|

|||||||

|

A few weeks ago we read a piece by Harry Dent via John Mauldin. Dent has studied demographics and believes they are the major driver of cycles in economies and he doesn’t have a bad track record. Interestingly he commented last week while in Australia to promote his book that he believes they are due a house price fall. —– “I don’t see an upside in Australian real estate but there is a lot of downside. If you are going to own a house and live in it forever then perhaps it’s OK to buy a house, but speculative property – don’t do it.”

With housing valued at 10 times average incomes – the same level as California’s just before the subprime crash – Dent thinks Australia is heading for a fall which will be sparked by a sharp reversal of the current global economic recovery.

“I see a decline in the 30-50% range across Australia, although it may vary from city to city,” he says.

“The rule with bubbles is that they always go back to where the bubble started. So the US housing bubble started to grow in 2000 and now house prices have fallen back to that point – a 55% fall.”

He is supremely confident that it will also happen here.

“Most people buying houses are aged between 28 and 41. When they can’t afford to buy a modest house for 800k as in Sydney, for example, then demand falls and real estate falls.”

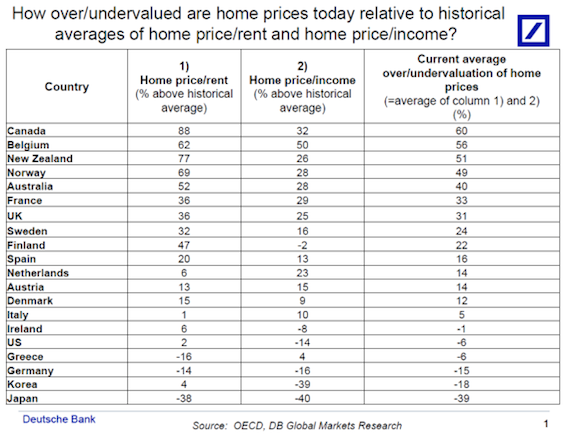

—– We note that New Zealand is in a similar boat demographically to Australia and also in terms of valuation by incomes. A piece on Canadian housing in ZeroHedge recently featured the following chart showing New Zealand is 3rd behind Canada and Belgium in terms of overvaluation against average of incomes and rents according to Deutsche Bank:

Then this past week Dent also commented that New Zealand property will also fall 30-50% in the next few years. —– “He said the bubble was being propped up by baby boomers, immigration and foreign buyers, especially from China.

“China is holding up real estate, especially in Australia and New Zealand, and one of the reasons is the rich Chinese are getting out of the country.”

However, China’s housing market was also in an “unbelievable” bubble. While house prices in Auckland were about nine times annual income, they were about 30 times income in China.

When the Chinese real estate bubble bursts – like Japan’s did in the late 1980s – it would trigger a similar collapse here. That could happen within the next few years.

Mr Dent – whose predictions draw on demographic data and long-term trends – said people wrongly believed property prices could not go down in value because there was strong demand.

“But what people don’t understand is the reason you get a bubble in the first place is because there’s strong demand versus limited supply, and that’s what you have in Australia and New Zealand,” he said…

…Mr Dent predicts the next global financial crisis will see the unwinding of commodity prices. That would be bad news for New Zealand’s export-led economy, he said.

The crisis – which Mr Dent predicts could start as early as this year – would be a major depression rather than a recession, he said.”

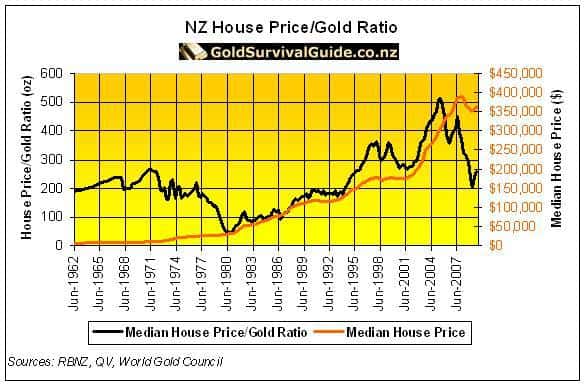

—– But of course house prices never fall in New Zealand or if they do it’s only briefly and not by much, so we have nothing to fear here do we? Keep cranking up the debt – it’ll be okay for sure is the message you’ll hear from most. For example in this headline following Dents comments: “Property crash ‘unlikely’ – experts”. Actually we’ll ease up on the sarcasm. Odds are the housing bubble is still not fully formed here as there are too many people looking for one still and still a bit much caution. For example, we’ve seen a few articles talking about how the RBNZ’s Loan to Value ratio restrictions have done the trick and levelled things out already. (Odds are the bankers are still working on ways to get around the LVR restrictions anyway with bridging loans and parents coming to the party as shown in recent news items like this and this) So we are yet to reach the point of unbridled optimism and Greenspan’s “irrational exuberance”. The point is that if or maybe when the day comes and we see house prices falling, we know we wouldn’t want to hold an expensive house with a massive mortgage outstanding on it. We don’t know if Dent will be right about a 30-50% fall in dollar terms but as we’ve written about before, we think that before the gold bull market is over NZ may see an 80% fall in house prices in gold terms. G20: Can we fix it? Yes we can! Also over in Aussie this past week has been the G20 meeting in Sydney. Odds are the weather has been warmer in Sydney with all the extra “hot air” being spewed forth by the Central Bankers and politicians in attendance. Mario Draghi the ECB president made some comments (sort of) on the RBNZ Loan to Value Ratio lending restrictions: —– “Asked whether New Zealand, which has required its banks to cut back substantially on low-deposit home lending, is setting a good example of effective macroprudential policy, Mr Draghi replied: “It might well be if I knew it.”

