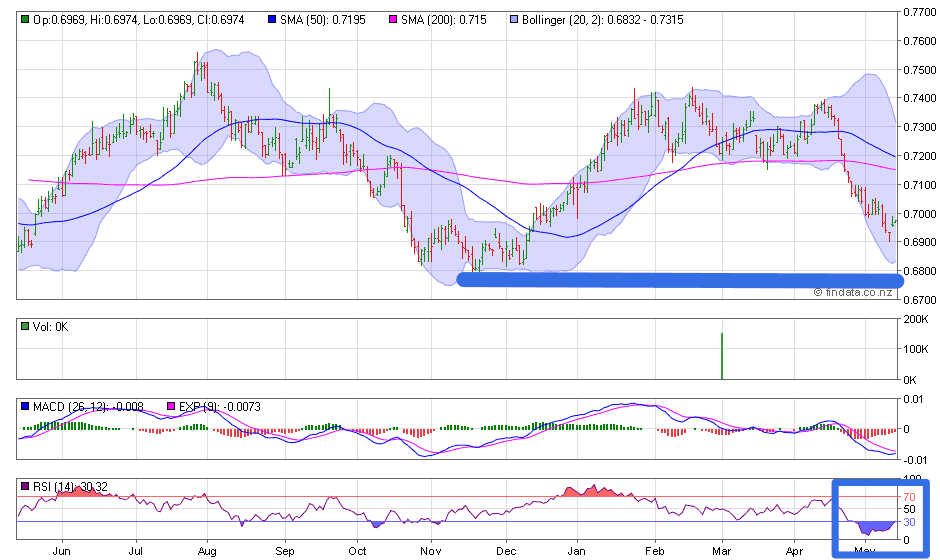

The New Zealand Dollar has been falling in value lately compared to the US dollar. The Kiwi dollar has also been losing value against its fellow commodity currencies, the Australian and Canadian dollars.

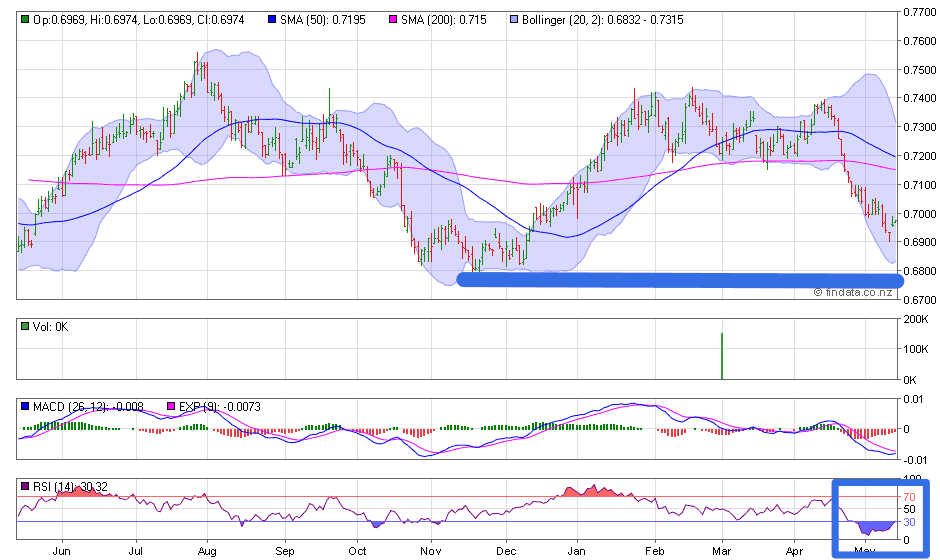

Looking at the chart of the NZ dollar against the US dollar, the Kiwi dollar is getting close to the next level of horizontal support at 0.68. The Kiwi dollar is also moving up from extremely oversold levels on the Relative Strength Index (RSI) – the bottom indicator in the chart below.

(Note: If you’d like to learn more about these and other technical indicators see:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide)

These 2 technical indicators may point to the NZ dollar bouncing higher in the short term.

