Prices and Charts

Gold Corrects at Last

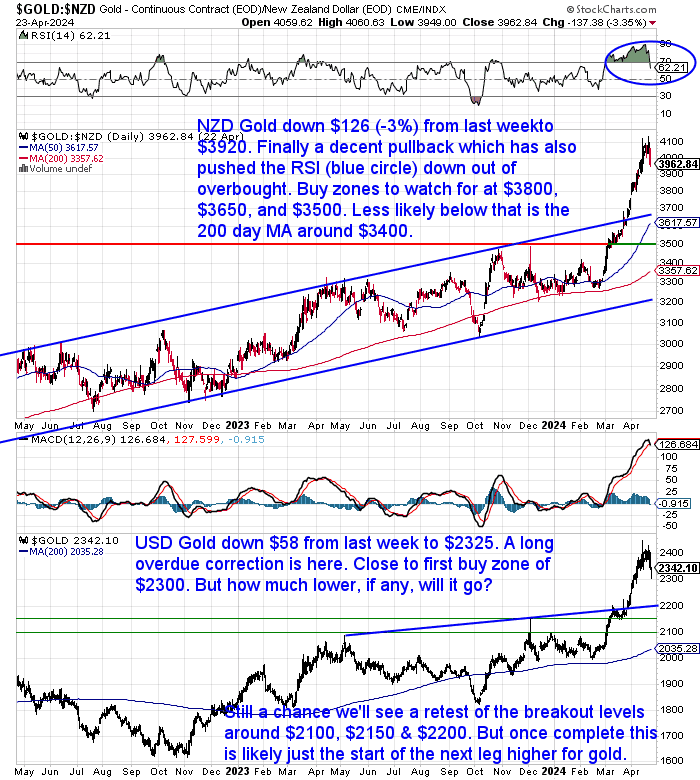

We finally have a meaningful correction in gold and silver. NZD gold is down 5% from a week ago to $3920 (lower than shown on the chart). In just 2 days the RSI has dropped out of extremely overbought. Now it’s a case of how deep this correction might be (more on that later). Buy zones to watch for are $3800, $3650 (which will be the intersection of the 50-day moving average (MA) and the blue uptrend line), and $3500. Then finally the 200 day MA around $3400.

It’s a similar situation for USD gold. Down $58 from last week to $2325 and close to the first buy zone at $2300.

Next support levels to watch for are $2200, $2150 and $2100.

NZD Silver Down Over 3%

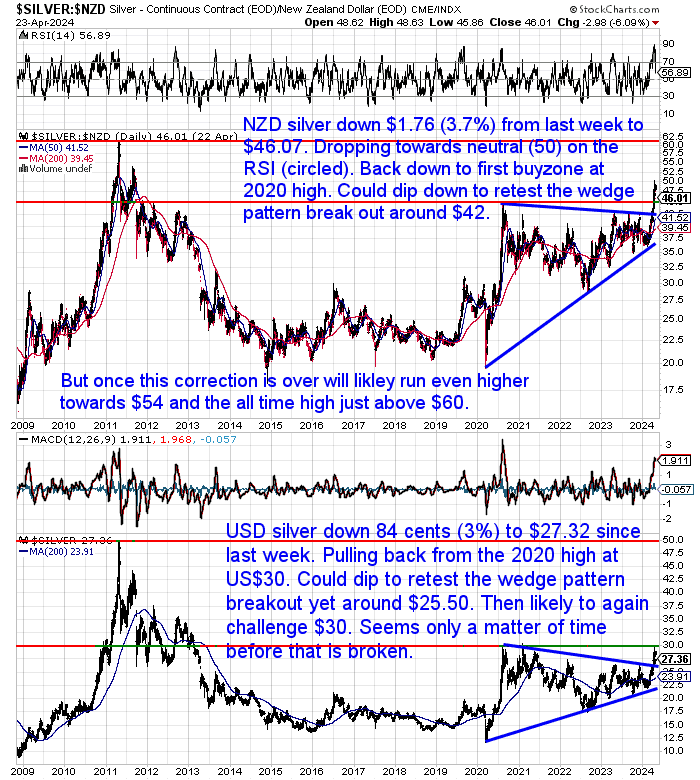

NZD silver is down $1.76 (3.7%) from last week to $46.07. It’s already close to neutral on the RSI and back down to the first support level and buying zone at the 2020 high (lower red line). We could yet see it dip lower to retest the break out from the consolidating triangle or wedge pattern. Around $42. While the 200-day MA is at about $40.

