|

Gold Survival Gold Article Updates:

November 13,2014

This Week:

- Gold and Silver Plunge Further

- Recommended Book: The Colder War

- Putin Signs Secret Pact to Crush NATO

- Paper vs Physical

- Free Shipping on 500 x 1oz Silver Maples

We’ll be very short and sweet this week. We’re working on trying to finally get our Freeze Dried Emergency Food venture up and running, and so that has consumed a lot of our time this week.

Hopefully we’ll be able to share that with you before too much longer. Things always take longer than you expect it seems. We intend to add more emergency preparedness info and products to the site too. So let us know if you’ve got anything you’d like to see available.

Fingers crossed we can share some specific details of that in the next couple of weeks.

Luckily we have plenty of content on the site to keep your busy this week. Scroll down to where we have 2 videos and 3 articles. We’ll hear from the likes of Professor Fekete, Rick Rule, Chris Martenson and more on the “Colder War” from Marin Katusa.

Recommended Book: The Colder War

Speaking of Marin – we’re part way through his so far excellent new book released just 3 days ago. It’s called The Colder War.

It details the struggle between Vladimir Putin and the US to control the world’s energy trade—and more importantly, what it means for the future of the petrodollar, the bedrock of American might and prosperity.

Marin is one of the most successful and well-connected dealmakers in the energy and resource exploration sector. He stakes millions on knowing precisely how geopolitics influences energy projects, production, and pricing. His hedge funds have outperformed the TSXV Index by 600% over the past five years, and he’s raised over $1 billion in startup capital, traveling to over 100 countries in the process, including Russia, Ukraine, and Iraq.

Marin outlines just how close to winning Putin is and get a horrifying glimpse at his endgame… a shock to the global financial system that could absolutely crush the life savings of many average people.

Definitely worth grabbing a copy of. Check it out here: The Colder War.

Prices and Charts

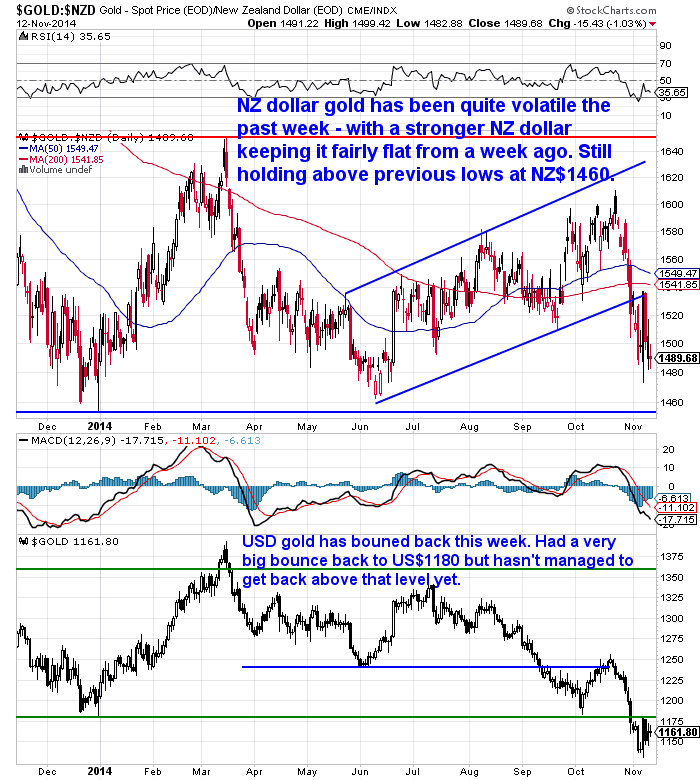

We’ve seen quite a bit of volatility this week in gold. Last week it was at US$1143.30 this week US$1159.65. So up $16.35 or 1.43%.

