|

||

2014-03-10 16:48:18-04Gold has risen quite steadily since the start of the year and mining stocks have actually led the way, most gaining much more than the metal itself. But if history is our guide, this is likely just the start of bigger gains to come. This article shows the eye watering rises that some mining stocks have had in past […]read more… 2014-03-10 16:48:18-04Gold has risen quite steadily since the start of the year and mining stocks have actually led the way, most gaining much more than the metal itself. But if history is our guide, this is likely just the start of bigger gains to come. This article shows the eye watering rises that some mining stocks have had in past […]read more…

|

||

2014-03-10 17:34:40-04If you’re mulling over just when to buy gold then check this article out for sure. It crunches the numbers to show in which month the gold price is usually the weakest and shows how this is on average the best time to buy as it means a high chance of the price rising by the end […]read more… 2014-03-10 17:34:40-04If you’re mulling over just when to buy gold then check this article out for sure. It crunches the numbers to show in which month the gold price is usually the weakest and shows how this is on average the best time to buy as it means a high chance of the price rising by the end […]read more…

Capital Gains Tax on Precious Metals in New Zealand – Is There Any? |

||

2014-03-11 21:06:20-04Last week we received a question from a reader on what tax is payable upon the sale of gold and silver bullion in New Zealand. They had just been reading an old article of ours: Windfall Tax on Gold | a New Zealand Perspective (which is a separate topic of whether governments might enact a windfall profits […]read more… 2014-03-11 21:06:20-04Last week we received a question from a reader on what tax is payable upon the sale of gold and silver bullion in New Zealand. They had just been reading an old article of ours: Windfall Tax on Gold | a New Zealand Perspective (which is a separate topic of whether governments might enact a windfall profits […]read more…

|

||

2014-03-12 04:49:05-04Darryl Schoon discusses how his favourite futurist Buckminster Fuller predicted a major financial crisis but how he also predicted a much better tomorrow to follow… HOW IT WILL END The amount of debt globally has soared more than 40 percent to $100 trillion since the first signs of the financial crisis as governments borrowed to […]read more… 2014-03-12 04:49:05-04Darryl Schoon discusses how his favourite futurist Buckminster Fuller predicted a major financial crisis but how he also predicted a much better tomorrow to follow… HOW IT WILL END The amount of debt globally has soared more than 40 percent to $100 trillion since the first signs of the financial crisis as governments borrowed to […]read more… |

Clamping down on cash transactions

Last week we wrote about privacy and whether gold purchases need to be reported in New Zealand. In it we discussed the anti money laundering laws and how these might eventually affect gold and silver transactions. Well this week we noticed a story showing just how closely big brother is watching what you do with your money. A reporter learnt first hand how the new anti-money laundering laws affect cash transactions when her partner attempted to withdraw a wad of cash to pay for a replacement car at a Westpac Branch.

—–

“My partner was informed that due to new money laundering laws he would be required to fill out a form in order to be granted access to his funds. Begrudgingly he did so. He was then asked where the money came from. Mike is a patient man but I could see that his cool, calm, façade was beginning to crack. The teller, clearly embarrassed, explained that he couldn’t give him the money until he knew where it came from. “I made it selling drugs,” said Mike. The teller smiled, as did a few others in line and there were murmurs of laughter.

The form and questions seemed as ridiculous as an American customs form. Are you a terrorist? It would have to be a pretty half-hearted terrorist that would confess because a form asked him to, likewise those making money in seedy ways aren’t likely to tick that box when a bank requests it.”

—–

This is similar to an international story that was doing the rounds earlier this year, where HSBC bank in the UK was also asking similar questions but wouldn’t actually allow withdrawal of a “large” amount of cash unless they were satisfied of the reason for the withdrawal.

Although a customer backlash later forced them to change their mind.

Anyway back to New Zealand – in this case you’ll be pleased to hear the reporters partner eventually got his money out of Westpac after filling in the forms. The reporter finishes by opining:

—–

“I’m left wondering how and why it became so difficult to gain access to your own money. It seems slightly invasive that you have to declare to a stranger what exactly you’re spending your cash on, be it a new car, breast implants, on overseas trip or an exotic porn collection. Isn’t it your business and yours alone?”

—–

Yeah, if only. As with most reductions in privacy and freedom, it is usually the average guy in the street who is affected most. While the criminals will still find a way around the rules and regulations.

