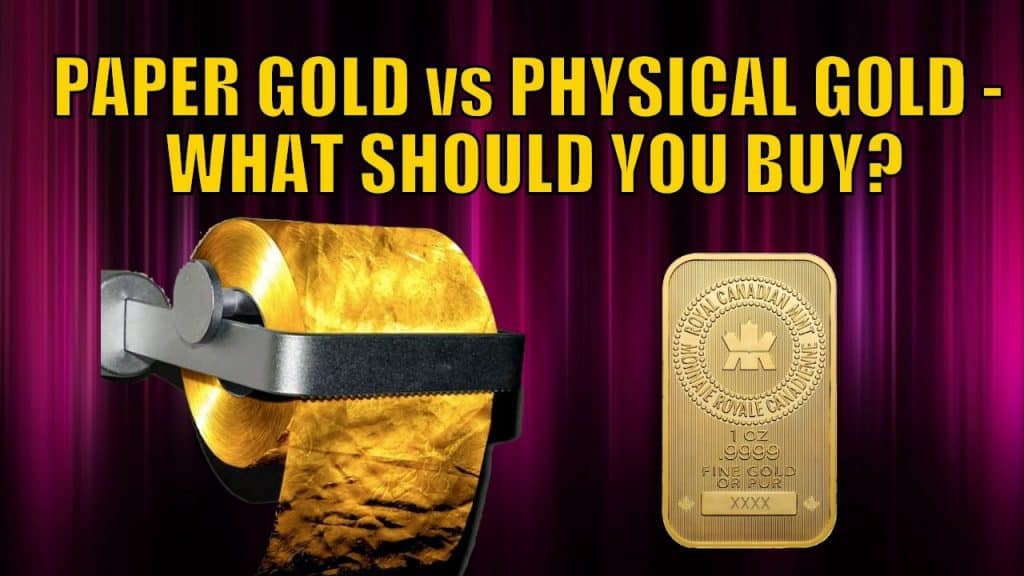

Buying the right type of gold is key. You have the choice between physical gold vs paper gold in its many varied forms.

But how do you decide which type of gold is right for you? Is it paper gold or physical gold?

Table of Contents

- What is Paper Gold?

- What is the One Disadvantage All Paper Gold Has Compared to Physical Gold?

- Different Types of Paper Gold:

- Advantages of Physical Gold in your Possession

- What Type of Physical Gold to Buy?

When deciding between paper and physical gold, the answer comes down to the main reason you are buying gold…

Are you only speculating on the price of gold or silver going up? Or are you buying gold or silver with a view to wealth protection? That is, as a form of financial insurance. Where you are protecting your wealth from the likes of the following:

- Inflation and Loss of Purchasing Power.

- Non Correlated Asset – smooth out your returns when shares/stocks, bonds and property are performing poorly.

- Diversification / Hedging in Times of Economic and Political Crises.

Learn more about gold as financial insurance and the protection it can offer. If wealth protection and insurance is your aim, then physical gold should be your choice over paper gold. Read on to see why…

What is Paper Gold?

Paper gold is a derivative of physical gold itself. Meaning the product is derived from and linked in some way to physical gold bullion, but not actually gold bullion itself.

Paper gold can include any of the following:

- Unallocated or pooled gold accounts

- Gold mining shares

- Exchange Traded Funds (ETFs)

- Gold Tokens

- Gold futures

- Gold options

- Contracts for Difference (CFD’s)

In the world of precious metals prices and amid talk of price manipulation, you’ll often hear the term “paper gold” mentioned. Such as “paper gold sets the price of gold”. In these cases the paper gold to which the writer is referring to is the gold futures market.

For more on this topic see: “Paper Gold” and Its Effect on the Gold Price

Along with: Flash Crash in Silver & a Tale of Two Gold Markets

What is the One Disadvantage All Paper Gold Has Compared to Physical Gold?

As per our definition earlier, all paper gold is a derivative of gold itself. Therefore all paper gold has what is called counter-party risk. Counter-party risk simply means your asset (in this case paper gold), is at the same time, someone else’s liability.

In the current global environment, with last year’s bank failures in the USA, along with higher interest rates and higher inflation, counter-party risk is likely a bigger concern than ever before. There is the potential for many businesses to come under financial pressure in the coming months and years.

So do you want to rely upon another party to remain solvent in order for your investment to maintain its value? Learn more about counterparty risk.

If you are buying gold as financial insurance, do you then want to keep track of the financial integrity of the company who manages your gold?

Different Types of Paper Gold:

Different types of paper gold also each have their own unique disadvantages. Let’s look at what they are:

Unallocated Gold vs Physical Gold

What is Unallocated Gold?

Unallocated gold or a pooled gold account, refers to gold from individual investors that is “pooled” together and stored and held by another party. Often a gold refiner, mint or sometimes a bank. Unallocated gold means investors’ gold are all pooled together.

