This Week:

- Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

- Update on The Yield Curve Recession Predictor – lowest in a decade

- Could Gold Sentiment Get Any Worse?

- Have Gold Miners Reached the Point of Capitulation?

Prices and Charts

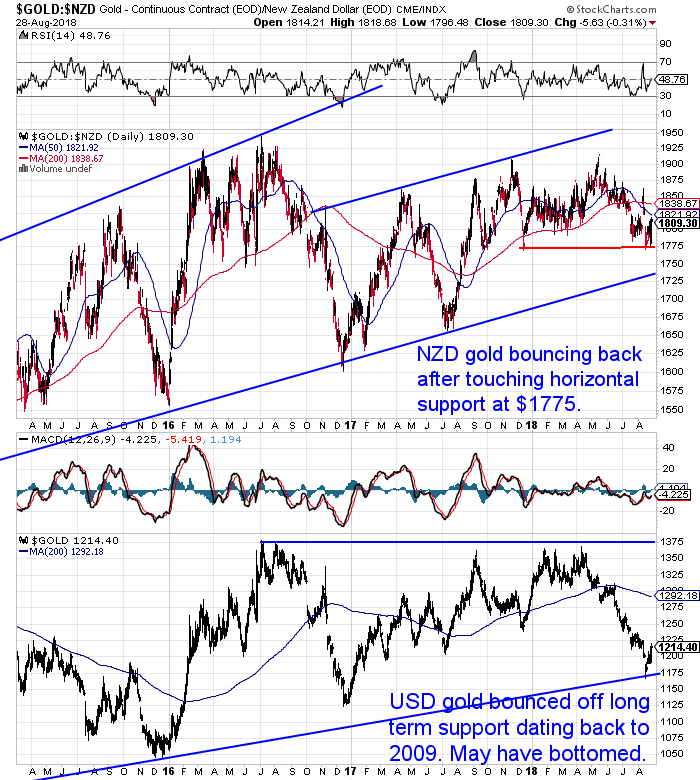

Has Gold Bottomed Out?

Gold in NZ dollars has edged up this week. It bounced off horizontal support at $1775 and got up close to the 50 day moving average (MA) this week. Before dipping back down again today.

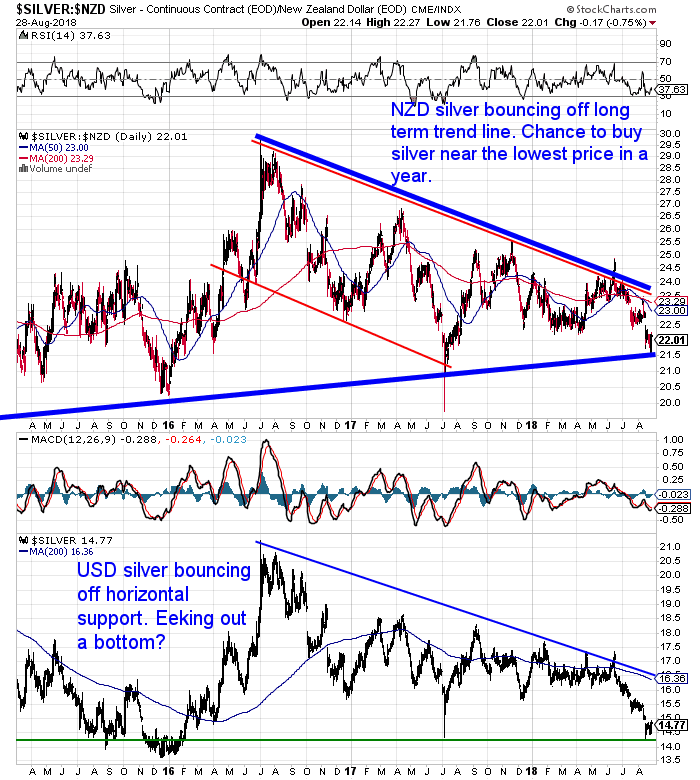

Similarly NZD silver also touched the long term uptrend line this week. We’d say NZD silver looks set for a bounce higher from here. We have the NZ dollar perhaps getting close to falling again (see below), and the USD silver price bouncing up off horizontal support. So right now the odds favour a move higher for silver.

The positioning of silver futures traders also points to that outcome. More on that below.

