We’ve featured Chris Duane and others who have looked at historical valuations and comparisons of silver in the past (Check out the related posts at the end for some of these).

This video below covers a number of historical comparisons in the valuation of silver such as what it bought in the past or what people were prepared to do in exchange for certain amounts of silver.

Such as:

- Sun Tzu in The Art of War stated that you could have a 100,000 man army for 1000 ozs of silver a day. i.e. 1/100th of an ounce of silver per man per day.

- Jesus was crucified for 15 ozs of silver = less than US$300.

- In the American Revolution, the King of England had a ranson on Samuel Adams head for about 10 oz’s of silver.

- The “Rise and fall of the Roman Empire” stated that the “Barbarians at the gate” were asking for a ton of silver not to sack Rome and the Romans couldn’t come up with it.

- At the turn of the century the average worker made 1/10 oz silver a day.

- In the Bible it states field workers made one Denarius a day which is about 1/10 of an ounce of silver.

- Two thirds of the world today lives off about $2 a day with also equates to roughly 1/10 oz of silver.

- Consider the Louisiana purchase when Thomas Jefferson bought almost 1/3 of the United States. He paid about 1 oz of silver for about 45 acres of bare land. There’s only about 8 billion ounces of arable land on earth. The above ground stock of silver is estimated to only be about a billion ounces. So if all things were equal you’d get 8 acres of land for 1 oz of silver. We’re a very long way away from being able to do that.

So these historical comparisons are interesting but while Chris doesn’t think we’ll get back to those times, these show things are severely skewed in the direction of financial assets and intangible wealth.

Emperor of China Sold out for 1700 lbs of Silver

Now the latest interesting historical comparison in more recent times concerns the last Emperor of China. It’s the story of how 2000 years of imperial rule in China ended in 1912.

The last emperor’s adoptive mother signed abduction papers forcing him from the throne.

Everyone wondered why she would do such a thing to her adoptive son.

Researchers have recently discovered that it was because she was was bribed with 1700 lbs of silver or 27,200 ozs of silver x $16 = US$435,000.

So for less than a half million dollars of silver the equivalent of China was sold out.

(However there was also possibly a threat of beheading if she didn’t go through with this. So we’d say that somewhat negates the seemingly small amount in todays terms that she was paid to sell out her son.)

So at current silver prices none of these historical stories make sense.

Would $15,000 to sell out Jesus make sense?

So this should make us consider how cheap $16 silver is in nominal terms, real terms and in historical terms.

Our Take on These Historical Silver Valuations:

Yes indeed silver appears very cheap in these comparisons. But of course that’s not to say that silver can’t get cheaper still!

However we’d agree with Chris that silver on most historical measures silver is exceptionally cheap today.

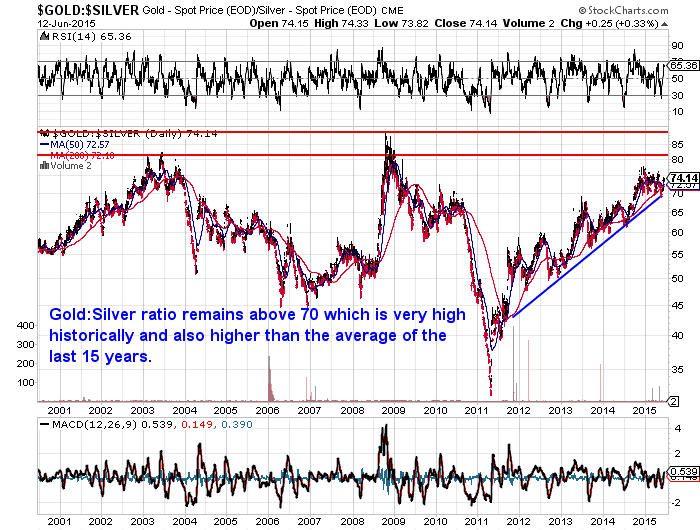

Another comparison is silver relative to gold. The gold to silver ratio is very high currently too – i.e. Silver is very cheap compared to gold. Although the gold silver ratio has not quite broken down out of the 4 year uptrend it has been in, so again this could actually still get higher yet. The ratio almost reached 90 back in 2008 so there is a precedent.

However it would seem likely that we much are closer to a top in the gold silver ratio than a bottom. So there should be more upside than downside here for silver versus gold.

To see how the Gold Silver Ratio is calculated, how it can be used, and where it might head to next see: What is the Gold/Silver Ratio?

HSBC Peak Silver is Here

This short video also shows other positives for silver in relation to Peak silver supply having been reached last year.

As a result silver’s supply deficit is expected to be 87 million ounces this year, up from 5 million last year

Scrap recycling is also down and expected to drop further this year.

Again this doesn’t guarantee the price of silver will rise from here now, but it does show there is plenty of potential upside to come.

However it would seem likely that we much are closer to a top in the gold silver ratio than a bottom. So there should be more upside than downside here for silver versus gold.What is the Gold/Silver Ratio?

Pingback: Wages from Ancient Greece and NZ Housing Both Say Silver Undervalued by a Factor of 20 - Gold Survival Guide

Pingback: Wages from Ancient Greece and NZ Housing: Both Say Silver Undervalued by a Factor of 20 - Gold Survival Guide