- 3 Gold Myths

- Why Aren’t These Investors Worried About The Gold Price?

- Buying Gold or Silver in NZ with Foreign Currencies

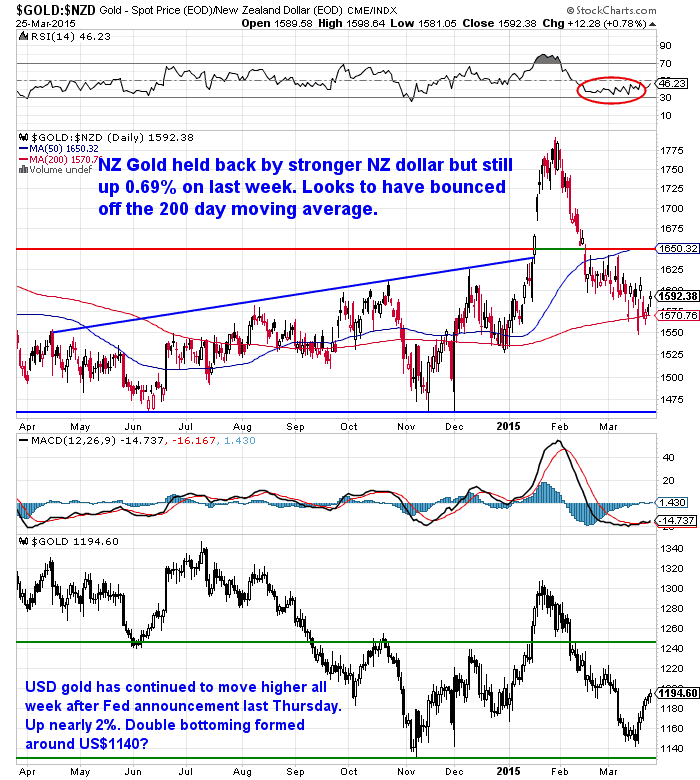

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1575.34 | + $10.86 | + 0.69% |

| USD Gold | $1196.16 | + $22.96 | + 1.95% |

| NZD Silver | $22.39 | + $0.90 | + 4.19% |

| USD Silver | $17.00 | + $0.89 | + 5.50% |

| NZD/USD | 0.7593 | + 0.0094 | + 1.25% |

Gold and in particular silver continued to move higher this week. It seems the Federal reserve announcement last week took many by surprise and many bearish bets were being reversed this week in the precious metals futures markets.

Likewise the Kiwi dollar has also moved higher – or rather the US dollar has moved lower on the expectation that US interest rates may not raise as early as most though. So that has dampened the rise in both metals here locally.

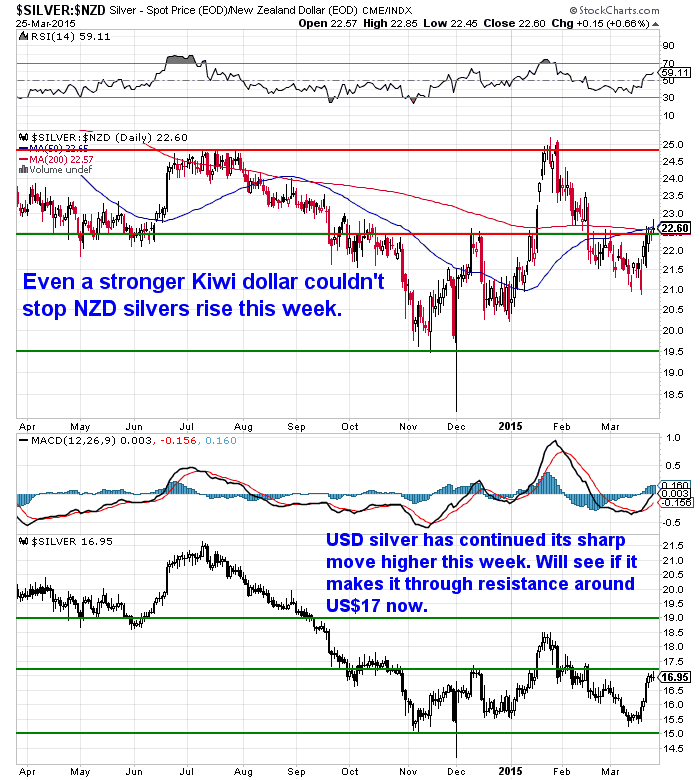

Looking at the 3 charts above we can see even after this weeks sharp moves in metals and currencies – for now the following overall trends remain in play:

- Gold in NZ dollars remains in the gentle uptrend it has been in for the past 12 months.

