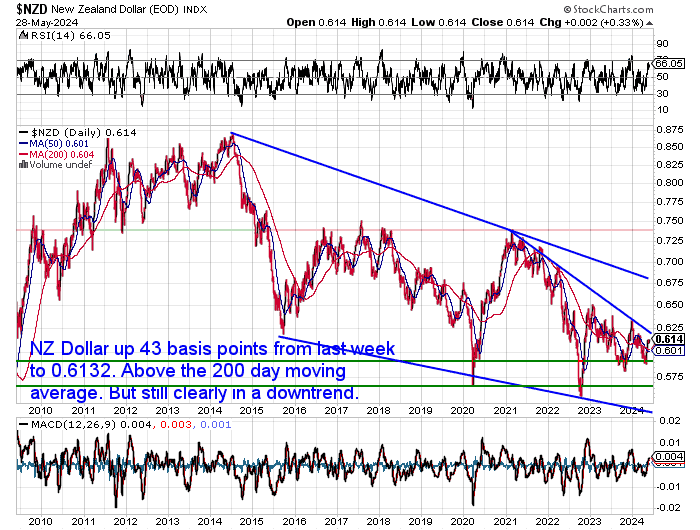

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3678 |

| Buying Back 1kg NZ Silver 999 Purity | $1557 |

Sharp Pullback In Gold

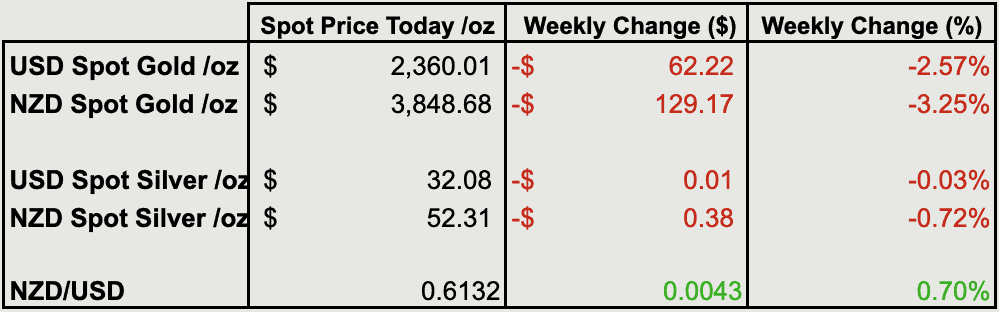

Gold in New Zealand Dollars had a sharp fall this week. Down $129 (3.25%) to dip just below the 50 day moving average (MA). It looks to be trying to rise up again off our first buy zone at $3800. If it can’t hold there then the next support is at $3700, then at the horizontal support of the previous all-time highs at $3500. The 200-day MA is also rising and not far from $3500. So if we did see a larger dip that would be very strong support. But we have our doubts about whether it will get that low. So if you’re looking at buying, don’t get caught on the sidelines.

It was a similar situation with USD Gold. Falling $62 or 2.5% from a week ago. It looks to be trying to put in a higher low just above US$2300. Otherwise, the next buy zones to watch for are $2200, $2150, and $2100. But again, there are no guarantees we’ll get back to those levels.