In USD terms silver got up close to the 2020/21 high at $30, but is now down 3% to $27.32. It could dip down to also retest the breakout around $25.50. Then it’s likely to again mount a challenge on the key $30 overhead resistance level. It seems only a matter of time before that is broken. Once it is we could see a fairly quick move back towards the all-time high at $50.

NZD Dollar Hovers Above 0.5900

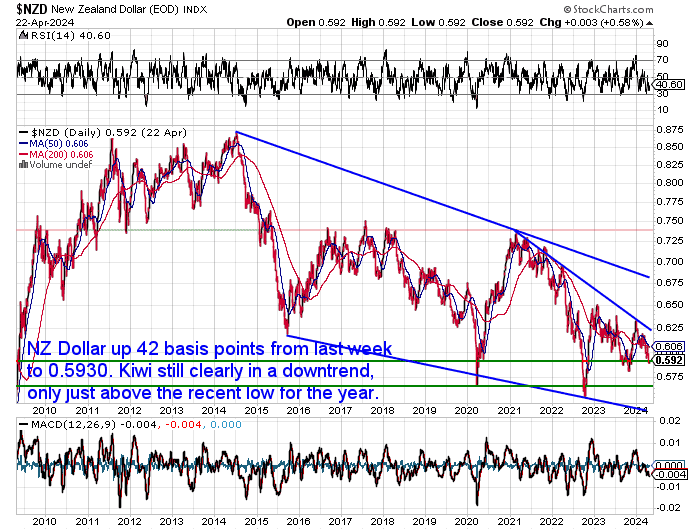

The kiwi dollar was up 42 basis points from 7 days ago to 0.5930. Not much to report on this other than to keep repeating that it remains in a clear downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The Great Gold Debate: Paper vs. Physical

Investing in gold can be a smart way to diversify your portfolio and hedge against economic uncertainty. But with so many options available, a crucial question arises: should you buy physical gold or opt for paper gold alternatives? This week’s feature article checks out the advantages and disadvantages of each approach.

We explore factors like security, liquidity, storage costs, and access, helping you decide which form of gold best suits your investment goals. Is the convenience of paper gold worth the potential drawbacks? Or does the tangibility of physical gold provide a sense of security?

It also delves into the newer gold tokens. Are these the answer to the drawbacks of paper gold?

This week’s article breaks down the facts: paper vs. physical gold. Learn which option aligns best with your investment strategy.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Correction: Short and Sharp or Something Longer?

As noted in today’s charts gold and silver are finally undergoing a much needed correction. After such a strong run it isn’t really a surprise. But the question now is how long and how deep will the correction be?

In Silver the RSI overbought/oversold indicator has already dropped to neutral territory after just 2 days. So we’re already in the could go either way territory. That is to have bottomed out already here and rise again, or to dip lower.

Here’s a sampling of a few viewpoints. Firstly from Jesse Colombo who by the way just wrote a great post on Zerohedge on Why A Powerful Silver Bull Market May Be Ahead.

“Precious metals are correcting a bit today, which is to be expected after such a sharp rally.

What I find notable is the lack of volume (in both futures & spot trading) behind this sell-off, which is further reason to believe that it is likely to be short-lived.”

Source.

