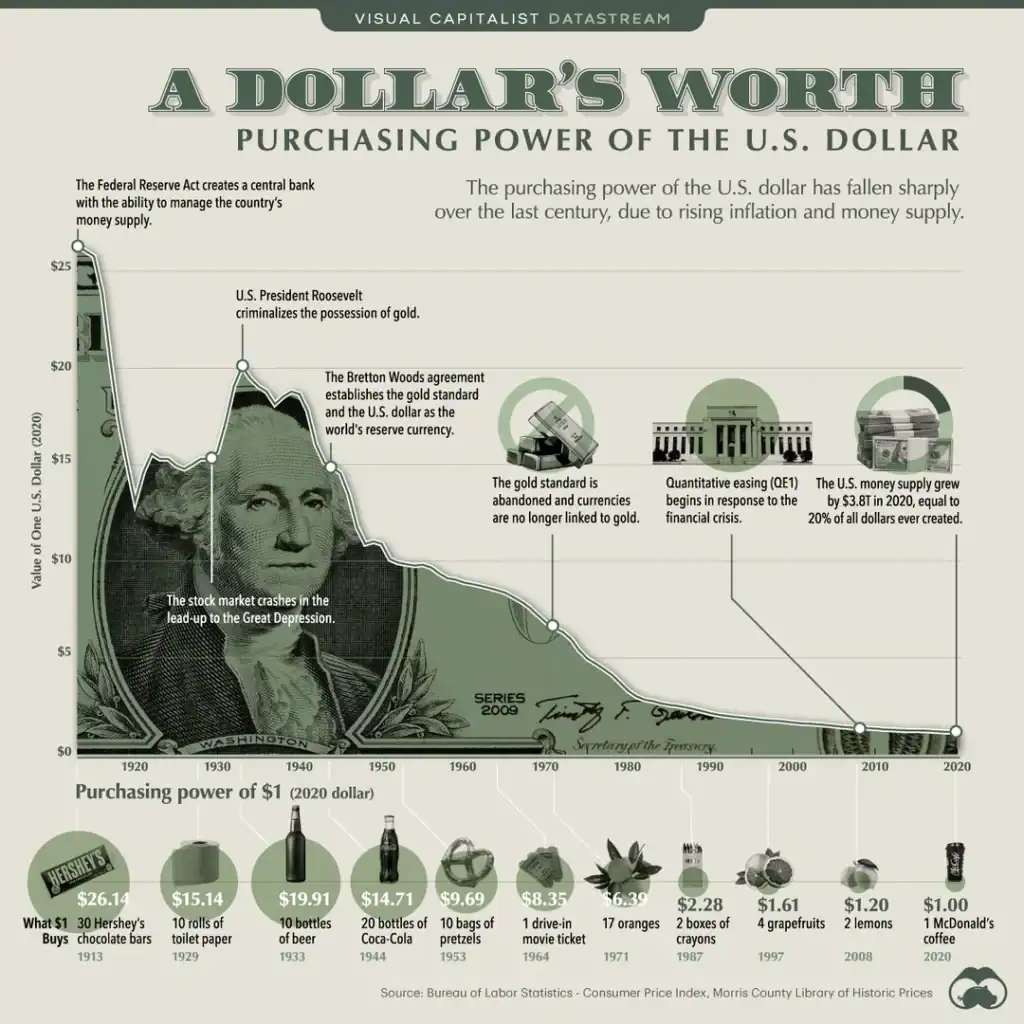

Here’s how far the U.S. dollar has fallen over the last century — while gold has held steady:

(Note how much $1 used to buy vs what it buys now.)

What Happens When the System Fails?

During a full-blown collapse, barter works first — food, fuel, bullets.

But once people settle into a new system, trust returns slowly — and it often returns to gold.

Gold becomes the bridge between:

- The old system that broke

- The new system that hasn’t formed yet

That’s why gold shows up in black markets, informal economies, and even prison systems. It’s money without a government.

Explore: Societal Breakdown – Gold vs Barter

But Isn’t Gold Just… Metal?

Yes — and that’s exactly the point.

It’s just metal, but:

- It doesn’t need a CEO

- It doesn’t rely on electricity or servers

- It doesn’t vanish in a cyberattack

- It doesn’t care who wins the election

Gold is apolitical, neutral, and final. That’s what makes it valuable.

Related Reading

What Good Is a Bar of Gold When the Shelves Are Empty? — A mindset guide for uncertain times

Why Buy Gold? 14 Reasons to Own Gold Now — A complete strategy guide

If/When the US Dollar Collapses – What Will Gold Be Priced In? — One of our most-read articles right now

Bottom Line

Gold doesn’t feed you. It doesn’t heat your home.

But it preserves your purchasing power through chaos — and gives you options on the other side.

That’s why it still matters.

That’s why it’s still valuable.

Free Resource: The Gold Survival Starter Guide

Still wondering if gold belongs in your plan?

👉 Download our Gold Survival Starter Guide – A free, practical resource to help you protect your savings from currency collapse, inflation, and systemic risk.

Click here to get your free copy →

Frequently Asked Questions About Gold’s Value and Fiat Money

Gold is still valuable because it can’t be printed, manipulated, or defaulted on. It stores purchasing power across time, holds global trust, and isn’t tied to the fate of any one government or financial system.

es, in many ways. While paper money loses value through inflation and government printing, gold maintains its worth over time. It’s durable, limited in supply, and widely recognized as a store of value — especially during economic instability.

In a collapse, gold often becomes a trusted fallback when fiat currencies fail. While people may first barter essentials, gold gains relevance during recovery — when trust begins shifting back toward durable, universal value stores.

Editors Note: This post was originally published 11 February 2020. Fully rewritten 13 October 2025.

Your questioner’s statement

Money in the bank is just electrons that can disappear as magically as they arrived.

is the best analysis of probabilities I have read and scary as ????

Thanks for your updates.

Hi Carla,

Thanks for taking the time to comment and yes that is the nature of the system we live with for now at least.

Thanks for reading.

Pingback: New RBNZ Governor from the World Bank | Gold Prices | Gold Investing Guide

@Carla – Money in the bank? What money in the bank? Our computer has no record of you ever having an account here. Have a nice day.

😉

Pingback: What Good is a Bar of Gold When the Shelves are Empty? | Gold Prices | Gold Investing Guide

Pingback: Could the Virus Cause a Financial Panic? - Gold Survival Guide

Pingback: Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine? - Gold Survival Guide

Pingback: If/When the US Dollar Collapses, What Will Gold be Priced in?

Pingback: If the US Dollar or SDR Was Linked to Gold, How Would This Affect New Zealand? - Gold Survival Guide

Pingback: How can you tell when it is the right time to sell your gold? | TechnologyIdea.info

Pingback: Are We Just Seeing A Pause In Longer Trends? - Gold Survival Guide