Prices and Charts

USD Gold Breaking Out to New Highs

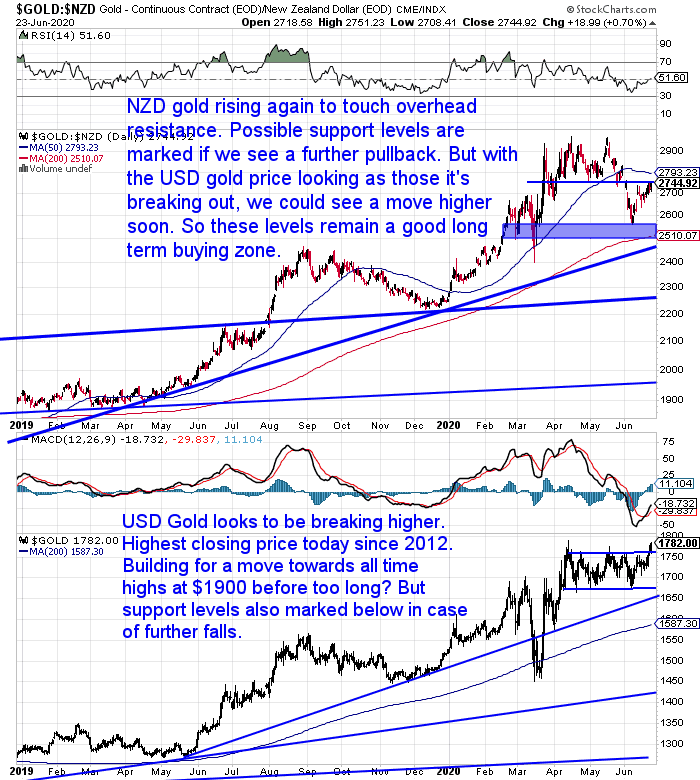

Gold in New Zealand Dollars is up about 2% from a week ago. Today once again touching the overhead resistance line at $2750. Gold is delicately poised here. It sits midway between the lows from earlier this month and the all time high from May. The RSI overbought/oversold indicator is right on neutral at 51.

So NZD gold could go either way.

However gold in US Dollars looks to be breaking out of the recent sideways consolidation pattern. Getting over $1770 today, for the highest daily closing price since 2012. Although the price is about in line with the intraday high from April. Therefore this could still be a “fake out”. We really need to see gold get above $1800 to confirm the breakout. Then the next stop is likely the all time high just above $1900.

If gold heads to new highs in US dollars, then even the recently strengthening Kiwi dollar likely won’t stop the NZD gold price also moving higher again.

Silver Keeping Up with Gold

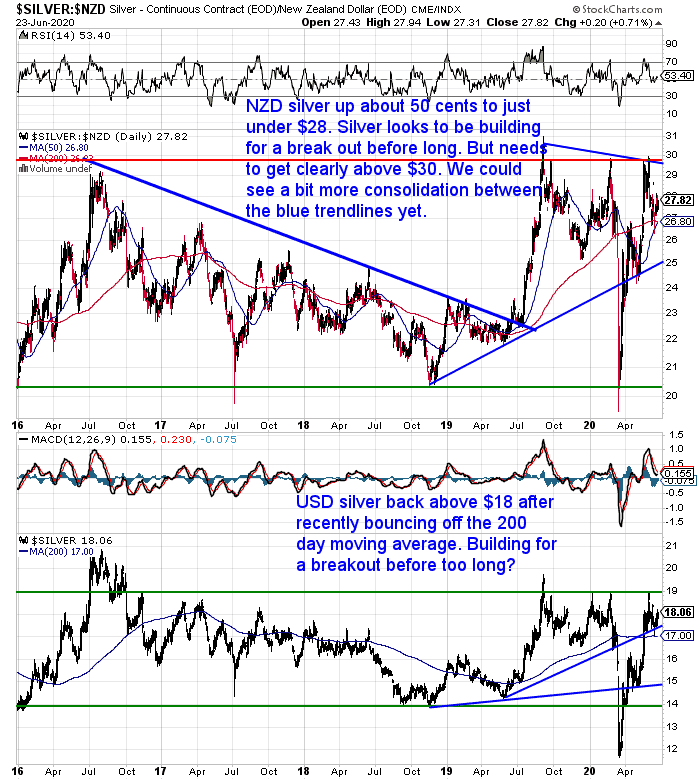

Silver has risen in lock step with gold this week. Up close to the exact same amount in percentage terms. NZD Silver sits around the middle of this pennant or wedge formation. Also neutral on the RSI so the likely direction here is not really clear either.

But the intersecting 50 and 200 day moving averages have provided good support lately. So if USD gold moves higher it’s very likely silver will follow.

NZ Dollar Higher

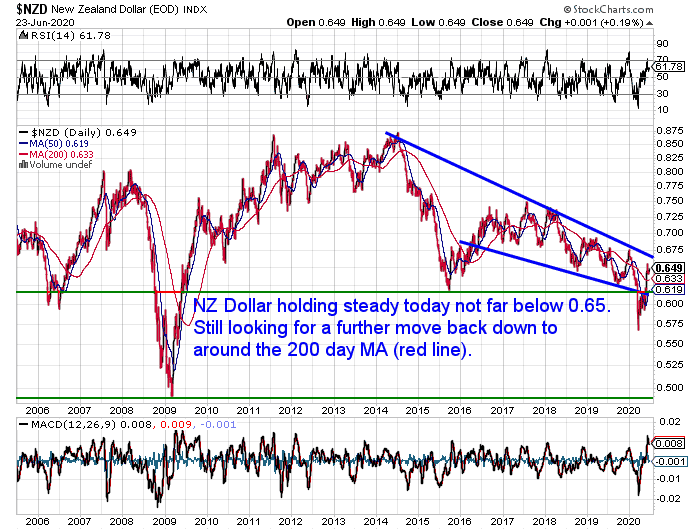

The Kiwi Dollar is also higher this week. But not enough to dull the moves in local gold and silver prices too much.