Should you wish to withdraw your gold you will usually have to allow time for this to be done. When held by a refiner or mint this gold is often used as their working supply. So they fabricate gold from this supply and continuously replenish it. As a result you may not have to pay for storage.

Disadvantages of Unallocated Gold

- You rely upon the honesty of the holder of the gold that they have bought and hold enough gold to cover all investors.

- There is usually a delay should you wish to take delivery of your gold.

Gold ETF’s versus Gold Physical

What is a Gold ETF?

A Gold ETF is an Exchange Traded Fund which you can buy or sell via a stock or share market. It tracks the price of gold or a gold index. It may be backed by physical gold or merely track the price of gold using the likes of gold futures.

Disadvantages of Gold ETFs

- You rely upon the fund manager to remain solvent. And you may also rely upon the custodian of the gold if it is a gold backed ETF.

- If the ETF is not gold backed but merely a tracker then you are only tracking the gold price.

- There may be not so obvious management fees each year.

As a real life example (hat tip to Bob Coleman @profitsplusid) of the risks contained in an ETF, this is taken directly from the iShares® Silver Trust silver ETF annual report:

“The Trust’s lack of insurance protection and the Shareholders’ limited rights of legal recourse against the Trust, the Trustee, the Sponsor, the Custodian and any sub-custodian expose the Shareholders to the risk of loss of the Trust’s silver for which no person is liable.”

Source.

Coleman points out:

“Institutional and individual investors reading this , realize the ETF is not the product, you are. Wanting silver exposure, along with the legal ownership and rights associated with it, only come from buying the actual metal held directly. (fully segregated).”

Blockchained Gold Tokens vs Physical Gold

In the age of cryptocurrencies and blockchain, we now also have various gold “tokens” on offer. These would more correctly called digital gold rather than paper gold. But do they still come with similar risks as paper gold?

What is a Gold Token?

A gold token, also known as tokenized gold, is a digital representation of physical gold ownership stored on a blockchain. Imagine a gold bar, but instead of holding the actual bar, you own a digital token on a secure online ledger that proves you own a specific amount of that gold bar.

Gold bullion is stored in a secure vault by a trusted custodian.

Each gold token represents ownership of a specific amount of that physical gold. One token could represent one gram, a whole ounce, or even a fraction of an ounce.

The tokens themselves reside on a blockchain, which is a secure and transparent digital ledger. This makes it nearly impossible to counterfeit or tamper with ownership records. You can also buy gold in very small increments and the tokens will potentially be very liquid (easily bought and sold).

Disadvantages of Gold Tokens

- Custodial Risk: Much like a gold or silver ETF you rely upon the custodian to remain solvent. Even if you research and understand the reputation and track record of the custodian who stores the underlying gold, there is still a risk.

- Regulation: The regulatory environment surrounding gold tokens is still evolving, so there may be uncertainties.

- Cryptocurrency Volatility: The value of the tokens can be influenced by the volatility of the cryptocurrency market, not just the price of gold.

Again a real life example care of Bob Coleman:

HSBC’s latest Gold Token

Remember most Block chain programs add counterparty layers not remove them. Is this product any different? NO!

From HSBC

You should note that an investment in the Product is not the same as acquiring a physical gold bar.

In particular, under the Product, investors acquire only fractional ownership of the Gold. When compared to directly acquiring a physical gold bar, investors holding only fractional ownership of the Gold represented by HSBC Gold Tokens (“Fractional Ownership”) will be subject to certain limitations, including but not limited to the following (the “Limitations”):(a) Investors will not have the ability to take physical possession or delivery of the Gold at any point, even in the case of insolvency of the Bank (in which an appointed Disposal Agent will be obligated under the Disposal Agent Appointment Agreement to liquidate the Gold and distribute the proceeds to the investors).

(b) Investors can only trade the Gold represented by the HSBC Gold Token via the Bank, subject to the below:

Source.

(i) the price of the Gold represented by HSBC Gold Tokens is determined by the Bank according to the pricing mechanism of the Product;

(ii) any trading outside the Gold Trading Hours will be subject to a higher Bank Margin of 5% at maximum; and

(iii) suspension of dealing may be imposed by the Bank.

Gold Shares vs Physical Gold

What are Gold Shares or Gold Stocks?

Gold shares or gold stocks are shares in the ownership of a gold mining or gold exploration company. You own a portion of the companies assets and liabilities. You may receive a dividend each year.

The price of gold stocks and shares will be impacted by the spot price of gold. But the gold stock prices will also fluctuate due to many other business and market conditions.

Disadvantages of Gold Mining Stocks or Shares

You are investing in a business as opposed to owning financial insurance. Thereby associated risks include:

- Management risk – who runs the company will have a large bearing on its profitability.

