|

Gold Survival Gold Article Updates

Aug 27, 2014

This Week:

- “Golden cross” for NZD gold and silver has occurred

- Hard to Bet Against Our Favourite Newsletter Writer

- Holding up a Mirror to the US Economy

- Prof. Antal Fekete: The Interest

Just a slight fall for gold this week.

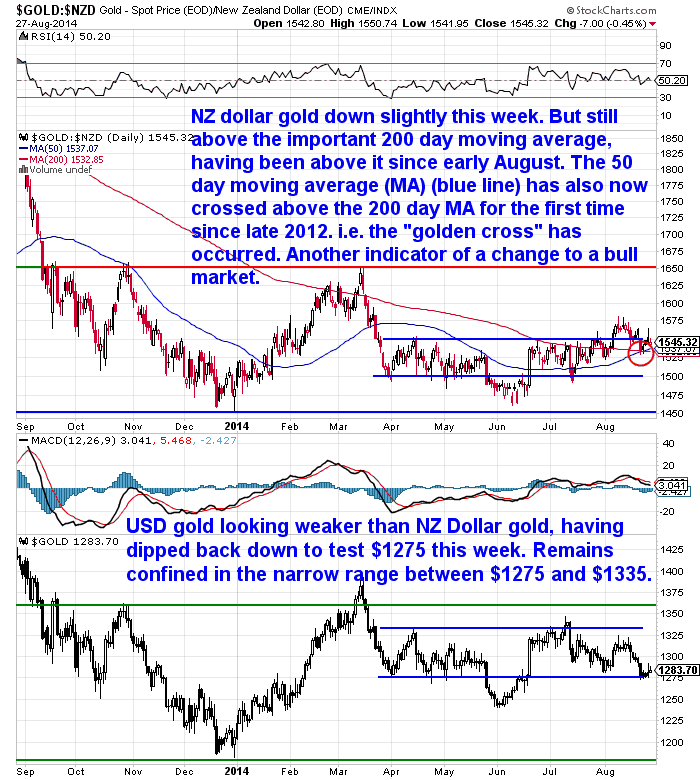

Gold in NZ Dollars is down $10.99 per ounce or 0.71% to $1534.01. While in US Dollars it is down US$9.19 per ounce to US$1283.20. This is a fall of 0.71% exactly the same as NZD gold, reflecting no change in the NZD/USD exchange rate from a week ago.