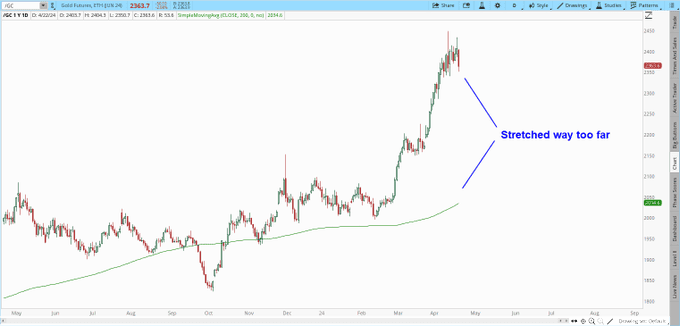

Then technical analyst Gary Savage makes the point that gold and silver had gotten way above the key 200 day moving average. When this happens a decent correction is expected, before the next leg up resumes:

“Another common mistake traders make is too assume that a very strong rally means any correction will be mild. The opposite is true. Powerful trending moves (like the one we just had in metals) stretch price too far away from the long term moving average (200 day or week moving average) When the profit taking event begins sellers all along that vertical rally get stopped out triggering more and more selling. So the correction ends up being anything but mild. It usually ends up being extremely damaging.

There is however one other form of correction that is possible when a market stretches too far. That is a long period of sideways churn. In this type of correction the reversal in sentiment is achieved via months of frustrating whipsawing. This is what gold did from Dec. until the March breakout.

I don’t think this will be a repeat of the earlier sideways churn. I think it’s more likely to be a sharp decline to retest the breakout at $2090-$2150.

I may even be wrong and after a brief correction gold produces one more higher high before the larger pullback begins, but i don’t think so. Too many red flags have been popping up that the rally is coming to an end …. for now. I still think gold will be $2700-$3000 by year end.”

Source.

Then Savage’s thoughts on silver:

“Go back and look at some of the comments to my posts around the end of Feb. and beginning of Mar. When we see that kind of sentiment again it will be time to start buying metals.

A retest of $30 was always the most likely best case scenario for silver during this intermediate cycle. But the next intermediate cycle silver will break through that resistance. $40 and maybe even $50 silver by the end of the year isn’t out of the question, but $24 or $25 silver first to reset sentiment, get everyone bearish, and on the wrong side of the boat is what we need to build the fuel for that breakout. Time for some patience for a few weeks.”

Source.

Our view?

We’d think for gold in particular there could be more of a pullback to come yet. But trying to pick the bottom in a correction is a fool’s errand. Better to start layering in from here at some of the buy zone levels we note in today’s charts.

Inflation Surprises – Stagflation Still Ahead?

Last week’s NZ CPI numbers came in slightly above the RBNZ’s february forecast but about where the market forecast at +4% yoy.

But as ASB reported there were some nasty surprises in the details:

“While tradable inflation was softer than expected at +1.6% yoy (survey: +1.3%), non-tradable inflation was quite a bit stronger at +5.8% yoy (survey: +5.3%). Inflation is continuing to ease, but it remains too high and proving stubborn to suppress.

- It’s the non-tradable side of things that will be of most concern to the RBNZ. These are the goods and services that don’t face direct foreign competition and thus give the clearest signal on the strength of domestically generated inflationary pressures. Prices for many of these goods and services are less driven by global commodity prices and more influenced by the NZ labour market. As a result, this is the component of inflation where there is the bigger risk of a wage-price spiral emerging, and the harder of the two to get under control. While the RBNZ targets headline inflation, in practice it’s the non-tradable stuff that the Bank has the most influence over and worries about most.

- The RBNZ’s sectoral core inflation model, released yesterday afternoon, affirmed that underlying strength in core domestically generated inflation seen in the CPI. We think the RBNZ will want to be confident inflation is trending back towards the midpoint of the 1-3% inflation target, on a sustained basis before cutting. Yesterday’s print highlights the likelihood that it’s going to take longer for that to happen – as many offshore central banks are also discovering. Accordingly, we think the first OCR cut of the cycle is more likely to happen at the beginning of 2025 than in November of this year.”

