This Week:

- Net Migration Falling – Could This Help Tip NZ into Recession?

- Paper Gold vs Physical Gold – What Should You Buy?

- Gold Sentiment So Bad, It’s Good?

Prices and Charts

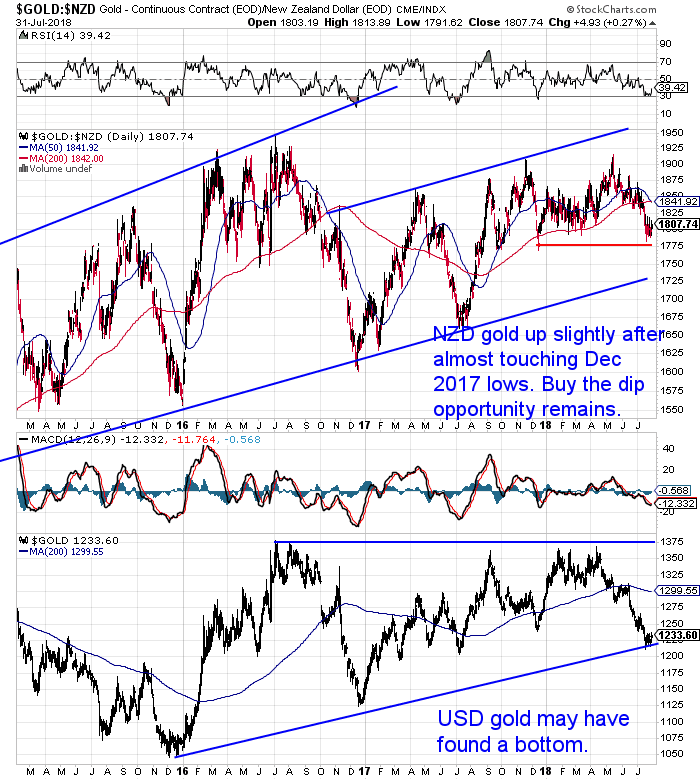

NZD Gold Holding Above 2018 Lows

NZD gold was down 0.22% from a week ago. But still remains above the 2018 lows and the low from late 2017 (see the red horizontal line in the chart below).

Gold has moved out of the oversold area. But today you can still buy at close to the lowest price since late last year.

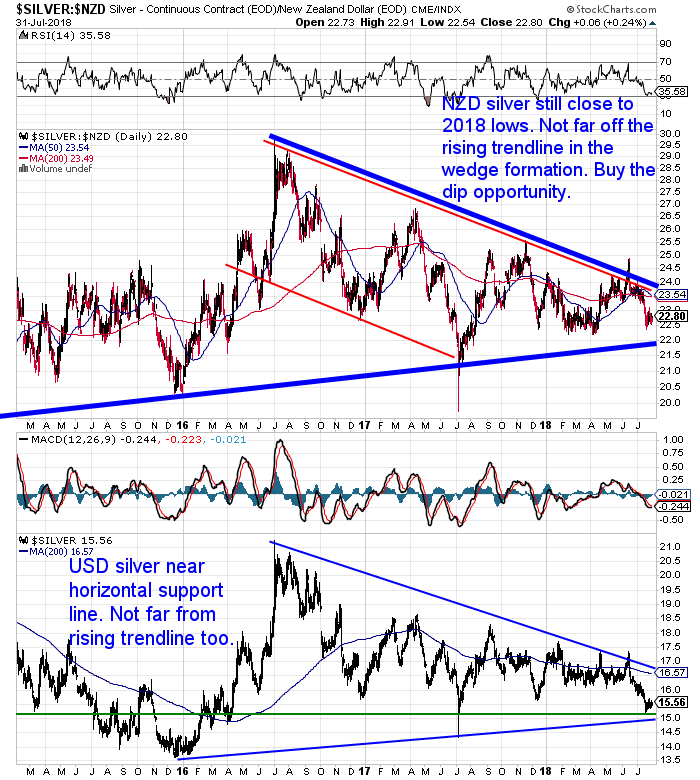

Meanwhile NZD silver was up 0.22% from last week. Also not far above 2018 lows and still not far above the rising trendline. The BTD (buy the dip) opportunity is still presenting itself. We could still see a return to the blue uptrend line, but it is by no means guaranteed.

