Prices and Charts

NZD Gold Close to 200 Day MA – Long Term Buying Opportunity

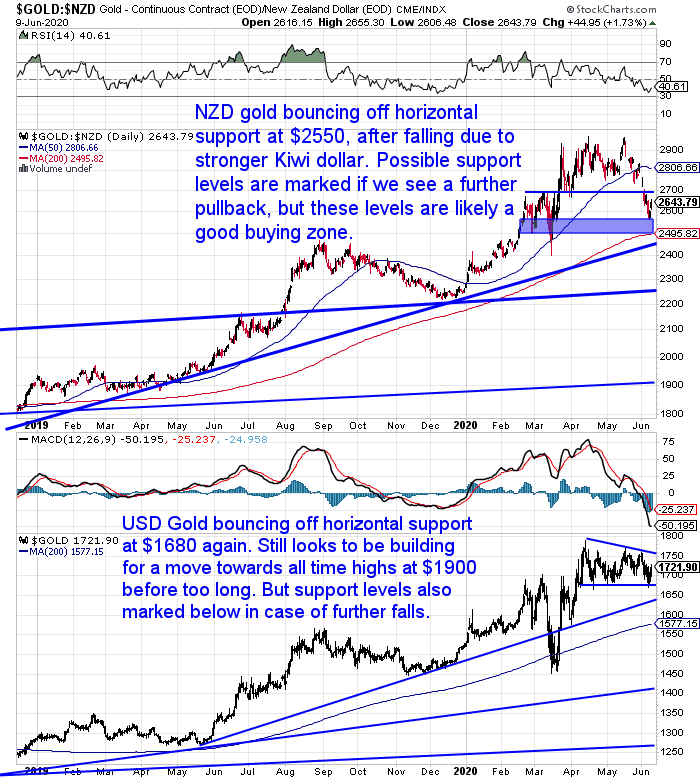

The correction in NZ Dollar gold continued this week with a fall of 3%. However today the price has bounced up after touching horizontal support around $2550.

Gold in New Zealand Dollars is currently over $300 per ounce lower than it was in mid May.

The pull back has come close to touching the 200 day moving average(MA) too.

Why is this significant?

Because the 200 day MA (the red line currently at $2495) is widely regarded as a solid indicator of a bull market. So when prices are above this line it’s a safe bet that a bull market is in place.

Therefore any dip down to near the 200 day MA is generally a very good place to buy. As in a bull market prices will generally turn higher from there.

Here’s a Contrarian Indicator

Here’s another tip from us with the benefit of some market insight. Buying has noticeably slowed this week compared to previous weeks. We’ve learned that when the bulk of people aren’t buying gold is often the best time to actually be making a purchase!

Yes, it’s harder to do. The human psyche worries that there are further falls ahead. So most will avoid buying after a decent pullback.

Could gold fall further?

Anything is possible. In fact NZD gold could fall all the way back to $1900 (something we think is very unlikely) and still be an uptrend.

But history says anywhere around current levels is likely to be a good long term buy.

This week’s feature article below has another reason why we’re entering a very good buying zone for gold.