Kiwi Dollar Could Turn Lower From Here

The NZ dollar is close to the 50 day MA line. Also touching the overhead downtrend line. The Kiwi may struggle to get through these, as it has done since April.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

The Yield Curve Recession Predictor: Update

It’s been 5 months since we wrote about the yield curve. A very important indicator to watch in terms of its predictive ability of US recessions.

Long term US treasury yields (the interest these bonds pay) have continued to fall quite sharply. Today the spread between the 2 year and 10 year treasuries is the lowest it has been for more than a decade.

So we’ve updated the chart and numbers that point to how far off the next US recession might be. Spoiler alert: To coin a US phrase, we are late in the final inning.

You’ll also see how the yield curve relates to gold.

Could Gold Sentiment Get Any Worse?

The negative sentiment towards gold is clearly shown by the record net-short positions of speculative investors in Comex gold futures and options.

“In a research note ANZ, a bank, points out that the short position (bets that gold will be cheaper in future) is the highest since data was first collected by the CFTC in 1993.

It’s also the first time since 2001 that investors have entered a net short position (gross shorts exceeding gross longs).

ANZ analysts Daniel Hynes and Soni Kumari say in the past, “such extreme levels of short positions have led to a rally in prices”:

“1999, short positions rose fivefold to hit a then record level of 80,000 contracts. Not long after, gold prices rallied 16% from USD250/oz to USD290/oz over the course of two months.

Short positions spiked again in July 2005 and January 2016, with gold prices rallying 12% and 14% respectively over the subsequent three months. In both these cases, the net long position was extremely close to being negative.

This raises the spectre of investors closing out their record level of short positions, and thus starting a short covering rally.”

Source.

Maybe All the Bad News is Priced in?

“The environment for gold remains challenging,” said Carsten Menke, a commodity analyst at Swiss private bank Julius Baer. “That said, a lot of bad news is priced in and even in the short term, there should be more upside than downside. We upgraded our view to ‘constructive’ and bought a first position.”

“Speculative traders are net short for the first time since the turn of the century, suggesting that prices are bombed out on current levels,” Menke added. “Hence, it is very unlikely in our view that gold falls back towards the lows reached during the past year’s bear market.”

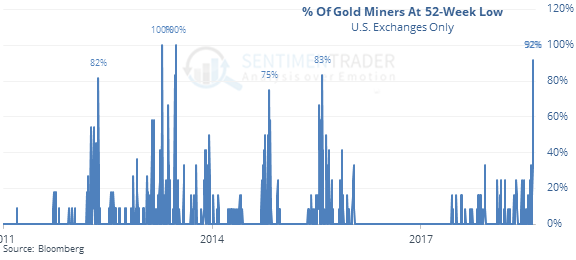

Have Gold Miners Reached the Point of Capitulation?

SentimentTrader’s Jason Goepfert reports that almost every U.S.-traded gold mining stock fell to a 52-week low last Wednesday or Thursday:

“That’s the biggest cluster of 52-week lows in the miners in five years. In the past 25 years, similar clusters signaled capitulation selling and excellent medium-term returns.”

Goepfert also commented on the commitment of traders report:

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers reduced their net short position in gold, now holding less than 2% of open interest as a net short, only the 2nd time in 15 years (early December 2015 was the other, which was the bottom for gold prices). Their total position in precious metals is now among the most position since 2002.”

Source.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Need Help Understanding the Gold & Silver Futures Commitment of Traders Report?

Does any discussion of futures positions and commitment of traders reports and data have you scratching your heading or just leave you cold?

We delve into this often quoted data and try to make it easy to understand for the layperson. Covering many of the points referred to by the various commentators above.

This includes:

- What is the Commitment of Traders (COT) Report?

- The Current Positions in the Commitment of Traders Report for Gold and for Silver

- What is a “Short Squeeze”?

- What is “Short Covering”?

- Is a Gold and Silver Short Squeeze Coming?

- How the “Smart Money” are Also Positioning Themselves in Other Assets

The latest COT data points to a likely bottom in gold last Friday.

Buying now will get you close to the cheapest entry point into gold this year. While for silver the cheapest for over a year. You’ll also be buying right on the trendlines for both metals.

Check out the deals going currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Only Only One Left in Stock – Learn More NOW….

—–

|