Prices and Charts

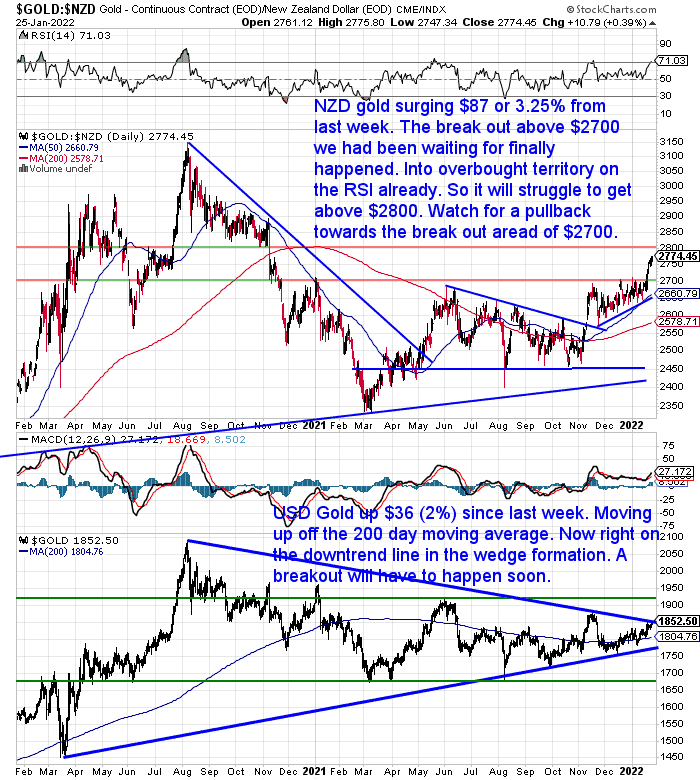

NZD Gold Finally Breaks Above $2700

Gold in New Zealand dollars jumped $87 from 7 days ago. The 3.25% rise saw gold at last break above the $2700 resistance line it had been bumping up against since November.

But gold has jumped so quickly that the RSI overbought/oversold indicator is now into overbought territory above 70. With major resistance at the $2800 mark, we’d guess that gold will struggle to get too much higher than that for now. So watch for a pullback in the coming days. Perhaps even for a chance to buy back close to the breakout point of $2700?

However gold looks to be on the next leg up. Maybe we will even see the 2020 all time high at $3150 challenged later this year?

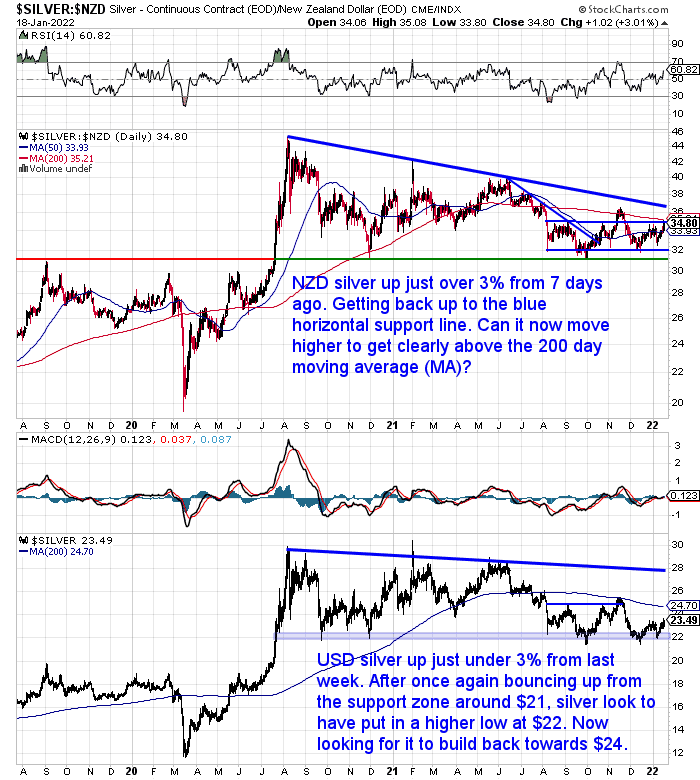

NZD Silver Jumping Over 3%

Silver in New Zealand dollars also jumped over 3% this past 7 days. Although unlike gold, silver has pulled back since Monday, after touching the blue downtrend line.