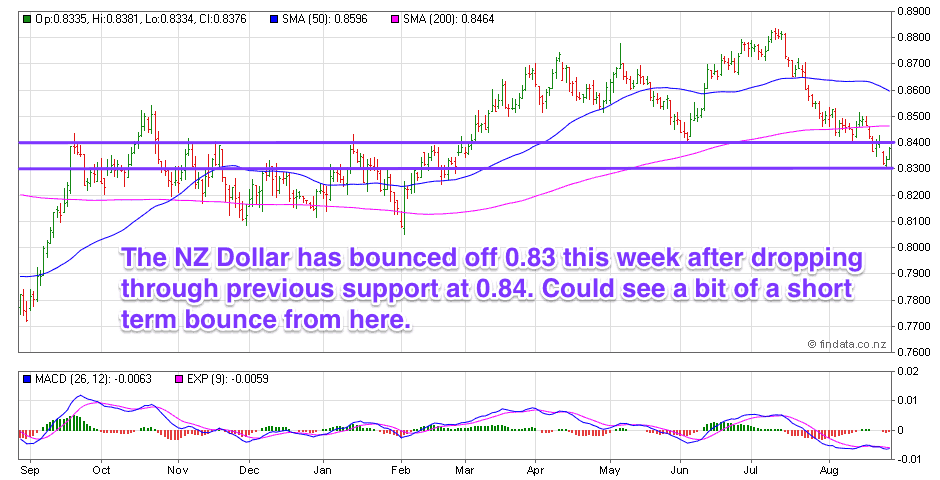

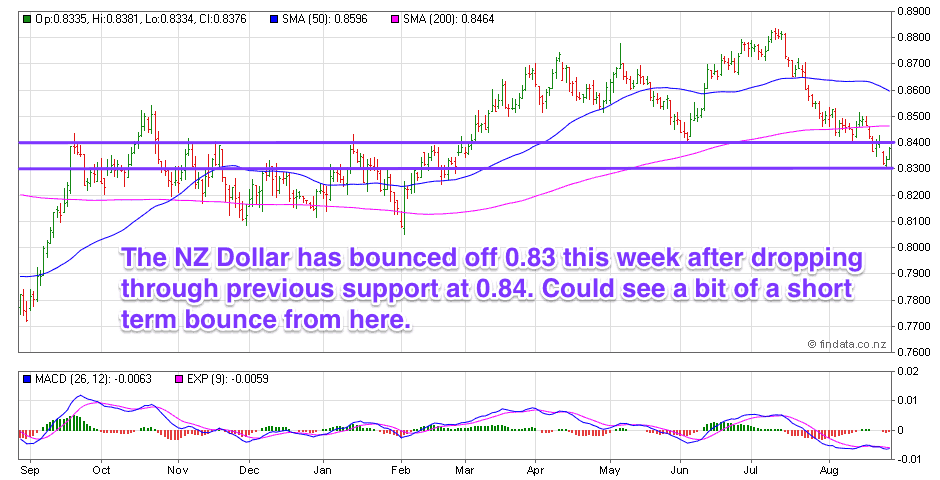

The Kiwi dollar did dip lower during the week.

Though but has since bounced back slightly. So we could see more of a bounce from here in the short term. But it does look to have broken below recent support levels at 0.84.

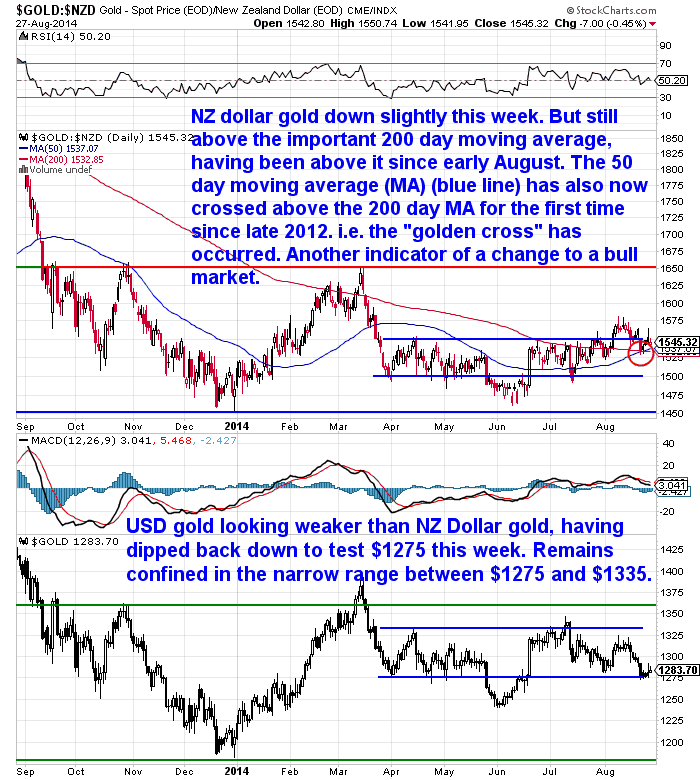

Technically NZD gold continues to look positive.

As can be seen in the chart below the price remains above the 200 day moving average as it has been since early August. On top of this the 50 day moving average has now crossed above the 200 day moving average. This is what is known as the “golden cross” and is a bullish indicator.

