Gold Survival Gold Article Updates:

June 13, 2013

This Week:

- The USD dollar price of gold

- Where to for the price of gold in NZ dollar terms?

- We also cast our eye over the Aussie dollar gold price.

- How about Silver in USD versus NZD?

This morning the Reserve Bank of New Zealand (RBNZ) didn’t surprise anyone with holding the price of money at 2.5% and saying they expect to keep it there to the end of the year. There wasn’t too much else of excitement in the announcement.

They expect house prices to keep rising but of course didn’t make too much mention that it is their, and other central banks around the world, low interest rates that are fueling the rise. They reiterated that they may use “macro prudential tools” like restricting riskier low deposit loans to try to dampen house price rises. As we mentioned last week – stoking with one hand and dampening with the other.

So not much new to worry about there. Onto the monetary metals then. It seems to us are we again at an interesting junction in the precious metals markets.

The USD dollar price of gold

The US dollar gold price is closing in on the lows of April. You can see the black candlesticks in the lower part of the chart below, show USD gold at US$1377, not far above the US$1350 closing price reached in April and also not a massive distance from the US$1320 intraday lows reached then either.

So it seems we are likely to be testing this region again soon as we did in mid May. The price held up then, so will we see a “triple bottom” soon or are we heading to new lows?

If someone held a gun to our head we would guess we could see another short and sharp burst lower yet. We’re still not quite convinced there has been true capitulation yet.

However the question then is….

Where to for the price of gold in NZ dollar terms?

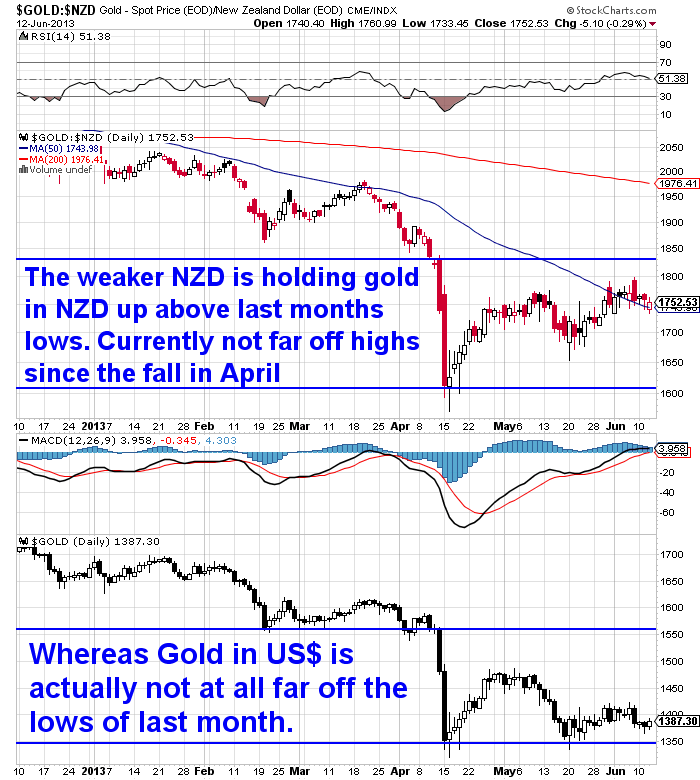

The difference in the performance of NZD gold and USD gold since the April plunge has been quite stark.

As just discussed we are closing in on the April lows in US dollar terms. However the weaker kiwi dollar has meant gold is currently almost NZ$200 per ounce up on the April lows in local currency. You can see the difference visually in the chart above. NZ dollar pricing in the top. US dollar pricing below. The former trending up since April. The latter only trending up initially and going sideways to down since the start of May.

So we have a weaker NZ dollar supporting the gold price here, whereas in US dollar terms the price is rather close to the lows of April.

Also US dollar gold is not oversold yet so it would not be a surprise to see it head lower still. Will it break the $1320-$1350 support area? We have an inkling it might yet. But if it does local gold prices may not plumb new lows, given we are almost $200 per ounce above the lows at the moment.

If US dollar gold dropped to the next level of support around US$1250 and the NZ dollar/US dollar cross range did not change much from where it is currently then NZD gold would likely remain above the April lows still.

This past week we also cast our eye over the Aussie dollar gold price.

