Gold Survival Gold Article Updates:

22 January 2015

This Week:

- Gold in NZD breaks out

- Silver getting close

- NZD falling again

- What to do now if thinking of buying gold & silver?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1714.00 | +$118.00 | +7.3% |

| USD Gold | $1295.61 | +$64.46 | +5.2% |

| NZD Silver | $24.11 | +$2.21 | +10.1% |

| USD Silver | $18.22 | +$1.33 | +7.8% |

Massive moves up in gold and silver this week. Check out the percentages in the table above.

7.3% in NZD gold and 10.1% for NZD silver since last Thursday. These moves have come with little fanfare which is making us a little more confident with our new year guesses that the lows for gold and silver were put in last year.

Gold

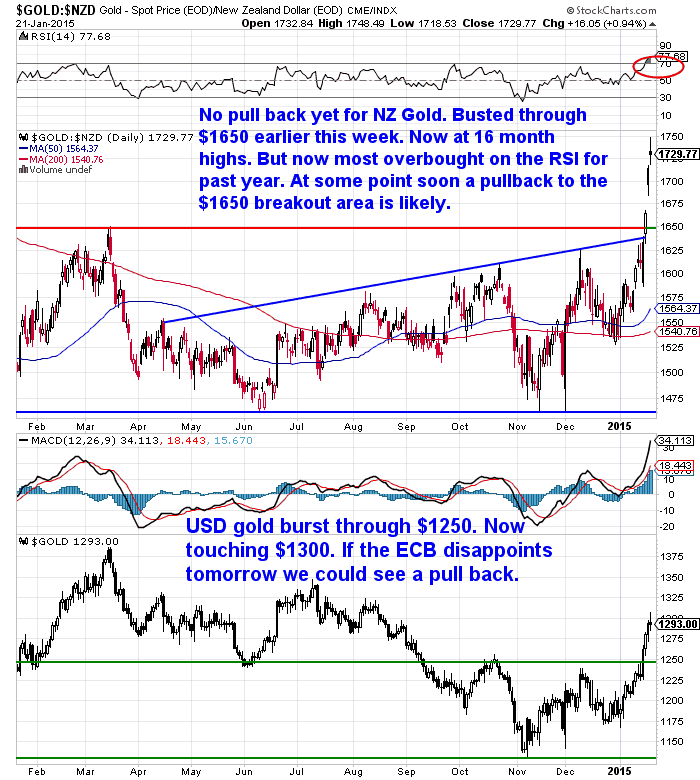

Check out the chart below to see just how significant the move up in gold was. NZD gold is suddenly at a 16 month high and has broken well above resistance at $1650 from last March.

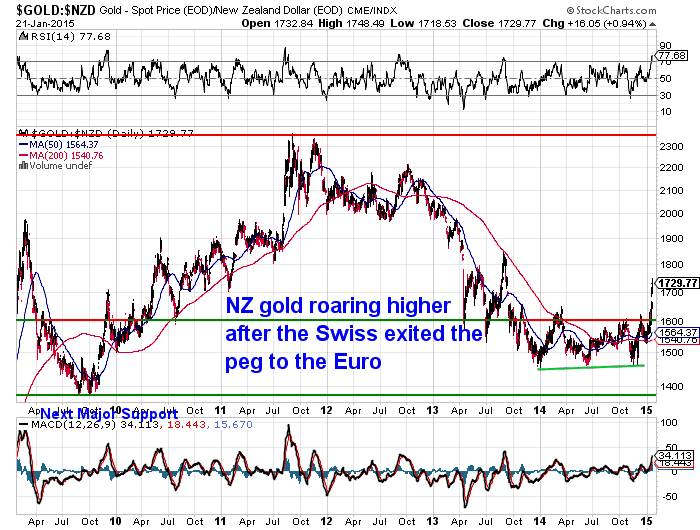

But there is still plenty of room to move higher now too. In the longer term chart below we can see the next level to break through will be around $1950. Which was where the massive plunge back in 2013 started from. But before then it wouldn’t be surprising to see a pullback down to at least the breakout level at $1650 at some point soon now.

