Table of Contents

Estimated reading time: 6 minutes

Here’s something you might have wondered about as well… How much might gold fall during the next crash?

A question recently from a reader Brett was:

“What might you imagine the % drop in the gold price might be after the next crash?”

Why Does Gold Fall During a Stock Market Crash?

Firstly though, why does this reader expect gold will fall during a stock market crash?

Because that is what it has done on occasion in the early part of previous crashes. Why?

The likely reason for gold falling in these crashes is due to its liquidity. Investors were likely liquidating gold holdings to cover losses in other areas. It may have been for margin calls in their stock market accounts. Where they have borrowed money from a broker to buy shares/stocks, then when the prices of those shares fall (as they do in a crash and very fast) the brokerage house requires the investor to stump up more cash to restore their loan to value ratio.

So selling gold pushes the price down initially. But as we’ll see in the examples below gold then bounced back sharply.

How Much Has Gold Fallen in Previous Crashes?

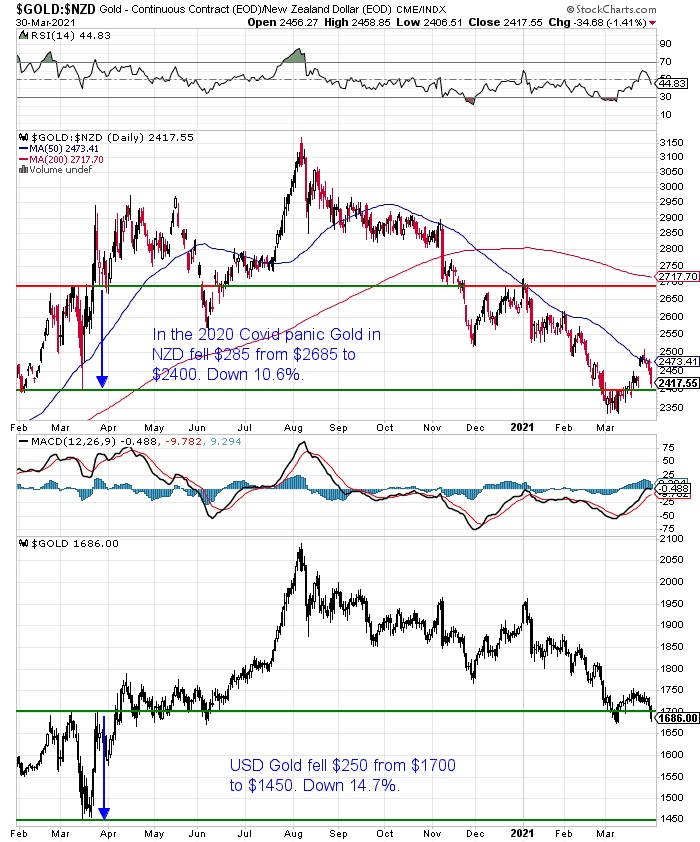

In the COVID19 panic crash of March last year we saw gold fall sharply but bounce back just as quickly. It was down about 10% in NZ dollars. While the USD gold price fell close to 15%, before bouncing back up.

