Gold Survival Gold Article Updates:

5 March 2015

This Week:

- Mining Shares Bottoming Out Before Gold?

- Unprecedented Interest Rates

- Blow-off top surge in Australian property?

- Which Countries Will Survive Economic Crisis?

- What Top Hedge Fund Managers Really Think About Gold

Prices and Charts

Gold is down slightly on a week ago, a bit more in NZ dollars (-0.84%) than US Dollars (-0.34%).

While silver has dipped 2.63% in NZD and 2.17% in USD. See the table below for the full rundown.

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1585.61 | – $13.43 | – 0.84% |

| USD Gold | $1201.26 | – $4.10 | – 0.34% |

| NZD Silver | $21.41 | – $0.58 | – 2.63% |

| USD Silver | $16.22 | – $0.36 | – 2.17% |

| NZD/USD | 0.7576 | +0.0038 | + 0.50% |

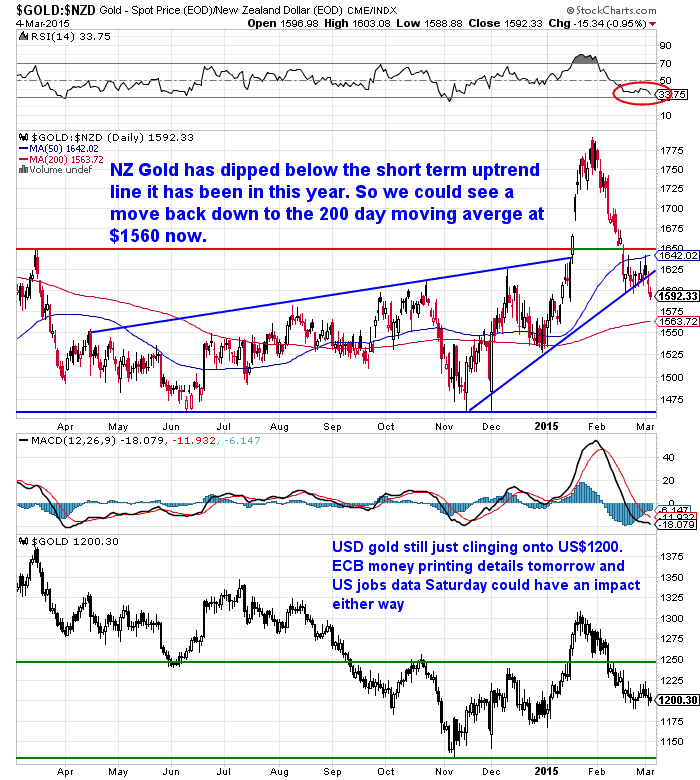

Looking at the chart of Gold in NZ dollars, it seems to have dipped below the quite steep uptrend line it has been holding so far this year. So it could now move down to test the 200 day moving average at around $1560.

While in USD dollar terms it continues to hover around the US$1200 mark.

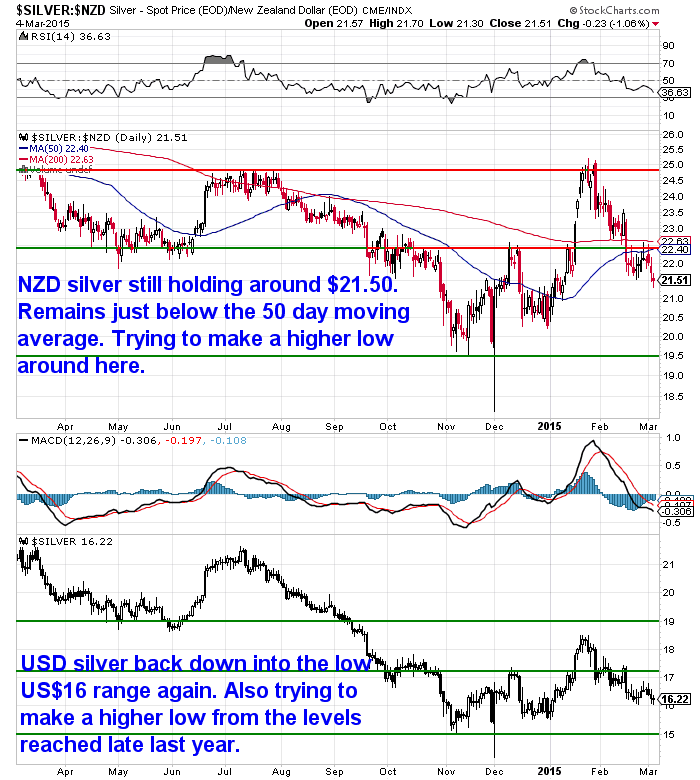

Meanwhile silver has dipped back down to the lows of last month in both local and US currencies. But still trying to eek out a higher low.

