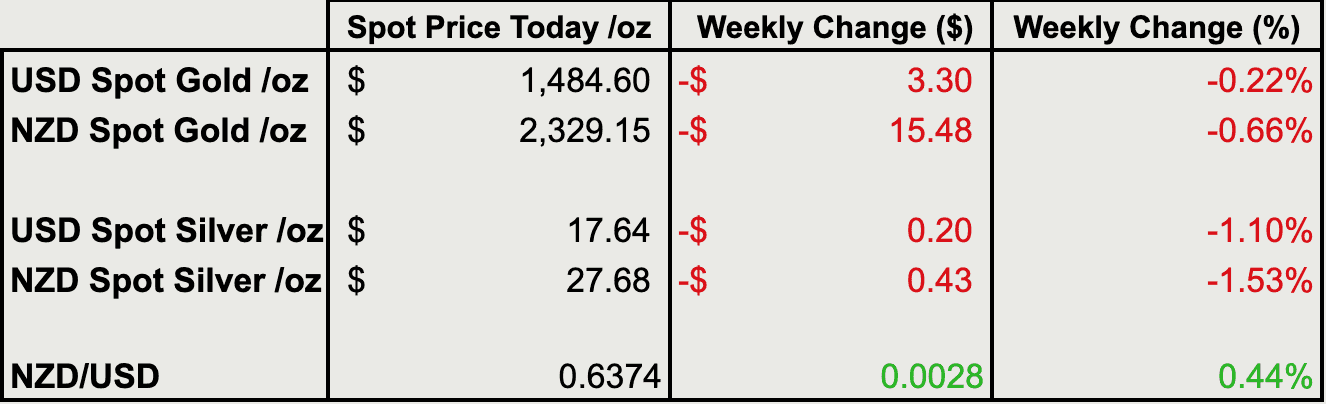

Prices and Charts

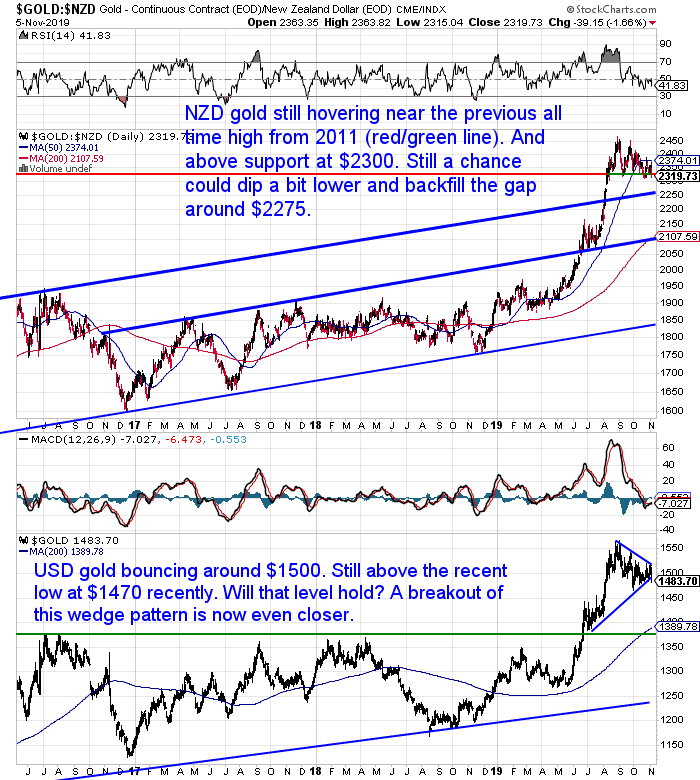

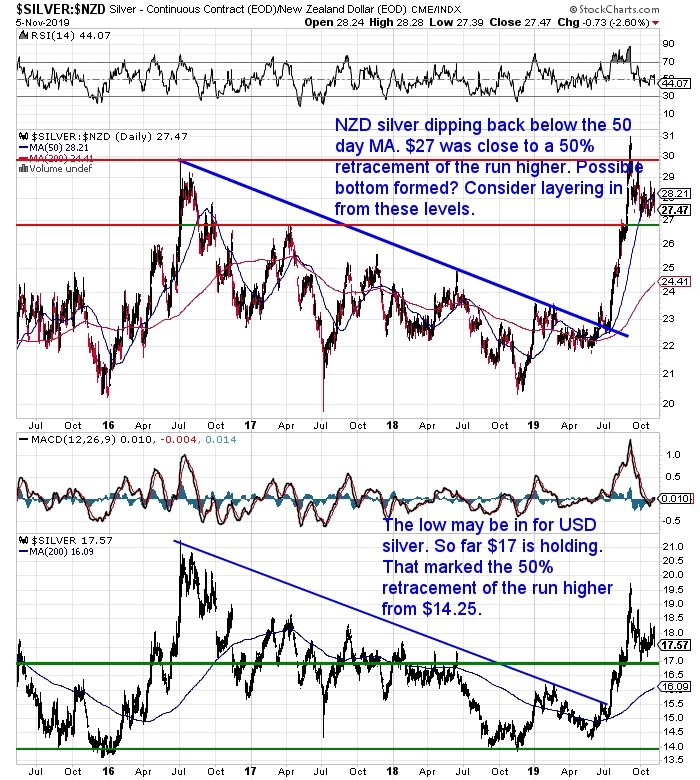

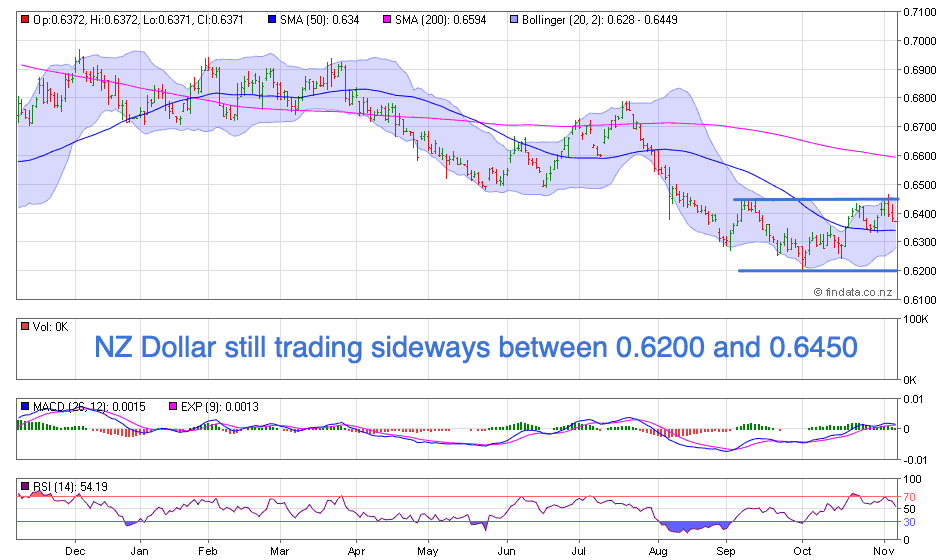

NZD Gold Still Consolidating Recent GainsUntil last night NZD gold had been edging higher for the week. But a sharp fall now sees it sitting back under the previous all time high from 2011. Down 0.66% from last week. But it is still above the recent low. So far gold is doing a good job of consolidating the previous hefty gains. Our educated guess remains that it won’t go too much lower from here. So is SilverNZD silver also dropped sharply overnight to be down 1.5% on a week ago. Although It too is still above the recent low of $27. Again our guess is that silver will hold above that mark. With the worst of the falls now likely over. That would make right now a pretty decent time to be layering in your purchases. NZ Dollar Still Trading in Sideways RangeThe Kiwi dollar moved higher at the end of last week but has pulled back lately. It is up for the week. But continues in the sideways pattern it has been in since late August. The pundits seem to think the odds of an interest rate cut next week are now 50:50. After being as high as 90% a week ago. So that decision may be what moves the Kiwi one way or the other. Even if the central bank doesn’t make a move next week, we’d say it is only a matter of time before another cut. Unemployment looks to be on the rise, even if at a slow rate. Need Help Understanding the Charts?Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you: Gold and Silver Technical Analysis: The Ultimate Beginners GuideContinues below —– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.Are you prepared for when the shelves are bare?For just $240 you can have a 56 serving emergency food supply.Smaller Emergency Food Packs Now Available.NZ Housing to Gold Ratio 1962 – 2019: Measuring House Prices in GoldWe’ve finally updated