The topic du jour in the media this week has been housing affordability or rather unaffordability in New Zealand and especially Auckland. So we couldn’t resist but throw our 2 cents worth into the mix.

In case you’d missed it the government has announced they will work to make more land available in Auckland and put a 6 month limit on the council for signing off medium sized consents. There was also some talk about making changes to the Resource Management Act (RMA). http://www.nbr.co.nz/article/nz-politics-daily-skeptical-reaction-housing-affordability-plan-ck-131487

Market Failure?

Bill English commented that there had been a “market failure” in low priced housing. It’s somewhat ironic to call it a market failure when there isn’t really a free market in housing anyway.

How so?

Well interest rates are manipulated and currently set artificially low by the Reserve Bank for a start. So the price of money is not freely decided but rather driven by bureaucrats guesses as to what is the right price. Then councils and the RMA determine exactly what people are allowed to build and where they can build it.

The nature of a free market is that it is free! So it’s a bit rich to call it a market failure. To us, it seems it is non free market factors that seem to be the main drivers of the unaffordability problem.

Prices Driven by Debt

The world over, high house prices have been driven by an ever expanding bubble of debt. The government can do all it likes to tinker here and there but ever greater amounts of money being created mean people will look for real assets in which to place their wealth. It should be no surprise that since the final link to the gold anchor was severed in 1971 that household debt has grown and housing has become more unaffordable.

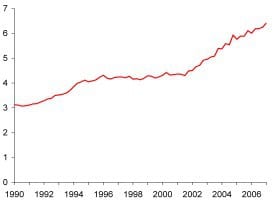

Average house price to average household disposable income

Household debt as percent of household disposable income

Sources: RBNZ, Statistics New Zealand

While cheap money exists in the form of exceptionally low interest rates there’s every chance house prices could continue to rise in nominal or dollar terms.

What to Do About the Un-affordability?

The government is looking to try to impact the supply to bring down the cost, when as explained above the rising prices are actually a reflection of the expanding credit. On top of this the Reserve Bank directs New Zealand banks to treat residential mortgages as the safest form of collateral and therefore lend heavily against it.

In the above NBR article it mentions some form of first home buyers assistance. Of course they used this scheme in Australia soon after the financial crisis broke and it merely succeeded in increasing prices further. No real surprise that a bunch of extra “free” money would do this we’d have thought! Same supply + more demand = higher prices. Not rocket science.

Another idea offered as a solution is a capital gains tax. The theory being that it will put a cap on people buying multiple properties. Of course this won’t stop high prices either. Many other countries around the world have some form of capital gains tax. One exists in the USA but that didn’t stop them having a monumental housing bubble.

So affordable standalone housing in Auckland will be difficult to achieve currently as it is the land prices that are so high compared to the cost of an actual house. A developer can make the cheapest house possible but the bare land will still make up the majority of the cost of the property so there is a limit to “how cheap” cheap housing can get while debt drives the market.

Our theory remains that it is the oversupply of money and credit that is the problem more so than the undersupply of land and housing.

At the end of the day, as the old saying goes, the best cure for high prices is higher prices. When prices get high enough they will eventually fall. Either there won’t be enough buyers to support the prices or more supply will find its way onto the market.

(For some very outside of the current box ideas on housing supply have a look at this libertarian blog which looks at the shocking concept of giving people choice with what to do with their land! http://pc.blogspot.co.nz/2012/10/sprawl-versus-intensification.html)

But What to Do Now?

But in the meantime, do you buy now expecting higher prices? From the talk of real estate agents it seems many people are. However our personal strategy remains to hold gold and silver until the respective housing to precious metals ratios get much lower.

See these articles for more on the house price to gold and silver ratios:

Could NZ house values drop by 80 percent?

NZ Housing to Gold Ratio Update

NZ Housing to Silver Ratio

That is we’ll wait until it takes fewer ounces of gold or silver to buy the average house. As we’ve written before this could happen while housing actually gets more expensive in nominal dollars as it did during the 1970’s (That is gold and silver prices rise faster than house prices). And if we get 70’s stagflation on steroids as seems more and more a possibility with the announcement of QE to infinity, then this could easily happen.

Of course we make money selling gold and silver so can be accused of “talking our book”. But we are just sharing what we are doing ourselves. It’s up to you to make up your own mind!

So would a monetary system using “real money” mean affordable housing the world over and no more bubbles?

No, human nature and herd behaviour means there will always be bubbles, the difference is how far they expand and how quickly they are liquidated. With governments constantly trying to prop the market up this just leads to more distortion in the long run. With currencies redeemable in gold and silver we would guess that we would likely see lower house prices in relation to incomes though. A more stable money supply where money is not debt, would likely mean more stability in prices over the long run.

Pingback: Why are US Bonds being sold? | Gold Prices | Gold Investing Guide

Pingback: Coming Housing Bottom for Canada? (And Similarities to New Zealand) | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Housing shortage in Auckland not backed up by rising rents - Gold Prices | Gold Investing Guide