However due to a stronger NZ dollar (78.62 today, versus 77.25 last week) the local NZD gold price is down $3 per oz or 0.2% from a week ago to NZ$1477

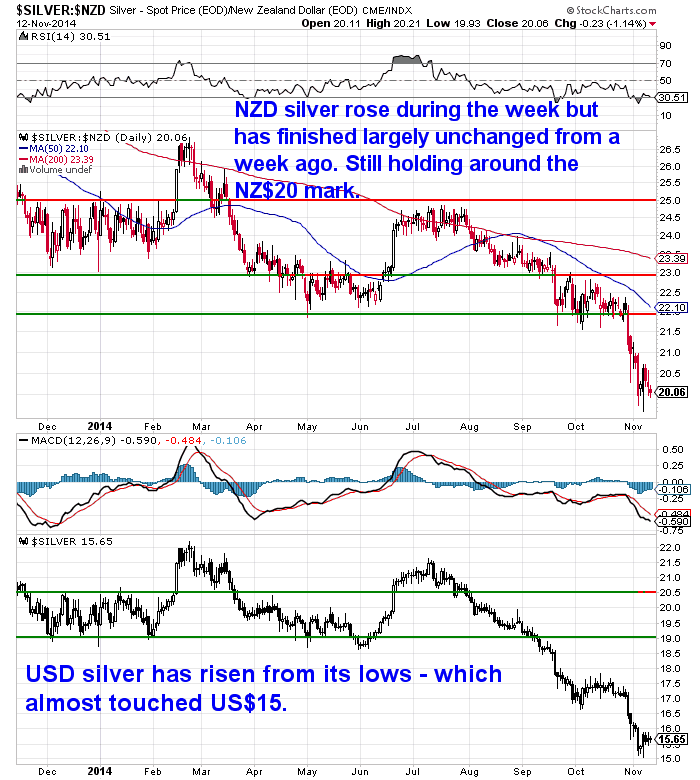

USD silver is up 32 cents or 2.08% to US$15.67. You can see in the lower half of the chart below the huge intra-day jump it took after touching US$15.

NZD silver is still around the NZ$20 mark. Up just 6 cents per oz or 0.3% to NZ$19.94.

Paper vs Physical

As David mentioned yesterday in our daily price alerts (sign up here if you are looking to buy and want to keep a close eye on prices), in a week of trading there have been around 64 plus million contracts traded. Each silver contract is 5000 ounces. This works out to 320 billion ounces of paper traded silver.

Out of the ground each year for investment purposes is around 250 million ounces; the other 500 million being used for industrial purposes; and the remaining 250 million comes in the form of scrap metal. So the paper markets last week just traded around 1280 years of investment supply which is mind boggling. Only a small portion of those 64 million contracts need to take delivery of the physical silver and game over.

We just read an excellent article from Bud Conrad which we’ll post during the week that outlined the numbers in the Comex gold futures market. It showed just how much control only 3 banks have in this market, hence likely why the price continues to fall in the face of what appears to be significant demand for physical gold.

Of course no one knows how long this can go on. But it can’t last forever. At some point someone, maybe a central bank that rhymes with Gusha or maybe another one that rhymes with Shina, may use the Comex as a means to take delivery of a bit of gold. It wouldn’t take much to overwhelm what are relatively small Comex inventories. According to Bud:

—–

“Warehouse stocks registered for delivery on the Comex exchange have declined to only 870,000 ounces (8,700 contracts). Almost that much can be demanded in one month: 6,281 contracts were delivered in August.”

—–

So getting some physical silver or gold before such a situation arises could be a smart move in our opinion.

Free Shipping Anywhere in NZ or Australia

On that note we have free shipping (via UPS fully insured) anywhere in New Zealand or Australia on 500 x 1oz Canadian Silver Maple coins.

The current price is $12140 and delivery is now about 7-10 business days.

If you prefer locally refined 99.9% silver the approximate cost for 5 x 1 kg (160.75oz) of silver delivered and insured today is around $3545. Delivery is around 8-12 days.

There is plenty of PAMP silver and gold in stock in the form of PAMP silver 1kg bars or gold 1oz bars.

Please give us a call or an email if you’d like a quote or have any questions.

|

Pingback: “Paper Gold” and Its Effect on the Gold Price - Gold Prices | Gold Investing Guide

Pingback: Close to Maximum Pessimism? - Gold Prices | Gold Investing Guide