Prices and Charts

NZD Gold Dips Slightly

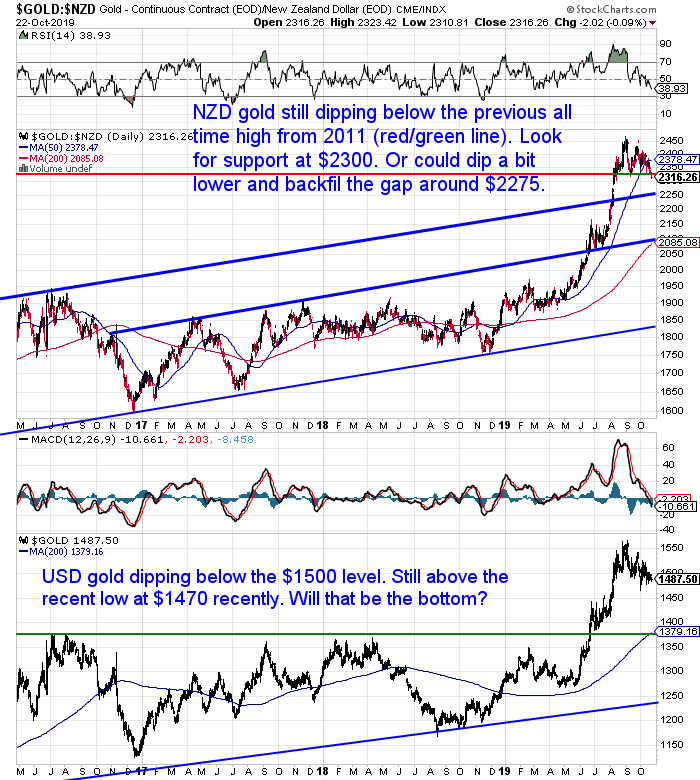

Gold in NZ Dollars was down 1.27% this week. Solely due to the strengthening Kiwi dollar. NZD gold is now just under the previous all time high from 2011. Look for support now at the $2300 level.

We could potentially see NZD gold back fill the gap up it made around $2275. Plus the rising trendline also sits at about $2250. So those are two other areas of support to watch for. You could also use these as buy zones if you are looking to layer in a series of purchases.

If those levels are hit, the odds are we will be in oversold territory and due for a bounce higher then.

Silver Still Holding at the 50 Day MA

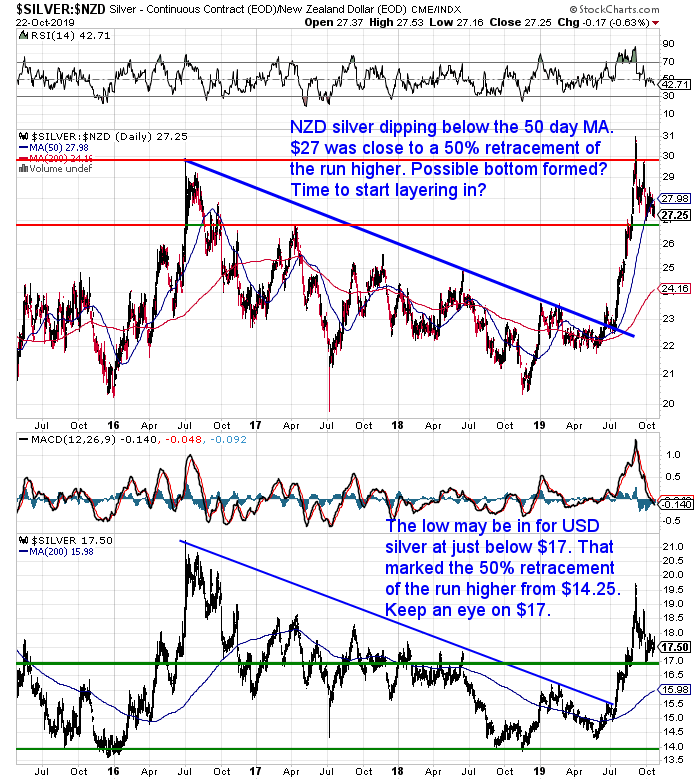

Silver in New Zealand dollars was down just over 1 percent. Now getting back close to the $27 region. We could expect to see some support there or else maybe at $26?

Either way we are probably entering a pretty decent buying zone around here.