Silver Knocked Down – But Straight Back Up Again

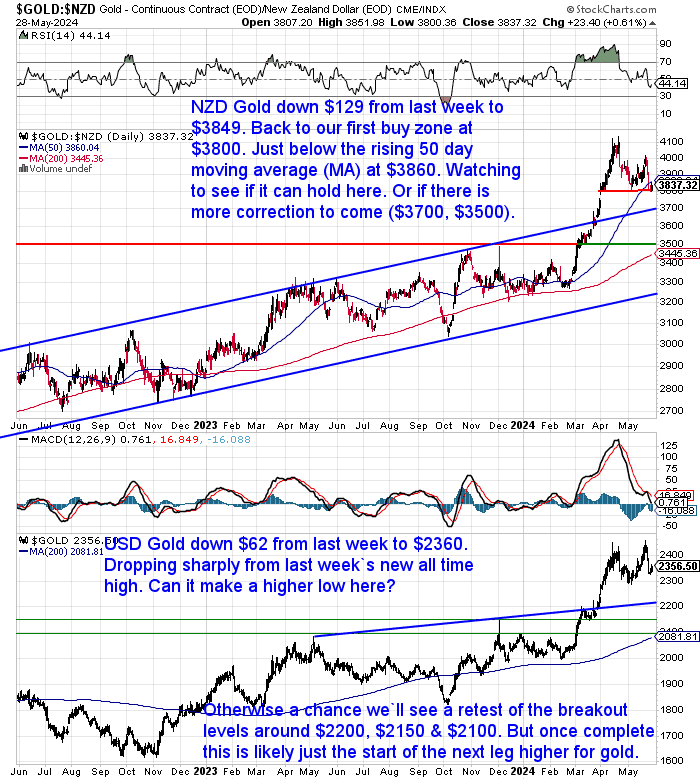

NZD Silver got knocked back down to $50 but then shot straight back up again. The net result for the week was a fall of 38 cents. But it’s back close to the 12-year highs of a week ago. It’s not much below overbought on the RSI indicator again. But such a brief correction indicates silver is very strong and so could run even higher yet. The 50-day MA currently at $46 will be a good place to buy if we see any further dips.

Silver in USD underwent a sharp fall but an equally sharp jump sees it back to where it was last week. Down just 1 cent to $32.08. The previous resistance line at $30 is now acting as strong support.

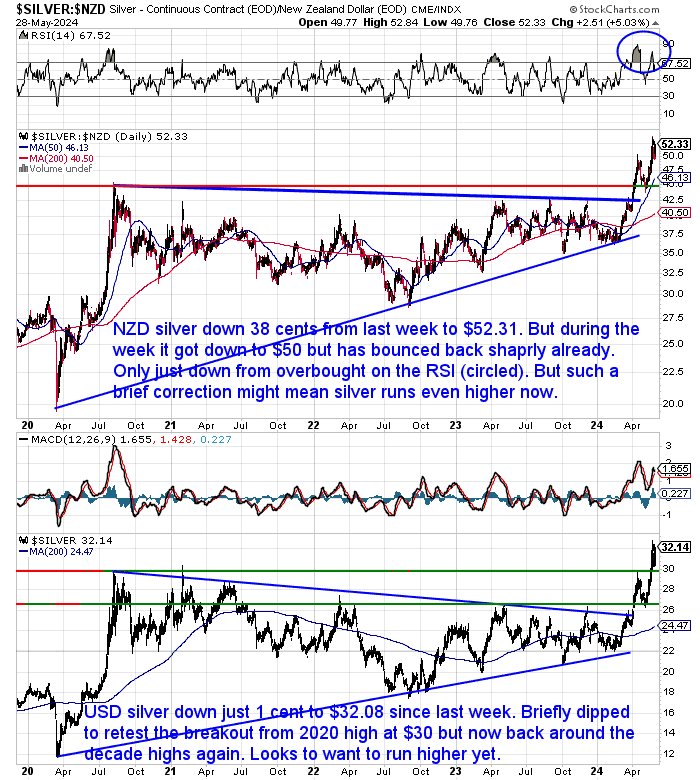

NZD Closing in on 2021 Downtrend Line

The NZ dollar was up 43 basis points from last week to 0.6132. It’s closing in on the downtrend line dating back to 2021. But still clearly within the confiness of that downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Paper Promises vs. Tangible Treasures: Are You Investing or Gambling on Gold?

Owning gold is often associated with wealth preservation, but is all gold created equal? This week’s feature article digs into the potential risks of confusing “paper gold” investments with holding physical gold.

The article explores:

- How certain gold investments might not be a true reflection of owning the precious metal

- Why paper gold could be vulnerable in a financial crisis

- The potential advantages of owning physical gold for wealth protection

Curious if your current approach to gold aligns with your investment goals? This article sheds light on the distinction between paper and physical gold and highlights some of the frauds that have taken place both here in New Zealand and abroad when dealing in paper gold.

Confusing Investing with Wealth Protection – The Risks of Paper Gold vs Physical Gold in 2024?

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

In Gold We Trust Report 2024 Highlights

The always excellent In Gold We Trust (IGWT) Report from Incrementum was just released. The full report comes in at a whopping 422 pages! But there is also a compact version at only 37 pages.

