This Week:

- Could Silver Be Worth More Than Gold?

- Bank Capital Changes: What is the RBNZ Preparing For?

- Gold and Silver Continue to Bounce Back

- More on Australia’s “Missing” Gold

Prices and Charts

Christmas Trading Hours

Local Auckland Suppliers: Closing Friday 21st December 2018 at midday and reopening Monday 7th January 2019

Offshore Suppliers: Normal trading apart from statutory holidays

So we’re still open for business throughout the next few weeks.

Gold and Silver Continue to Bounce Back

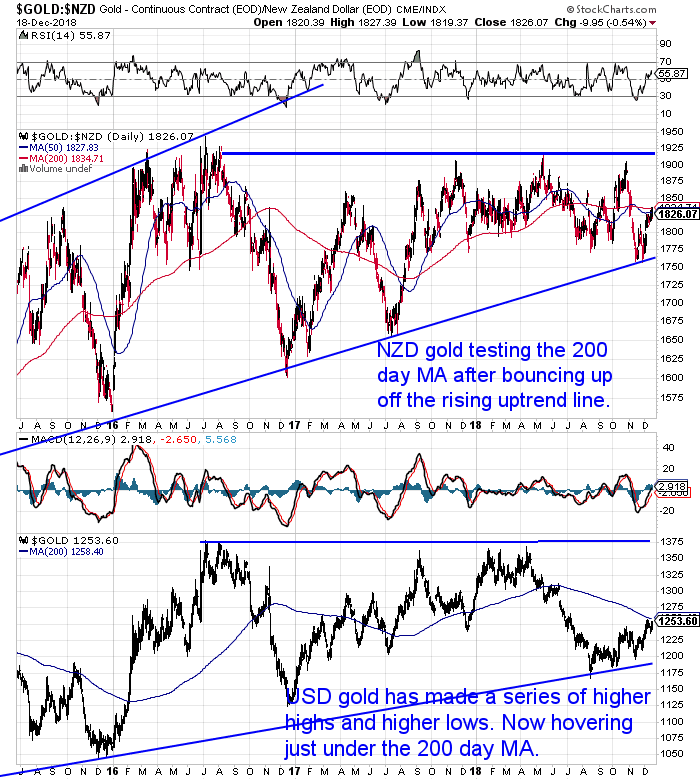

Gold in NZ Dollars continued its recent move higher this week. Up almost 1% and touching the 200 day moving average.

Let’s see if it can now push its way higher. Or will the low volume New Year trading see a spike down as it has done in previous years? If so we will be open for business so get in touch to buy over the holidays.

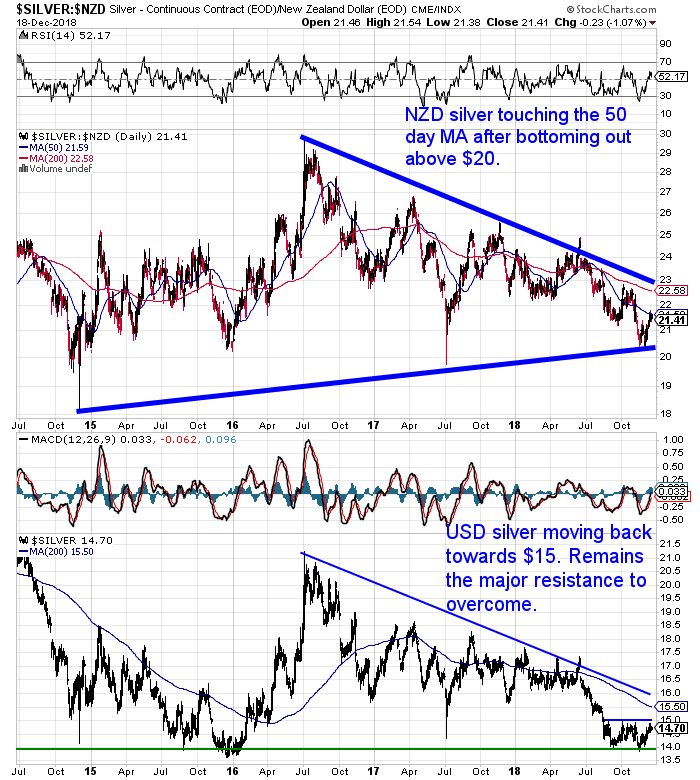

Silver also moving continued its move higher after bottoming out above $20. Touching the 50 day moving average (M.A.) before pulling back slightly overnight.