The chart still shows the Kiwi in a long term downtrend. However given the troubles in the US it would not be a surprise for this trend to change before too long. Especially since the USD seems to be weakening against most currencies at the moment.

But economically things aren’t all beer and skittles here in NZ either. So this strengthening of the NZ Dollar may just be gradual.

The long term trend of all national currencies going down, versus the only true yardstick of gold, will likely continue. Regardless of how each of these currencies move against each other.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

The Fourth Turning and Gold: What’s Still to Come in This Crisis?

Have you heard of the book The Fourth Turning: An American Prophecy?

We came across it some years ago, although still a while after it was written in 1997.

The book has garnered renewed attention recently with the Coronavirus and riots in the USA. With even a recent article in Forbes focusing on it.

The authors studied past generations and came up with cycles that are repeated thorughout American history. They have been spookily accurate in many of their predictions. The authors Strauss and Howe even outlined how a pandemic could lead to major ructions in the USA during a coming crisis:

“A spark will ignite a new mood.The CDC announce the spread of a new communicable virus. Congress enacts mandatory quarantine measures. Mayors resist. Urban gangs battle suburban militias. Calls mount for the president to declare martial law.”

“At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where, during the Unravelling, America will have neglected, denied or delayed needed action. Anger at ‘mistakes we made’ will translate into calls for action, regardless of the heightened public risk.”

So this week we’ve put together a summary of this fascinating book. It looks at what might be still to come in this crisis. We’re actually only in Stage 1 of 5 before the new beginning. So things are likely to get worse before they get better.

Understanding what is still to come means you can plan and prepare. So if the Coronavirus took you by surprise make sure you read this week’s feature article…

Has the RBNZ Got the “Wrong End of the Stick” With its QE?

The flooding of capital markets with massive new money from the RBNZ’s quantitative easing program calls for a fuller debate of what the central bank and the Minister of Finance are trying to achieve, says Keith Woodford. (The Professor of Farm Management and Agribusiness at Lincoln University for 15 years through to 2015).

Woodford points out that:

“Quantitative easing has now shifted to become mainstream as the dominant monetary response to COVID-19 economic conditions. It has also led to capital markets being flooded with money searching for a home.

As a monetary policy, quantitative easing is an obvious way to increase inflation to meet inflation targets. It is also intended to be an economic growth stimulant. Further, it can provide a funding solution for government financial deficits. Of course, lunch seldom comes free.

…Traditional economic theory says that lowering interest rates will lead to increased investment. Economists can argue convincingly that there is lots of empirical evidence to support that theory. However, that evidence comes from history and right now we are making a new history that is different from the past.

Despite the low interest rates, it seems that both here in New Zealand and almost everywhere else in the world, businesses have little wish to invest. As for consumers, they are choosing to save money rather than spend it, once again reflecting the huge uncertainties ahead.

…It really does not matter how much lower interest rates decline from here, it seems unlikely that investment spending will increase. It is other factors, not interest rates, that are controlling investment decisions. And there lies the nub of the issue.

Given all of these things, consideration needs to be given as to whether the Reserve Bank, currently going hell for leather for more and more quantitative easing, has got the wrong end of the stick.

…Right now, at a policy level, we need to be thinking about whether the current extent and proposals for quantitative easing are simply holding up asset prices to unsustainable levels and reinforcing economic distortions. It may well be directing behaviours in quite the wrong direction.

Perhaps we need to focus more on other policies that can reset the economy for the world ahead.

There might also be merit in asking some big questions as to whether, within the global economy, New Zealand has become a plaything of international finance. Perhaps that has been the case for a long time. What happens next in New Zealand is highly dependent on how overseas investors might respond within a risk-on environment. Short-term money flows can themselves be highly distortionary.

It would seem hard to refute that the global macroeconomic system is a complex but ‘jerry-built’ system. There was never an overarching and planned design. Rather it was built piece by piece over the last 100 years, and with many patches. It is a bit of a mess.

Source.

A mess indeed. As today’s feature article alludes to, a mess that will likely only be sorted out by even greater troubles taking place first.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Inflation Dog May Finally Bark, Investors Bet

Reuters this week reports that more institutional investors are preparing for possible higher inflation down the track…

“Gold, forests, property stocks, inflation-linked bonds – these are just some of the assets investors are pouring money into on the view that the recent explosion of government spending and central bank stimulus may finally rouse inflation from its decade-long slumber.”

Source.

This high inflation could be some years off yet. But as the price has shown recently, gold doesn’t need high inflation rates in order to rise and protect you.

Buying has slowed up noticeably in the last couple of weeks. A good contrarian indicator shown by the fact that the USD gold price seems to be heading higher now.

Both metals are still down from recent highs and in decent long term buy zones.

Premiums on the likes of Canadian silver maple 1oz coins have also dropped sharply this week. Even though the silver price is up, a mint box of 500 maples is over $500 cheaper than a week ago (see below).

So right now is looking like a fairly decent place to buy. Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Why Boring is Good - Gold Survival Guide