- Geo-political risk – who is in government may impact the company. Gold mines have a history of being nationalised in some countries.

- Lack of cashflow risk – Non producers are even more risky and speculative. Because they have no cash flow and trade instead based upon the level of gold reserves they have discovered.

- Risk of dilution of ownership via issuing more shares – this is a common way a company can raise more capital for expansion or exploration. But it does mean you end up owning less of the business.

- Further counterparty risk – Most shares are owned via a custodian so your ownership has another counterparty involved.

Read more: Gold Mining Shares vs Physical Gold Bullion – Which to Buy?

If you’re serious about investing in gold mining shares or stocks, then we’d recommend you check out our favourite financial newsletter writer. We have been a subscriber of his for over 10 years. Learn more about him and the special deal he has offered our readers here.

Gold Futures vs Physical Gold

What are Gold Futures, Options and CFD’s?

Gold futures contracts allow producers, miners and end users of gold and silver to hedge or to mitigate price risk. But they also allow speculators to “bet” on the future price of gold or silver.

Futures also involve leverage so you get exposure to the gold price that is greater than the sum you invest.

Likewise options and CFD’s are derivatives that give leverage to the price of gold.

Disadvantages of Gold Futures and Options

- Margin – while you get leverage to the upside in the gold price, if the price falls this also magnifies your losses. You can potentially lose your entire investment.

Advantages of Physical Gold in your Possession

There are a number of advantages of physical gold over paper gold.

But the key advantage is that physical gold in your possession has no counterparty risk. That’s what makes physical gold (and silver) the only financial asset(s) that qualifies as financial insurance.

For more on the reasons to hold gold for financial insurance and the 5 benefits see: Why Gold Bullion is Your Financial Insurance

Other Advantages of Physical Gold Over Paper Gold

- Once you’ve bought you know your costs. You know your purchase price and your storage costs (if any).

- Physical gold takes some effort to sell – you can’t just click a button to sell physical gold. Some may see this as a disadvantage compared to say a share or an ETF. However as it takes a conscious effort to sell, you won’t sell impulsively and without giving it due consideration.

- No management fees – unlike gold funds and ETF’s.

- Unlike paper gold, physical gold won’t go to zero. History shows it will always have value.

What Type of Physical Gold to Buy?

Once you’ve decided to buy physical gold you also may wish to consider exactly what type of physical gold to buy. Here are some factors to consider:

- In New Zealand, GST is payable on some gold and silver coins due to their purity. So these are generally best avoided. Learn more: Gold Purity and Silver Purity – A Complete Guide

- You’ll want to consider whether to go with coins or bars: Gold Coins or Gold Bars: Which Should I Buy?

- If you’d prefer bars there are also options: What Type of Gold Bar Should I Buy?

- There are also some choices when it comes to coins. See:

But it’s not as complicated as that might seem. You can always just get our thoughts. Either use the live chat below or pick up the phone and give us a call on 0800 888 465 (Outside New Zealand: + 64 9 281 3898).

Or browse the gold products available in our online precious metals shop.

If you need more information on the process of how to buy physical gold see: How to Buy and Invest in Gold.

Editors Note: This article was first published 1 August 2018. Last updated 23 April 2024 to include iShares® Silver Trust silver ETF information and also Blockchained Gold Tokens.

Pingback: Physical Gold vs. Paper Gold: The Ultimate Disconnect

Pingback: Why Gold Bullion is Your Financial Insurance - Gold Survival Guide

Pingback: Is Demand For Physical Gold Really Collapsing? Our Take... - Gold Survival Guide

Pingback: “Paper Gold” and Its Effect on the Gold Price

Pingback: Paper Gold Ain’t as Good as the Real Thing

Pingback: Why the NZ Super Fund Should “Invest” in Gold - Gold Survival Guide

Pingback: Physical Gold and Silver Markets in NZ Decoupling From the Paper Markets

Pingback: Infographic: Bullion Banking Mechanics - Gold Survival Guide

Pingback: Gold Mining Shares vs Physical Gold Bullion - Gold Survival Guide

Pingback: Confusing Investing with Wealth Protection: The Risks of Paper Gold

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: Warning Signs Are Appearing in Many Countries - Gold Survival Guide

Pingback: NZers: Do You Hold Cash or Gold in the Coming Crisis?

Pingback: Why Will Gold Still be Valuable in the Future? - Gold Survival Guide

Pingback: Elon Musk’s Tesla Buys $1.5 Billion in Digital Currency - Read the Small Print - Gold Survival Guide

Pingback: Flash Crash in Silver & a Tale of Two Gold Markets - Gold Survival Guide

Pingback: Central Bank Record Gold Buying Continues - Gold Survival Guide

Pingback: Caution: Don't Be Caught on the Sidelines - Gold Survival Guide