This Week:

- Final Chance to Buy Gold at Cheaper Levels?

- Inflation will arrive eventually

- Chinese Gold Demand – the biggest story in the gold market right now

|

After a quote? ***** Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1795.62 | + $23.90 | + 1.34% |

| USD Gold | $1223 | – $2.50 | – 0.20% |

| NZD Silver | $22.16 | + $0.16 | + 0.72% |

| USD Silver | $15.09 | – $0.13 | – 0.85% |

| NZD/USD | 0.6811 | – 0.0106 | – 1.53% |

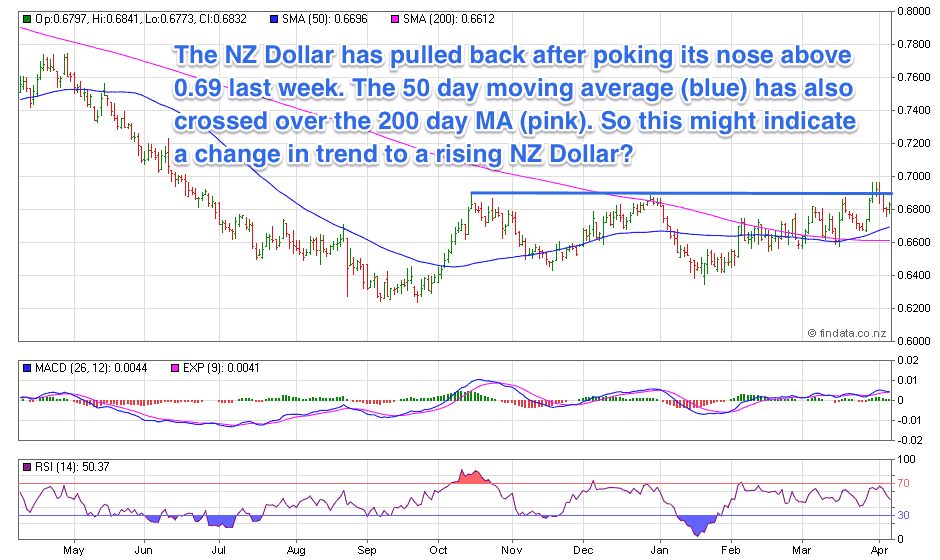

The Kiwi Dollar has again been the main driver of local precious metals prices this week. Weakening against the US Dollar to push the price up of both metals higher from recent lows. However as you can see in the chart below it did edge briefly above the 69 cent level and the 50 day MZ has crossed the 200 day MA. So there’s a chance we may be seeing a trend change to a strengthening NZ Dollar.

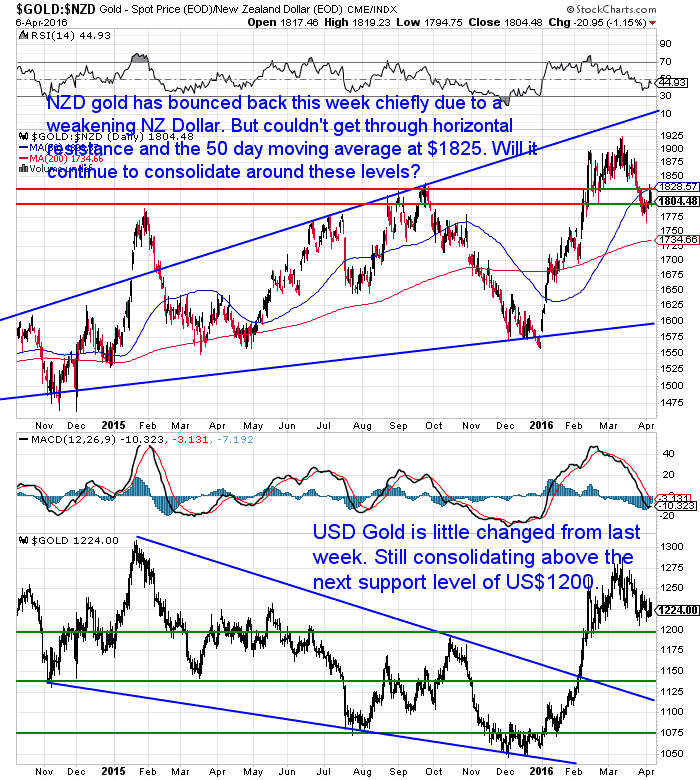

Gold in NZ Dollars bounced up from the lows of around $1775 last week. While you can see in the lower half of the chart below that USD gold was slightly down on a week ago.