NZ Dollar Bouncing Higher

As mentioned already, the New Zealand dollar charged higher this week. Up a hefty 1.78%. We could see if move up closer to 0.6500. But with the RSI overbought/oversold indicator nudging into overbought territory, there may not be too much more upside in the short term.

As we said last week, perhaps we’ll just see the Kiwi consolidate around these levels. Between 0.62 and 0.65.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

Last week we wrote about the potential impact of ultra low or even negative interest rates.

We discussed how interest rates are so low in New Zealand but may head even lower yet.

But in reality, interest rates are already lower than the rates you see quoted in the press.

How so?

Because these commonly quoted rates don’t take inflation into account. What is referred to as the “real interest rate”. So that is the interest rate minus the current year on year change in inflation rate.

When you look at these numbers, interest rates are already negative here in New Zealand. And that is using the government inflation numbers, which likely don’t reflect the average person’s weekly expenses.

So we’ve crunched the numbers on the real inflation rate in New Zealand right back until 1985. Then we’ve compared these numbers to the NZD gold price. The results are very interesting.

There is a stronger correlation that we might even have thought.

This relationship can be pretty useful in helping us identify the better times to be buying gold.

Read more here…

Why Stocks Could Keep Rising – But So Could Gold

We stumbled across an opinion backing up what we said last week about shares rising with the current low interest rates:

“Perhaps we’ll now see the “melt up” that a few financial writers have been expecting?

What about here in New Zealand?

Our share market continues to tick higher. So perhaps this will continue too? That extra credit needs to find a home. And with lower interest rates likely coming, perhaps more people will look to share markets?”

Source.

Frank Holmes, CEO of US Global Investors, pointed out in a recent interview that:

“…whenever you have an expanding economy and you drop rates in the U.S., it is very bullish for stocks. And if you have negative real interest rates, it’s very bullish for gold. So, having an expanding economy is bullish for stocks and negative rates are bullish for gold and silver, guess what? Gold and silver stocks are going to rip. And they’ve done that.”

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

The Biggest Take-Away From this Years LBMA Event in China:

Central Banks Don’t Expect Gold to Regain Any Role as Money Itself. But…

This year’s London Bullion Market Association (LBMA) event was held in Shenzhen, China.

Yesterday Adrian Ash reported on the biggest and best idea he picked up at the gathering of golds big wigs…

“#1. Central banks are buying gold because they don’t yet know what will replace the Dollar.

It’s not because they expect gold to regain any role as money itself, and not because they’re using gold to replace US Dollars in their holdings. Not as a long-term plan.

Instead, central-bank managers don’t like how US foreign policy (ie, Trump’s twitter account) could hit their ability to hold or trade the Dollar. Nor do they like how US policy means more debt on top of this year’s $1 trillion deficit, potentially driving the Dollar down against other currencies.

But there isn’t, as yet, any contender to replace or even challenge the Almighty Dollar as the world’s No.1 reserve currency. (When Sterling lost its crown after WW2, the Dollar looked the obvious new king. Whereas the Euro today has problems all of its own, and the Chinese Yuan isn’t even freely traded on the FX market.)

So, while waiting for the future shape of global money to become clear, central banks are choosing to buy some gold at a near-record pace simply as a place to hide out…

…a stop-gap away from the Dollar but also free from any other monetary or government authority’s policy mistakes.”

Funnily enough, this is just the point we made in last weeks article, Why Sleeping Beauty Should Own Some Gold or Silver…

“Wealth can be thought of as an accumulation of knowledge. Gold is a stable means to safely transfer that wealth into the future.

Bitcoin and cryptocurrencies may well play a part in the future monetary system. But it’s very difficult to predict which one, if any, will win out over the others. Plus they are so far untested in a global crisis.

Whereas gold and silver have stood the test of time. They have been used as money and retained their value for millenia.

…So store a portion of your wealth in physical gold and silver.

…That way when you “wake up” in 5 or 10 years time, regardless of how things change, you can rest easy that your wealth in gold and silver will hold its purchasing power.

Then you can transfer your stored wealth into whatever is being used as money at that time. Or “spend” your gold and silver on whatever the most undervalued assets are at that time.”

So. If central banks are buying gold “as a place to hide out”, while they wait for the “future shape of global money to become clear”, we’d say that is a pretty good reason for the average person to do the same!

This current pull back is starting to look like a good place to join the central banks “hide out”. Request a quote today.

Or give us a call if you have any questions. Or book a time online that suits you for a free bullion consultation.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|