What could impact prices in the short term?

There is the usual monthly craziness of the US jobs data on Saturday, so that could have some short term impact on gold.

But a more likely long term fire stoker according to an analyst from BNY Mellon could be the announcement of details of the ECB’s money printing programme tomorrow.

He noted that “The [ECB has been] most hawkish of the major central banks, and it’s worth recalling that the ECB actually hiked rates in the summer of 2008, if the ECB is now prepared to launch its own program for quantitative easing, following on from the various programs launched over the past 14 years by the Bank of Japan, Fed, the Bank of England, then some may have concluded that hard assets such as gold are once again amongst the best stores of value. The rally seen in gold since November, in turn, reminds me of the start of the uptrend in gold that dominated the market for the past 14 years started within days of introduction of QE by the Bank of Japan back in March of 2001.”

Also that “the recovery in gold prices in late 2008 came about as the Fed was preparing its own program of asset purchases.”

And so tomorrow the ECB will let us know the full details of its own $1 trillion QE programme.

“History therefore suggests that…the current move could last for far longer and travel much further than might commonly be expected.”

Interesting that is the second parallel between what is going on currently with gold and the start of the bull market in 2001, that we’ve read this week.

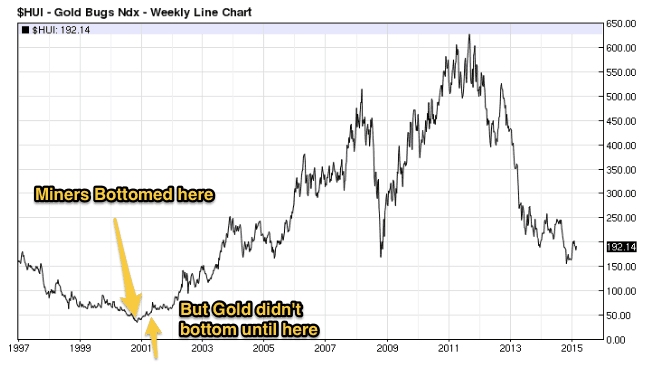

Mining Shares Bottoming Out Before Gold?

Here’s the second one.

Our favourite financial newsletter writer, Chris Webber, commented on how the sharp rise in gold mining shares in recent months – while gold itself lags – is similar to what occurred in 2000.

You can see in the chart below that the miners bottomed in late 2000, however gold itself didn’t bottom until about April or May of 2001.

Of course none of this will be known until well after the fact. But as he said “it would be wonderful if we had a replay of this trend all these years later”.

Odds are most people won’t be on board if it is. Judging by the low sales numbers we’ve seen for February from the likes of the Perth Mint and US Mint.

And while we don’t pretend to be even close to their scale, sales for us were also record lows in February too.

Some backing for the old saying of a bull market likes to run with the fewest people on board perhaps?

Unprecedented Interest Rates

Interest rates this week were cut by both China and India.

Again we think the odds of the US Fed raising them soon is far less likely than most would think.

But here’s the latest news in how crazy things have gotten in some parts of the world.

A Danish “borrower” has a business loan with an interest rate of -0.0172 percent — less than zero. “While there would be fees to pay, the bank would also pay interest to her. It was just a little over $1 a month, but still.”

Then the flip side to that is the poor old saver having to pay to keep money in the bank:

—–

“Last month, Ida Mottelson, a 27-year-old student, received an email from her bank telling her that it would start charging her one-half of 1 percent to hold her money.”

“She does plan to move her money to another bank. And there are signs that such practices are spreading to the United States. This week, JPMorgan Chase said it would start charging some institutional clients to hold their money, because of a combination of new regulations and low interest rates.

Economists are now pondering some of the odd things that might occur if interest rates stay negative for a long time.