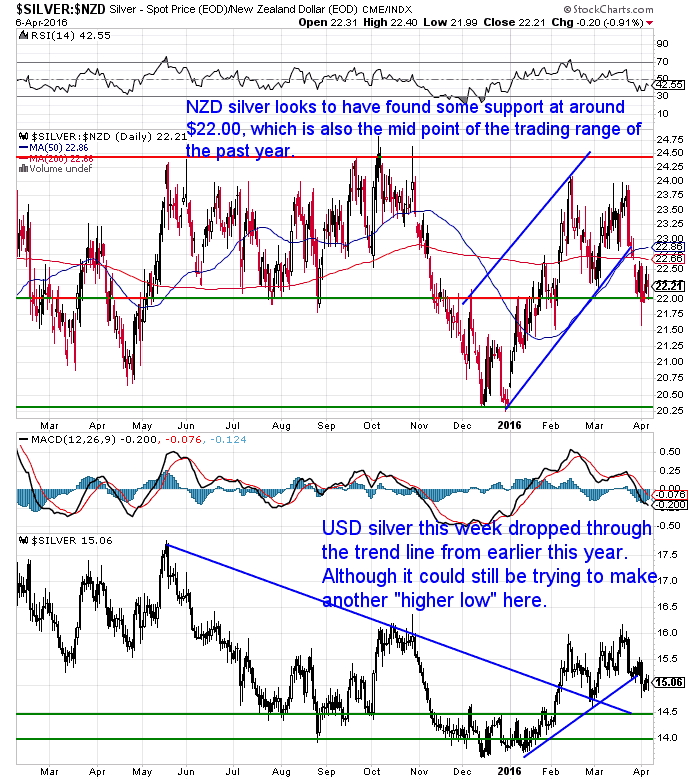

NZD silver also edged higher, bouncing off $22.00, which is the midpoint of the trading range it has been in for the past year or so.

We just get the feeling that silver is maybe starting to get a little momentum. But as we’ve been saying for a while we need to see it get above the $25 level to confidently say the trend has changed from sideways to up. Still sideways is better than down! As is often the case with silver, patience is required but will likely be rewarded in the end.

Final Chance to Buy Gold at Cheaper Levels?

We’ve been saying in our daily price alerts lately that we get the feeling that this is a consolidation before a move higher for gold.

However, Jeff Clark had a look at the latest Commitments of Traders positions for the group known as the “commercial traders”. These guys are the “smart money.” They’re gold merchants, miners, explorers, and bankers in the gold business. They use futures contracts to hedge their exposure to gold and protect themselves from any downside moves. The latest number are showing their short position in gold has grown larger. Meaning? There could be a further correction in gold yet after the recent US$50 per ounce pull back.

“Commercial traders [in mid March] had built their net short position in gold back up to 195,000 contracts. So I suggested it was time to take profits on the gold trade.

Since then, gold has fallen about $50 an ounce. But according to last week’s COT report – which includes positions as of last Tuesday – commercial traders have increased their net short position to 206,000 contracts.

That means that gold is likely to pull back even more in the short term. So traders should get an even better buying opportunity in the weeks to come.

Don’t miss it.

I own gold for the long term. And I’m looking forward to the chance to buy more of it.

As governments around the world continue to print money and central banks push interest rates into negative territory, the long-term case for owning gold gets stronger.”

However we also saw a slightly different take on these commercial traders positions from lawyer and journalist Robert Appel. In an interesting piece he described the history and mechanisms of central bank gold price suppression. He also reckons there are indications that the gold market is starting to give central banks trouble again.

“For the last five years, G-O-L-D has been a four-letter world. The suppressors have used every trick they have to abuse it, insult it, and diminish it. If on the entire planet even one study existed, for example, to show gold caused cancer, rest assured they would have found that one by now, and used it too. (Ironically, there are studies that show, in some circumstances, gold can actually treat cancer…but I digress.)

Lately, however, gold has reappeared in the news with a positive bias, and reignited the interest of the longs. April is shaping up to be a very definitive month in the Gold Wars.