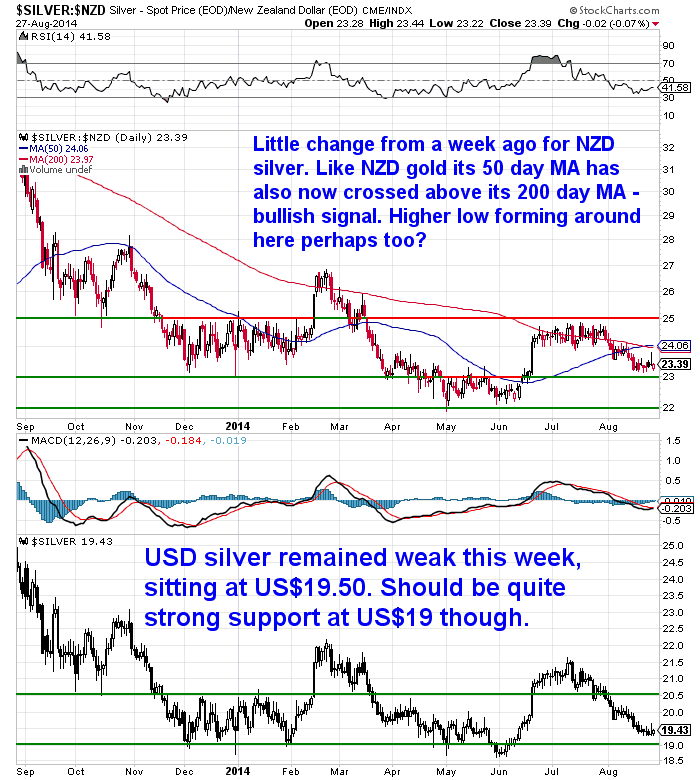

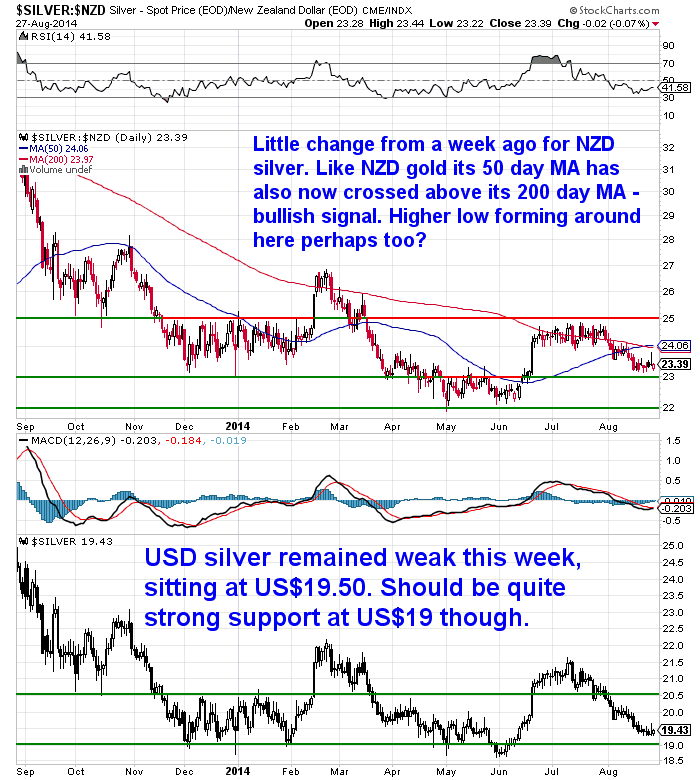

Meanwhile silver in NZ Dollars hardly budged from last week.

It’s down just 2 cents or 0.08% to $23.31. While in US Dollars it’s down 1 cent per ounce or 0.05% to US$19.50.

Like NZD gold, the “golden cross” has also occurred for silver in NZ dollars. Although unlike NZD gold, NZD silver remains below its 200 day MA.

As we’ve said recently we’d want to see both metals get above their respective March and February highs before we get too excited. But the weakening NZ dollar has certainly helped cause a few technical indicators to turn positive.

But the weakening NZ dollar has certainly helped cause a few technical indicators to turn positive.