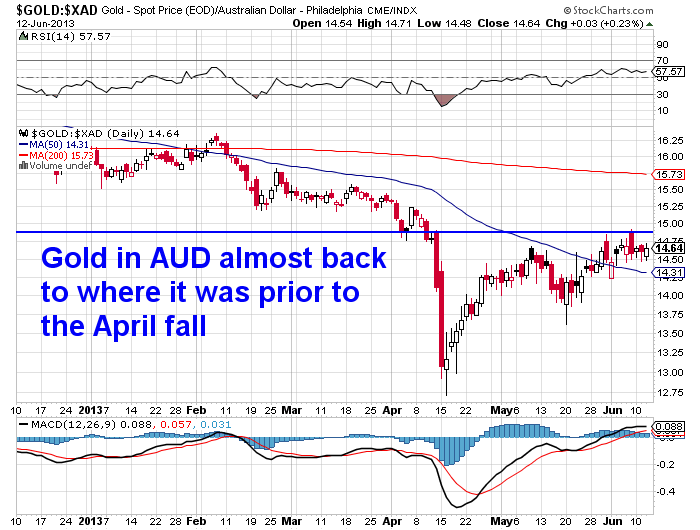

Here the weakness of the Aussie dollar shows even more starkly than its Kiwi cousin. You can see the Australian gold price is almost back to where it was prior to the 2 day plunge in April!

So while the “premium” on gold “insurance” for New Zealanders isn’t as low as it was in April, it has still not risen as much as it has for Australians wanting to buy.

This demonstrates one of golds roles – it is a hedge against devaluation. Be it of the overnight by Government decree Iran/Venezuela style or the still fast but more steady Australian variety.

Odds are the New Zealand currency will get its turn eventually too.

On the topic of Australia still

We also wonder what impact a weakening Australian economy will have on NZ. Being our largest trading partner, less cashflow into Australia will likely translate into less cashflow into New Zealand.

Below are just a few links we’ve had sent to us over the past week or so.

Some fear the mining boom will turn to bust

Will the Aussie dollar fall to 60 US cents?

Mining boom not over yet, figures show

We’re not sure we know enough to make a call that Australia is headed for a bust but they certainly seem to be in for some tougher times. Certainly the currency markets seem to think they are, judging by the money leaving the Aussie dollar in the past month or so.

Just how much any slow-down in Aussie affects us will remain to be seen. In the past our business and property cycles seemed to lag theirs by a year or 2. We will watch to see if this holds true.

This Weeks Articles

We have 3 articles for you this week.

We have 3 articles for you this week.

First up a response to economist Nouriel Roubini’s comments that the gold bubble has burst and why it’s headed lower in the long run.

NYU Economist Nouriel Roubini Says Gold to Crash Below $1000. Is He Right?

Then a more controversial piece looking at gold confiscation. This article also has links to previous articles we’ve written on gold confiscation with respect to New Zealand in case you haven’t read those either.

Don’t Dismiss the Possibility of Gold Confiscation

Then finally a short piece looking at how to handle this fall in the gold price. It has an offer for a free webinar Gold: Dead Cat or Raging Bull? for later in June. It features a number of well known industry experts such as Doug Casey and Eric Sprott. We’ve just signed up for it ourselves So it’s worth a quick read to see that. Or here is the link to the webinar sign-up page if you’d just like to go straight to that. Time to Stress Test Your Resolve in the Gold Markets

How about Silver in USD versus NZD?

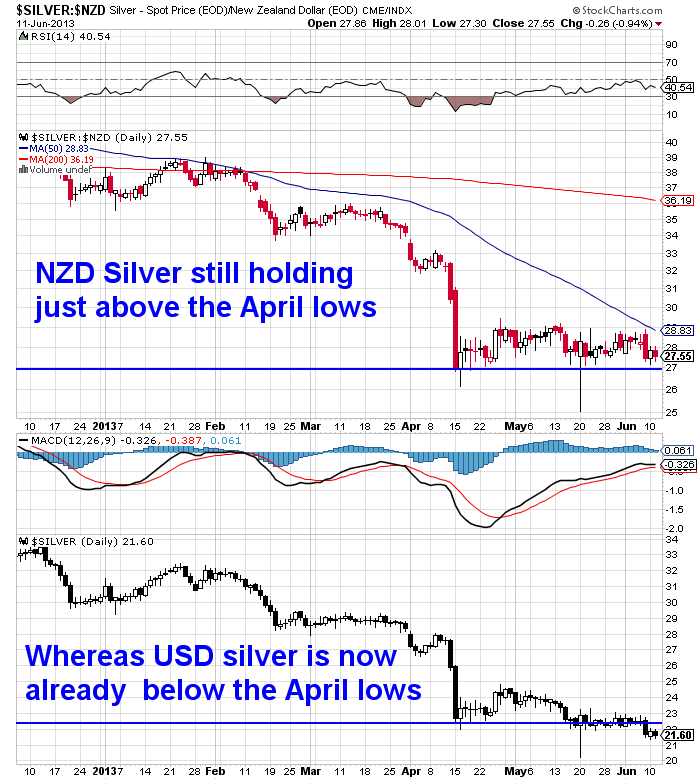

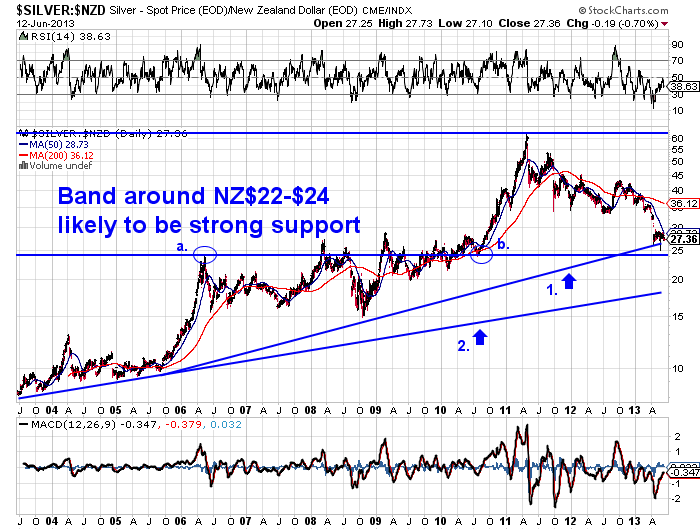

Silver has struggled to regain much ground after the April fall. Trading in a relatively narrow band sideways for the last 2 months. However unlike gold, in US dollar terms silver is actually now lower than it was after the 2 day plummet in April.

Even the weaker kiwi dollar hasn’t had much impact on the price of silver locally, although we are still above the April lows.

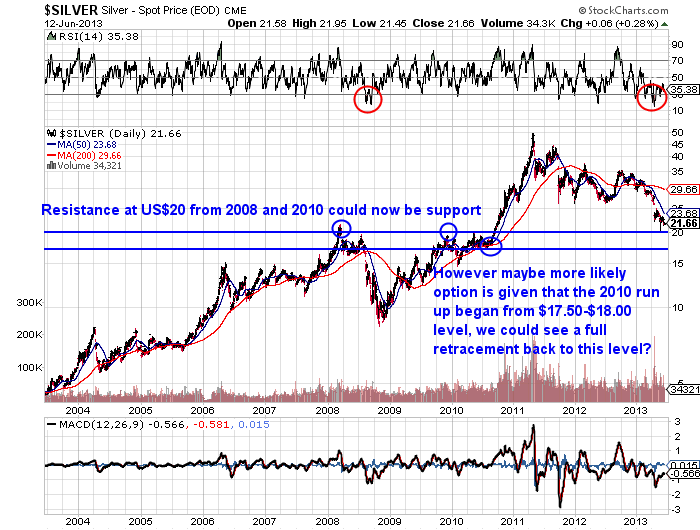

If gold was to head a bit lower from here silver would follow as it always does and so we could be looking at the the levels we’ve previously written about as seen in the charts below. The top chart being in US dollars and the bottom one showing possible support levels in NZ dollars.

Silver in US dollars

Silver In NZ Dollars

Of course there are other signs that a bottom in gold may be close.

Well known contrarian Newsletter writer Dr Steve Sjuggerud this week wrote under the title “Signs of a Bottom in Gold”:

——-

“It’s a sign of the bottom when a billionaire’s [Paulson’s] performance is so bad, he chooses not to report it to his regular clients.

