Prices and Charts

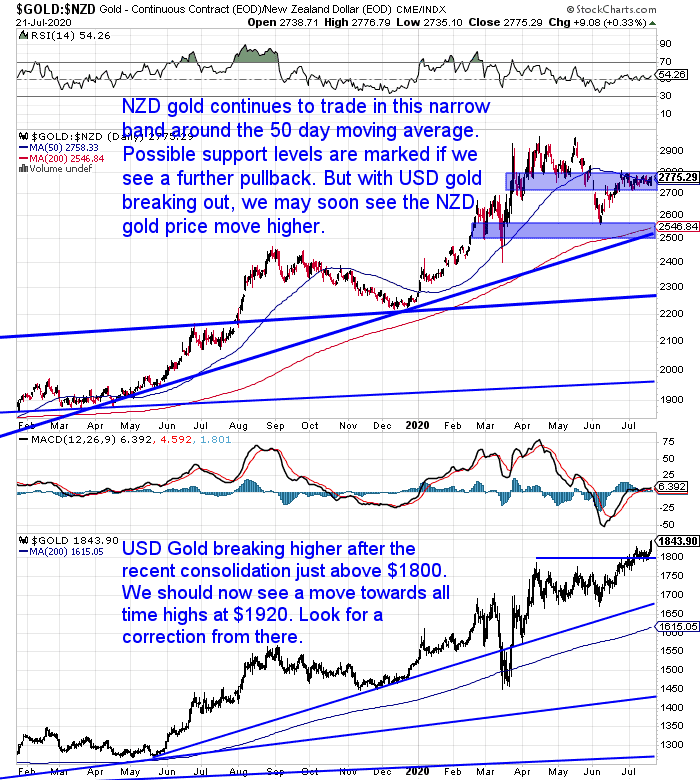

USD Gold Jumping Higher But NZD Gold Sideways Still

Overnight the USD gold price jumped into the $1840’s. This was after a week or so of sideways action just above $1800. We are now likely to see a move towards the all time USD high of $1920. Perhaps fairly quickly too?

That might then be where we see a correction. As there is likely to be pretty stiff resistance at the all time high.

Conversely the NZD gold price has continued to trade in a sideways range, due to the ongoing strength in the Kiwi dollar. Today the NZD gold price is near the top of this range of the past month. So if the USD gold price heads even higher, we may then see a move higher from the NZD gold price too.

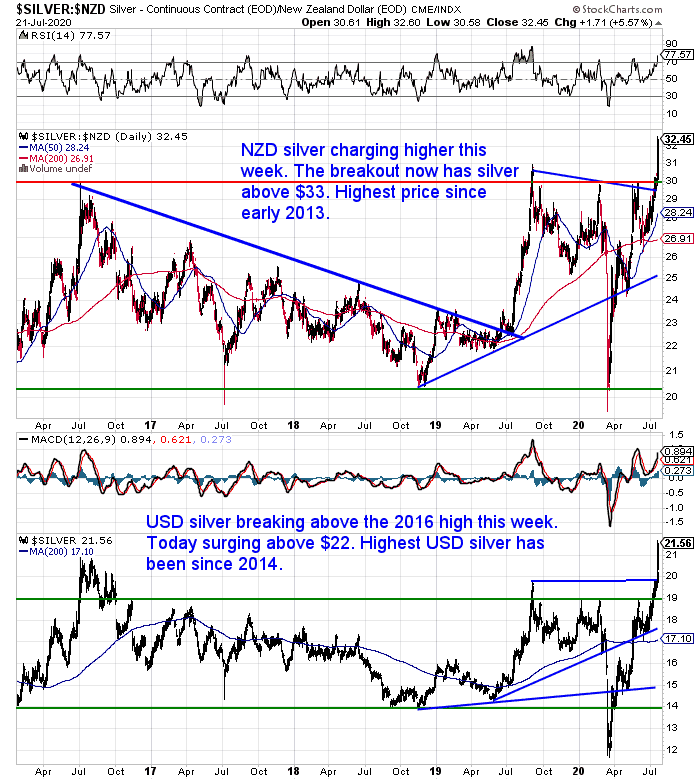

Silver Breakout – NZD Silver Surges to Highest Price Since Early 2013

However, even the strength of the Kiwi dollar couldn’t dent the rise in the New Zealand dollar silver price this week. Up a massive 15% on just 7 days ago! Most of that rise coming in the past 2 days.

The price has even surged higher in the short time since we added the comments into the chart below. It’s sitting above $34 as we now type. The highest price since early 2013 in NZD terms.

Silver is now into overbought territory so any pullback should not come as a surprise. But with silver you can’t count on that happening and it could run even higher now.

