Prices and Charts

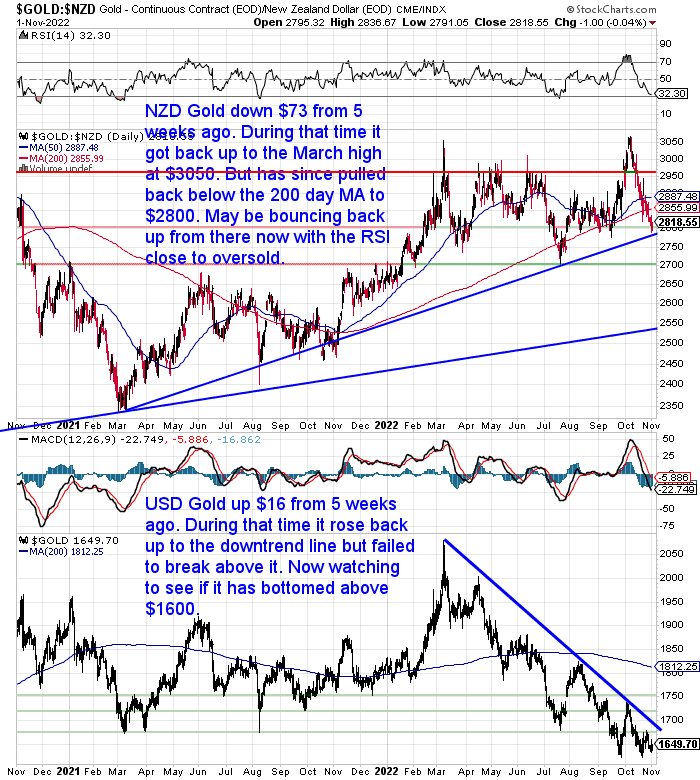

NZD Gold Rose To March High But then Retraced All That Move

Since our last newsletter 5 weeks ago, gold in New Zealand dollars is down $73. However during that time NZD gold did climb right back up to the March high at $3050. But has since then returned down to the $2800 level which it has bottomed out at multiple times since July. This level also coincides with the blue uptrend line and with the RSI overbought/oversold indicator getting close to oversold. So there’s a good chance we should see gold bottom out somewhere around here.

In USD terms the downtrend since March continues. Since we last wrote USD gold did get back up to the downtrend line, but failed to break above it. It then returned down to just below $1650. We are watching to see if it can hold above there now.

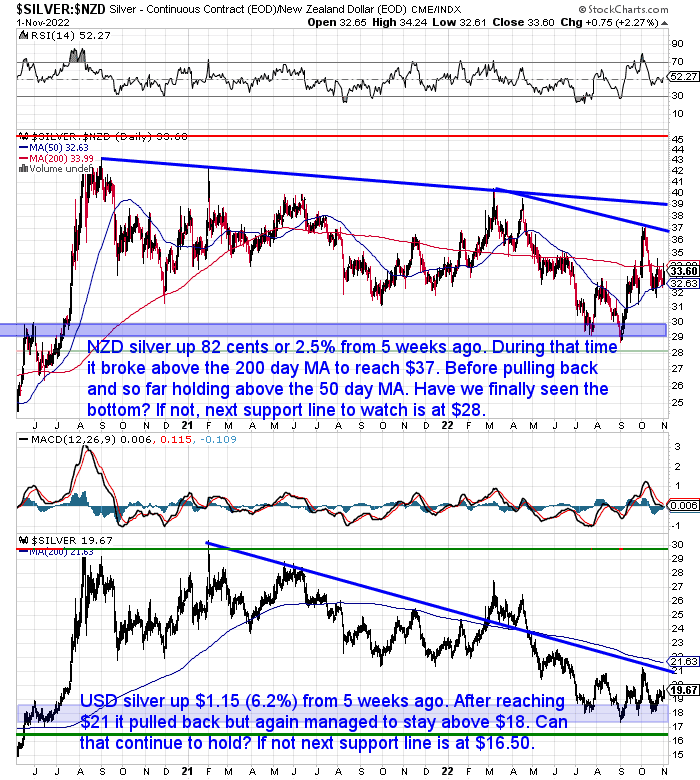

NZD Silver Holding Above the 50 Day Moving Average

In contrast to gold, silver in New Zealand dollars is up 2.5% since we last wrote. During that time, and like gold, NZD silver broke higher and reached $37. But has pulled back since then, so far holding above the 50 day MA. Have we finally seen the bottom just below $29? If not then the next support line to watch is at $28.

USD silver is up over $6 from 5 weeks ago. After reaching $21 it has pulled back but managed to stay above $18. Can that continue to hold and have silver bottom out at $17.50? We’ll keep watching.