Silver could yet bounce up and down between say $32 and $36 for a bit longer. Thereby getting even more compressed. However silver looks to be building for a breakout above the downtrend line before too much longer.

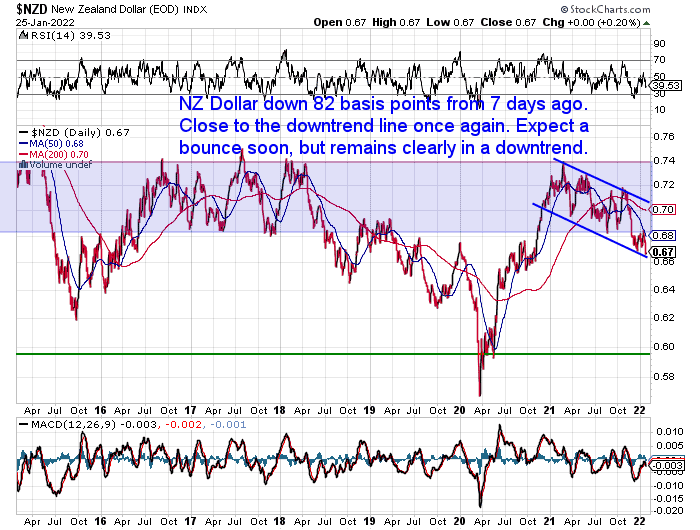

NZD Fall Boosts Local Prices Higher

The New Zealand dollar weakened by 82 basis points this past week. Thereby giving the local prices a boost higher compared to the USD price for gold and silver. So the downtrend that the Kiwi has been in for all of 2021 continues. Although watch out for a bounce higher in the short term as the dollar approaches oversold levels.

The weaker Kiwi dollar was one call we got right in our punts for 2021. See how we did with the rest of them in this week’s feature article below. We also have our guesses for 2022.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Gold & Silver Performance: 2021 in Review & Our Guesses for 2022

It’s a bit later than normal. But we finally have our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2021. Then finish off by making a few guesses as to what 2022 might hold in store for us…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

A Bear Market for Stocks in 2022?

One of our “predictions” for 2022 was that Central banks will cause a stock market crash (more than 20%) by withdrawal of stimulus. So we will see them promptly reverse course and pump more back into global economies. Hence real interest rates will continue to be negative.

Today we noticed in our notes a tweet from Jim Rickards from back in December along the same lines (maybe we saw it there first?!).

Jim Rickards

@JamesGRickards

The last time the Fed tried a taper/rate hike exercise (2013-2018) they caused the stock market to crash 20% (Oct-Dec 2018) then they reversed course. This time the tempo will be faster, so we should expect the market to crash sooner.

The US stock market has been falling so far this year. It’s probably due a bounce after such a sharp drop. But we get the impression that the prevailing attitude is still to “buy the dip”.

So a 20% or more fall would likely take many by surprise. The Market Ear recently pointed out the similarities in comments by the current US central bank head, Powell and that of Alan Greenspan back in 1996 prior to the dotcom crash.

25 years later: watered down version of “irrational exuberance”

Dec 1996: “But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?” (Greenspan)

Dec 2021: “Asset valuations are ‘somewhat elevated.” (Powell)

Now we’re not saying there has to be a huge 50% sharemarket crash. With the way central banks operate these days we imagine they’d reverse course on any rate hikes if anything close to that kind of fall took place. Doing their best to pump things back up again.

But while – hopefully – 2022 is the year we can finally bid goodbye to the pandemic, we imagine it might hold a few surprises in store for us still. The effects of the mountains of currency printing and government spending over the past 2 years will likely start to become more obvious this year.

Make sure you have enough insurance in place to weather any storm.

So get in touch if you’d like a quote and all the best for 2022…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|