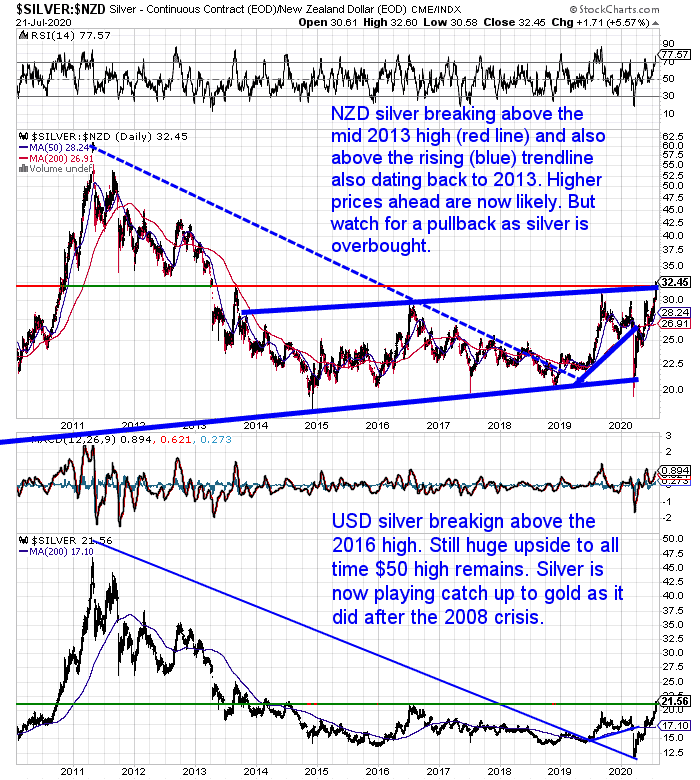

Regardless of whether a pull back comes now or later, it is clear silver has broken out. Check out the long term chart below. NZD silver is above the horizontal (red) resistance line dating back to 2013. It is also now above the rising blue trendline also from 2013.

But there is still massive upside ahead just to get to the 2011 high. Almost double today’s price.

With all the currency that has been created we don’t expect silver to stop at the all time high. Adjusted for inflation that is much higher than US$50 (NZ$62.50).

More on that in this week’s feature article below.

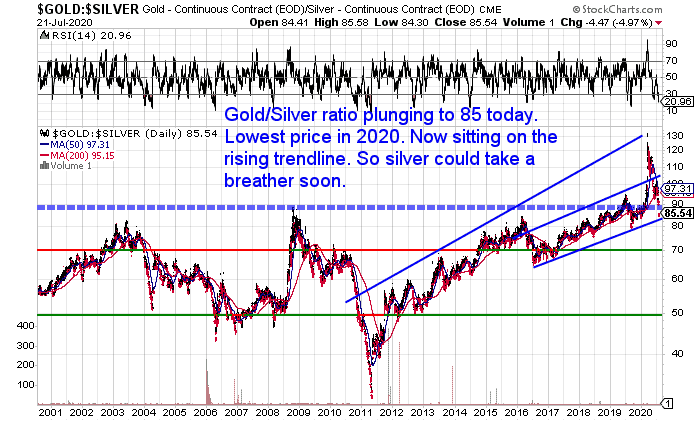

Gold Silver Ratio Plunges

The gold to silver ratio has today plunged to the lowest level this year. Down to 85. Close to touching the rising blue trendline. So perhaps that is indicating we’ll see a pull back in silver soon? But then again gold could just run higher to achieve the same result.

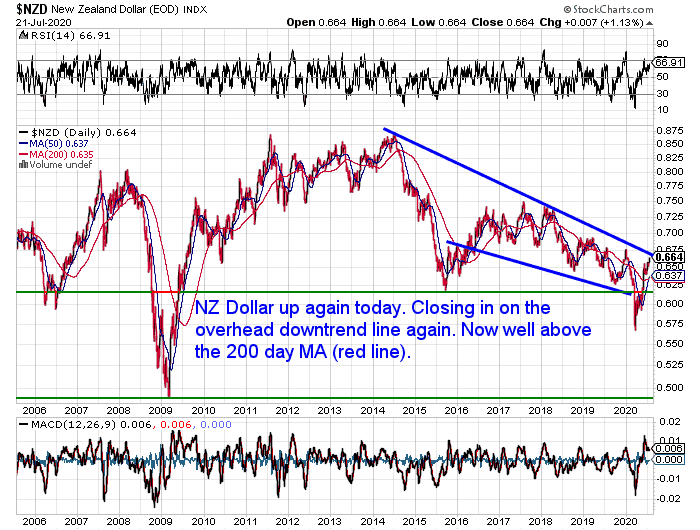

Kiwi Dollar Jumping Higher

The Kiwi dollar is up 1.75 on a week ago. As mentioned above that has put a handbrake on any gains in the local gold price

Once again it is closing in on the downtrend line dating back to 2014.

We’d need to see a clear break above 0.67 for this to change.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Buying Silver in New Zealand – Why is it More Expensive?

Silver is much cheaper to buy per ounce than gold. But people are often surprised that the premium above the spot price is higher for silver than for gold.

In this week’s feature article we answer this question. Along with why silver premiums are often more expensive in New Zealand than elsewhere in the world. Especially for coins.

Interestingly COVID-19 has actually diminished the gap between here and elsewhere in the world in terms of silver premiums.

But don’t let higher premiums put you off buying silver. As we also outline 4 reasons why silver will most likely have more upside compared to gold.

Can You Get Insurance on Gold and Silver Bullion in New Zealand?

Buying gold or silver? Don’t forget about storage. And if you’re storing precious metals you might also have considered trying to insure it. It’s not that easy.

We run through the ins and outs of insurance on precious metals. Both at home and in private storage facilities.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Premiums and New Products

In recent weeks, premiums on most international brand silver coins have come down from the crazy highs during the COVID-19 lockdown. But with the silver price rising our bet is we’ll see a surge in buying. So there’s a chance these premiums could rise again. That could make now a decent time to buy any coins you’re after.

The ideal time to buy is at the bottom. But that is very hard to pick. So a breakout is also not a bad time to buy. As generally when a long held resistance level is broken we can expect a decent move higher in the near future.

It’s noticeably busier today. So if requesting a quote please bear with us if we’re a little slower to respond.

We will be adding some more silver coin and bar products to the website in the coming days. So keep your eyes peeled for them too.

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: USD Gold Sets New All Time High - 3rd Phase of the Bull Market Begins - Gold Survival Guide