one of our most requested pieces of data. The New Zealand Housing to Gold Ratio. While we’ve written a few updates in recent times, we hadn’t updated the data and chart since 2010. Partly due to the difficulty in deciphering how we did it back then! So we now have New Zealand housing priced in gold from 1962 all the way through to September 2019. This shows the importance of measuring assets in “real money”. Not the papery, digital fiat type. Click through and you’ll see how NZ house prices in nominal terms have continued to rise after the slow down from 2008 to 2013. However when measured in gold, house prices peaked way back in 2005. The benefit of a historical chart like this is that two fold.

The post covers:

NZ Housing to Gold Ratio 1962 – 2019: Measuring House Prices in GoldWarning Signs Are Appearing in Many Countries – Bank Runs in China and IndiaWe’ve reported on the troubles in the US “repo” market. And how the US central bank may have quietly restarted a form of QE to help out the banks some more. But it’s not just in the USA where there are warning signs. Here’s some news that has gone very under reported, care of our friend John Kim. “…there have been multiple bank runs in China and India already this year, with the latest Chinese bank suffering a bank run last week being Yichuan Bank, with hundreds of customers waiting in long lines for hours to withdraw their savings for fear of losing it all. As can be expected, the normal reaction to such news by citizens of developed nations is something akin to “these are small banks with zero discipline mismanaged in nations with inadequate regulations, but those types of problems will never manifest in my nation.” And these types of false sentiments persist because of the fact that bankers in developed nations have influenced the mainstream media to the point where the mainstream media plaster and paint over the cracks instead of exposing them and warning the public.

