See why Stewart Thomson thinks regardless of whether Clinton or Trump wins the US election, the outcome will be a positive one for gold…

Graceland Updates

By Stewart Thomson

- The US election is now only about two weeks away. The winner of this election is likely to be… gold. Here’s why:

- Both candidates are eager to increase infrastructure spending, and that’s likely going to open the door to congressional discussion of the issuance of perpetual bonds (aka “perps”).

- That’s inflationary. It is also going to lead to a significant drop in central bank credibility, because central banks will be reluctant to increase the cost of borrowing for governments at a time when governments want to borrow more for their infrastructure spending schemes.

- Please see below now. The longer that central banks wait to increase interest rates more consistently and substantially, the more dangerous the credit bubble becomes.

- Also, bank loan profits have been in a twenty-year bear cycle. That has caused a vicious deflationary bear cycle in money velocity.

- Central banks are prolonging that bear cycle by promoting unprecedented growth of government debt and unfunded social programs.

- The longer that central banks wait before moving interest rates noticeably higher, the more violent the liquidity flows from the government bond markets will be when the rates are finally hiked.

- In my professional opinion, I think most career politicians really believe the world is in a “new era”, where governments can take on unlimited amounts of debt without any real consequences.

- Central bankers are supporting this fantasy world view by pretending that the economic upcycle now in play from 2009 was created by them.

- They created nothing except more danger for pension funds and government bond investors. Central banks effectively engineered a massive flow of bank assets into the stock market, real estate, and government bonds.

- They did it with the biggest attack on Main street citizens in the history of America.Main street workers and pensioners have really been under constant attack since 2009, via QE and low rates.

- The one rate hike that Janet deployed in December of 2015 has been the only real central bank help for Main street in the past seven years.

- That help is just a drop in a bucket. Much more needs to be done in 2017. Main street needs four rate hikes over the next twelve months. I’m predicting they get two, which is better than one or none.

- Western governments need twenty rate hikes from the US central bank. That’s the only way to force them to clean up their disgusting debt-obsessed acts. Sadly, in 2017 I expect most American politicians will cry like babies over just two rate hikes.

- Paul Volker had no problem raising rates to 14% to reign in inflation. Janet Yellen should have even less issue with hiking rates to reign in government lunatics who act more like dictators than politicians.Government size is the disease. Aggressive rate hikes are the cure!