What they are talking about here are things like your council rates, insurance or electricity prices. These are not really affected by official cash rate movements.

But, on top of this, as we discussed last week, there are indicators of global inflation starting to tick back up again.

So our main concern and prediction for the coming years is stagflation. Higher inflation and a stagnant economy.

Goldman Sachs trading desk has a stagflation measure that is also pointing to a rising risk of the return of this 1970s phenomenon, up around 7% in 6 weeks:

Hello stagflation

“Keep our stagflation proxy (GSPUSTAG) on your radar, up ~7% in just under 30 sessions with the inflation narrative turning and growth possibly coming into question” (GS trading desk)”

Source.

So with this report of the Chinese government now encouraging silver purchases as well, could China start to begin to have more impact on the silver price as well?

Gold: Top Asset in 7 of 10 Years in 1970s

Speaking of the 70’s, Bank of America analyst Micahel Hartnett chart shows gold was the top performing asset class for 7 of 10 years in the 1970’s. Analyst “VBL’s Ghost” shared the table and commented on that decade:

“Hartnett: 1970’s Chart

When Gold Ruled Over All.

Personal note: Distinctly remember in 1976 in Phila. things were great after years of hi inflation but work.

My father said: “The bicentennial is coming, so they will do what they can to make things feel good for folks again. The world is watching now.”

And then 1977 came like a punch in the face for a decade. Everything out of step as the economy transitioned from manufacturing to services.”

Source.

History doesn’t repeat but it does rhyme. So no doubt there’ll be a few curve balls thrown into the mix. But a return to the 70’s is looking more and more likely.

The recent performance of gold is just another indicator of this.

Investing Legend Ray Dalio: Do You Have Enough Non-Debt Money?

Care of Reader Stephen C. comes this great summary and an important question to ask yourself:

“You guys are probably aware of Ray Dalio – he recently posted this on LinkedIn – I thought you might be interested if you haven’t already seen it.”

“Do You Have Enough Non-Debt Money?

Good money is both a good medium of exchange and a good storehold of wealth that is widely accepted around the world. The most globally recognized and accepted monies are the dollar, to a lesser extent the euro, to a much lesser extent the yen, and to an even lesser extent the Chinese renminbi. These monies are held in debt assets—i.e., they are debt-backed money—i.e., currency = debt. In other words, when you hold these monies, you are holding debt liabilities, which are promises to deliver you money.

History and logic show that when there are big risks that the debts will either 1) not be paid back or 2) be paid back with money of depreciated value, the debt and the money become unattractive. Since debts are promises to pay money, when a government has too much debt to be paid, its central bank is likely to print money. This prevents a big debt squeeze from happening by devaluing the money (i.e., inflation).

Gold, on the other hand, is a non-debt-backed form of money. It’s like cash, except unlike cash and bonds, which are devalued by risks of default or inflation, gold is supported by risks of debt defaults and inflation. It is held by central banks and other investors for this reason. In fact, gold is the third-most-held reserve currency by central banks, more so than the yen or renminbi. Cryptocurrencies are also non-debt monies. I don’t know of any other types of non-debt monies, though some people might argue that gems and art act similarly because they are non-debt, portable, and widely accepted storeholds of wealth.

When the financial system is working well—which is when there aren’t debt and inflation crises and the borrower-debtor governments printing debt-backed monies are meeting their obligations and paying their interest without printing and devaluing money—debt assets and other financial assets are good assets to hold; on the other hand, when the reverse is the case, gold is a good asset to own. That’s the main reason that gold is a good diversifier and why I have some in my portfolio.

PS: To be clear, I am trying to share my thoughts with you about investments but not give investment advice. So I am not recommending that you buy gold. In my communications with you, I am trying to convey to you how the markets work, explain what I think you should be aware of, and give some strategic investment thinking.”

Source.

Very hard to argue with Dalio’s logic. So, do you have enough non debt money?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|