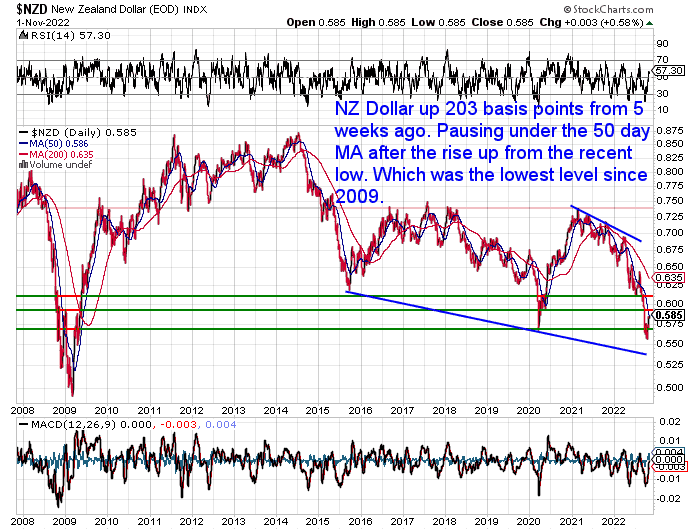

New Zealand Dollar Up Over 3.5% From 5 Weeks Ago

The sharp fall in the New Zealand dollar has finally stopped or maybe is taking a breather at least. From 5 weeks ago the NZD is up 3.61%. Currently pausing at the 50 day moving average after rising up from what was the lowest level since 2009. It could still run a bit higher yet. But will need to rise a whole lot higher, before we see a change in the downtrend that’s been in play since early 2021.

Gold bought in New Zealand dollars has offered protection from this downtrend throughout that time. Just as it has in currencies that have performed even worse, such as the Great British Pound.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

We’ve got a couple of feature articles this week:

Gold vs Stocks: Historical Returns

The first takes a look at how gold has performed versus stocks over various periods. We’ll see how different times can mean one does better than the other.

What Are The Different Types of Gold Bars?

Then we look at the different options that exist when it comes to buying gold bars including:

- Categorised by manufacturing: cast and minted gold bars

- Categorised by weight: Traditional Gold Bars vs. CombiBars

- Categorised by refinery levels

- The advantages of buying gold bars

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

The Big Question: Will the Fed “Wimp Out” and “Pivot”?

We’ve been reading a number of articles that believe the US central bank is likely to back down from its interest rate increases or at least slow the pace of them before too long.

David Brady of Sprott Money wrote:

“The market certainly believes that the Fed will slow their hikes going forward, even if they raise rates 75 basis points next week. We know this because stocks soared, nominal bond and real yields fell, the dollar dumped and is now testing key support, and monetary metals climbed off their lows. Now it’s up to the Fed to spoil the optimism or join the other central banks by scaling back their rate hikes—in other words, “pivot”.”

Source: Fed’s Pivot is Inevitable

Economist Nouriel Roubini says the Federal Reserve is going to “wimp out” on the inflation fight and that will lead to a dollar crash.

“Right now, all central banks are playing tough, and talking tough, and acting tough – hawkish – because they have a problem of credibility. But in my view, there are two problems. One problem is if they try to get to 2% inflation, they cause a recession. And this recession is not going to be short and shallow. It is not going to be garden variety. It’s not going to be plain vanilla. It’s not going to be two quarters of negative growth and then inflation collapses and they can ease again. … It’s going to be a severe recession because of the debt ratio — because we’re going into fiscal and monetary tightening. And at the same time, not only do we have an economic crash, you’re going to have also a fiscal crash.”

…Once the Fed is going to essentially prevent an economic and financial crash – or try to prevent it by … stopping raising rates, even though inflation is too high, then the dollar is going to start to sharply weaken. That is going to be the trigger for it. Because what is raising the dollar is tight monetary policy.”

…Gold has not done very well because you have tight monetary policy and a strong dollar. But if central banks are going to blink and wimp out, gold is going to rise in value.”

Source.