So right now still presents an excellent buying opportunity.

Kiwi Dollar Still Locked in Downtrend Longer Term

The Kiwi dollar edged slightly higher this week. But it still looks like the 50 day moving average line may prove difficult to breach. Longer term the NZ dollar remains in a downtrend.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Paper Gold vs Physical Gold – What Should You Buy?

The charts are saying now is likely a pretty good place to buy gold. But there are many different types of gold. And many different ways to get exposure to the gold price.

What type of gold is best for you likely depends upon your reason for buying.

Check out this comprehensive run down of paper gold versus physical gold.

Net Migration Falling – Could This Help Tip NZ into Recession?

Currently the New Zealand economy appears pretty steady. But as we reported a couple of weeks ago, there are some numbers coming out that point to possible bumpier times ahead.

Also see: NZ Was Spared in the Last Crisis, But Could Be At the Forefront of the Next One

This week the latest migration numbers came out and showed annual net migration at its lowest since November 2015.

Some may cheer this result – after all lower immigration was one of the central campaign policies of the labour government.

But see what numbers we’ve found that show falling migration numbers may not be so good for the New Zealand economy…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Largest N.Z. Trade Deficit for a June Year in a Decade

There was another number printed this week for the New Zealand economy that also wasn’t so great.

“The value of annual imports rose $374 million more than exports, pushing the June 2018 annual trade deficit to $4.0 billion, Stats NZ said today. This is the largest trade deficit for a June year in a decade.”

Source.

A trade deficit simply means we import more than we export. $4.0 billion more to be exact.

Specifically New Zealand imported $59.6 billion worth of goods, up $6.0 billion from the June 2017 year. While we exported $55.5 billion worth of goods, up $5.6 billion from the June 2017 year.

In the past the trade deficit has been wider, but this number appears to be going in the wrong direction.

With a global trade war seemingly in the early stages, New Zealand exports may get worse instead of rising as they have been lately. So this would blow the trade deficit out even further.

More imports than exports mean we borrow more to fund the difference. Some argue this doesn’t matter. But in the long run we’d say it’s better to sell more stuff than you buy isn’t it?

Gold Sentiment So Bad, It’s Good?

Gold futures positioning is once again pointing to a likely bottom in gold. Bill Baruch, President of Blue Line Futures, comments:

“As expected, the herd has chased gold‘s move lower. Poor market sentiment right now leads me to wonder, if everyone has gotten out of gold, who’s left to sell?

According to the CFTC’s CoT data, managed money short positions have outweighed long positions for four weeks now, amounting to a near-record short position. Traditionally, it’s the opposite; gold sits in a net long position, meaning managed money longs outnumber shorts. We’ve only seen this kind of pattern twice, and both times, gold has rallied.

The first time was in July 2015. Gold bottomed within two weeks, and rallied 11 percent. The second such time was in November 2015, and gold bottomed within three weeks before ultimately rallying 32 percent.

This signals that gold is creating a bottom near the psychological $1,200 mark. Goldwas trading at $1,221.50 per ounce on Monday.”

Source.

Signs are pointing to the New Zealand economy slowing. Does this mean it’s the end of the world? No, quite likely not. But as Alistair Macleod pointed out this week

“We cannot be sure what form the next credit crisis will take, but we can be certain it will happen, because it is a cyclical event created by central bank monetary policy. Once that fundamental point is grasped, it follows that the severity of the crisis is proportional to the monetary distortions that precede it. The next credit crisis will almost certainly dwarf anything seen so far in the fiat currency era.

Following the next credit crisis, the suppression of the gold price by expanding the quantity of paper derivatives will become less effective at controlling the price when the purchasing power of the dollar deteriorates under the sheer weight of its increased quantity.

The price of gold can be expected to rise significantly higher when measured against fiat currencies. How much depends on the degree and the rate at which fiat currencies lose purchasing power.”

Source.

You need your financial insurance before trouble actually appears. With prices dipping recently now is a good time to take out a “policy”.

Check out the deals going currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Only Only One Left in Stock – Learn More NOW….

—–

|