Darryl Schoon outlines why he believes the falling velocity of money means it’s likely deflation that we face for a while longer yet…

THE SKY IS FALLING

Chicken Little

June 2020

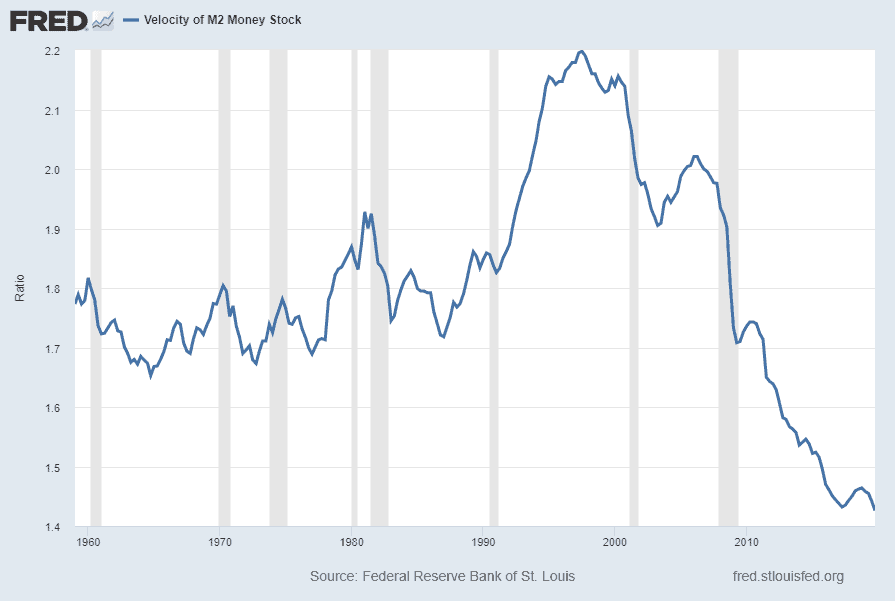

The velocity of money is like blood pressure. If it is too high or too low, it can be fatal. Too high indicates inflationary pressures are building and/or the presence of speculative bubbles. If too low, deflationary pressures are growing, presaging a dangerous collapse in demand.

The velocity of money reached its high during the 1990s dot.com bubble. After it collapsed in 2000, low interest rates (2002-2007) fuelled another bubble, the US property bubble, and when it collapsed in 2008, the velocity of money again plunged and never recovered.

Despite trillions spent by central banks after 2009, the velocity of money has continued to fall. Today, in 2020, the velocity of money reached an all-time low. In Q1, the average velocity was only 1.37. Q2 will be even lower.

To offset the historic plunge in demand caused by COVID-19, central banks resorted to money printing on an unprecedented scale. While the money printing will stave off starvation for the vast majority at the bottom of the economic food chain and ensure profits for the few still at the top; today’s money printing will turn fiat money into little more than food stamps and give the economic elites little incentive to do otherwise.

Despite central banks’ excessive money printing, hyperinflation may not occur, at least not immediately. In capitalist economies, because currencies are circulating coupons of credit and debt, when credit disappears, so, too, does “money”; and, today, money is disappearing into deflation’s waiting maw even faster than the Fed can print it.

The mandate of the Fed in 1913 was to create a system of debt-based fiat money that insured bankers profited, i.e. “made bank”, off all societal productivity, a never-before-seen form of economic parasitism.

Since that time, the Fed has done admirably with that mandate, given the problems they’ve had to deal with, e.g. a dangerously low gold/fiat ratio in the 1920s, the 1929 stock market crash, the 1930s collapse of world trade, the loss of gold reserves due to US overseas military spending, the serial collapse of bubbles beginning in 2000 triggering “the great recession of 2008, the amuse-bouche to what is now about to happen,

I made the following observation in May 2011 in my article, Gold and Silver Storm The Fed.

AMERICA THE FROG

The frog is frozen still

In water now so hot

The water’s almost boiling

But the frog knows it not

Quickly it must jump

To avoid a boiling death

The Fates themselves are watching

With collective bated breath

Will America survive?

Or will it now succumb

Its heritage abandoned

Its future now undone

By its own hand it’s threatened

Itself its great threat

The frog continues sitting still

In denial ignorant yet

The water’s getting hotter

The heat’s turned up to high

And it’s an even money bet

That the frog is gonna die

It’s June, 2020. The water’s boiling. The frog’s still in the pot.

My video, Will They Confiscate Gold, Etc? with a few observations on Bernard Baruch’s role is posted at https://www.youtube.com/watch?v=uUOa0-8ghiI

These are interesting times.

Buy gold, buy silver, have faith.

Darryl Robert Schoon