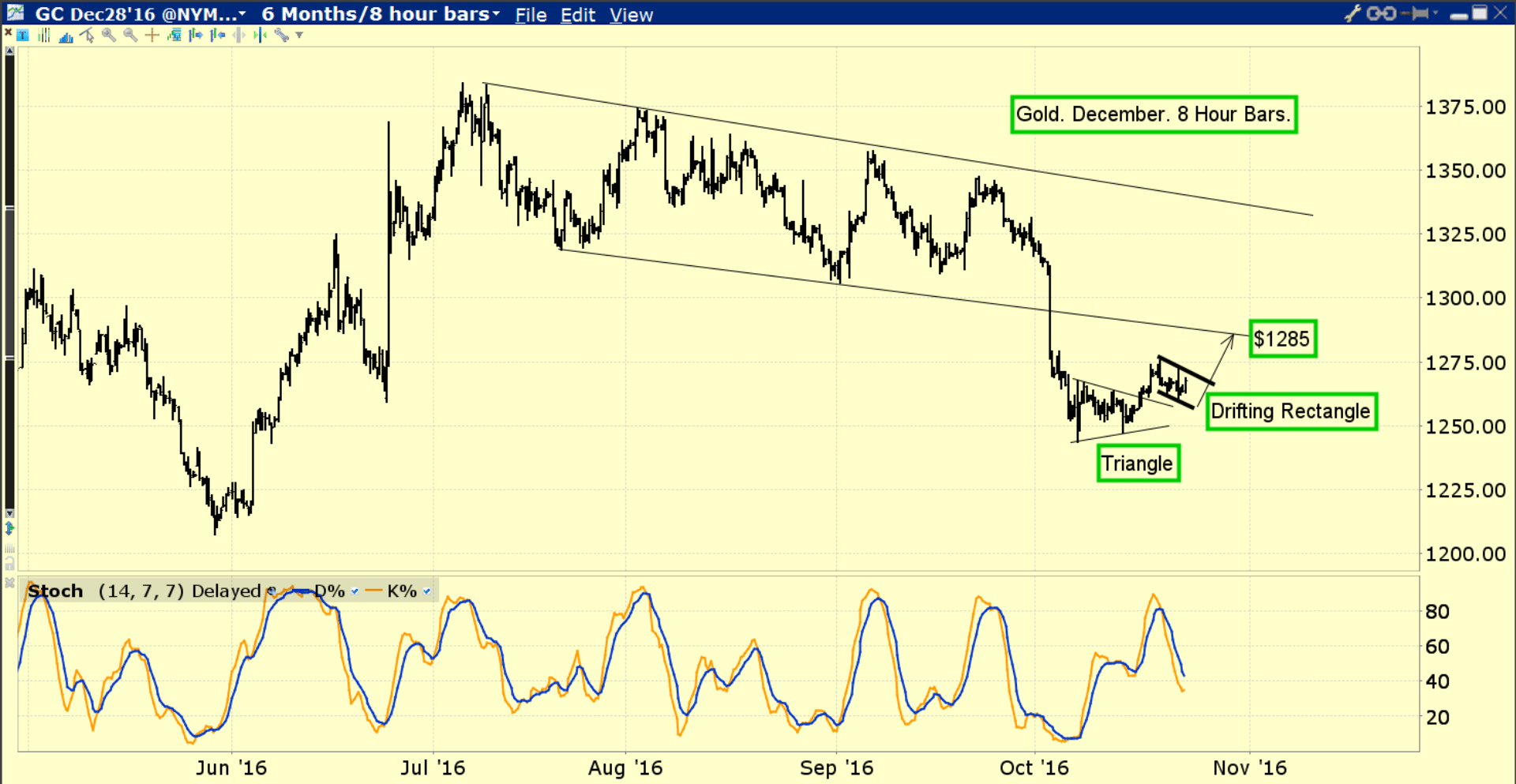

- Gold is very well supported at this point in time.Please see below now. Double-click to enlarge. After bursting upside from a small symmetrical triangle pattern, gold is coiling nicely in a drifting rectangle pattern. My next short term target is $1285.