This month gold could drop like a stone. Or the bulls could overwhelm the shorts and the metal could soar.

Or, the third (and maybe the most interesting) possibility, gold could simply hold at its current levels. Understand that if gold held this month in spite of the largest commercial short position ever, that would be a major bull signal for the rest of the summer.

My advice? Take a seat and prepare for fireworks.”

So we’re watching closely and just putting a lazy bet that perhaps we see an ongoing consolidation which is not what most people probably expect.

Inflation Will Arrive Eventually

The inflation numbers here in New Zealand continue to come in very low and bordering on deflation.

An RBNZ press release just out at lunchtime today noted:

In contrast, we’ve been reading some numbers that point to an uptick in inflation numbers in the USA.

Jim Rickards was also wondering this week…

“[A]t what point will the Fed lose faith in its models entirely and try to get inflation the old-fashioned way with more ease and a cheaper dollar?

What does my IMPACT system tell us about the next turning point in this never-ending currency war?

The short answer is the turning point is growing near but is not quite here yet. We look for the Fed to raise rates in June (possibly, but unlikely in April) and continue to make hawkish statements about future rate hikes, despite Tuesday’s speech. This will put upward pressure on the dollar, partially offsetting recent developments.

But sooner than later, the weakness in the U.S. economy and stock markets will become obvious even to the Fed. At that point, probably late in 2016, a major turning point in the currency wars will be upon us.

Look for the Fed to reverse course, take easing steps (forward guidance, rate cuts, “helicopter money,” QE4 or even negative interest rates) and trash the dollar. When the dollar goes down, the Fed will finally get the inflation it wants. But it may be too little, too late.”

“As Central Bankers Confront Stagflation, Gold Shines More Brightly

Central bankers have already inflated beyond reason since 2008. Eventually, this excess credit, some $100 trillion of it, will circulate. The West’s larger asset bubbles, including the derivatives bubble, are bound to burst at some point, and some may have already.

Central bankers won’t be able to raise rates for fear of destabilizing what little economic progress has been made. The result will be something that defined the 1970s – a period analogous to this one. We’ve mentioned it in numerous articles: Stagflation.

We’re seeing more articles about stagflation now as reality of its emergence is beginning to be recognized by the mainstream media. CNBC recently posted an article entitled, “Wall Street’s latest dirty word—stagflation.”

The last bout of stagflation in the 1970s pushed gold to around $800 an ounce, a valuation that still hasn’t been reached again when accounting for inflation. This is why some analysts eventually expect gold to travel to $2000 an ounce or more against the dollar.

Conclusion: Much in the world today is unsettled and frightening. Continued purchases of gold and silver are an apt, if modest, remedy. It’s paid off before.”

Read more: Could Stagflation Happen Again?

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $179 you can have 4 weeks emergency food supply.

Learn More.

—–

Chinese Gold Demand – the biggest story in the gold market right now

There’s been a wealth of data out on precious metals this past week. Two metals consultancy firms GFMS and Metals Focus both published reports on gold demand.

Hardly any of their figures matched up and they were different from those that Koos Jansen produces care of Shanghai Gold Exchange withdrawal data. This data does back up what a refiner known as “Goldfinger” had to say about Chinese demand though. More on that soon.

“Looking at private-investor appetite to buy and own physical gold however, China’s demand rose overall in 2015, say both GFMS and Metals Focus, notably in the second-half of the year…after prices slipped below $1100 per ounce, the stockmarket crashed, and the Yuan was devalued.

Amid China’s financial slump, notes GFMS, Beijing imposed new restrictions on people buying US Dollars. The strict limit of $50,000 per citizen was strengthened by a new rule forcing banks to report any customer buying more than $10,000…and anyone building large holdings below the $50,000 limit would also need to be ‘blacklisted’.

“This increased scrutiny and additional red tape,” says GFMS, “made gold an attractive option”. Call it “widespread safe-haven type gold buying,” says Metals Focus, marking a change from the last decade’s search for capital gains from gold…and a turn to “gold’s wealth preservation properties.”

China’s shift of tone comes despite disappointment with gold’s poor performance after households bought so heavily on the 2013 plunge. It may also map another “plug” for the gap between visible consumer demand and China’s world-beating supplies.