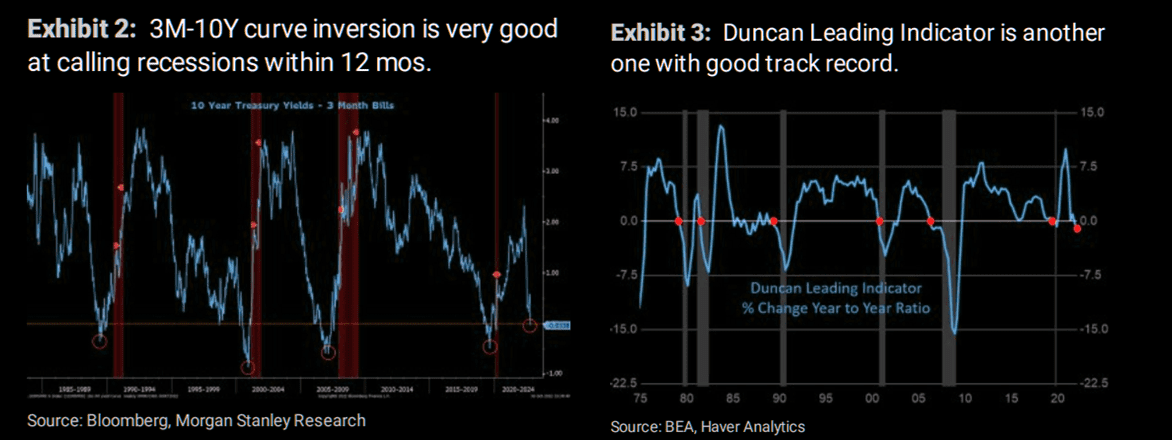

While The Market Ear shared some charts from Morgan Stanley that shows a Fed pivot could be near…

A Fed pivot sooner rather than later

3M-10Y yield curve inversion, a negative y/y % change in the Duncan Leading Indicator, and M2 growth that is plummeting toward zero all support a Fed pivot sooner rather than later…”

Morgan Stanley

Source.

Next, this interesting post discusses a measure of liquidity and how it is showing increasing signs of stress in the banking system.

The FRA-OIS spread compares interest rates demanded by banks with international risk to lend to each other, to overnight risk-free interest rates which is Fed Funds based. i.e. what banks demand of each other versus the rate set by the US central Bank.

This measure has now spiked up to the same level as when Putin invaded.

“THE BREAKING POINT IS VERY CLOSE.

Why 10-15 bps? We feel because that is where the last spike got mysteriously capped at the inception of the Ukraine-Russian war. Somebody stepped in then, and it is reasonable to think somebody will step in near that level again. Yellen most definitely pivoted fiscally Thursday and Friday. The money offered to Switzerland and the UK this week was directly related to this indicator spiking we’d wager.”

…THEY DONT HAVE TO LOWER RATES TO PIVOT THIS TIME- But they will

This time, however, the Fed may keep on hiking at least longer than we feel they should, but bail out the ones (banks, pensions, or industries) they deem worth saving. That is a pivot, even if they do not lower rates. Isn’t that what the UK just did?

Is this not what the US is indirectly doing as of this week. Witness what was done by (Dammit Janet) Yellen’s DOT these past 2 days alone. The Fed isn’t pivoting yet. The DOT is doing it for them on the heels of the UK’s temporary QE idiocy. The last 48 hours:

DOLLAR WINDOW OPENS: Swiss National Bank this week drew nearly $6.3 billion from the U.S. Federal Reserve’s currency swap line facility Oct 13th- RTRS

IMF FUNDING REQUEST: Yellen told a news conference that the Treasury has asked the U.S. Congress for permission to lend $21 billion in existing U.S. Special Drawing Rights (SDR) to IMF- Oct 14th- RTRS

QE DURING QT: U.S. Treasury asks major banks if it should buy back bonds- Oct 14th- RTRS

Source: FRA-OIS Says Powell Didn’t Pivot Yet, But Yellen Sure Did

Will We See Multiple Waves of Inflation?

So then what happens if the Fed and other central banks do pause their interest rate hikes?

Perhaps we see inflation dip and so everyone thinks the central bankers have solved it? Only to see another spike in inflation rates down the line?