One of which we discussed in this article last week:

Another Gold Indicator Flashing Buy – 80% Gains Ahead?

Reader Question

We received a thoughtful email last week in reply to this article from a reader:

—–

Hi,

I just read the article below in the MoneyMorning newsletter which is pretty contrary to your article “Another Gold Indicator Flashing Buy – 80% Gains Ahead?” What are your thoughts on it? How likely is a fall to $931? When I read articles on a short term fall or rise in gold it makes sense both ways which is very confusing. I know in the end everything is possible and nobody can has a glass ball. But then why should we bother with technicals and analysis at all…?

Thanks and regards,

C

Version 2.0: Gold Heading to ‘Fire Sale’ Prices

Jason Stevenson, Resources Analyst, Diggers and Drillers

I like gold. But there’s a time to buy and a time to sell.

Last week, I showed you the first part of my analysis of why gold is going to US$931 dollars per ounce next year. If you didn’t get to see it, you can view it here. This week, I’m going to back up my claim with more analysis and another chart.

One reason gold will fall is due to the bullish stock market run. Despite the mainstream media calling the stock market a ‘bubble’, this rally doesn’t look anywhere near the top…far too many people remain bearish and interest rates are still too low.

There is a clear thirst for yield out there, pushing more and more people into the stock market. This should result in the stock market hitting new highs next year.

This chase for yield will likely mean a sell-off in gold. After all, gold doesn’t offer any yield. At US$931, gold will be trading at a ‘fire sale’ price and the mainstream media will no doubt go crazy. Especially when the stock market is hitting new all-time highs.

50% corrections are typical in any financial market. It happened in the US housing market during the 2008/09 financial meltdown. The stock market felt similar pain. In fact gold fell 50% between 1974-1976. This sort of price action isn’t unusual.

After falling from US$1,920 per ounce at the end of 2011, US$931 would represent roughly the 50% correction level. In this case, US$931 would be a great buying opportunity.

Read more…

—–

Here’s our reply…

—–

Hi C,

I read Part 1 of this a week or so ago myself actually.

All makes good sense what he says. However just because the stock market keeps moving higher (which I agree is likely – at least for a while longer yet anyway) doesn’t guarantee that gold will have to fall. Gold could actually rise in tandem with stocks just as it did in the mid 2000’s. So I’m not sure this is such a great argument on it’s own.

As for the technicals of fibonacci etc. As you point out- with technicals you can make an argument either way most of the time.

Personally I feel gold is pretty hated right now so would be surprised to see it fall that far – even though there is a precedent in the mid 70’s for such a 50% fall.

I only look at the technicals in combination with other fundamental and sentiment indicators. And I think the negative sentiment is probably the key factor currently. Hard to see gold getting too much more hated than it already is. There is very little interest from anyone in buying. We are getting very few requests for quotes even. Of course never say never and as you put it no one has a crystal ball.

But if you’re looking at buying then you could consider breaking your purchase up into a few “chunks” and grabbing some now and keeping some up your sleeve just in case such an eventuality occurred.

If I had to bet on it I would say we are close to a bottom already. But that is just my opinion for what it’s worth.

Thanks for the question though.

Regards

Glenn.

—–

Hard to Bet Against Our Favourite Newsletter Writer

Interestingly our favourite newsletter writer Chris Weber issued a gold shares inverse fund as a hedge against a short term fall in gold and its related miners this past week. He thought there was too much bullishness around about gold and the miners currently.

We’d not want to go against Chris as he has a knack for timing, particularly major turns – like the bottom in gold at the end of last year. However as we said to our reader above, to us the sentiment towards gold seems terrible currently. There are just no buyers. So maybe there aren’t enough buyers to push gold too much higher but there might not be enough sellers to push it too much lower either? Perhaps we might stay in more of this sideways action for a while yet?

Speculative Silver Traders

Also of note is that with the price of silver down currently speculative traders in US futures contracts are turning bearish on silver again. You might know that this group of traders has a knack for being wrong at the extremes. At the last such extreme back in June they got it horribly wrong when silver then rose 14% in the next month and they piled onto the other side of the trade.