When the New Zealand policy was explained to him in brief as putting a cap on the number of low deposit loans that can be issued by banks, Mr Draghi gave a general tick of approval.

“The loan-to-value ratio is a classical instrument for housing,” he added.”

—– This question to Super Mario came about because he had stated that interest rate rises were not the way to stop a housing bubble. See: ECB president says interest rate rises not the way to stop housing bubble

Further proof that central planners want to keep interest rates at record lows for a long, long time yet. Because of course it is artificially set record low interest rates that are causing housing bubbles across the globe! This was also made pretty obvious in the G20 statement where they put a specific number on the groups growth over the coming 5 years: —– “We will develop ambitious but realistic policies with the aim to lift our collective GDP by more than 2 percent above the trajectory implied by current policies over the next five years.”

—– This would amount to $2 trillion in US dollar terms. The statement made it pretty clear that central banks intend to “hang loose” when it comes to monetary policy for a while yet. This would also explain why many central bankers are busy shifting the goal posts with regards to unemployment rates and the like, looking for an excuse to keep the money taps on full.

The “move to growth” fits in with a point we mentioned last week care of Roger Kerr. Where if Labour and the Greens got into power they intend to make the RBNZ focus on growth not just inflation. —– “The stated manifesto of the Labour Party is that they will widen the brief of the RBNZ to not only keep inflation under control, however also have growth and employment objectives. Furthermore, the RBNZ will have wider powers to intervene directly in the NZ dollar FX markets to reduce volatility (good luck with that!).

More disturbingly for offshore investors, the decision making powers on moving official interest rates to set monetary policy will be shifted from the independent RBNZ Governor to the appointed RBNZ Board of Directors.

It is not hard to guess who will be on the RBNZ Board under a Labour/Greens coalition government.”

—– We reckon the odds favour our Central Bank also remaining looser for much longer than most believe to be likely. Eventually this need for growth might well be the impetus for the Fed opening the floodgates by reducing the interest rate they pay banks for holding the $2 trillion in excess reserves with them. Something we have mentioned many times over the past couple of months. If you’d like some insurance against such a money torrent reducing your purchasing power, then get in touch. And 500 Silver Maple Coins are $415 cheaper than they were yesterday : 1. Email: orders@goldsurvivalguide.co.nz 2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898) 3. or Online order form with indicative pricing

|

| Todays Spot PricesSpot Gold | |

| NZ $ 1602.15 / oz | US $ 1329.46 / oz |

| Spot Silver | |

| NZ $ 25.63 / ozNZ $ 824.10 / kg | US $ 21.27 / ozUS $ 683.84 / kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$895.59

(price is per kilo only for orders of 5 kgs or more)

Box of 500 $14990

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

To demystify the concept of protecting and increasing ones wealth

through owning gold and silver in the current turbulent economic

environment.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

| We look forward to hearing from you soon.Have a golden week!

David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer: We experiences. The information we discuss is of a general You should seek professional

|

|

2014-02-24 18:40:51-05Our feature article this week again comes about following a question from a reader on whether we had an exit strategy for when the time comes to sell our precious metals. We outline how it may not just involve you selling or “spending” your gold and silver on other assets, as there are quite a number of other potential options that may exist when the time comes to exit precious metals. We also mention a few methods that might help with determining just when to exit…

2014-02-24 18:40:51-05Our feature article this week again comes about following a question from a reader on whether we had an exit strategy for when the time comes to sell our precious metals. We outline how it may not just involve you selling or “spending” your gold and silver on other assets, as there are quite a number of other potential options that may exist when the time comes to exit precious metals. We also mention a few methods that might help with determining just when to exit… 2014-02-24 19:09:02-05Rick Rule reviews a number of factors that are the drivers of the natural resource cycle and why they mean the current cycle is still on the up. He then outlines where to consider investing if the bull market cycle still has a way to run yet… Why the Resource Supercycle Is Still Intact By […]

2014-02-24 19:09:02-05Rick Rule reviews a number of factors that are the drivers of the natural resource cycle and why they mean the current cycle is still on the up. He then outlines where to consider investing if the bull market cycle still has a way to run yet… Why the Resource Supercycle Is Still Intact By […] 2014-02-24 19:37:35-05Grant Williams loves a good anecdote. His weekly letter usually starts with one. This one he borrowed from someone else but it explains beautifully just why most everyone with some wealth should have some gold and silver… Things That Make You Go Hmmm: Appetite for Distraction By Grant Williams… It was during the siege […]

2014-02-24 19:37:35-05Grant Williams loves a good anecdote. His weekly letter usually starts with one. This one he borrowed from someone else but it explains beautifully just why most everyone with some wealth should have some gold and silver… Things That Make You Go Hmmm: Appetite for Distraction By Grant Williams… It was during the siege […]

Pingback: Gold Prices | Gold Investing Guide Privacy: Are purchases of gold and silver in NZ reported?