However analysts at Deutsche Bank have in fact recently identified the New Zealand dollar as the most expensive of all major currencies across the planet. So perhaps the NZ dollar is due to bounce higher in the shorter term? But in the longer run it may still be overvalued at current prices, according to Deutsche Bank.

(In case you’re thinking it pays not to listen to bank analysts, Deutsche Bank do put out some thought provoking and non mainstream research. for example:

Deutsche Bank: The Fiat Money World May Be Coming to an End)

Here is an explanation of the Deutsche Bank currency valuation methodology…

The Cheapest and Most Expensive Currencies in the World Right Now, in One Chart

By David Scutt – originally posted at BusinessInsider.com.au

- The Thai Baht is currently deemed to be the most overvalued currency worldwide, according to modelling from Deutsche Bank.

- Of the majors, the New Zealand dollar is seen as the most expensive with the Canadian dollar the cheapest.

- Deutsche says its model has “significant predictive power for FX, both in terms of directional accuracy and the magnitude of moves, especially over longer-term horizons”.

Buy low and sell high is a basic principle in investing, including in currency markets.

But how do you tell what currencies are cheap and what are expensive? And, more importantly, what’s likely to happen in the future?

Well, we may have something of interest for the currency traders and longer-term investors among you.

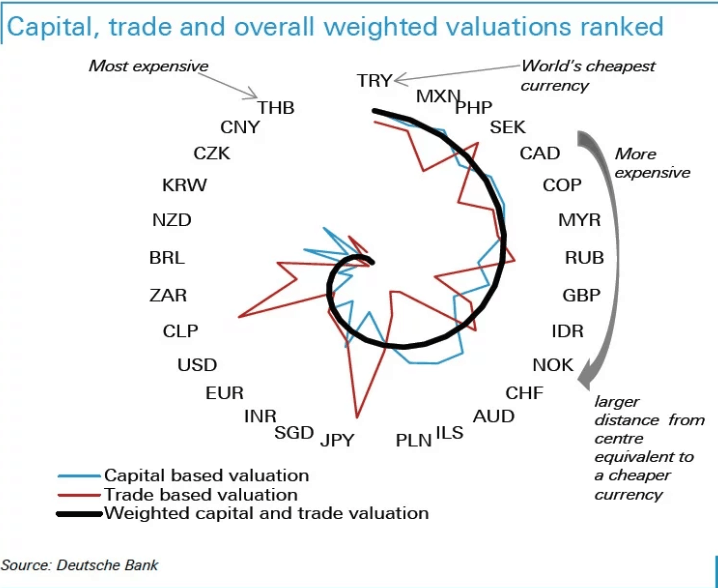

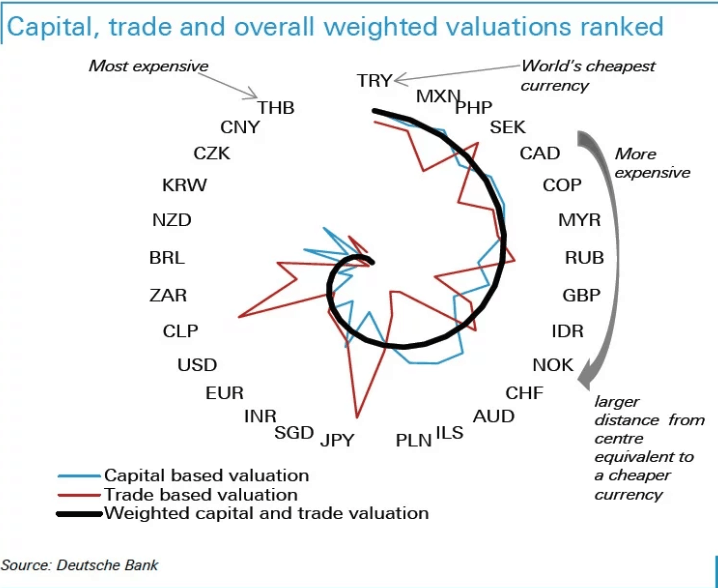

According to Deutsche Bank, the chart below has “significant predictive power” for what currency markets are likely to do next, especially over the longer-term.