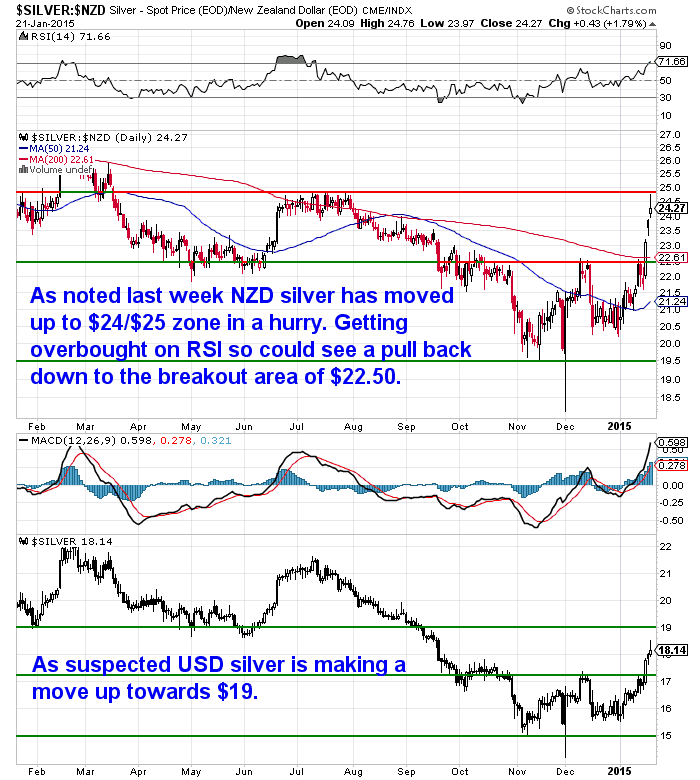

Silver

NZD silver has seen a parabolic rise this week too. We mentioned last week that we could see a test of the $24/$25 level soon. It has zoomed up close to the NZ$25 level in just a few days since then. Like gold it too is looking overbought and it too is due a pull back to perhaps the $24.50 level.

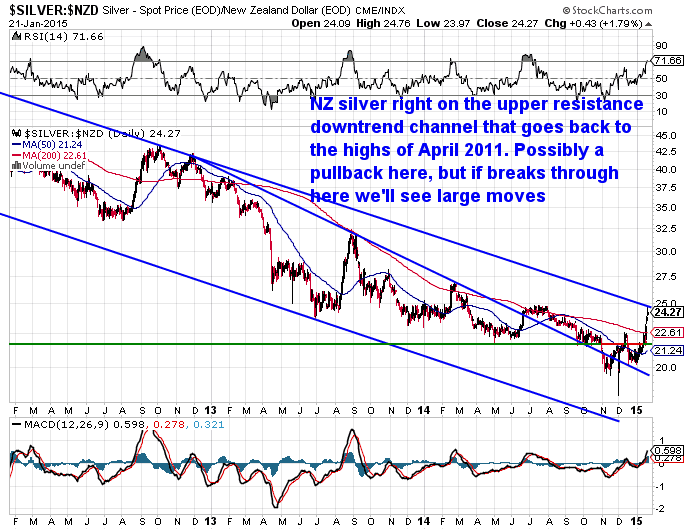

But silver too has a fair bit of blue sky ahead of it yet. However the longer term 3 year chart below shows that – unlike gold – silver still has yet to break out of the multi year downtrend it has been in. But a move above the $25 area soon would see this occur.

So why the big moves up in precious metals now?

Who knows for sure but a few guesses could include:

- The European Central Bank announcing its first “official” money printing

- Swiss Euro peg ending

- Low NZ inflation numbers

Lets look at each of these more closely…

The European Central Bank announcing its first “official” money printing

It looks like they’ve leaked their intentions already care of a Bloomberg article out overnight announcing that the “ECB Seeks to Inject Up to 1.1 Trillion Euros Into Economy in Deflation Fight“. So the ECB looks likely to print 50 billion Euros a month for the next couple of years.

Of course quantitative easing or money printing doesn’t really work anyway.