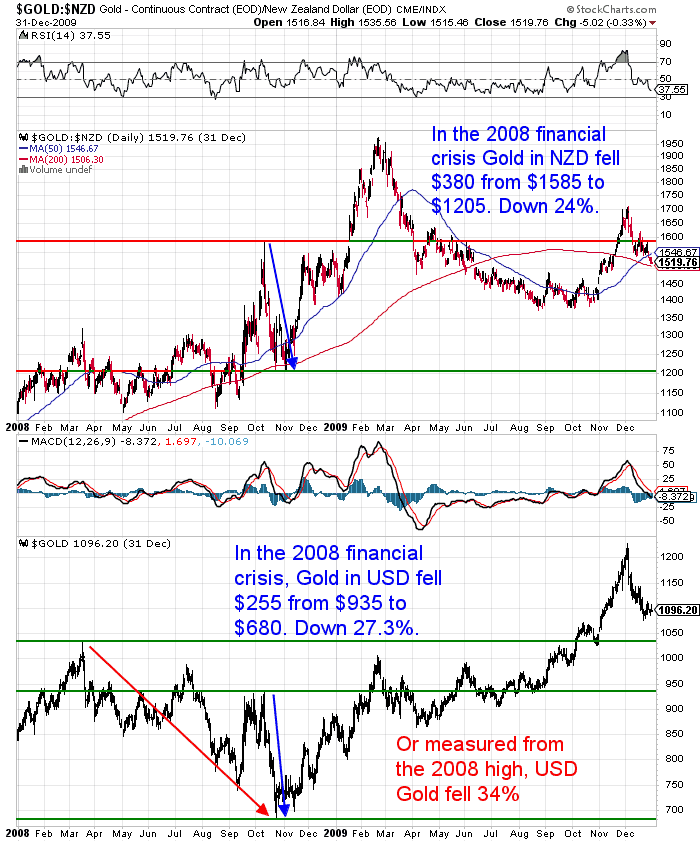

Looking back further to the 2008 financial crisis, gold in NZD fell by 24%. While USD gold fell 27% in late 2008. However if we count from the high back earlier in 2008, USD Gold was down 34%. This shows how the NZ dollar was falling sharply against the USD over this time. Thereby holding up the NZD gold price somewhat.

What Percentage Might Gold Fall in the Next Crash?

Who really knows is the truthful answer? However with this look back at recent history and past crashes, we can get an idea what has happened before.

The above couple of examples are a useful guide as to what could potentially happen in a future crash.

As it happens just after we received this question from our reader, Mike Maloney and Jeff Clark put out an article and video on the same topic. So you might want to check them out too.

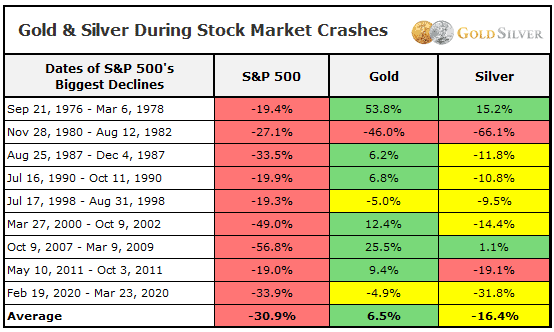

Here’s a table from Jeff Clark showing the US stock market “S&P 500’s nine biggest crashes since the mid-1970s, and how gold and silver performed during each. The green boxes mean they rose, yellow means they fell but less than stocks, and red signifies they fell more than stocks.”

Interestingly our numbers seem to differ to theirs.

However that is likely down to where the start point and end point is for calculating the fall. We have simply gone from the top to the bottom of gold’s fall. Whereas Jeff Clark has used the start and end point of the stock market crash instead. Gold usually bounced back before the share market crash was over. Thereby resulting in lesser numbers for gold.

His interesting conclusion is that gold has actually risen more than it has fallen during stock market crashes.

“On average, gold has risen during stock market crashes. Twice it fell but less than stocks, and only once did it fall more than stocks, though I’ll point out this was immediately after gold’s biggest bubble in history.

Gold even climbed in the biggest stock crash of all: the 56% decline that lasted two full years in the early 2000s. And during the sharp decline last March, where stocks fell by a third, gold declined less than 5%.

The historical record suggests that one can’t assume gold will fall in a stock market crash—the exact opposite has occurred much more often.”

Source.

Other Factors to Consider

There are a few other factors worth taking into account too we think…

What If Gold Had Already Fallen?

Both of these crashes took place when gold had been rising in price in the lead up to them. So if gold was down – like it is now – we could potentially see a much smaller fall.

Central Bank and Government Response Gets Bigger Every Crash

The rapid and sharp bounce back we saw in gold during the Covid19 panic crash was most likely due to the massive coordinated response from governments and central banks around the planet. The 2008 currency printing response paled in comparison to the Covid19 response.

So for any future crash we can expect to see the same response and likely on an even bigger scale. So again if gold does fall we may see it bounce back equally as fast, as the currency printing machines crank up again.

We Need to Consider Premiums Too

These prices also only show the spot price of gold. Whereas in both of these crashes the premium above spot price for gold and especially silver actually rose while the spot price fell. As physical supply couldn’t keep up with demand. So if you were to sell and expect to buy back at cheaper prices, it may be easier said than done to achieve that.

Holding is Likely the Best Move in a Crash

Therefore while you may find it emotionally difficult, simply holding on during a crash is likely the best course of action. Not only due to likely rising premiums, but also because how will you know when to buy back in? Also will you be emotionally able to do it?

A better option may be to simply keep some cash back in cash of any sharp falls in price. That way you have a core position in gold you don’t sell, but have the chance to buy more at cheaper prices in a panic fall.

To us gold looks like it is bottoming out currently. So rather than waiting for a crash that may not come, now is likely a good time to buy gold. Head to the store to see what gold products are available to buy now.

Pingback: US Debt Clock’s Dollar to Gold and Silver Ratios vs Our Debt to Gold Numbers - Gold Survival Guide