A Nostradamus for currency markets, of sorts, combining two of Deutsche Bank’s currency valuation models to determine what’s cheap and what’s not at present.

And all in visual form, too. Very spiffy.

So we know what you’re asking — how does it determine current valuations?

By combining its capital-based valuation and trade-based PPP (purchasing power parity) models together, Deutsche created the appropriately-named Cap-PPP model, shown above, to provide a better picture on what currencies are expensive and what are cheap based on both metrics.

“A more complete picture of valuations is hence obtained by combining both models, which we do to produce an ‘overall’ weighted valuation, using weights that reflect the relative importance of capital and trade flows for each currency,” it says.

Deutsche says the model has “significant predictive power for FX, both in terms of directional accuracy and the magnitude of moves, especially over longer-term horizons”.

So how do you read the chart?

Basically, the further out from the centre the black line sits, the cheaper a currency is deemed to be, and vice versus.

Based on the latest valuation snapshot, the Thai Baht is deemed to be the most expensive currency of all those tracked by Deutsche, edging out the Chinese yuan, Czech Republic koruna and South Korean won in April.

At the other end of the spectrum, the Turkish lira, Mexican peso and Philippines piso were deemed to be the cheapest currencies last month.

For the majors, the New Zealand dollar is the clear standout in terms of overvaluation. The US dollar, euro and Japanese yen are also seen to be a little expensive at present.

In contrast, the Canadian dollar, Norwegian krone, British pound, Swiss franc and Australian dollar are all deemed to be cheap based on the latest scoring.

So What Should a New Zealander Do if the NZ Dollar Is the Most Overvalued Currency?

You could buy a much less expensive currency and hold it for the long term. Maybe the Australian dollar or even better perhaps the Canadian dollar? According to the Deutsche Bank Chart the Canadian is least expensive of the major currencies.

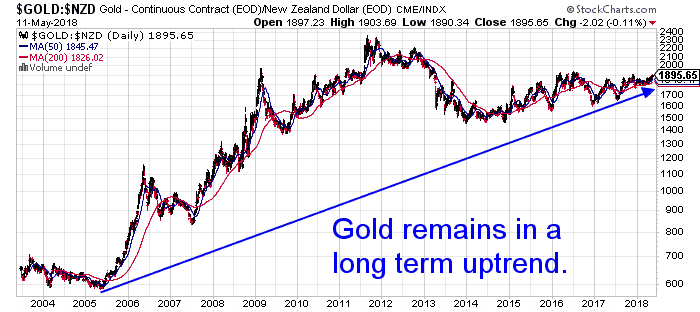

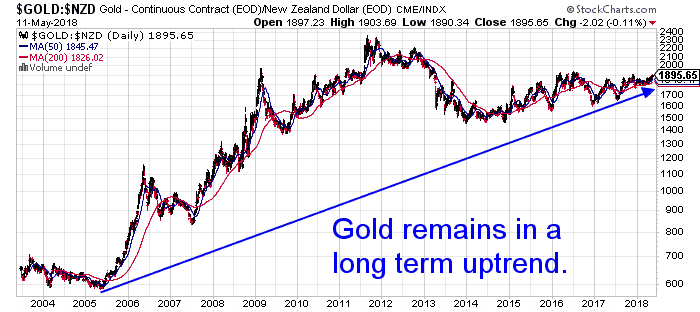

However our favourite way of hedging the New Zealand dollar against a fall, is simply to buy gold and silver. The long term trend of each is up. Or rather the long term trend of all fiat currencies including the NZ dollar is down against gold.

This way you don’t need to track how the NZ dollar is doing against multiple currencies. Simply buy gold and/or silver and hold them until they reach full valuation.

How Will You Know When Gold Reaches Full Valuation?

By comparing gold to other metrics such as other assets like shares, housing or money supply.

Read more:

How Do You Value Gold | What Price Could it Reach

(Note: If you’d like to learn more about these and other technical indicators see: Gold and Silver Technical Analysis: The Ultimate Beginners Guide)

These 2 technical indicators may point to the NZ dollar bouncing higher in the short term.