Greg Canavan of the Daily Reckoning Australia sums it up well saying the whole point of QE being to buy bonds and push rates down is pointless. Why? Because interest rates in the Eurozone are already at record lows…

—–

–“The point to note here is that despite record low interest rates, the European economy continues to remain weak. Record low borrowing costs haven’t helped at all.

–What is a round of QE going to achieve? I mean, really?

–All it does is allows banks to sell their most risky (or unwanted) government bonds to the central bank, and use the money they get in return to speculate on other assets.

–So don’t believe any of this nonsense about QE preventing deflation and reviving the economy. QE is a smokescreen to fund governments and help the banks make trading profits.”

—–

Although it does look like an ECB Q.E. might well help the gold price. This was from an National Inflation Association email back in September:

—–

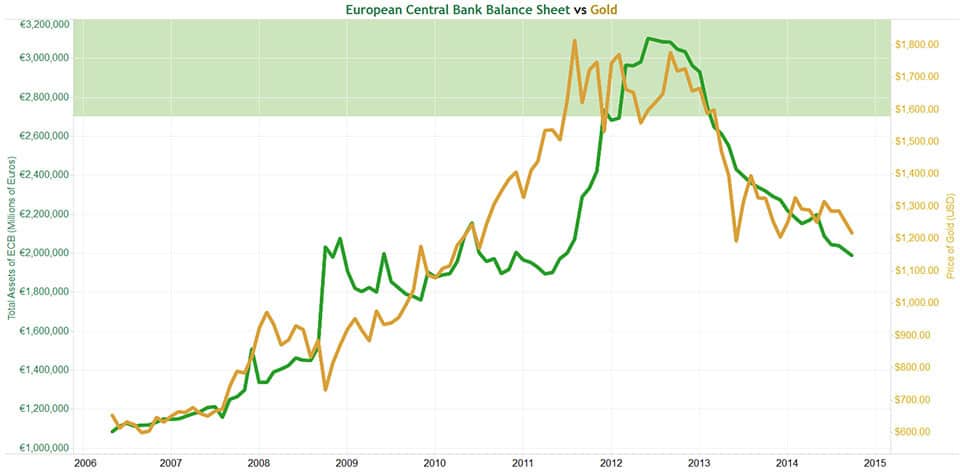

“For the last eight years, the price of gold has closely followed the balance sheet of the European Central Bank (ECB) – not the Federal Reserve. While the ECB’s balance sheet was expanding from 2006 through 2012, with its total assets increasing by 186% from €1.084 trillion to a medium-term peak of €3.102 trillion – gold simultaneously increased by 190% from $653 per oz to a peak of $1,895 per oz.

Over the last 2-3 years, gold has dipped 36% from its medium-term peak – to its current price of $1,217 per oz. During the same exact time period, the ECB’s total balance sheet assets have also declined by 36%! Currently, the ECB’s balance sheet contains total assets of €1.988 trillion – after declining by€1.114 trillion in exactly 27 months!

The ECB’s balance sheet has been rapidly shrinking due to European Banks repaying the emergency loans they received from the ECB’s two Long-Term Refinancing Operations. However, earlier this month – ECB President Mario Draghi announced brand new quantitative easing measures that he says will boost the ECB’s balance sheet assets back up to approximately €3 trillion.

Take a look at the chart below (especially the shaded green area). A return to €2.7-€3.2 trillion in assets on the ECB’s balance sheet will in NIA’s opinion cause gold prices to simultaneously rise back to $1,600-$1,900 per oz!”

—–

2. Swiss Euro Peg Ending

You’d have certainly heard about the Swiss Central Bank suddenly ending their peg to the Euro last week. In fact this is probably linked closely to the pending ECB money printing announcement due tonight. The Swiss saw the writing on the wall and how much more it was going to cost them to keep the franc artificially low and so threw in the towel. As we saw written somewhere:

Why tie yourself to someone about to jump down a bottomless hole?

To try and somewhat negate the rise that will now come in the Swiss Franc, the Swiss also announced even more negative interest rates – down to -0.75%. Put another way this is the crazy situation where you pay the government in order to lend them your money!

The upshot of this is, that it’s now cheaper to hold gold or silver than it is to have Swiss Francs in your account.

It will be interesting to see how long it takes a decent number of people to cotton on to this. Maybe some of the big money already has, given how much gold and silver jumped on the news.