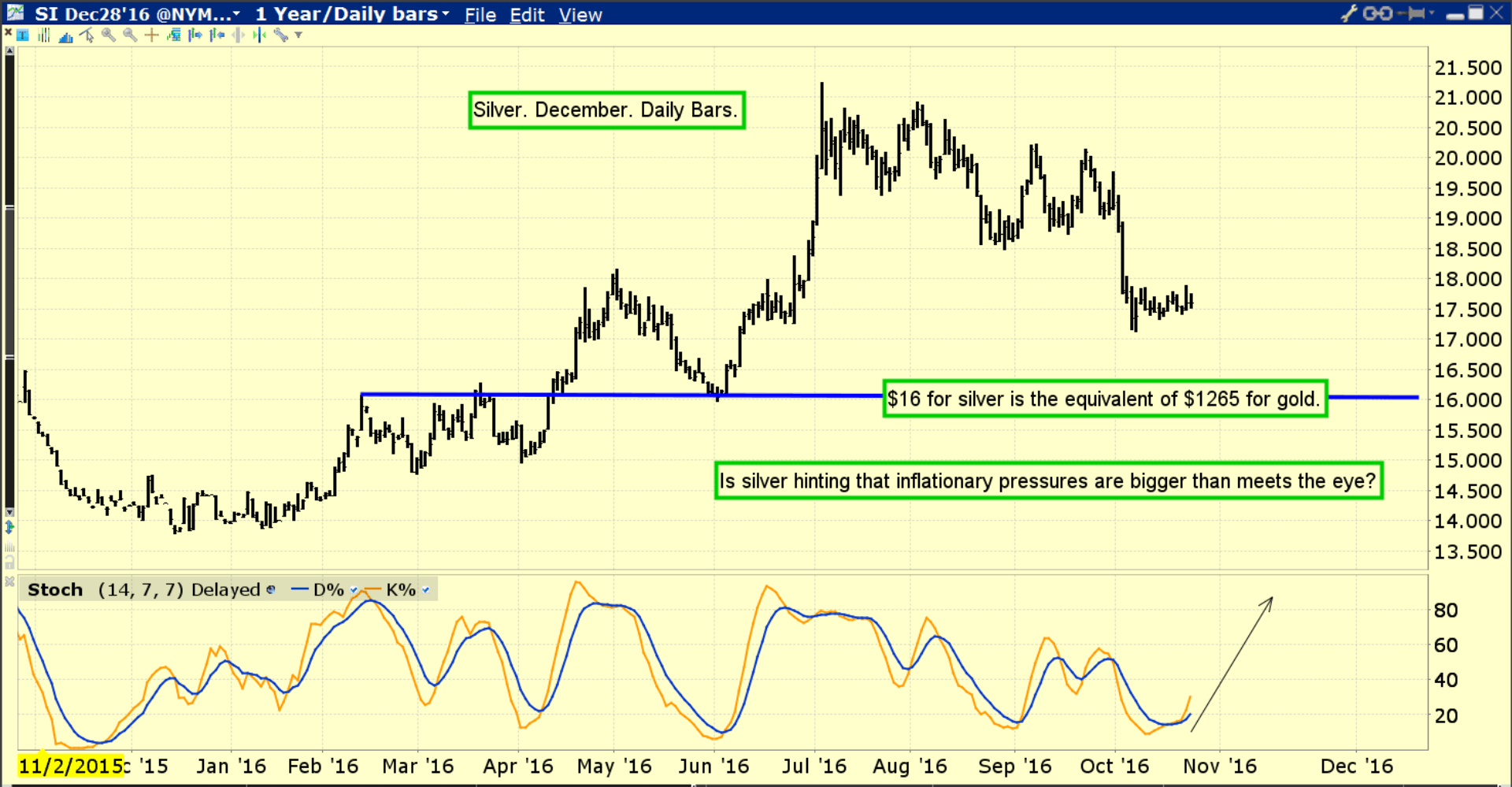

- Please see below now. Double-click to enlarge this daily bars silver chart. I look for key non-confirmation events between gold and silver, and there’s a great one in play right now.

- On this pullback, gold is trading near the key February highs, and has even traded below them, while silver has held well above its February highs.

- That tells me that inflation is becoming a potential issue, and silver’s relative strength during this pullback is a very positive indication that 2017 will see inflationary pressures strengthen more than they already have in 2016. Two rate hikes in 2017 plus one in December of this year should be enough to reverse the bank loan profits and money velocity bear cycles.

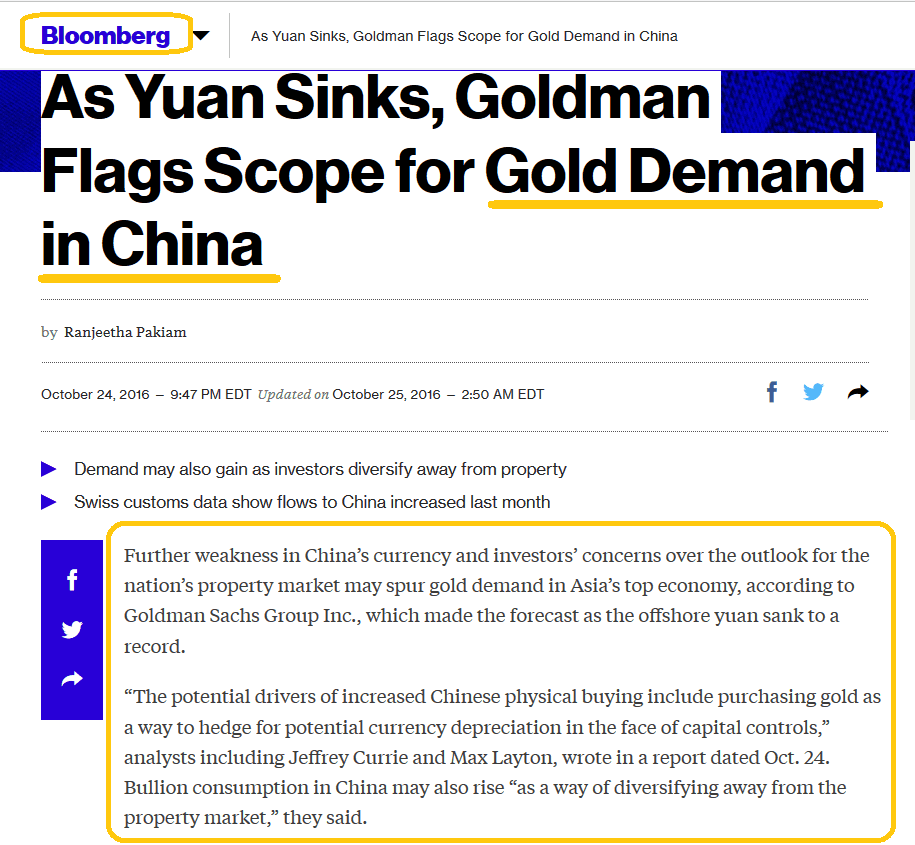

- I’ve predicted a revival in the Chinese gold jewellery market will commence by early 2017, if not sooner. Please see below now. Top Goldman economists are also very excited about the Chinese gold market.