Companies and individuals may start to hoard cash outside of ordinary banks if the banks start to effectively charge substantial sums to hold deposits. Large savers, for instance, may choose to put their money in special institutions that do little more than warehouse their cash.

“There is some negative interest rate at which it would become profitable to stockpile cash,” said James McAndrews, an economist at the Federal Reserve Bank of New York. He said that economists had speculated that such cash hoarding might begin once interest rates were around minus 0.5 percent.”

—–

We don’t know about you but we know if we had the choice between negative interest rates in the bank or hoarding cash which one we’d choose.

Neither.

We’d prefer to hoard something with no counterparty risk and that will maintain purchasing power in the long run. Odds are negative interest rates won’t do too well in maintaining the value of a currency.

And we think others might agree too.

As noted earlier, perhaps that is why gold has been edging higher since the ECB’s initial QE rumours surfaced?

How about you?

Blow-off top surge in Australian property?

From the Daily reckoning Australia, Could this have a familiar ring about it for NZ too, in light of this weeks numbers showing Auckland house prices continuing to climb (along with Christchurch to a lesser extent), while the rest of the country treads water?

—–

“–Well. Here we are on the first Tuesday of the month. It’s national interest rate decision day…again. The market says that chief deflation buster — RBA boss Glenn Stevens — will cut interest rates again to another record low of 2%.

–While this would have a negligible impact on the longer term health of the economy, it would continue to fire up the Sydney property market.

–This property boom that ‘Australia’ is having is more and more confined to Sydney alone, with a little help from Melbourne. That’s not meant to provide comfort. It doesn’t mean the boom is ‘contained’.

–Rather, I would argue that this is the final, insane, blow-off top surge in the nation’s core property markets. In the same way that a select number of large and popular stocks go ‘parabolic’ in the final stages of a stock market bubble, so too Sydney’s (and to a lesser extent Melbourne’s) housing market has completely lost touch with fundamentals.

–Chris Joye, writing at The Financial Review, explains this nicely in a recent article:

‘Over the three months to 27 February, 2015, national prices climbed 2.5 per cent, which represents annualised capital gains of 10.5 per cent. That’s more than four times wages growth, which is running at 2.5 per cent.

‘Dwelling values in Sydney and Melbourne have appreciated at a 12.0 per cent and 18.4 per cent annualised rate, respectively, over the last quarter (and by 13.7 per cent and 7.3 per cent, respectively, over the past 12 months).

‘According to the RBA’s data, housing credit growth is also rising at 2.8 times the rate of wages, which is pushing Australia’s housing debt-to-income ratio, which was already at an all-time peak of 139 per cent in September, further into unchartered territory.

‘Finally, one of the RBA’s preferred valuation benchmarks, the national house price-to-income ratio, is on my analysis now above its preceding high water-mark touched in 2007 and again in 2010. After both these episodes, home values fell by 6 per cent to 8 per cent.’

–As Joye points out, Victoria and NSW represent 60% of Australia’s population. Add in Queensland and you get 78%. The east coast property boom has the potential to be hugely destabilising in the years ahead.”

—–

So could we also be near the “blow off top” phase in the property market here in NZ?

Who knows with low interest rates and the potential for them to get even lower it could have a bit of steam left in it yet. Still it might be wise to spread your eggs a bit if you’re heavily into property.

Particularly in light of the content of one of this weeks articles:

Which Countries Will Survive Economic Crisis?

Which Countries Will Survive Economic Crisis?

Mike Maloney answers a reader’s question about which countries will be hit hardest by economic crisis. And we also give our views on where New Zealand fits in the scheme of things.

Check out the other articles on the website this week below.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is back under $13K again at $12,990 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot PricesSpot Gold | |

| NZ $ 1585.61 / oz | US $ 1201.26 / oz |

| Spot Silver | |

| NZ $ 21.41 / ozNZ $ 688.50 / kg | US $ 16.22 / ozUS $ 521.61 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuideToday’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide?If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

|

|

Our Mission

|

|

We look forward to hearing from you soon.Have a golden week!

David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

The Legal stuff – Disclaimer:We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

|

|

Copyright © 2015 Gold Survival Guide.All Rights Reserved.

|

Pingback: Will “the Chinese” takeover NZ? - Gold Prices | Gold Investing Guide