Because as the Q&A session at Metals Focus’ book launch last Thursday noted, data on retail investment demand doesn’t capture large bank-vaulted purchases. And with the gap between visible demand and supply yawning wider in 2015, odds are that large-scale allocations to gold from money managers, high-net worth individuals and investment institutions in China have been growing sharply.

“Really?” asked one attendee. “Isn’t this surely the biggest story in the gold market right now?”

Source: Adrian Ash via email.

“According to ‘Goldfinger’, the supply of physical gold remains scarce. While he says there is increasing amount of scrap gold coming from Southeast Asia (due to the economic slowdown there),

‘On the other hand, good delivery bars were becoming scarcer. Vaults in London — such as the vault holding gold for the GLD exchange traded fund — were being stripped bare. Goldfinger knew this because each LBMA good delivery bar is stamped with the name of the refinery that produced it, and the date it was produced.

‘Bars are generally stored in a vault on a ‘last-in-first-out’ basis. Newer bars are removed first. The older bars — some with dates from the 1980s — are not moved out until the vault is almost empty. Goldfinger was now seeing more of those older bars come in for refining.

‘He told me he had recently returned from the Middle Kingdom where he had visited Chinese refineries and gold mines. His tour was somewhat restricted by Chinese Communist officials but, as a prominent gold executive himself, he was able to see far more than most outsiders.

‘He said Chinese gold demand was insatiable. The Chinese were buying over 450 tonnes of gold produced from their own mines each year, while importing approximately 1,400 tonnes of gold on top of this. Meanwhile, Chinese gold exports were zero.’

–Jim’s message? Buy gold before the buying panic sets in.”

“ICBC Standard Bank Reclassified as an LBMA Market Maker

ICBC Standard Bank has been reclassified as a spot Market Making Member of the London Bullion Market Association with effect from today.

In order to qualify as a LBMA Market Maker, a company must offer two-way quotations in both gold and silver to the other Market Makers throughout the London business day. Reclassification is the responsibility of the LBMA Management Committee. In deciding on the issue of reclassification, the Committee takes account of the views of the other Market Makers on the performance of the candidate company during an approximately three month probationary period.

Total LBMA membership stands at 146, consisting of 13 Market Making Members, 67 Ordinary Members and 66 Associates Members. The membership list can be found on the LBMA’s website.”

Gold in a world of negative interest rates

The WGC is pretty low on hype but they did make a somewhat surprising recommendation. That being that Investors should consider doubling their gold allocations amid negative interest rates.

“We have entered a new and unprecedented phase in monetary policy. Central banks in Europe and Japan have now implemented Negative Interest Rate Policies (NIRP) to counteract deflationary pressures and, in some cases, currency appreciation. Amid higher market uncertainty, the price of gold is up by 16% year-to-date – in part due to NIRP.*

Investors, including central bank managers, should assess the implications of holding bonds with negative return expectations on portfolio composition and risk management.

Our analysis shows that:

-

Gold returns in periods of low rates are historically twice as high as their long-run average

-

Investors may benefit from increasing their gold holdings up to 2.5 times, depending on the asset mix,even under conservative assumptions for gold.

-

Reduces the opportunity cost of holding gold

-

Limits the pool of assets some investors/managers would invest in

-

Erodes confidence in fiat currencies

-

Further increases uncertainty and market volatility.”

How much exposure do you have to gold and silver?

Rickards recommends about 10%. The WGC is saying there may be a benefit in increasing gold holdings up to 2.5 times.

If you think you are underweight, then get in touch. This could be a good opportunity after a bit of a pull back. SIlver in particular, as it is in the middle of the trading range over the past year. Plus the gold silver ratio is back up above 80.

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,760 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles: |

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

|

Today’s Spot Prices

Spot Gold |

|

|

NZ $ 1795.62 / oz

|

US $ 1223 / oz

|

|

Spot Silver

|

|

|

NZ $ 22.16 / oz

NZ $ 712.44 / kg |

US $ 15.09 / oz

US $ 485.24 / kg |

|

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

|

Our Mission

|

|

We look forward to hearing from you soon. Have a golden week! David (and Glenn) |

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: - Gold Survival Guide - Gold Survival Guide

Pingback: 5 Reasons to Buy Silver Right Now - Gold Survival Guide - Gold Survival Guide