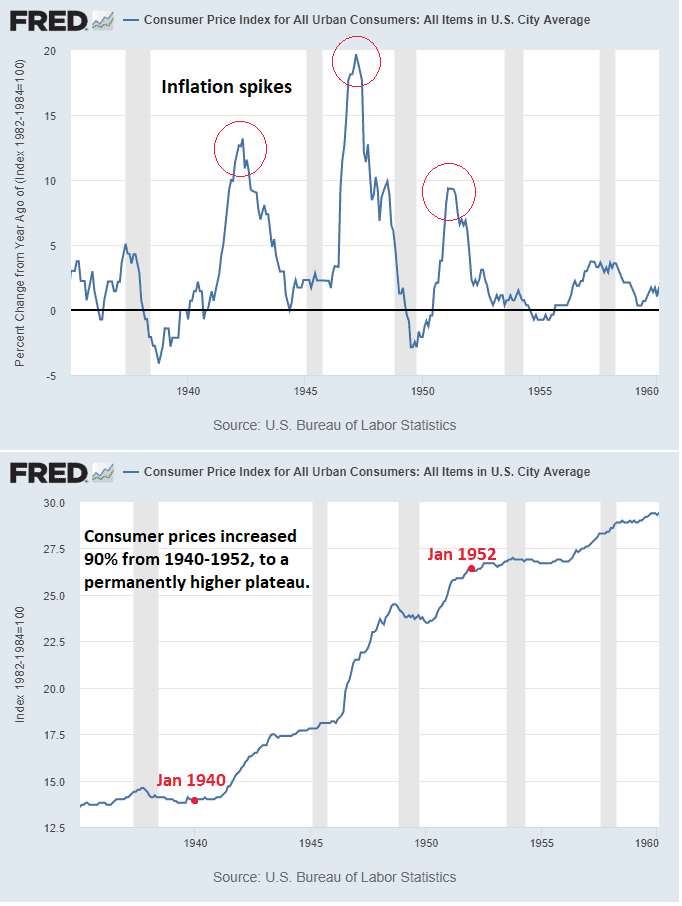

Lyn Alden Tweeted this chart and commented that:

“The 1940s had multiple waves of inflation too.”

Source.

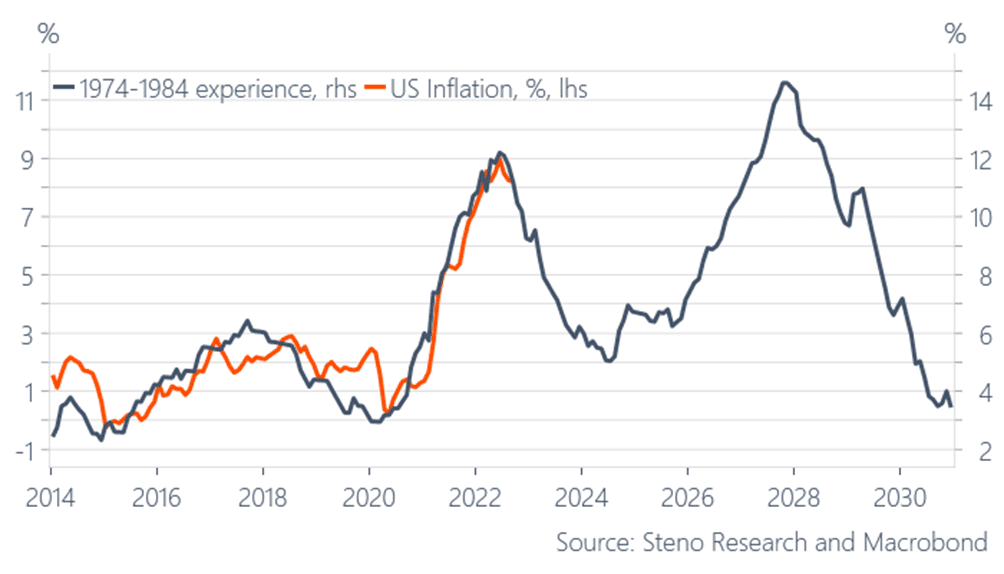

Here is a substack post from Andreas Steno Larsen that explains this more fully:

“Even if the zero-interest-rate policy is hopefully dead and buried by now, I would not rule out that we start discussing (much) lower interest rates again during 2023/2024 due to the upcoming recession. Most, if not all, of my inflation indicators point to substantial disinflation in 2023, which is likely to reignite the discussion of rate cuts and central bank pivots.

BUT! … We have never had inflation running at current levels without experiencing a so-called double top inflation regime. That was the case in 1974-1980 and in 1946-1951. The reason is simple. As soon as disinflationary trends get clearer and clearer, everybody (including politicians) will be screaming at the Fed and the ECB to pivot. Central banks will likely cave in under immense external pressure, no matter what they are saying currently. Just look how intensively we have discussed the central bank pivot over and over this year, and most asset managers, pension funds and investment banks still hope and pray that the pivot will arrive due to their asset allocation, which is still mostly based on observed trends from 2008-2021.

Chart 4. We have always seen double tops in inflation, once inflation gets as hot as it is now

Markets will consequently likely try and chase the zero time value of money narrative once more over the next few years, before the next inflation wave kicks in. The smart investor ignores it and ensures that the portfolio is sufficiently inflation protected for the decade ahead. Source.

We agree that it could be something like a decade of inflation to come. Do you have sufficient protection in place from a long term loss of purchasing power in dollars?

Get in touch if you have any questions about silver or gold:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Gold and Inflation Analysis 2023 | Gold Survival Guide