For example, in this article I wrote on my blog just about a month ago, I stated that the reintroduction of the US Central Bank repurchase agreement program to provide overnight liquidity to US banks for the first time in eleven years was a clear sign “that there is something seriously and operationally deficient within the US banking system.” The very fact that the Central Bank needed to step in to provide cash needed for daily operations in the US banking system because banks do not trust one another to loan large amounts of cash and have it returned within 24 hours is a sign that multiple bank runs are possible due to large amounts of risk inherent in all of the largest US banks. In other words, banks will assess whether or not to lend money to each other, on an overnight basis, based upon the level of risk of receiving the loaned money returned to them within 24 hours. If they feel the risk exceeds the interest charged, they will not lend any money, which causes a liquidity crunch, and the need for Central Bankers to step in to create hundreds of billions of dollars out of thin air every week just to keep the US banking system afloat and operational. Thus banker manipulation across all aspects of the global banking system exists, and banker manipulation does not just pertain to stock markets. …History has already informed us that banker manipulation charades can cover up cracks for an irrationally long period of time. However, history has also informed us, that when such cracks appear with such enormity as a consequence of perpetual banker manipulation of markets, whether overt or secretive, eventually Humpty Dumpty will fall off the wall and shatter into pieces.” Your Questions WantedRemember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin. Our feature article this week shows you that there is still plenty of upside left in gold. Even despite gold being not far from all time highs in New Zealand dollar terms. With cracks like these above appearing you want to own your insurance before everyone else realises it is needed. Give us a call if you have any questions. Or book a time online that suits you for a free bullion consultation.

— Prepared for the unexpected? — Never worry about safe drinking water for you or your family again…

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective. Royal Berkey Water Filter —–

|

||||||

This Weeks Articles:

NZ Housing to Gold Ratio 1962 – 2019: Measuring House Prices in GoldWed, 6 Nov 2019 12:57 PM NZST  The housing to gold ratio shows that when priced in Gold, NZ median house prices have fallen 47% since 2005. See how history shows NZ house prices could fall 80% further yet… There’s always plenty of discussion in the mainstream media about where house prices are going. Given New Zealanders predilection for property it’s no […] The housing to gold ratio shows that when priced in Gold, NZ median house prices have fallen 47% since 2005. See how history shows NZ house prices could fall 80% further yet… There’s always plenty of discussion in the mainstream media about where house prices are going. Given New Zealanders predilection for property it’s no […]

The post NZ Housing to Gold Ratio 1962 – 2019: Measuring House Prices in Gold appeared first on Gold Survival Guide.

|

Paper Gold vs Physical Gold – What Should You Buy?Wed, 30 Oct 2019 10:49 AM NZST  Buying the right type of gold is key. You have the choice between physical gold vs paper gold in its many varied forms. But how do you decide which type of gold is right for you? Is it paper gold or physical gold? The answer comes down to the main reason you are buying gold. […] Buying the right type of gold is key. You have the choice between physical gold vs paper gold in its many varied forms. But how do you decide which type of gold is right for you? Is it paper gold or physical gold? The answer comes down to the main reason you are buying gold. […]

The post Paper Gold vs Physical Gold – What Should You Buy? appeared first on Gold Survival Guide.

|

Does Gold and Silver Need to be Assayed When You Sell It?Wed, 30 Oct 2019 9:21 AM NZST  Prices and Charts Looking to sell your gold and silver? Visit this page for more information Buying Back 1oz NZ Gold 9999 Purity $2252 Buying Back 1kg NZ Silver 999 Purity $858 NZD Gold Drifting Sideways Gold in New Zealand Dollars bounced back a little this week. Up three quarters of a percent. […] Prices and Charts Looking to sell your gold and silver? Visit this page for more information Buying Back 1oz NZ Gold 9999 Purity $2252 Buying Back 1kg NZ Silver 999 Purity $858 NZD Gold Drifting Sideways Gold in New Zealand Dollars bounced back a little this week. Up three quarters of a percent. […]

The post Does Gold and Silver Need to be Assayed When You Sell It? appeared first on Gold Survival Guide.

|

Choosing Between PAMP Suisse Gold & Silver vs Local NZ Gold & Silver Bars: VideoTue, 29 Oct 2019 5:26 PM NZST  We’ve written about this topic previously as it is a common question people have. How to choose between the local New Zealand silver bars and New Zealand gold bars on offer and imported Suisse PAMP gold bars and PAMP silver bars? But for those people that prefer to watch and listen rather than read, we’ve […] We’ve written about this topic previously as it is a common question people have. How to choose between the local New Zealand silver bars and New Zealand gold bars on offer and imported Suisse PAMP gold bars and PAMP silver bars? But for those people that prefer to watch and listen rather than read, we’ve […]

The post Choosing Between PAMP Suisse Gold & Silver vs Local NZ Gold & Silver Bars: Video appeared first on Gold Survival Guide.

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

|

1kg NZ 99.9% pure silver bar

$968 (price is per kilo for orders of 1-24 kgs)

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2019 Gold Survival Guide. All Rights Reserved. |

Pingback: Gold Dipping Lower - Gold Survival Guide