|

Gold Survival Gold Article Updates:

Nov. 6, 2014

This Week:

- Gold and Silver Plunge Further

- Why the Fall?

- Silver Shortages?

- Greenspan a “Good Guy”?

We’ve got 2 videos and an articles on the website this week, so scroll down to check all them out.

Gold and Silver Plunge Further

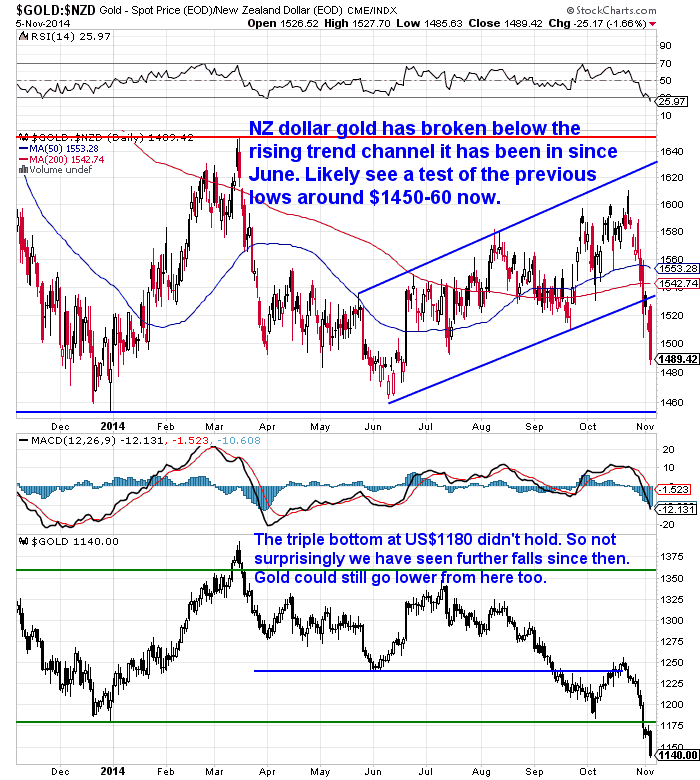

We have seen further hefty falls in precious metals since last week. The triple bottom in USD gold at $1180 did not hold. Gold in US dollars has fallen $69.20 or 5.7% to US$1143.30 from a week ago.

Gold in NZ dollars has not fared all that much better. It is down $76.08 or 4.8% to NZ$1480.

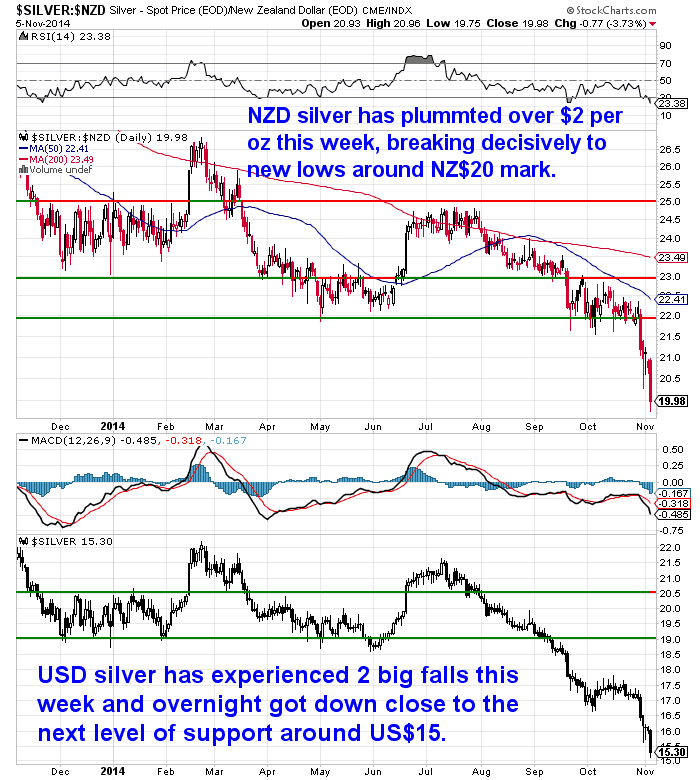

Meanwhile silver in US dollars has really taken a beating. It has plummeted $1.76 to $15.35. A massive fall of 10.28% in one week.

Silver in NZ dollars is down $2.08 or 9.4% to $19.88.

The Kiwi dollar has weakened slightly to 0.7725 from 0.7792 last week. Hence the slightly smaller falls in the local precious metals prices compared to the US.

Why the Fall?

The mainstream argument has been the end of QE. Although it hasn’t actually ended. The Daily Bell notes:

—–

“In any event, the cessation of QE is not really accurate.

We are being misled about the end of this program, as in so many other ways.

Here, From Sprout Money via ZeroHedge a few days ago:

But wait, let’s not get carried away by the so-called ‘End of Quantitative Easing’ and have a closer look at this MBS purchase program. The Fed’s announcement to stop purchasing additional Mortgage-Backed Securities was just talking about NEW investments paid for by freshly printed money. It is the central bank’s intention to continue to reinvest the returns on its $1.7 trillion dollar Mortgage-Backed Securities portfolio back in the market in the foreseeable future.

… The real ‘credibility test’ for the Federal Reserve will no longer be in the official Quantitative Easing numbers but in the size of the balance sheet. We dare to bet the balance sheet of the Federal Reserve won’t shrink at all in the near future, and we expect the total balance sheet to remain at extremely elevated levels for the foreseeable future.

The official Quantitative Easing has ended, but the Federal Reserve isn’t stopping its interventions as the MBS purchases will continue at the same pace. It only wants you to believe it did.

The Fed really CAN’T stop QE because markets would surely be ruined and the ultimate goal of inflating and then deflating markets dramatically would be put at risk.”

Source.

—–

Nonetheless the end of QE remains the narrative being used for the fall. However there is a more likely explanation for why the price of gold and silver has been falling through the floor in the past few days. Via Zerohedge…

—–

Because Nothing Says “Best Execution” Like Dumping $1.5B in Gold Futures at 0030 ET

“For the 5th day in a row, “someone” has decided that 0030ET would be an appropriate time (assuming the ‘seller’ is an investor who prefers best execution rather than the standard non-economically-rational share-repurchaser in America) to be dumping large amounts of precious metals positions via the futures market. Tonight, with over 13,000 contracts being flushed through Gold – amounting to over $1.5 billion notional, gold prices tumbled $20 to $1151 (its lowest level since April 2010). Silver is well through $16 and back at Feb 2010 lows. The USDollar is also surging.”

“The timing of the dump is right as Japanese trading breaks for lunch”

—–

So yet again we see what can only be described as “not for profit” sales in the futures markets. So for now the paper tail continues to wag the physical dog. This will change eventually but who knows when. However silver shorts in the futures markets are at extreme levels, so this is a very difficult time to predict. If they are forced to cover we could see rapid moves up in price.

Meanwhile Goldman Sachs are sticking to their predictions of gold reaching US$1050, which is actually not that far off currently. So there could be further downside ahead for silver too, if gold were to head to those levels.

As we noted way back in September 2011 (Just How Low Could Gold Fall?) as gold was peaking, there is a precedent for gold to fall 50% from it’s peak as happened in the 1970’s before it eventaully powered to new and much greater highs.

Also after the big fall last April we wrote that:

—–

“a real bottom is where no one wants to buy. So this would point to the fact that we are yet to see the bottom in gold and silver as all this physical buying means there are still more buyers than sellers. Whereas when there are no buyers the bottom is likely then in. It does seem to us that maybe the rise following the plunge has been a bit too far too fast.”