- While gold in US dollars looks to be in more of a sideways to downtrend over the same period.

- Silver in NZ dollars has been in a sideways trading pattern over the past 12 months. Although since December it has been trending upwards.

- Silver in US dollars is down over the past 12 months but in a sideways range since October.

- While the NZ dollar has bounced back this past couple of weeks, for now it remains in a downtrend longer term against the US dollar.

Of course these are just trends and can change at any time.

There certainly was a lot of people expecting the US dollar to keep strengthening, so no surprises that it’s now correcting back down.

Although we reckon the overall trend of a rising US dollar might still continue for a bit longer yet.

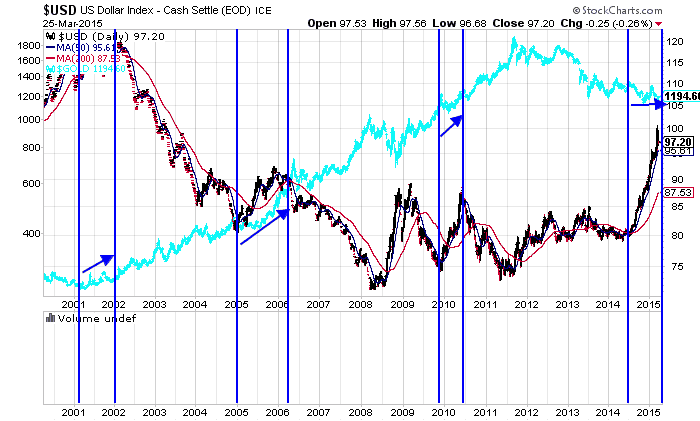

While you won’t hear it in the mainstream, this doesn’t always mean gold has to fall in an inverse relationship to the US Dollar. There have been a number of periods in the past 15 years where gold and the US dollar have risen in tandem.

See the chart below. The turquoise line is Gold in US dollars, the other line the US dollar index. The highlighted areas show where gold moved higher at the same time as the US dollar rose, sometimes for over a year.

And even over the past 9 months when the US dollar has zoomed higher, gold has at least held pretty steady.

2 Other Gold Myths

That when the US dollar rises gold must fall is not the only gold myth out there. Here’s a couple of others:

Gold Myth Number 1

Another myth often spouted about gold is that rising interest rates are bad for gold.

However there is no real basis for this – in fact just the opposite!

The NIA sent out some interesting stats this week on this very topic:

“Historically since 1970, the Fed Funds Rate has averaged 5.66% vs. the current Fed Funds Rate of 0.11%. There have been four major periods of the Federal Reserve raising the Fed Funds Rate from below its average of 5.66%, and gold prices have increased during all four of these periods- with gold prices averaging a gain of 146.54%.February 1972-December 1974: Fed Funds Rate increased from 3.29% to 12.92% while gold rose from $48.40 per oz to $154 per oz for a gain of 218.2%.January 1977-April 1980: Fed Funds Rate increased from 4.61% to 17.61% while gold rose from $132.10 per oz to $519.25 per oz for a gain of 293.1%.

December 1992-April 1995: Fed Funds Rate increased from 2.92% to 6.05% while gold rose from $332.90 per oz to $389.50 per oz for a gain of 17%.

May 2004-July 2006: Fed Funds Rate increased from 1% to 5.24% while gold rose from $387.30 per oz to $637 per oz for a gain of 57.86%.

With gold currently at $1,190 per oz and the Fed expected to begin raising rates later this year, gold could easily rise by 146.54% once again to $2,934 per oz.

Since 1970, gold has averaged a year-over-year price gain of 10.92%. Gold has averaged a year-over-year price gain of 15.39% when the Fed Funds Rate has increased on a year-over-year basis, which is more than double gold’s average gain of 7.09% when the Fed Funds Rate has declined on a year-over-year basis. When the Fed Funds Rate has increased year-over-year by 25% or more, gold has averaged a year-over-year gain of 25.1%.

Check out NIA’s three must see charts of Gold Prices during Fed Rate Hikes: http://inflation.us/gold-rose-big-during-historical-fed-rate-hikes/ ”

So while we’re not sure that rising interest rates are that close to hand, these numbers show that if even if they are, this is just as likely to be a positive for gold.

Why would this be?

Our guess – because it’s the “real interest rate” that matters.

The real interest rate is simply the interbank lending rate less the current rate of inflation.

It shows you what return you are getting on your money after inflation.

It is the real interest rate that is more closely correlated to the price of gold. When it’s less than about 2% is when people often prefer to hold gold overs cash.

See these previous articles for more on this topic:

Real interest rates in New Zealand | What can they tell us about when to buy gold

Gold Critical Metric | The One Indicator to Watch

Read more: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

Gold Myth Number 2

Inflation and Gold

Another very common myth is that gold requires inflation to rise.

We’ve seen many argue that since inflation is not high like that of the 1970’s there is no reason to hold gold.

It’s fair to say gold definitely shoots higher during hyperinflationary periods such as in Weimar Germany among countless other historical examples.

But during run of the mill more mild inflation it is not so clear.

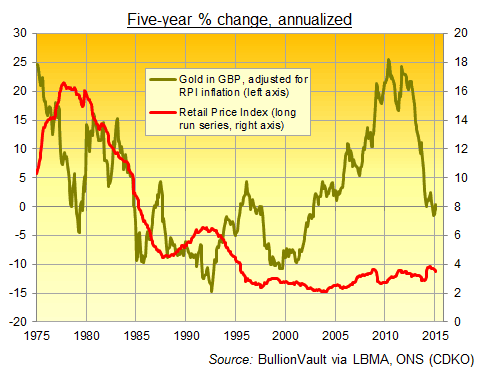

The below chart from Bullionvault plots the change in UK retail price inflation against the change in the gold price (in Pounds).

Clearly over the past 15 years gold has gone up – and down – with no real relation to the rate of inflation. As Adrian Ash notes:

“Doing what Roubini did (like many other, smarter people)…and simply looking at the 1970s…seeing strong inflation…and then assuming that strong inflation is necessary for strong gains in gold…would mean ignoring the last 15 years.

Inflation went AWOL more than a decade ago. https://twitter.com/bullionvault/status/580311302079438849 Gold has tripled for UK savers in real terms…over and above changes in the cost of living.”

So that’s that myth busted too we reckon.

Buying Gold or Silver in NZ with Foreign Currencies

As noted this week has seen very large moves in foreign exchange cross rates. The US dollar fell a record amount in one day.

So there’s plenty of reasons to get at least some of your money out of fiat currency regardless of which one it is.

Have you got some foreign currency you’d like to exchange for gold or silver?

We have accounts in Australian Dollars, US Dollars, Euros or Pounds available. It is generally much cheaper to move your foreign currency directly into these accounts, rather than taking the massive hit in FX charges in converting back to NZ dollars via your bank.

If you’d like to exchange some Dollars, Euros or Pounds for precious metals then get in touch via phone or email and we can answer any questions.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,480 and delivery is now about 7-10 business days.

Stop the Press! Late Addition

Just in are these fine looking Perth Mint 1 oz .999 Silver Funnel Web Spider coins.

They are legal tender in Australia and have a maximum mintage of 1,000,000. So you could call them semi-numismatic (semi-collectible).

DESIGN

The coin’s reverse features a large funnel-web spider, displaying its sprawled legs and hairy body. The design also includes the inscription AUSTRALIAN FUNNEL-WEB SPIDER, the 2015 year-date, the coin specifications, and The Perth Mint’s traditional ‘P’ mintmark.

The coin’s obverse depicts the Ian Rank-Broadley effigy of Her Majesty Queen Elizabeth II and the monetary denomination.

These bullion coins come in protective tubes of 25 coins. There are 20 tubes to a monster box.

We’re also offering free delivery on these anywhere in Australia or New Zealand for a 500 coin box at $13,650.

Email back or give us a call on 0800 888 465 or +64 9 281 3898 if interested.

This Weeks Articles: |

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot PricesSpot Gold | |

| NZ $ 1564 / oz | US $ 1240.25 / oz |

| Spot Silver | |

| NZ $ 21.96 / ozNZ $ 776.60 / kg | US $ 17.41 / ozUS $ 559.86 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuideToday’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide?If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.Have a golden week!David (and Glenn)

Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

| The Legal stuff – Disclaimer:We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2013 Gold Survival Guide.All Rights Reserved. |

Pingback: China Gold Reserves and SDR Inclusion