It’s a sign of the bottom when hedge funds are quitting the business. [discussing Taurus Funds Precious Metals fund closing]

Heck, it’s a sign of the bottom when a newsletter focusing on small gold and mining companies is forced to close up shop.

This, to me, is anecdotal evidence… These are “signs of a bottom.”

Again, these signs don’t actually mean that the bottom is here, today. We don’t know exactly when the bottom will get here, based on these “signs.”

But from experience, I can say you typically only see extreme anecdotal evidence like this when you’re actually near a bottom.

I’m always on the lookout for “signs of a top” – guys like Matt’s plumber quitting his day job to flip houses.

I think that, today, in gold, we’re seeing relentless “signs of a bottom.”

I am not a buyer, yet. Personally, I would like to see a bit more of an uptrend before piling in.

But I’m not far from being a buyer, either.”

——-

So as always it can be tough to make up your mind as to what to do. And as always our answer is you have to decide for yourself, but consider taking a position but saving some cash in case we see lower prices still. This way you won’t be disappointed regardless of short term movements.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| RBNZ Jawboning But May Follow Through |

2013-06-04 20:41:35-04 2013-06-04 20:41:35-04 |

Gold Survival Gold Article Updates: June 5, 2013 This Week: RBNZ Jawboning But May Follow Through Turning Israeli, I Really Think So Debt Ceiling: Forgotten But Not Gone Gold and silver have looked a bit stronger this week, perhaps not surprisingly given, as reported last week, the record short positions by speculators and record […]

| NYU Economist Nouriel Roubini Says Gold to Crash Below $1000. Is He Right? |

2013-06-09 21:20:57-04 2013-06-09 21:20:57-04 |

Below is just one of a number of responses we have read to Nouriel Roubini’s gold negative editorial for the UK Telegraph newspaper of last week. As always it pays to look at someones track record in terms of predictions as when it comes to gold the below article shows Roubini has not been very […]

| Don’t Dismiss the Possibility of Gold Confiscation |

2013-06-10 03:49:59-04 2013-06-10 03:49:59-04 |

We’ve written a couple of articles ourselves on the topic of gold confiscation and how it pertains to we New Zealand residents. If you haven’t read our own thoughts on the topic of precious metals confiscation then here are the links to those: Gold Confiscation: Could it happen in New Zealand? Windfall Tax on Gold: […]

| Time to Stress Test Your Resolve in the Gold Markets |

2013-06-12 20:04:13-04 2013-06-12 20:04:13-04 |

If you have precious metals positions in physical or in shares, and find some of them underwater currently, then the following might be of help to you. There’s 4 facts to mull over about the current state of the precious metals markets and an offer of some free advice from a number of sector experts […]

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1743.06 / oz | |

US $1387.48 / oz

Spot SilverNZ $27.38 / oz

NZ $880.27 / kgUS $21.79 / oz

US $700.69/ kg

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg PAMP 99.9% pure silver bar

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

Our Mission

1. To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

IMO, if you really want to know whether Australia is still booming, or getting ready for a bust, call some employment agencies. Over the last few years, there have been some pretty sweet job offers in WA (where most of the mining is; and most of that raw material was being shipped to China).

When that hiring tapers off, the bust is coming.

Also, spot on with looking out for a top. One of the signs of the top that spurred my exit from US real-estate was when the “big banks” unloaded all of their mortgage debt into companies that didn’t exist a few years earlier (or they existed, but weren’t significant/major players); those companies bought up the debt, the loans turned bad, the lending companies went bully-up, and then the “big banks” wound up re-acquiring the debt (which was back-stopped by Freddie & Fannie) at fire-sale discounts. Of course, by then, everyone and their hairdresser was either flipping houses or taking an active interest in it (which is, of course, another sign that the top is in).

That play by the banks in US real estate was, to me, one of the signs that the crisis was “engineered”, or at the very least predicted, by the “big banks”.

If we look at Cyprus as a template (hell, “Cyprused” is already a verb for the loss of funds held in deposit!) then gold (and silver) has a long way to climb.

Thanks a lot for your thoughts Atom.

Pingback: Another Contrarian Silver Indicator | Gold Prices | Gold Investing Guide

Pingback: Global co-ordinated Central Bank action? | Gold Prices | Gold Investing Guide