—–

That was certainly the case as gold in NZ dollars was at NZ$1735, so has since dropped another $250. The chart we drew back then (see below) noted a couple of possible support levels. One being around NZ$1380 which we are only $100 per oz above now. The next being at $1175, a 50% fall from the high of NZ$2350.

Click to Enlarge

So who knows where to now?

The odds favour further falls ahead now that the previous support at US$1180 was broken. However the counter to this is that it seems to be commonly expected that gold will now fall to somewhere in the vicinity of US$1050. So perhaps this expectation is getting somewhat all pervading?

Silver Shortages?

We’ve just received the following notice on supply of US silver eagles and Canadian Silver Maples from a supplier:

—–

“US Mint has SOLD OUT of 2014 Silver Eagles

RCM has SOLD OUT of 2014 Silver Maples

We are suspending Silver Maple Sales for the next few Days/Weeks until we have more information.

We are suspending Silver Eagles Sales for a FEW HOURS until we get the more details. We will advise you soon…..however expect a BIG increase in the premium….so raise your prices immediately or freeze sales as Eagles are going to be scarce.

As you know markets are moving fast. Please be advised of difficult delays and availability in the market. Please educate your customers of what’s going on as this demand is causing shortages all over the place. (Other mints are reporting delays of more than 1 month)”

So while the paper price of silver has dropped sharply, it’s likely the price of these coins won’t be dropping to match it.”

—–

While talk online might be that there is no silver available that is not strictly accurate. The cause of these supply shortages are more likely to be the lack of silver blanks that the coins are minted out of, rather than a lack of actual metal. Most national mints have cranked up their capacity after the run of 2013. But they are still restricted by the availability of the silver blanks.

With regard to supply of silver here in New Zealand there are mixed messages. One suppliers delivery has extended out into the New Year. This is likely partly driven by demand for silver fabrication from Jewellers in the lead up to Christmas. However another local supplier has much shorter lead times of only days rather than weeks. But this could well change given demand globally seems to have picked up for silver, although not nearly as much as it did after the plunge in April of last year.

So we will likely see premiums above spot rising much like we did in 2008 and in April/May last year. Nonetheless silver is available despite what you may read – for now at least anyway.

Greenspan a “Good Guy”?

This recent interview with Alan Greenspan featuring Marc Faber and Porter Stansberry is quite enlightening.

It does offer some back up to Bix Weirs long held theory that Greenspan is actually a “good guy” who was working inside to bring the system down.

A new post from Bix summarises his position quite well and is worth a read in our opinion:

—–

“I am amazed by how many people still have no idea that Alan Greenspan was acting out a secret plan to rig the markets and ruin the US Dollar thus forcing a return the US onto a Gold Standard and the destruction of the banking cabal.

I’ve proven it five ways til Sunday over the past 7 years but still only a handful of people actually get it and even fewer believe it. It’s amazing to me that the PROGRAMMING of the “Central Banker = Bad Guy” meme is so ingrained in the minds of the Sheeple that even when shown the truth point blank they block out any type of understanding of the what is really going on.

I guess I should blame myself….if I explained it better maybe the people could finally wake up and we can make some headway in the battle to regain our freedom.

So here’s my latest attempt at show the Sheeple what should be obvious by now…

Bix Weir Interview on Greenspan’s “Golden Agenda“

—–

So Greenspan a good guy? Seems hard to believe but stranger things have happened so we wouldn’t count it out especially on the back of what he has had to say lately about gold.

Also hard to believe is that gold and silver will even stop falling!

As noted earlier there is a precedent for a fall of this size. And while it may hurt for those who bought at higher levels, these lower prices offer a chance to average down. Or for newcomers a very attractive entry point.

A monster box of 500 Canadian Silver Maple 1oz coins again makes good buying today at $12270 fully insured and delivered to your door.

Scroll down for more details on this and other products.

Pricing and supply is changing rapidly so get in touch for the latest pricing on local or imported gold and silver.

|

Pingback: Greenspan: Run Away from the Economic Tsunami - Gold Prices | Gold Investing Guide