We’d highly recommend at least checking out the compact version.

Or you can see a 13-minute video overview of some of the key charts here.

But we’ll share some highlights here for you today…

The 10 Key Points of the New Gold Playbook

The meta-theme of the new gold playbook could be summarized as follows:

The reorganization of the international economic and power structure, the dominant influence of the emerging markets on the gold market, the reaching of the limits of debt sustainability, and possibly multiple waves of inflation are causing gold to appreciate. This phase will continue for some time, until a new equilibrium has been established.

- The high inverse correlation between US real yields and the gold price is history (for now). Despite the rise in real yields, the rise in the gold price could not be halted.

- Central banks are a decisive factor in the demand for gold: Demand from these institutions is not very price-sensitive. Central banks are likely to have put a floor under the gold price.

- The militarization of fiat money has lasting consequences: The confiscation of Russian reserves and the assets of Russian oligarchs in 2022 was a wake-up call for numerous states, as well as wealthy private individuals from the Gulf states, Russia and China. (Luxury) real estate in London, New York or Vancouver has always been the preferred destination for savings from the emerging markets, but this has changed in 2022.

- Safe-haven assets are becoming scarce: The list of liquid safe-haven assets is getting shorter. New and old safe-haven assets are gaining in importance.

- In contrast to the gold drain in the US in the 1960s, the emerging markets are now experiencing a gold gain. China is playing a leading role in this respect but is no longer alone. The Western financial investor is no longer the marginal buyer or seller of gold. The pricing power on the gold market is increasingly shifting to the East.

- Monetary climate change: Fiscal largesse has seriously jeopardized the debt sustainability of Western countries. The explosion of the interest burden is a harbinger of the limits of debt sustainability.

- The new playbook in the context of stagflation 2.0: The Great Moderation is over. Periodic supply shocks will cause additional fluctuations in inflation.

- The end of the 60/40 portfolio: A positive correlation between equities and bonds, as in the case of structurally higher inflation rates, means that bonds offer no protection when growth slows.

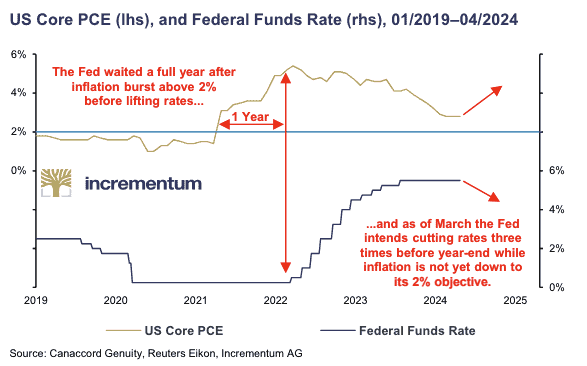

- The central bankers’ new playbook: The holy grail of the 2% inflation target is no longer sacrosanct. Even before the mark has been sustainably reached again, Western central banks are openly talking about a change of course to a less restrictive monetary policy.

- Noninflationary investments such as gold, silver, commodities and Bitcoin are playing an increasingly important role for investors.

Point 8 above that bonds offer no protection was also covered in depth in a Bloomberg piece this week too:

Bonds’ Decades-Long Lead Over Gold Vanishes as Debt Worries Grow

- ‘Safe haven’ of choice has become gold, Invesco says

- Gold’s outperformance signals concern over rising debt

Japan Leading the (Strange) New Way Forward? Or a Recipe For an Unwanted 1970s Potluck Meal?

Earlier in the month we commented on how gold demand has been so high in Japan due to their very weak currency and therefore increasing expectations of inflation. This is quite a turnaround from a nation that for years had just the opposite problem.

But the IGWT report had another very interesting point about how Japan may be leading the way forward for other central banks…

“The Japanese yen has come under increasing pressure over the past year due to the interest rate differential between the BoJ and other major central banks. In response, the Bank of Japan (BoJ) recently introduced a new monetary policy strategy that could act as a blueprint for a new playbook for (Western) central banks. On March 19, the BoJ raised interest rates moderately, meaning that nominal interest rates are no longer negative for the first time in 17 years. The BoJ also announced the end of its yield curve control (YCC) policy. It is particularly noteworthy that, in an unprecedented but unsurprising move in view of government debt of 263% of GDP, it is maintaining its QE program with monthly JGB purchases of USD 40 billion.

This is the first time that a central bank has combined conventional interest rate hikes with balance sheet expansion through QE. This amounts to a monetary policy oxymoron, as it effectively means tightening while easing monetary policy conditions.

Has the BoJ once again positioned itself as a trendsetter for the monetary policy vanguard?”

This will be very interesting to watch. It sounds like something other central banks will try too if inflation continues to hang around. But to us, it sounds like a recipe for an unwanted 1970s potluck meal: Stagflation.

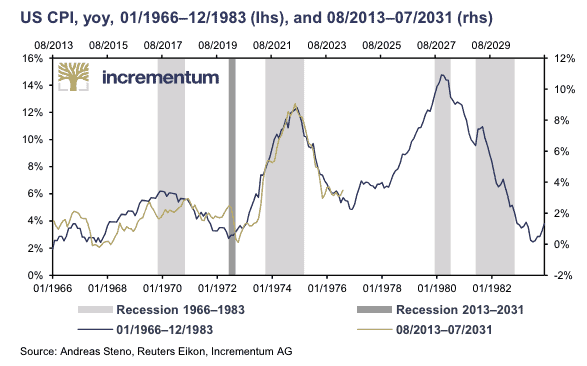

Inflation Waves Rhyming

Speaking of inflation. Here’s a chart comparing the 1970’s inflation waves to where we are currently. History certainly looks to be rhyming…

While this next chart shows that cutting interest rates while inflation is still well above 2% could likely lead to the next wave up in inflation…

In (Silver) We Trust

IGWT report also features silver. Although this chart is already out of date because of course silver has already clearly broken above $30.

Is this Silver’s golden moment?

As always, we have dedicated a chapter to silver in this year’s #IGWT report. Get up to date with silver dynamics and what is causing price movement at the link below!

Breakout or Fake-out: Is this Silver’s Golden Moment?

“In summary, the conditions for a materially higher silver price are strengthening with each year of supply deficit that goes by. Thanks largely to industrial demand derived from solar PV, and an expected gold-linked monetary demand from persistent inflation, we expect that a continued depletion of secondary supply will make it hard to meet silver demand in the years to come.

Frankly, this unsustainable trajectory will be characterized by demands of higher silver prices from recyclers and private holders, until mine production rises sufficiently to close the supply deficit. Although, as we mentioned in the In Gold We Trust report 2023,108 mining project development lead times for silver average 15 years. Therefore, higher silver prices for longer is the likely outcome here.

Importantly, several variables could either prevent or delay this scenario. For one, a global recession could see silver demand fall to the extent where a supply deficit becomes a surplus and aboveground inventories are not needed. However, total silver demand is expected to rebound by 2% in 2024, and even if that recessionary scenario did arise, accompanying decreases in mine production, and thus supply, would likely result in the maintenance of a deficit.

On this basis, the demand side is unlikely to be the principal obstruction to rises in the silver price. Instead, the factors standing in the way of a higher silver price would be a rise in silver recycling, a near-term increase in silver mine production, or the sale of privately held silver to replenish inventories on exchanges. Yet, much to the dismay of silver bears, the incentive of higher silver prices will be an unavoidable prerequisite for all 3 of these supply-side phenomena to materialize.

As a result, we are bullish on silver and silver miners for 2024 and beyond, both as a uranium-esque supply-deficit play and as a high-beta play on gold.”