NZD Silver Also Just Above 200 Day MA

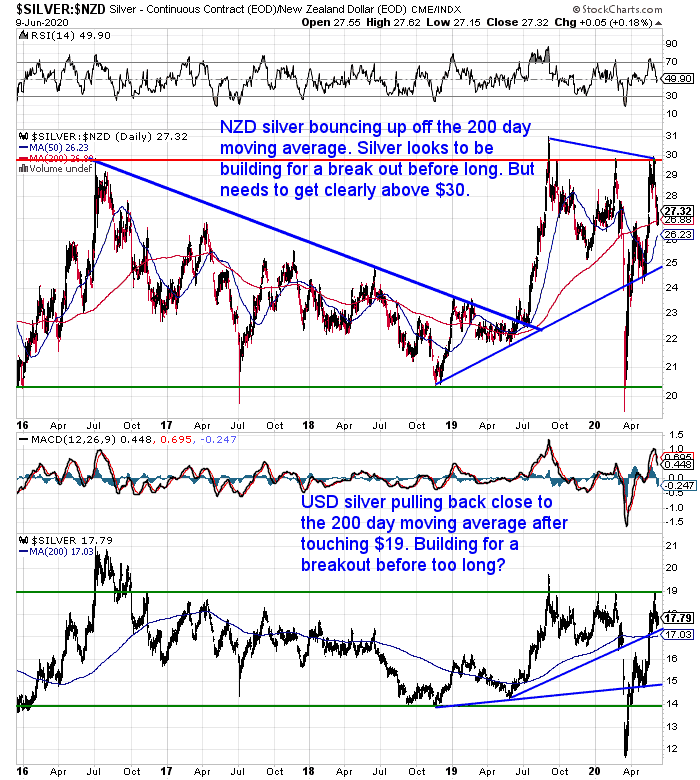

Silver in New Zealand Dollars is also not far above the 200 day MA today. It dipped just under it this past week before bouncing back.

Silver could yet see a further pull back to the 50 day MA near $26. Or even down to the uptrend line around $25. But again likely entering a solid buying zone between here and those points (if we see them).

NZ Dollar Continues Its Sharp Rise

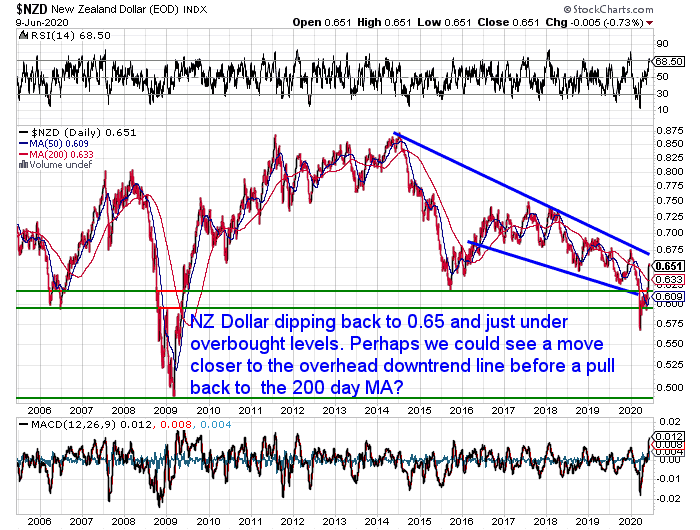

The Kiwi Dollar has continued its move higher this week. Well above the 200 day MA and not far from the overhead downtrend line dating right back to 2014.

That is likely to prove to be tough resistance to break above. Especially since the NZ dollar is close to overbought levels still. After such a rapid move higher, we’d expect to see it pull back to at least the 200 day MA before long.

That will also lend support to local gold and silver prices.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Using Gold Seasonality to Determine When to Buy Gold in NZ Dollars

Here’s another method to aid in determining when the best time is to buy gold and silver. We can look at past historical trends. That is by looking at the months throughout the year when the gold and silver prices fall the most. That way you can purchase following these periods when the price has dipped.

See: Gold Is Seasonal: When Is the Best Month to Buy? This shows the months of March, April and June are often the best time to buy.

However the above article looks at gold prices in US dollars terms. As we explain here you should look at the price in your home currency when buying gold and silver: Why You Should Ignore the USD Gold Price When Buying in New Zealand.

So for New Zealand gold and silver buyers this week’s feature article may be of more use…

The Sky is Falling

Darryl Schoon makes the point in this post that it’s likely still deflation that is the biggest risk as the velocity of money continues to fall…

“Despite central banks’ excessive money printing, hyperinflation may not occur, at least not immediately. In capitalist economies, because currencies are circulating coupons of credit and debt, when credit disappears, so, too, does “money”; and, today, money is disappearing into deflation’s waiting maw even faster than the Fed can print it.”

It also includes a great video from Darryl where he explains the intricacies of the confiscation of gold in the 1930’s in the USA…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

How to Destroy a Country

Jared Dillian in his 10th Man newsletter makes some excellent points that follow on nicely from what we wrote last week in: Why RBNZ Q.E. Will Increase the Gap Between the Haves and Have Nots

“If I wanted to think of how to destroy a country, I could not have done a better job if I’d tried. Years of zero interest-rate policy (ZIRP) and quantitative easing (QE) created the most inequality we have ever experienced. Then everyone is locked up for a few months, and all it takes is a spark.

