This Week:

- Deflation Coming to NZ? RBNZ Worried it is

- Inflation Versus Deflation and What Comes Next?

- Why the War on Cash Will Spread to New Zealand

- But Federal Reserve Worried About Inflation?

|

No Specials This Week Sorry Ph 0800 888 465 and speak to David or reply to this email if you’d like a chat about buying gold or silver. No advice though, just my personal opinion!!! |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1887.48 | + $25.58 | + 1.37% |

| USD Gold | $1253.10 | + $12.52 | + 1.00% |

| NZD Silver | $23.05 | + $0.60 | + 2.67% |

| USD Silver | $15.30 | + $0.34 | + 2.27% |

| NZD/USD | 0.6639 | – 0.0024 | – 0.36% |

Precious metals have continued their climb higher this week.

NZD gold is up 1.37%, a good part due to the plunging NZ Dollar after the RBNZ interest rate cut this morning which surprised many.

NZD gold has continued to push up against the $1900 resistance level. It has traded in a narrowing pennant or wedge formation and will have to break out either way any day now.

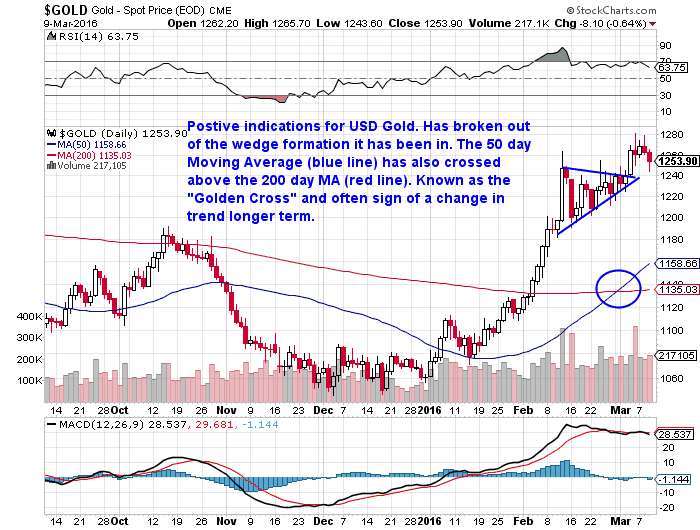

The USD gold chart (bottom half of below chart) shows that it recently broke higher out of a similar pattern. Although it has pulled back overnight.

Also of significance is that in both currencies the golden cross has occurred. This is where the 50 day moving average (MA) crosses over the 200 day MA. Often a sign of a change to a bullish or rising trend.

As we wrote in our weekly email last Thursday, the US dollar gold price has been the main driver of the gold price in NZ dollars. That is, the NZ dollar has been relatively stable so far this year. So a move higher in US dollar gold could translate into a similar sized move in NZ dollar gold. (Below is a closer up view of the US Dollar Gold Chart from our daily price alerts email today).

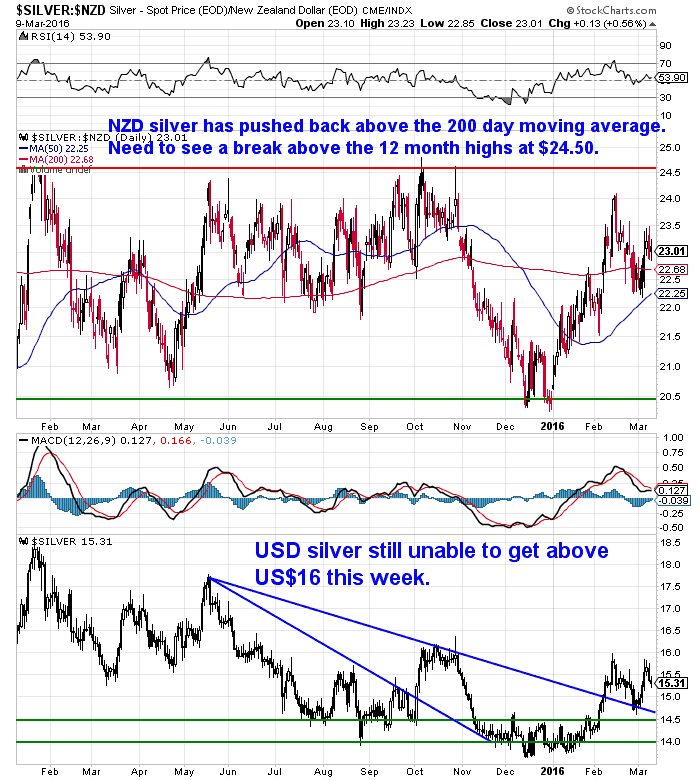

NZ Dollar silver continues to move in the sideways range it has been in for the past year. It is up above the 200 day moving average this week. $24.50 remains the key level that we need to see broken to indicate a sustained move higher.