The Kiwi dollar was down this week. It dropped back below the important 200 day moving average again over the past few days. So we still need to see if it can keep solidly above that line yet. For now we may see a test of the 50 day moving average.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

Could Silver Be Worth More Than Gold?

Have you ever come across the idea that silver could one day be worth more than gold?

A key argument is the increasing industrial uses for silver will boost its value significantly, even above the price of gold.

We offer our opinion on this topic including:

- The gold to silver ratio over 3 centuries

- Some historical evidence of silver being worth more than gold

- Silver industrial demand versus investment demand

- Could Silver Be Worth More Than Gold Due to:

- Peak Silver?

- Increasing Institutional Investment Demand?

- Increasing Photovoltaic Demand?

More on Australia’s “Missing” Gold

Last month we reported on A New Gold Scandal – England Denies Australia Access To Its Gold.

Recently we spotted that this had reached the mainstream news

‘Just bring the gold back’: RBA responds as conspiracy theories swirl around Australia’s ‘missing’ gold

Australia owns 80 tonnes of gold worth $4.4 billion but it’s not even in the country — and the internet is rife with conspiracy theories.

Source.

Also over in the lucky country last week we spotted a news item on the Reserve Bank of Australia:

Reserve Bank says rate cuts and QE possible as Australian housing enters ‘uncharted territory’.

“For many months the Reserve Bank has told us the next move in interest rates is likely to be up, albeit not for some time.

But, in a speech to a business economists’ dinner on Thursday night, not only did the bank’s deputy governor say further rate cuts were possible, but also that the RBA could engage in quantitative easing (known as QE) — like the US Federal Reserve did to assist the recovery from the global financial crisis — if it was needed.”

Source.