I try to underreact to things and not interpret historical events too broadly. But this isn’t bullish.

What’s especially not bullish is our treatment of small-business owners. These are people who might not have the academic pedigrees to work at a large company. Some have minor criminal records. But they worked hard and built something of their own, and were able to join the middle class.

Now, we’re hollowing out the middle class further and creating even more inequality. As we’re finding out, this isn’t sustainable.

This makes the optics of what the Fed is doing even worse. The next tool it will deploy is yield-curve control, but it’s an open secret that it has considered buying stocks—which does nothing to benefit the people on the street. It’s a bit like a bad dream.

I don’t spend much time criticizing the Fed. (There are enough people who have made entire careers out of that.) And it may seem like a bit of a stretch to blame the riots on the QE of 2008, but I disagree.

Monetary policy indirectly bears responsibility here. If you wanted to fix all of this overnight, it is actually very easy: Raise interest rates to 5%.

Of course, that is not going to happen anytime in the foreseeable future. So you are going to have to look a little harder to find profitable opportunities.”

RBNZ QE Ahead of Plan – Chart Proves There’s More to Come

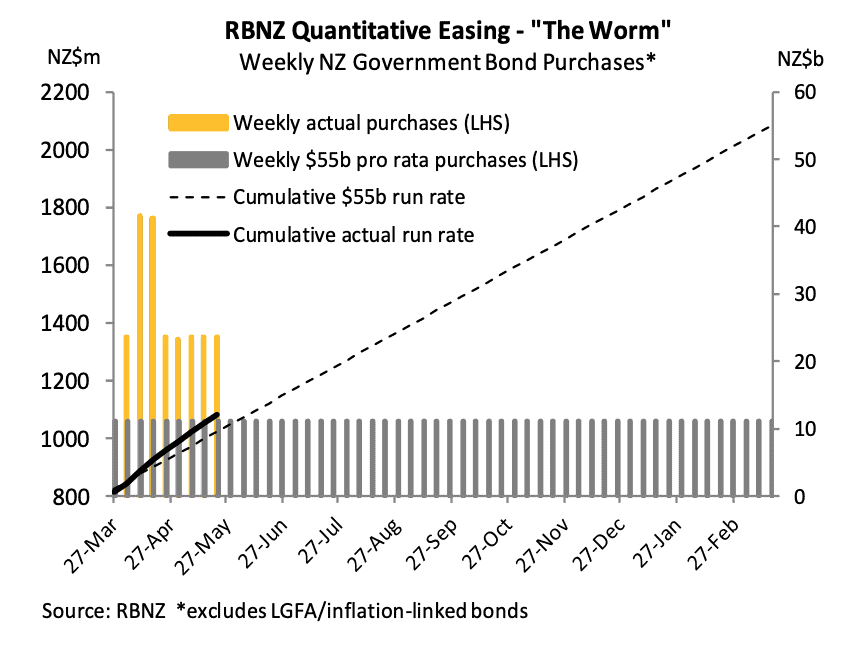

Dillian’s thoughts segue nicely into the chart below. Showing how New Zealand’s Central Bank is progressing with its own currency printing operation.

Three weeks ago we said that the “RBNZ Had Nearly Doubled QE to $60 Billion – and More Was Likely to Come”.

This chart shows graphically how this increase to the QE programme looks very likely.

The dotted line plots what the cumulative currency printing should be each month to reach the $55 billion total planned for the 12 months. The solid black line shows the actual to date. As you can see that is substantially ahead of plan.

Source.

As we’ve said before the massive spending increases in the government budget will need to be paid for somehow. QE looks like an easy answer. So we should expect more to come.

We should also expect the NZ dollar to lose value at an even faster rate.

Just don’t be fooled by only looking at the NZD to USD forex rate. That is merely a measure of who is the prettiest horse in the glue factory!

We can expect gold (and silver to also play catch up) in New Zealand dollars to continue to rise in the long run. Or rather the New Zealand dollar to keep losing value against gold. Just as every other fiat currency on the planet is doing.

This current correction is likely to look like a very good buying opportunity a year from now.

Keep a close eye on what prices do in the coming days and please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Cash - a Casualty of Coronavirus - Gold Survival Guide