Prices and Charts

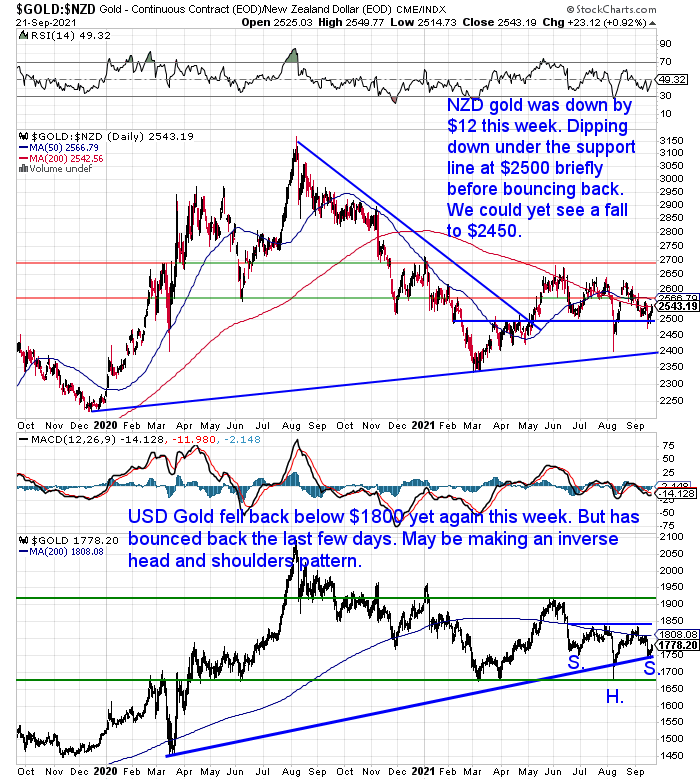

NZD Gold Lower This Week But Then Bounced Back

Gold in New Zealand dollars was down since last week. It did get as low as $2500 before bouncing back. We’ve only marked it on the USD gold chart, but gold may be trying to carve out an inverse head and shoulders pattern – see the S’s and H. If so we would see gold head back towards US$1825 or NZ$2650.

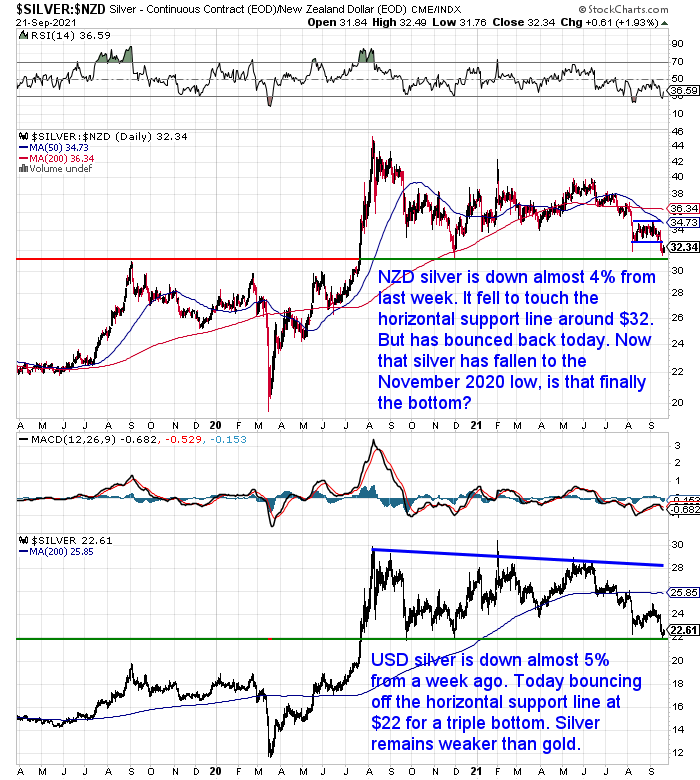

Silver Falls Sharply Again

While silver was again underperforming gold. Dropping almost 4% in NZ dollar terms. NZD silver touched the horizontal support line at $32, but bounced back today. So now that silver has fallen back to the November low, is that finally the bottom in this corrective phase?

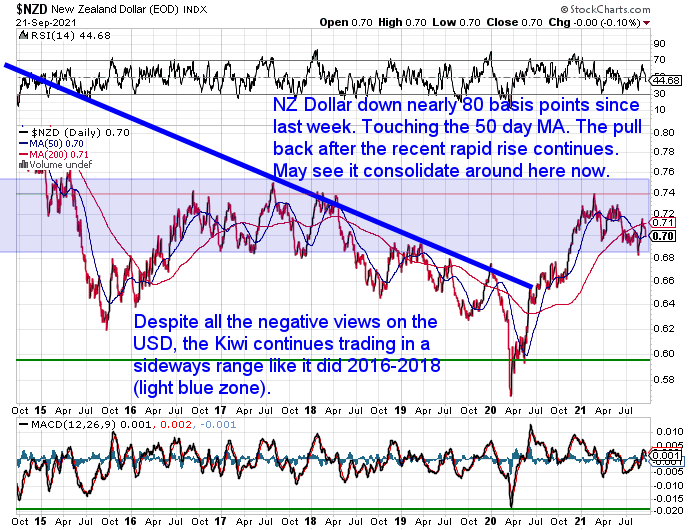

NZ Dollar Also Falling Sharply

The New Zealand dollar has also continued its fall this week. Down nearly 80 basis points from last Wednesday. The pullback after the recent very rapid rise has continued. Now that the Kiwi has reached the 50 day moving average we may see it consolidate around these levels.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

The Fourth Turning and Gold: What’s Still to Come in This Crisis?