- The bottom line is that gold is well supported by both the Western fear trade and the Eastern love trade.

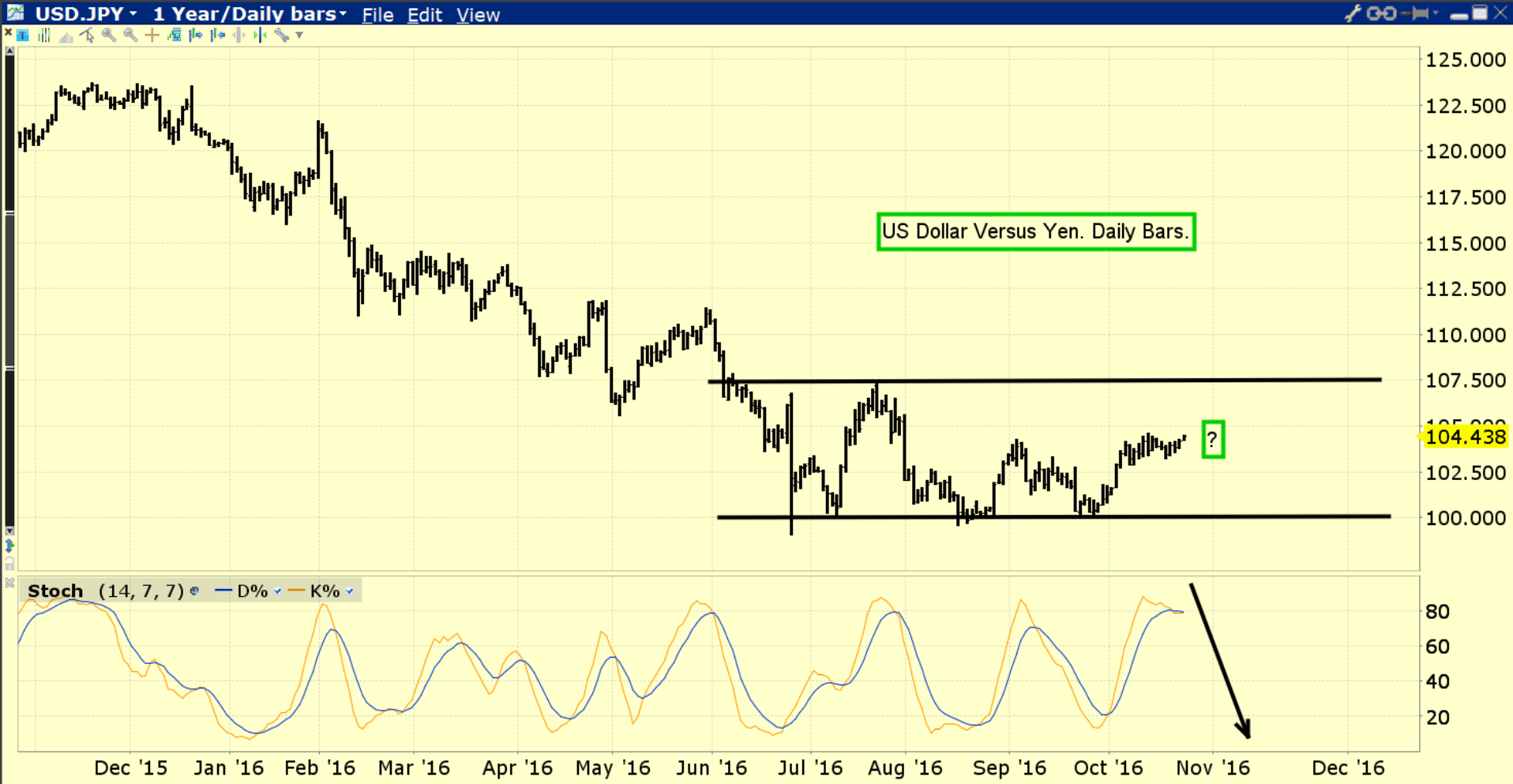

- Please see below now. Double-click to enlarge. The risk-on dollar is drifting sideways against the safe-haven yen, and is technically overbought. If it starts to decline, I expect gold to race straight to my $1285 short term target zone.