This jump also came without a major move in the quantity of US gold futures or options outstanding according to BullionVaults Adrian Ash. But it did…

—–

“see a huge jump in the size of the giant SPDR Gold Trust (NYSEArca:GLD).

Thursday saw the GLD need an extra 10 tonnes to back its shares. The fastest growth since August 2011, that was then beaten on Friday with an inflow of nearly 14 tonnes.

Okay, so the GLD’s total holdings have now recovered less than 4% from this New Year’s fresh 6-year lows. Down at 704 tonnes before last week’s jump, the GLD’s holdings had almost halved by weight from the peak of end-2012.

But the huge inflows of Thursday and Friday…sparked by the Swiss decision…point to a major blip, if not a change of direction.

Together worth almost $1 billion, these inflows came on rising prices. What’s more, the size and speed says big-money managers, not ‘retail’ investors, led this demand.

And as we’ve noted before, it really is bigger investors…so-called ‘real money’ managers…who move the gold price long term.”

—–

An interesting point was that the 6 September 2011 was the day the Swiss announced their peg to the Euro at 1.20 Swiss Francs. Strangely this was also the day gold reached its all time nominal high of US$1895 per oz.

Side Note: The massive move in the Swiss Franc has not left NZ untouched either, with a local FX Broker going bust as a result of losses from clients being passed on to them.

Although it seems they may have had insufficient capital already and so this may have been the straw (albeit a pretty heavy straw) that broke the camels back.

A close to home reminder that physical gold and silver are the only financial assets that don’t have a counter party risk.

3. Low NZ inflation numbers

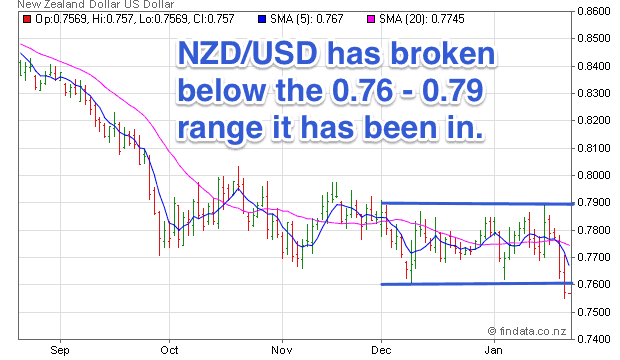

You might think low inflation should mean lower gold prices if you listened to the mainstream. However it’s likely the annual NZ inflation rate of 0.8% announced caused the NZ dollar to drop.

Why?

Because the Bank economists are coming around to our way of thinking now. That there is now more chance of a rate cut than a rate rise. So hence a selling of NZ dollars by overseas holders.

This has pushed the dollar down below the range it has traded in lately.

In turn the weaker dollar has also further boosted the local prices of gold and silver as clearly seen in the earlier charts.

What to do now if thinking of buying gold & silver?

Here’s our (non) advice.

We wonder if the ECB money printing announcement could be a case of the old trading adage of “Buy the rumour – sell the fact”.

That is, this move might already have been built into the prices and so we could see a fall in them as soon as tomorrow.

However we are more confident that this could be a correction that is worth buying. The currency wars are heating up. The recent rise of the US dollar means many others are keen to weaken their currency now. The race to the bottom is looking for a new leader. Odds favour gold liking this.

So keep a close eye on the price over the next few days. Or sign up to our Daily Price Alert and we’ll do it for you. We also offer a Price Watch Service. Just email us the price you want to buy at and we’ll get back to you with a quote when it does.

Free delivery anywhere in New Zealand and Australia

Todays price for a box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured is $14,230 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices

Spot Gold |

|

|

NZ $ 1714 / oz |

US $ 1295.61 / oz |

| Spot Silver | |

|

NZ $ 24.11 / oz NZ $ 775 / kg |

US $ 18.22 / oz US $ 585.82 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

|

We look forward to hearing from you soon. Have a golden week! David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

|

The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2013 Gold Survival Guide. All Rights Reserved. |

Pingback: RBNZ takes a leaf out of the Fed’s book - Gold Prices | Gold Investing Guide