It’s been 18 months since the outbreak of the Corona-panic. Some parts of the world seem to be returning to some semblance of normality. For example this week Denmark removed all restrictions and even the requirement for vaccine passports for travel.

But here in New Zealand we seem a long way off any return to something close to normal. Our healthcare (a.k.a. sickness) system is already bulging at the seams and that is with very few hospitalisations linked to Covid19.

While Sweden was tarred and feathered a year ago as the worst example to follow. Now seems to be doing better than anyone else in surviving the dreaded delta variant. Could it be that natural immunity actually works? A study we recently read out of Israel also seems to back this up.

However even if we get “back to normal” as far as the pandemic goes, there is still likely more to come in this crisis.

This week’s article looks at the unique book that is the Fourth Turning, and asks that very question: What’s still to come in this crisis?

Here’s what’s covered:

- What is “The Fourth Turning”?

- What the USA Should Have Done to Avoid the Current Crisis

- How Will the Crisis Play Out From Here?

- How Will The Crisis Conclude?

- Neil Howe on What to Expect Next – Creative Destruction

- But We’ll Stumble Through to the Other Side

- The Fourth Turning and Gold’s Coming Peak Valuation

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

RBNZ: Rates Rises Will be Slower Than the Bank Economists Had Predicted

In a speech this week RBNZ Assistant Governor Christian Hawkesby said that the central bank will hike rates very slowly. So the 50 point rate hikes that were being predicted prior to the current lockdown seem very unlikely now.

ANZ noted that while markets were on Friday pricing in a 35-point hike, they’re now pricing in a hike of less than 25 points.

This gels with what Peter Schiff recently said about the US central bank “tightening”…

“All they’re going to do is be a little less easy than they are right now. But under no definition of monetary policy is less easy when you’re already super easy, and now you’re slightly less super easy — that’s not tight. That type of ‘tightening’ is not positive for the dollar. It is not negative for gold. But again, that is the way markets are reacting to it because they’re simply looking back at time, and they know, that oh, when the Fed is tightening you don’t want to fight the Fed. When the Fed is raising rates and fighting inflation you want to own the dollar. You don’t want to be in gold. Except the Fed is not going to do that in the traditional sense because it can’t because it’s inflated too big a bubble to actually do that.”

Source.

We reckon the same can be said of the RBNZ and interest rates here in New Zealand. There is so much debt that borrowers won’t be able to handle significant interest rate rises. It’s likely the central bank will err on the side of caution. Raises will be too little too late and they are likely to continue to inflate the bubble ever higher. Simply because to do otherwise is to bring the system down.

Are Positive Economic Numbers Merely the Result of Rising Prices?

Peter Schiff also had an interesting theory about recent supposed very rosy numbers out of the USA, where they got a much better than expected retail sales report for August.

“Just because the number is higher doesn’t mean consumers are buying more stuff. Retail sales numbers are not adjusted for price.

There are two ways retail sales can go up.

- Consumers buy a larger quantity of stuff.

- The price of the stuff they’re buying goes up.

The question is: are retail sales up because consumers are buying more, or is it simply another sign of rising prices?

You can’t tell from the data. But obviously, if you’re living in the real world, it’s obvious what’s going on. I think the bigger component of the increase in retail sales is the price of the stuff people are buying. So, it is the fact that they’re paying more that is driving these numbers up. Not that they’re buying more.”

The huge, unexpected plunge in consumer sentiment in August backs Peter up. The culprit was inflation. Americans are putting off plans to buy big-ticket items such as cars and other durable goods.

“If consumers aren’t buying household durables; if they’re not buying cars; why are retail sales so strong? Well, probably because the stuff they are buying is so much more expensive now than it used to be that retail sales are up because prices are up. But that is nothing to celebrate. That is not a sign of economic strength.”

That seems to make good sense to us.

Perhaps we are also seeing the same factor at play with numbers here in NZ? Much hoopla was made of the “huge” rise in GDP for the June quarter of 2.8%. This big jump was what prompted the talk of a 50 basis point rate hike, before the latest lockdown put paid to that idea.

“New Zealand economy up in June 2021 quarter. Economic activity rose 2.8 percent in the June 2021 quarter as measured by gross domestic product (GDP). This follows a rise of 1.4 percent in the March 2021 quarter. Average annual GDP rose 5.1 percent through the year to June 2021.” Source.

But maybe a fair bit of this rise is due to rising prices for goods we export? Fro example: “Economic activity in the primary industries rose 5.0 percent in the quarter”.

We believe the data report above is not “real” GDP, as in after inflation GDP. But even if it was, then because the official government inflation rates are so artificially low, we’d be unsure how “real” the real GDP figure is! That is before we even get into teh worth or otherwise of measuring GDP.

Anyhow, our overall theory gels with Schiff’s. That is that currently precious metals are not doing so well because the average person thinks central banks are about to “tighten”. However as Schiff says: “All they’re going to do is be a little less easy than they are right now.”

In the long run precious metals are likely to do very well as a result of this. Because real interest rates (after inflation) will remain low to negative. See: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand? [2021 Update]

Local refinery operations have commenced again under Level 3. But dispatches and collections have been suspended as goods cannot be inspected, counted or signed for by the customer. Your orders will be stored and insured free of charge until it is safe to either collect them or when signatures can be obtained for proof of delivery.

Dispatches will stored and insured free of charge until it is safe again to dispatch them and signatures can be obtained. When we drop down a level, you will be advised when your order is ready to collect and to book in a collection time to ensure an adequate distance between customers.

Although, currently imported orders are continuing to be delivered via Fedex. So that is an option if you are looking to spend more than around NZ$10-15,000.

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Silver Outperforming Gold This week - Gold Survival Guide