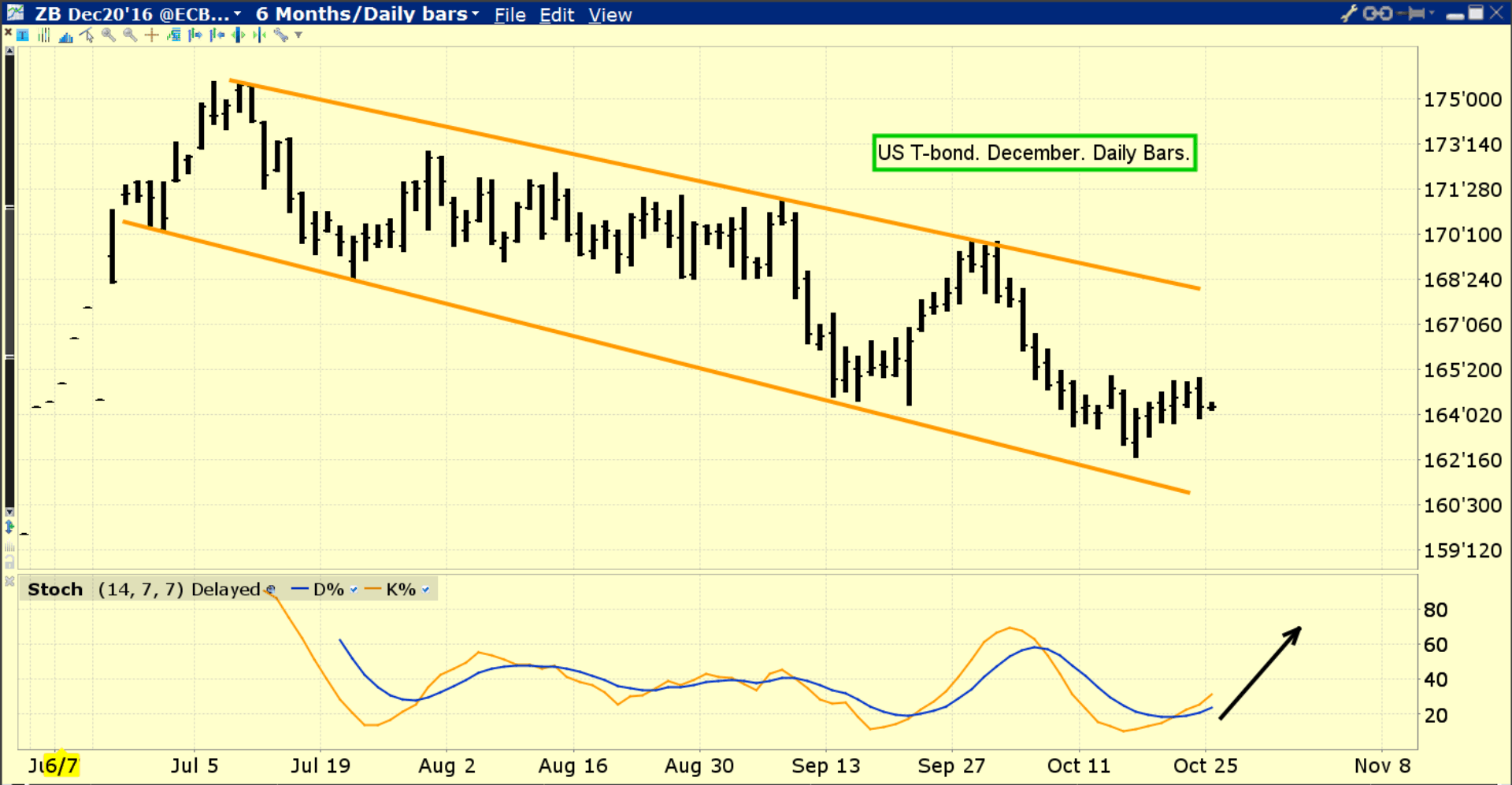

- Please see below now. Double-click to enlarge. The US T-bond has swooned since the Brexit vote occurred, and that’s been a headwind for gold. In 2017, I expect the T-bond to swoon more, but against a background of falling real interest rates and rising nominal rates. That’s good news for gold.