So our guess would be that if there is some downside in gold and silver from here it shouldn’t be too far. Of course as we said to our reader above, never say never!

If you’re looking at buying gold or silver these prices should be good in the long run, but for peace of mind it makes sense to keep some funds on hand just in case there was a further fall.

Free “Q&A” session

Given it’s quiet and we have some spare time we’ll offer four 15 minute Q&A sessions to the first 4 people to reply to this email. So you can have both of us on the phone for 15 minutes to answer any gold or silver questions you might have. Perfect for anyone who is new to the sector and considering buying but not sure where to start. Just hit reply and give us your phone number/skype address and the best time to call.

This Weeks Articles:

| NZ Dollar Breaks Below Key Support |

2014-08-21 02:33:00-04Gold Survival Gold Article Updates: Aug. 22, 2014 This Week: NZ Dollar Breaks Below Key Support Another Gold Indicator Flashing Buy – 80% Gains Ahead? Government Bond Yields Continue to Fall Miners Still Looking Good Despite Flat Gold and Silver Prices Quite a bit of action overnight in the precious metals resulting in some movement […] 2014-08-21 02:33:00-04Gold Survival Gold Article Updates: Aug. 22, 2014 This Week: NZ Dollar Breaks Below Key Support Another Gold Indicator Flashing Buy – 80% Gains Ahead? Government Bond Yields Continue to Fall Miners Still Looking Good Despite Flat Gold and Silver Prices Quite a bit of action overnight in the precious metals resulting in some movement […]

read more…

65,000 Marines Hold up a Mirror to the Economy |

2014-08-27 18:10:58-04Check out this great summary of the US economy and stock market. It’s hard to argue with too much of it. While share markets could well continue to head higher for a while yet it does seem to be getting close to the time to take some money off the table, or at least prepare […] 2014-08-27 18:10:58-04Check out this great summary of the US economy and stock market. It’s hard to argue with too much of it. While share markets could well continue to head higher for a while yet it does seem to be getting close to the time to take some money off the table, or at least prepare […]

read more…

Prof. Antal Fekete: The Interest – Episode 06/17 |

2014-08-27 19:05:46-0406/17 Prof. A. Fekete: The Interest This is the sixth video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary […] 2014-08-27 19:05:46-0406/17 Prof. A. Fekete: The Interest This is the sixth video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary […]

read more…

|

|

2014-08-21 02:33:00-04Gold Survival Gold Article Updates: Aug. 22, 2014 This Week: NZ Dollar Breaks Below Key Support Another Gold Indicator Flashing Buy – 80% Gains Ahead? Government Bond Yields Continue to Fall Miners Still Looking Good Despite Flat Gold and Silver Prices Quite a bit of action overnight in the precious metals resulting in some movement […]

2014-08-21 02:33:00-04Gold Survival Gold Article Updates: Aug. 22, 2014 This Week: NZ Dollar Breaks Below Key Support Another Gold Indicator Flashing Buy – 80% Gains Ahead? Government Bond Yields Continue to Fall Miners Still Looking Good Despite Flat Gold and Silver Prices Quite a bit of action overnight in the precious metals resulting in some movement […]

2014-08-27 18:10:58-04Check out this great summary of the US economy and stock market. It’s hard to argue with too much of it. While share markets could well continue to head higher for a while yet it does seem to be getting close to the time to take some money off the table, or at least prepare […]

2014-08-27 18:10:58-04Check out this great summary of the US economy and stock market. It’s hard to argue with too much of it. While share markets could well continue to head higher for a while yet it does seem to be getting close to the time to take some money off the table, or at least prepare […]

2014-08-27 19:05:46-0406/17 Prof. A. Fekete: The Interest This is the sixth video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary […]

2014-08-27 19:05:46-0406/17 Prof. A. Fekete: The Interest This is the sixth video (just 8 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary […]