Prices and Charts

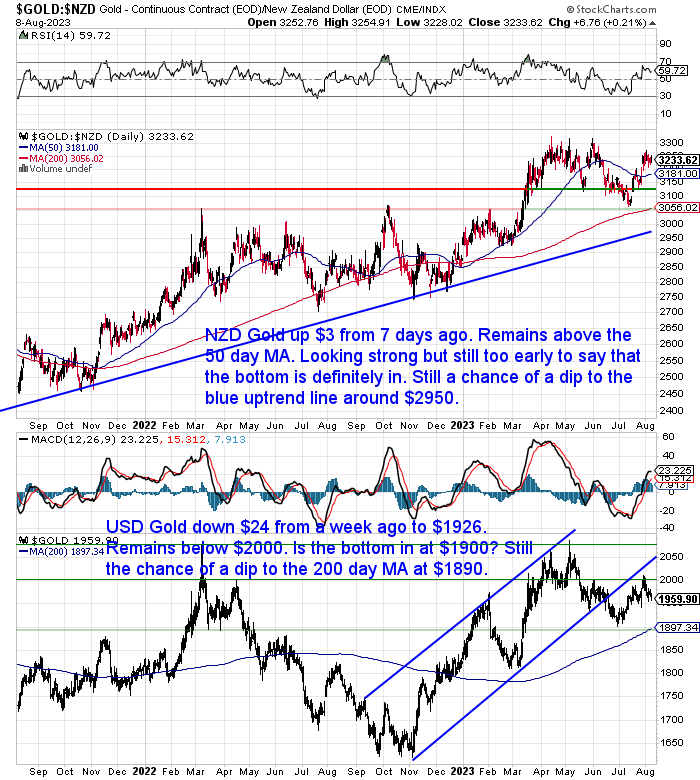

NZD Gold Steady From Last Week

Gold in New Zealand dollars was up just $3 from 7 days ago. It remains just above the 50 day moving average (MA). The closest futures month continues the unusual anomaly we mentioned last week where it trades at much higher prices to spot gold. So our chart below from stockcharts is also showing higher prices than what the spot price actually is. i.e. NZ$3233 in the chart. But spot is actually lower at NZ$3184.

Gold continues to look strong. But, until we get a clear breakout above $3300 we can’t confirm the bottom is in. However it is looking pretty good. The 200 day MA continues to rise and is now above the July low of $3050. So even a pull back to the 200 day MA will mean a higher low is made. Of course there remains a chance of a further dip all the way to the blue uptrend line. But that is now getting close to $3000. Therefore consider any pullbacks to these levels buying zones.

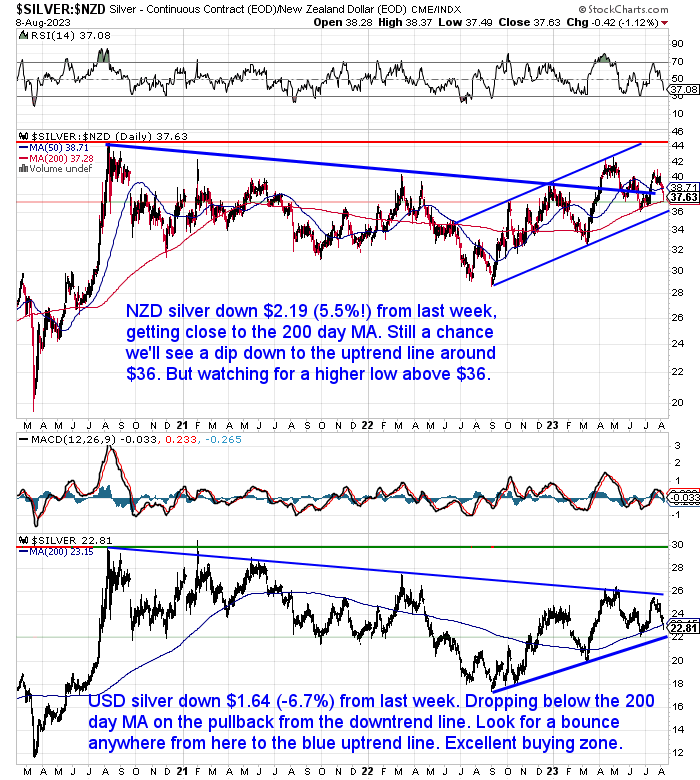

But Silver Drops 5.5%

In contrast to gold, NZD silver took a pounding this week. It fell $2.19 or 5.5% to get back close to the 200 day MA. There remains a chance of a further dip to the uptrend line. But that is now up above $36 as well. So our guess is there’s a very good chance of a higher low just above $36 now. Anywhere from here down (if it happens) is likely to be a great long term purchase.

USD silver is in much the same boat. Falling 6.7% but getting below the 200 day MA. So look for a bounce anywhere from here down to the blue uptrend line. Silver is likely in an excellent buying zone already. This wedge formation continues to narrow. So we are likely not too far from a breakout in the coming months.

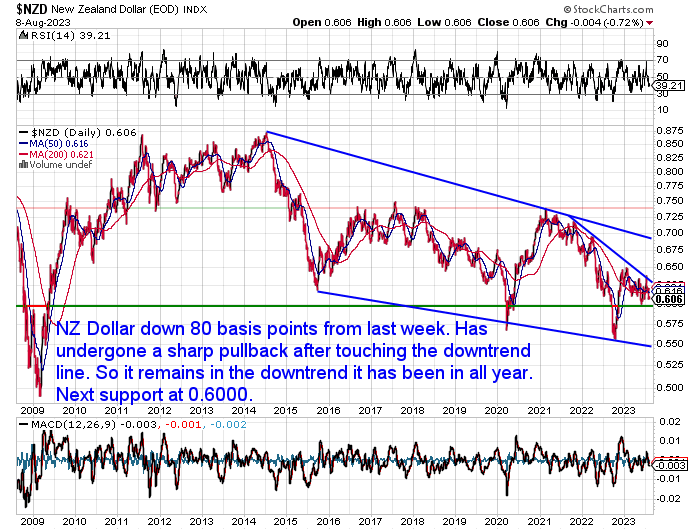

Kiwi Dollar Drops 1.25%

The Kiwi dollar was down 80 basis points from last week. That has been a sharp pullback after touching the blue downtrend line. So the NZD continues in the downtrend it’s been in all year. Next major support area is at 0.6000.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Could the New Zealand Government Build Its Own Gold Reserves By Charging Miners a Royalty?

In this week’s feature article, we’re delving into the topic of New Zealand’s natural resources: specifically gold royalties. Ever wondered how the New Zealand government benefits from the country’s rich deposits of gold? Our latest article details what royalties are required to be paid by gold miners to the government. We explore the Crown Minerals Act 1991, the different types of royalties, how these contributions support New Zealand’s growth, and then finally the intriguing potential for building a gold reserve.

Here’s what’s covered:

- The Crown Minerals Act 1991

- Types of Gold Royalties

- Royalty Rates and Thresholds

- How Royalties Benefit New Zealand

- What Might the Royalties From the New Snowy River Mine Be?

- The Potential for Gold Royalties to Build a Gold Reserve

- Why We Should Be Embracing Gold (and Maybe Even Gold Mining)

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

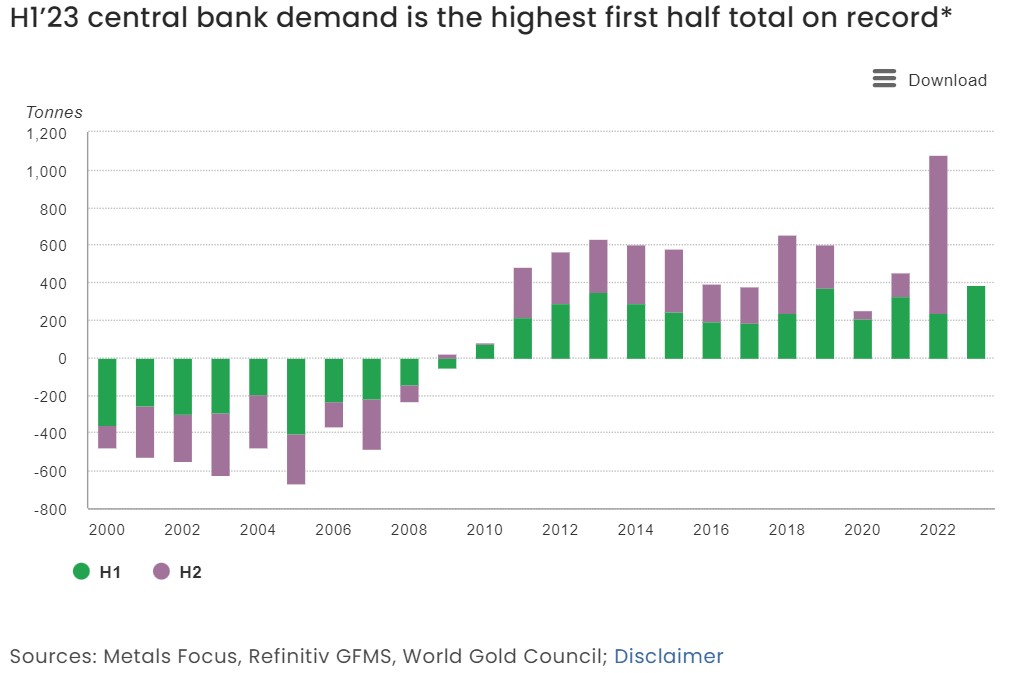

Record Central Bank Gold Purchases in First Half of 2023

The World Gold Council’s (WGC) latest gold demands trends for Q2 2023 reports that:

“Central bank gold buying in H1 reached a first-half record of 387t. Despite the Q2 slowdown, the strong Q1 start set the seal on a record-breaking H1. Buying activity remains widespread and distributed among both emerging and developed countries.”

Source.

Source.

The quarter 2 slowdown to which the WGC refers, was as a result of Turkey changing from being a prominent central bank buyer in quarter one to a big seller in the following quarter. Turkey sold bullion into its local market following a ban of gold imports into the country. Selling 132 tonnes of gold in quarter two. So even despite these country-specific political and economic circumstances in Turkey, central bank gold buying still hit a record high.

China was the largest purchaser, where the “People’s Bank of China reported adding 103t during H1, extending its monthly buying streak to eight months. Its gold reserves totalled 2,113t (4% of total reserves) at the end of June.”

However, analyst Jan Nieuwenhuijs estimates the Chinese central bank bought 247t more than what it reported (103t) in H1 2023, totaling 350t of gold.

Jan outlines how he reaches his estimate in this interesting report: Estimating the True Size of China’s Gold Reserves.

According to his analysis:

“…the Chinese central bank owned 4,309 tonnes of gold on December 31, 2022, which is more than double than what is officially disclosed. My estimate would make China the second largest gold reserve country after the US. The Chinese private sector holds 23,745 tonnes, bringing the total amount of gold in China to 28,054 tonnes.”

This topic of private gold ownership in China follows on nicely to our report published 2 weeks ago looking at: How Many People Own Gold? New Zealand vs Other Countries. We noted China was on top for gold consumption in 2022 with 824.9 metric tons. This equated to a per capita gold consumption of approximately 0.56 grams, which shows a growing wealth for the country’s huge middle class.

Nieuwenhuijs actually had a solid estimate as to how much gold on average is held by private chinese citizens:

“On the non-monetary side, China wants private gold reserves to be proportionate to its peers too. Sun Zhaoxue, President of the China Gold Association, wrote in 2012 in Qiushi magazine (the main academic journal of the Chinese Communist Party’s Central Committee):

“as an important part of China’s gold reserve system, we should also encourage individuals to invest in gold. Practice has proven that private gold reserves are an effective supplement to official reserves and are very important for maintaining national financial security. World Gold Council statistics show that Chinese individuals possess less than 5 grams of gold per capita, a significant difference to the global average of more than 20 grams.”

Multiplying 5 grams by 1.3 billion people (the Chinese population in 2012) equals nearly 7,000 tonnes, which matches my estimate of Chinese private reserves held at the end of 2011. My estimate for Chinese private reserves in 2022 is nearly 24,000 tonnes, divided by 1.4 billion people (the Chinese population in 2022), equals 17 grams per capita. China’s non-monetary gold reserves are close to the global average.”

Nieuwenhuijs concludes that:

“China’s monetary gold to GDP ratio (computed with 4,309 tonnes) is 1.5%, which is still lower than 2% in the US and 4% in the eurozone. It’s clear that now is the time for the PBoC to speed up buying. One, China is still behind in its relative gold holdings vis-à-vis Western powers. Two, Russia’s dollar assets were frozen due to the war in Ukraine and the Chinese don’t want to suffer the same fate. Three, the Chinese population has accumulated enough already.”

He also states:

“China and European countries are in agreement to equalize their ratios of monetary gold relative to GDP in order to prepare for a global gold standard.”

…Previously, I have demonstrated on these pages that European central banks have been preparing for a global gold standard since the 1970s through equalizing their monetary gold to GDP ratios. Balanced gold to GDP ratios will smooth the transition to a gold standard (or gold price targeting system) if the current international monetary system is stretched beyond its limits. The Chinese were in on this plan since the 1990s.”

A better balance of gold reserves would certainly make it easier to implement a gold standard or a “gold price targeting system” as Nieuwenhuijs also mentions.

BRICS Currency: Difficult to do in the Short Term – Golden Ruble Instead?

Of course there has been all the recent discussion of the BRICS gold linked currency recently. Higher gold reserves amongst the member countries would make this easier to implement too.

Although Russia Today this week reported that:

“Introducing a single currency in the BRICS countries would be difficult to do in the short term, Kremlin spokesman Dmitry Peskov said on Thursday.”

Source.

As we’ve said in recent weeks, don’t expect a huge announcement at the BRICS meeting later this month. But to us it seems inevitable that the current monetary system will change some time this decade.

But even if there is no BRICS currency, a report from December 2022 outlines how Russia could take steps on its own towards a “Golden ruble 3.0” (hat tip to Jan Nieuwenhuijs for this):

“Golden ruble 3.0” – How Russia can change the infrastructure of foreign trade.

The article explains how Russia can use its trade surplus with friendly countries to buy gold and reduce its dependence on the U.S. dollar. The authors are two Russian experts on economic integration and development. They argue that the U.S. sanctions have forced Russia to switch to trading in national currencies with its partners, such as China, India, Iran, Turkey, and the UAE. However, these currencies are not very stable or reliable, so Russia should use them to buy gold from these countries. Gold is a non-sanctioned asset that can protect Russia from exchange rate fluctuations and political risks. The authors call this strategy “Golden ruble 3.0”, which is an updated version of the previous attempts to create a gold-backed ruble in Soviet times and in the 1990s. They claim that this strategy will help Russia to increase its economic sovereignty, diversify its reserves, and challenge the dominance of the U.S. dollar in the global financial system.

These reports all increase the odds that the Chinese and other central banks will continue purchasing more and more gold in the coming years. This will likely set a floor under the gold price. In fact perhaps it already has?

There doesn’t seem to be much belief in the gold price holding up right now. So that’s why we’re starting to think it has bottomed.

Therefore if you want to follow these central banks in preparing for monetary change right now might be a very good time to do it.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Inflation - Not Beaten Yet? - Gold Survival Guide

Pingback: The Gold Standard & A Free Market For Money: What Do We Think About It?

Pingback: Positive Sign: Silver Short Positions Dropping - Gold Survival Guide