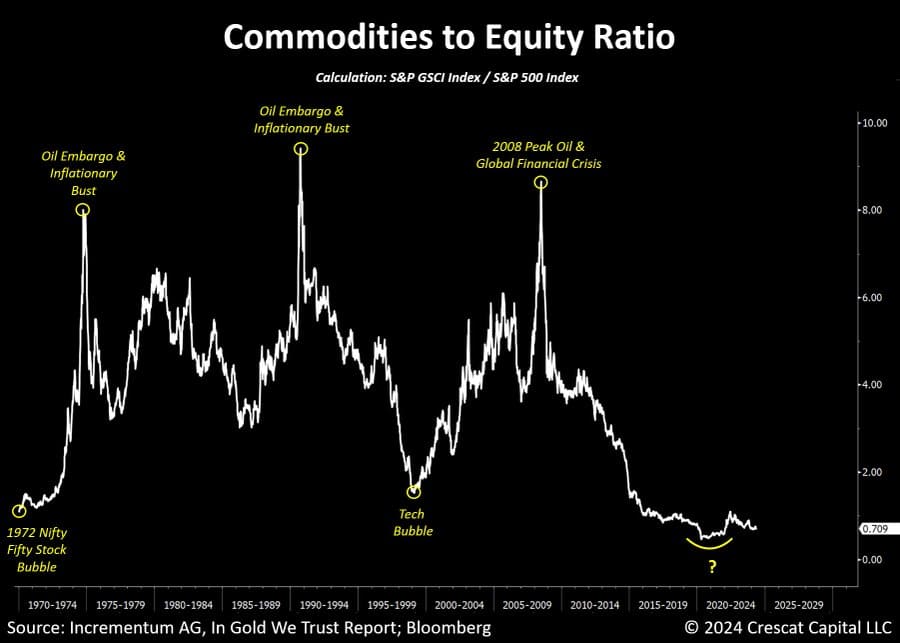

Hard Assets Horrendously Underowned

Last week we shared a chart that showed that “Gold and Gold Miners Are Still Only 1% of Total Global Assets”.

Tavi Costa shows just how significant this disparity is when comparing commodities to stocks:

“Undoubtedly, still one of the most important macro charts of the upcoming decade.

None of us own enough hard assets.”

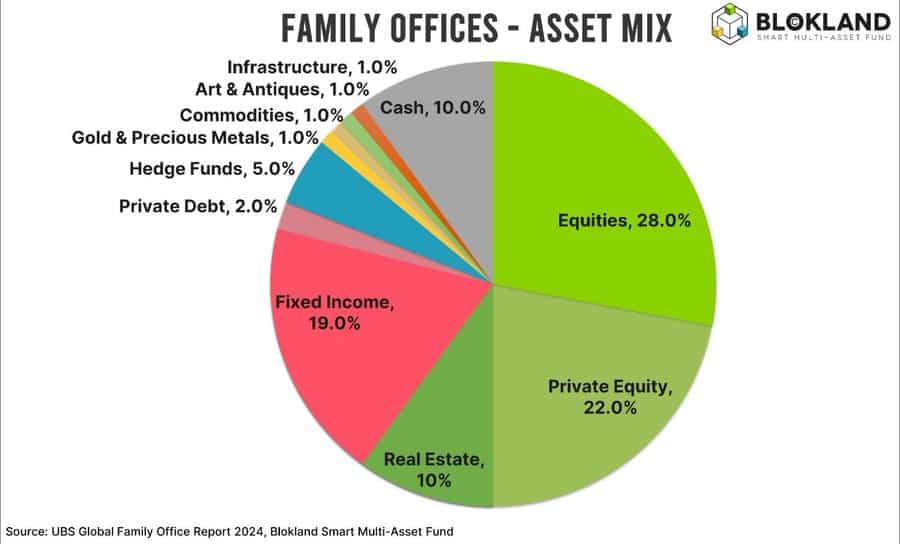

While according to the below chart even the “old money” of family offices that manage generational wealth also only hold 1% in gold.

The end of the 60% Stocks/40% Bonds portfolio which the IGWT report discusses, will likely mean the likes of family offices drastically changing their asset allocation in the coming years.

Does your “family office” have enough gold (or any silver)? If not then now might be a good time to alter your own asset allocation.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

Confusing Investing with Wealth Protection – The Risks of Paper Gold vs Physical Gold in 2024

Mon, 27 May 2024 4:15 PM NZST

Gold and silver are starting to gain a little more attention. As a result more new people are coming into the market. So we think it’s timely to post some warnings about the significant differences between physical gold and paper gold. A New Zealand Example Of the Danger of Paper Gold The case of Bullion […]

The post Confusing Investing with Wealth Protection – The Risks of Paper Gold vs Physical Gold in 2024 appeared first on Gold Survival Guide.

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: $1635.54 (pick up price – dispatched in 2 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $29,659.28

Backdated coins: $29,414.40

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.Read More…