Deflation Coming to NZ? RBNZ Worried it is

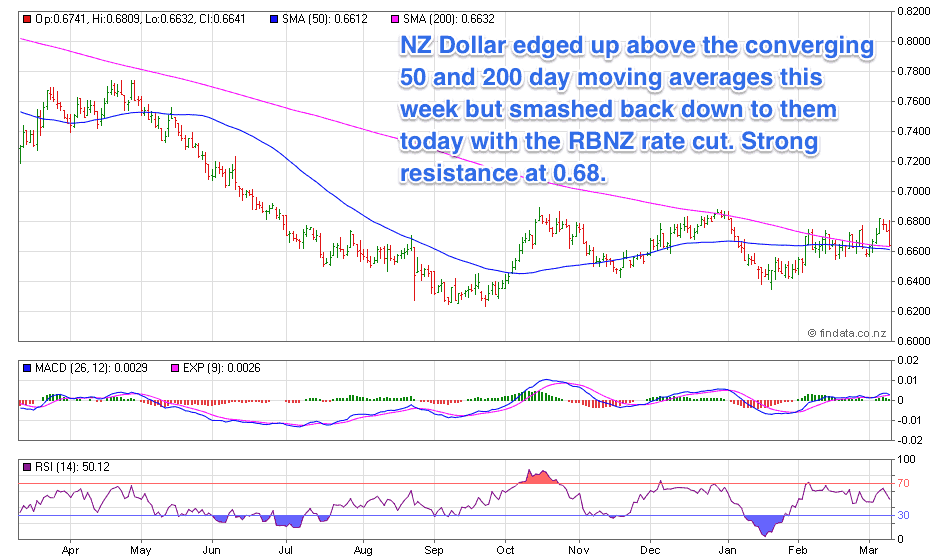

Like we said earlier, the NZ Dollar took a dive this morning when the RBNZ made a rate cut of 0.25% which surprised many it seems. It had edged up above the converging 50 and 200 day MA’s but has been knocked back down to them today. 0.68 cents again proved a tough level for it to get above. So for now a move higher would seem unlikely. Especially with the expectation of more rate cuts ahead now.

Here’s a rundown of what the RBNZ announcement said.

We’d say the key point is that lower inflation levels have them spooked. Like just about every other central bank on the planet, their fear is of deflation setting in (well apart from the likes of some like Venezuela where very high inflation rates are the worry instead!) So where to from here?

Well, that leads us into this weeks feature article.

Inflation Versus Deflation and What Comes Next?

Inflation Versus Deflation and What Comes Next?

- We look at the argument for deflation versus inflation and cover a few different opinions on what Central Banks – in particular the US Federal Reserve – will have in store for us next.

- We also cast our mind over where the RBNZ might be heading in the long run.

- Spoiler Alert: Deeper down the rabbit hole – just following a bit behind everyone else. READ MORE.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

But Federal Reserve Worried About Inflation?

Interestingly while the Reserve Bank here is cutting rates, Jim Rickards believes the US Fed will shock everyone and raise them on the 16th March. (Although he still thinks they’ll about face in the long run after they’ve made things worse).

The Daily Reckoning noted that:

The market does not expect a rate hike in March. In fact, the market is giving low odds of any rate hikes in all of 2016. Meanwhile, the Fed is moving at full throttle toward a rate hike…

The market’s dovish view has made it more, not less likely the Fed will raise rates in March. The dovish interpretation caused equity markets to rally the past two weeks in expectation of no rate hike. The rally eases financial conditions, which makes it easier for the Fed to raise rates.

The Phillips curve says, for example, that lower unemployment leads to higher inflation. And inflation must be ’round the bend since unemployment is so low. So she has to head it off at the pass.But the Phillips curve exists solely upon hearsay evidence. The stagflation of the 1970s should have discredited the witness for all time. But Janet Yellen is like a juror at the O.J. trial. She still swallows the story. And so she thinks a rate hike this month reflects healthy economic growth.Jim thinks the Fed announcement on the 16th will blindside the market. He says that could lead to a “train wreck.” There’s only one way to avoid that unpleasant outcome, says he. And there isn’t much time. Janet Yellen would have to telegraph her rate hike to the market ASAP. That way, the market could adjust in an orderly fashion before the Fed meeting in 10 days:

Why the War on Cash Will Spread to New Zealand

We’ve discussed a lot recently how there is a move towards outlawing cash gloablly. Mainly as it will assist the central planners with controlling our finances more and taxing us more. Perhaps even more importantly with more and more countries heading down the road of negative interest rates, it will also stop people from escaping this by hoarding cash.

The main argument we’ve seen used is that cash is just for criminals and terrorists – so who needs it?

Well, here’s a reason why we’re likely to see more of a clamp down on cash here in New Zealand as well then. A headline this week read:

Financial transactions thought to be linked to terrorism have almost doubled in the past two years.

“Information released by the police under the Official Information Act showed a rise from 21 cases in 2014 to 40 in 2015 and the latest figure was 24.”

Another straw in the wind for cash perhaps? So instead of hoarding cash, maybe hoard some gold or silver instead?

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,255 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles: |

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1887.48 / oz | US $ 1253.10 / oz |

| Spot Silver | |

| NZ $ 23.05 / oz NZ $ 741.05 / kg |

US $ 15.30 / oz US $ 491.98 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.Have a golden week!David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

Pingback: War on Cash: Implications for New Zealand - Gold Survival Guide