However analysts at Deutsche Bank have in fact recently identified the New Zealand dollar as the most expensive of all major currencies across the planet. So perhaps the NZ dollar is due to bounce higher in the shorter term? But in the longer run it may still be overvalued at current prices, according to Deutsche Bank.

(In case you’re thinking it pays not to listen to bank analysts, Deutsche Bank do put out some thought provoking and non mainstream research. for example: Deutsche Bank: The Fiat Money World May Be Coming to an End)

Here is an explanation of the Deutsche Bank currency valuation methodology…

(Note: If you’d like to learn more about these and other technical indicators see: Gold and Silver Technical Analysis: The Ultimate Beginners Guide)

These 2 technical indicators may point to the NZ dollar bouncing higher in the short term.

However analysts at Deutsche Bank have in fact recently identified the New Zealand dollar as the most expensive of all major currencies across the planet. So perhaps the NZ dollar is due to bounce higher in the shorter term? But in the longer run it may still be overvalued at current prices, according to Deutsche Bank.

(In case you’re thinking it pays not to listen to bank analysts, Deutsche Bank do put out some thought provoking and non mainstream research. for example: Deutsche Bank: The Fiat Money World May Be Coming to an End)

Here is an explanation of the Deutsche Bank currency valuation methodology…

So we know what you’re asking — how does it determine current valuations?

By combining its capital-based valuation and trade-based PPP (purchasing power parity) models together, Deutsche created the appropriately-named Cap-PPP model, shown above, to provide a better picture on what currencies are expensive and what are cheap based on both metrics.

“A more complete picture of valuations is hence obtained by combining both models, which we do to produce an ‘overall’ weighted valuation, using weights that reflect the relative importance of capital and trade flows for each currency,” it says.

Deutsche says the model has “significant predictive power for FX, both in terms of directional accuracy and the magnitude of moves, especially over longer-term horizons”.

So how do you read the chart?

Basically, the further out from the centre the black line sits, the cheaper a currency is deemed to be, and vice versus.

Based on the latest valuation snapshot, the Thai Baht is deemed to be the most expensive currency of all those tracked by Deutsche, edging out the Chinese yuan, Czech Republic koruna and South Korean won in April.

At the other end of the spectrum, the Turkish lira, Mexican peso and Philippines piso were deemed to be the cheapest currencies last month.

For the majors, the New Zealand dollar is the clear standout in terms of overvaluation. The US dollar, euro and Japanese yen are also seen to be a little expensive at present.

In contrast, the Canadian dollar, Norwegian krone, British pound, Swiss franc and Australian dollar are all deemed to be cheap based on the latest scoring.

So we know what you’re asking — how does it determine current valuations?

By combining its capital-based valuation and trade-based PPP (purchasing power parity) models together, Deutsche created the appropriately-named Cap-PPP model, shown above, to provide a better picture on what currencies are expensive and what are cheap based on both metrics.

“A more complete picture of valuations is hence obtained by combining both models, which we do to produce an ‘overall’ weighted valuation, using weights that reflect the relative importance of capital and trade flows for each currency,” it says.

Deutsche says the model has “significant predictive power for FX, both in terms of directional accuracy and the magnitude of moves, especially over longer-term horizons”.

So how do you read the chart?

Basically, the further out from the centre the black line sits, the cheaper a currency is deemed to be, and vice versus.

Based on the latest valuation snapshot, the Thai Baht is deemed to be the most expensive currency of all those tracked by Deutsche, edging out the Chinese yuan, Czech Republic koruna and South Korean won in April.

At the other end of the spectrum, the Turkish lira, Mexican peso and Philippines piso were deemed to be the cheapest currencies last month.

For the majors, the New Zealand dollar is the clear standout in terms of overvaluation. The US dollar, euro and Japanese yen are also seen to be a little expensive at present.

In contrast, the Canadian dollar, Norwegian krone, British pound, Swiss franc and Australian dollar are all deemed to be cheap based on the latest scoring.