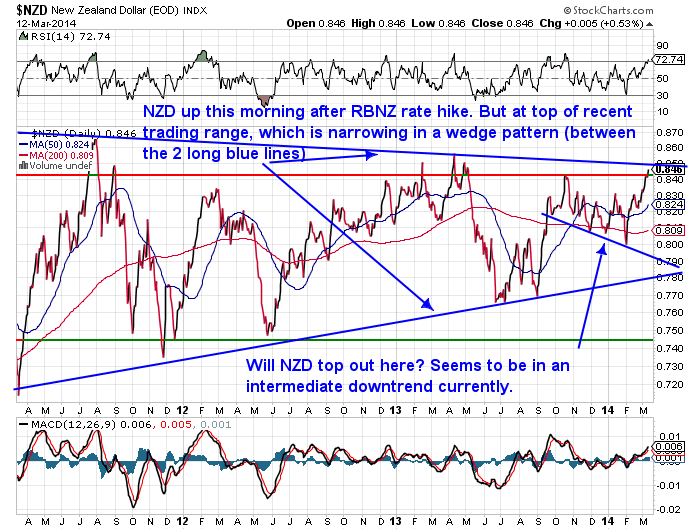

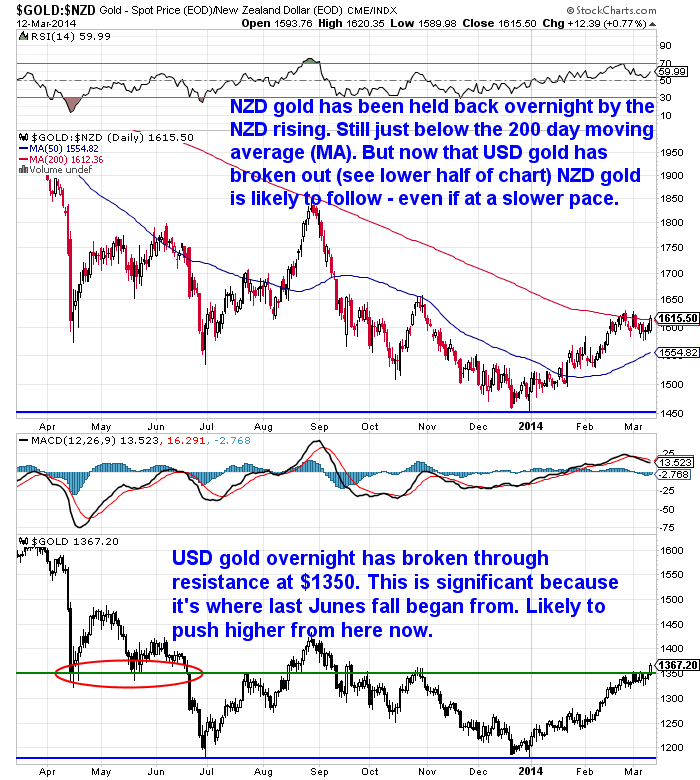

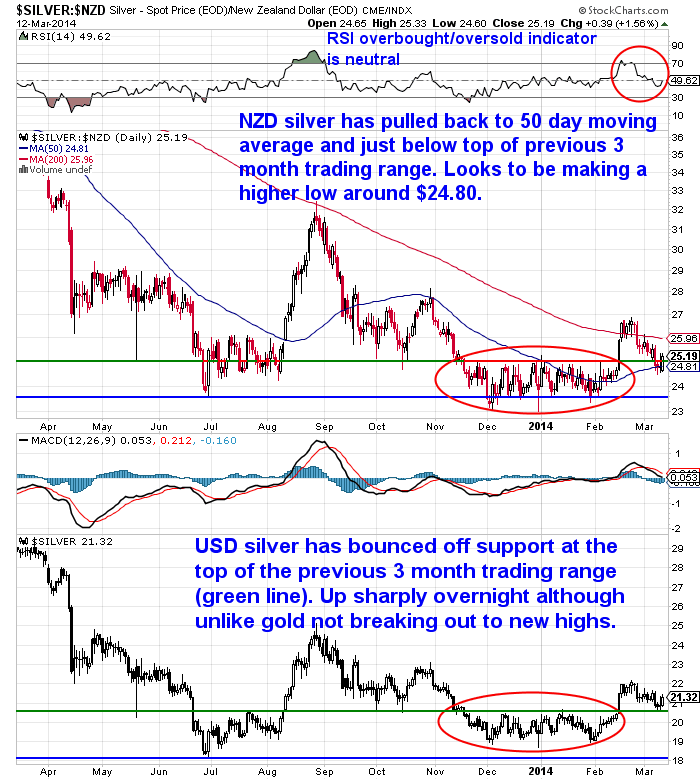

As we said last week this could be a good time to buy gold and silver while privacy still remains for these transactions – if that is of concern to you. Plus with the kiwi dollar close to record highs the precious metals make a good insurance policy against dollar weakness further down the track. Get in touch if you’d like a quote.

LATE UPDATE: The NZD has just risen a little further although so has the gold price so prices are not too different from below.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

| Today’s Spot Prices |

Spot GoldNZ $ 1591 / oz

US $ 1337.55 / oz

Spot SilverNZ $ 25.20 / oz

NZ $ 810.35 / kgUS $ 21.19 / oz

US $ 681.26 / kg

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

$846.85

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

To demystify the concept of protecting and increasing ones wealth

through owning gold and silver in the current turbulent economic

environment.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

| We look forward to hearing from you soon. Have a golden week! |

David (and Glenn)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

|

2014-03-05 22:46:45-05Gold Survival Gold Article Updates March 6,2014 This Week: NZ dollar looking toppy? Bigger news than the Ukraine situation? Privacy: Do purchases of gold and silver in NZ have to be reported? Looking first at prices and charts – NZD gold is down $11.15 per ounce from a week ago or 0.70% to $1591. It […]

2014-03-05 22:46:45-05Gold Survival Gold Article Updates March 6,2014 This Week: NZ dollar looking toppy? Bigger news than the Ukraine situation? Privacy: Do purchases of gold and silver in NZ have to be reported? Looking first at prices and charts – NZD gold is down $11.15 per ounce from a week ago or 0.70% to $1591. It […]

Pingback: Reader Question: “Why would a fall in the NZ dollar be a negative?” | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Currency Charts Indicate an Asia-Pacific Slow Down