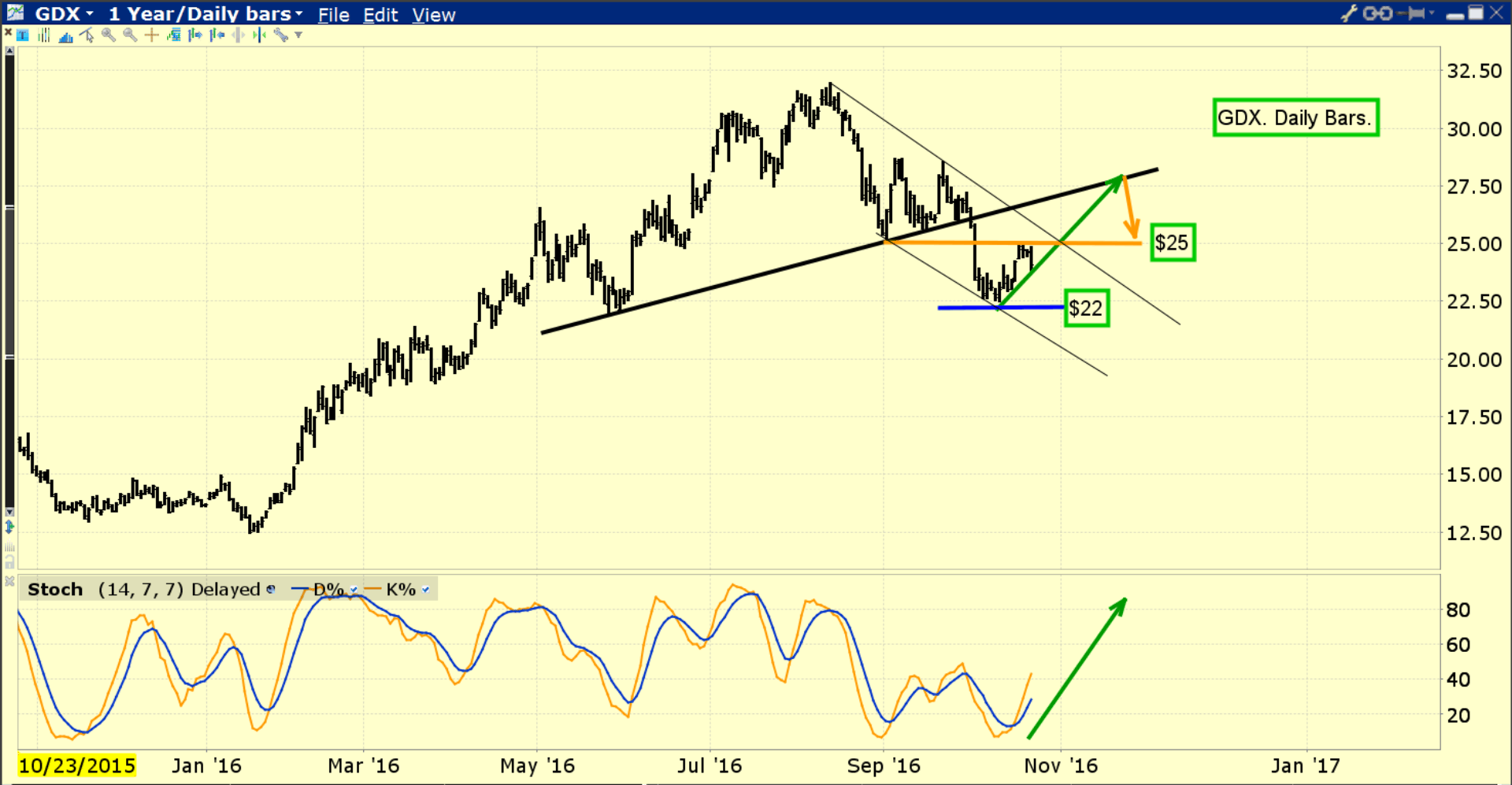

- Gold stocks, like silver, are doing a bit better than gold itself is, compared to the February highs. Please see below now. Double-click to enlarge this daily bars GDX chart. I suggested the $22 area needed to be bought, and the pullback from the $32 area did halt in my target zone. GDX is now trading in a tight range between $22 – $25. I suggested traders could book light profits at $25, and that’s worked out well. Now, I think GDX is getting ready for a rally to $27, and pullbacks to $22 – $23 should be bought again, and sold between $25 – $27 for healthy profits!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

https://www.gracelandupdates.com

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?