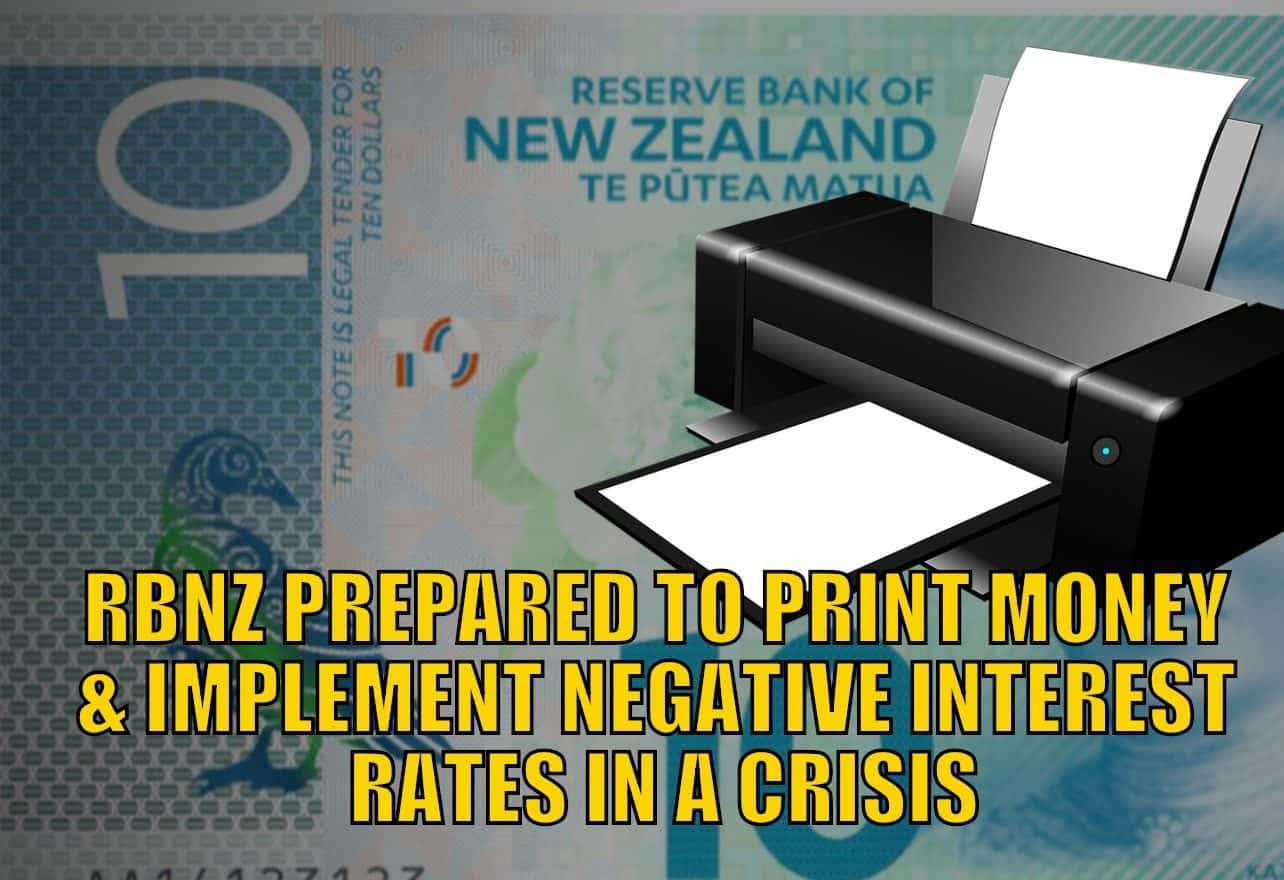

Recall that our own central bank said something very similar earlier this year:

RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

“This is all about planning for the future,” McDermott said. While there’s “no imminent prospect” of using such measures, “the probability of needing them at this point in the cycle is higher than it ever was in history” and “it would be silly of us not to be ready just in case.”

It seems central planners around the world are readying themselves for a financial crisis 2.0.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Bank Capital Changes: What is the RBNZ Preparing For?

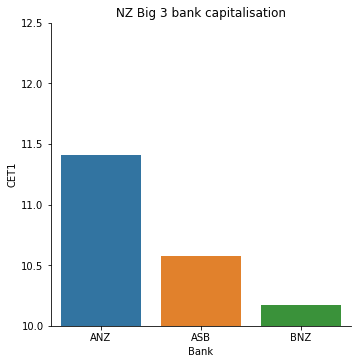

Speaking of our central bank, the Reserve Bank of New Zealand is looking to increase the amount of capital that N.Z. banks must hold.

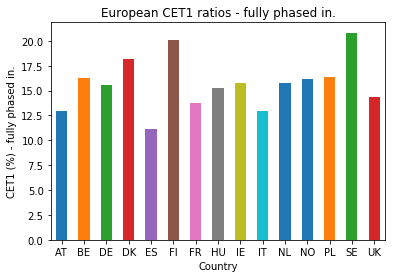

This in itself is not a massive surprise as recently Martien Lubberink (Associate Professor at the School of Accounting and Commercial Law at Victoria University) pointed out NZ banks capital ratios were actually sharply lower than European banks:

Adjusting for size, the average common equity tier one (CET1) capital ratio of New Zealand banks is 11.43%, with the big banks barely meeting that average:

Compare this to CET1 ratios of EU banks, which are 14.22% on average.[1] Most European banks sport CET1 ratios higher than 11.43%:

Source.

To us the more surprising thing is just what is the reserve bank preparing for?

We look at their press release on this topic along with a speech by the RBNZ governor as these give some interesting hints as to just what they might be trying to ready the NZ banking system for.

Hint – something more than your average recession.

Make sure you’re also prepared for something more than your average recession.

Check out the current deals above and prices below.

Merry Christmas – Last Gold and Silver Update for the 2018

Also this will be our final weekly newsletter until the New Year.

So we wish your and your loved ones a very merry Christmas and a safe and prosperous New Year. Thanks for reading and see you in 2019!

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Back in Stock – Learn More NOW….

—–

|

Pingback: Discussions of QE in Australia Increasing - How About NZ? - Gold Survival Guide